How to become a builder in 7 simple steps

5-minute read

If you enjoy working with your hands and want to join an industry that’s seeing a surge in demand, becoming a builder could be for you.

Builders are often self-employed and this can be a great way to earn a living while being your own boss. Read on for your step-by-step guide to getting started where we’ll cover the following:

What does a builder do?

Builders oversee and work on a range of construction projects, as well as repairs and renovation. You could work on residential buildings, for example on remodelling, brickwork, and plastering. Or you may work on small commercial projects doing minimal repairs and restoration work.

It’s not uncommon for self-employed builders to do a bit of everything when it comes to domestic construction projects. While with specialist skills you may be subcontracted to work on larger commercial or non-residential property projects.

How much do builders earn in the UK?

The average builder salary in the UK is £43,500, according to job site Totaljobs.

However, as a self-employed builder you can set your own hours and day rates. This can vary depending on experience and specialism, as well as where in the country you’re working. A builder day rate can range from £150 to £280.

Your rate might vary for different skills though. For example, a bricklayer salary in the UK can be around £150 to £200.

When it comes to working environment, you’ll generally be working outdoors, but there may be some internal work too. You’re likely to work in a variety of settings, both residential and commercial, including houses, hospitals, or even roads.

As you set your own rates, there’s no set self-employed minimum wage, but make sure you’re aware of the current national and living wage rates if you employ anyone in your business.

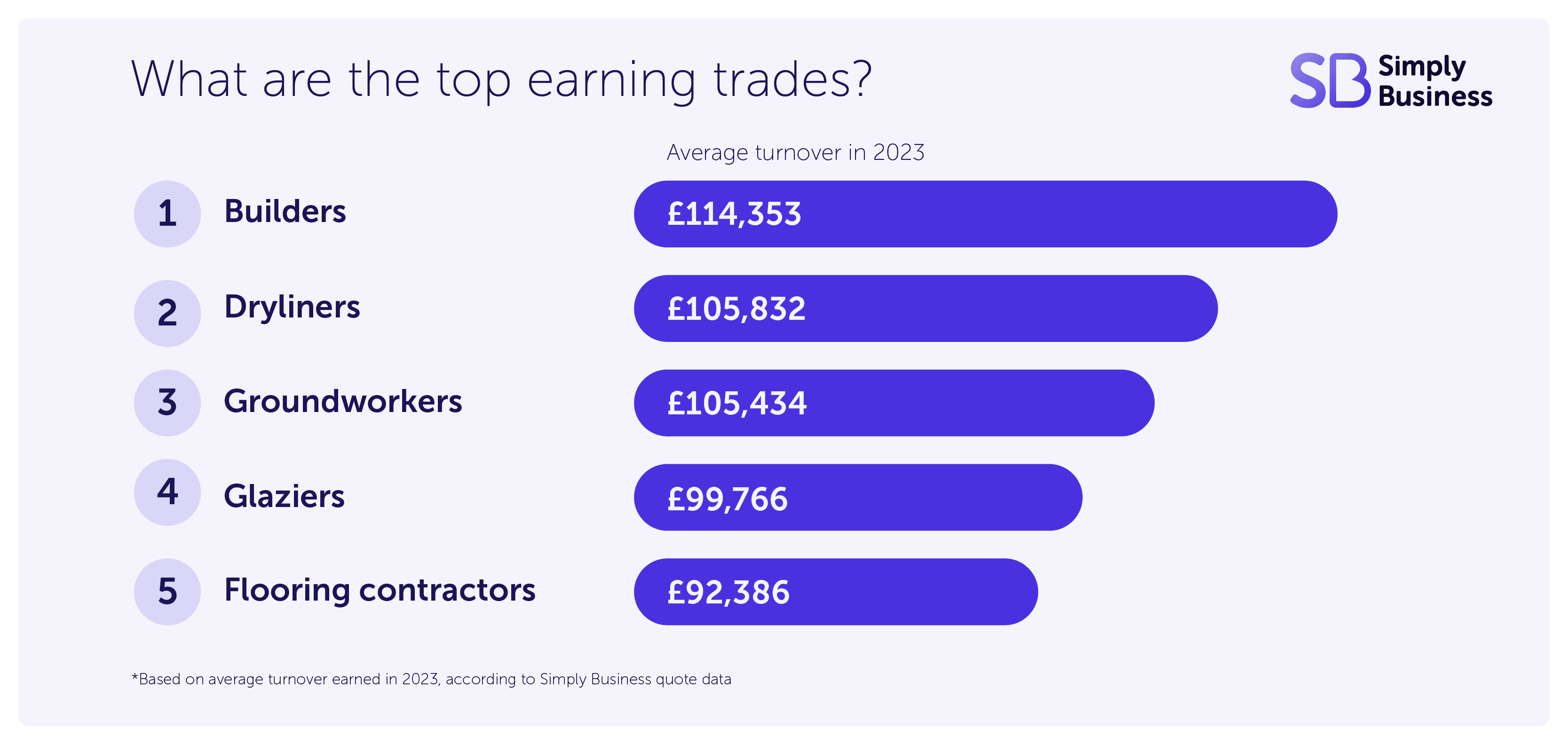

And as you can see from our data, builders ranked as the top earning trade in the UK in 2023.

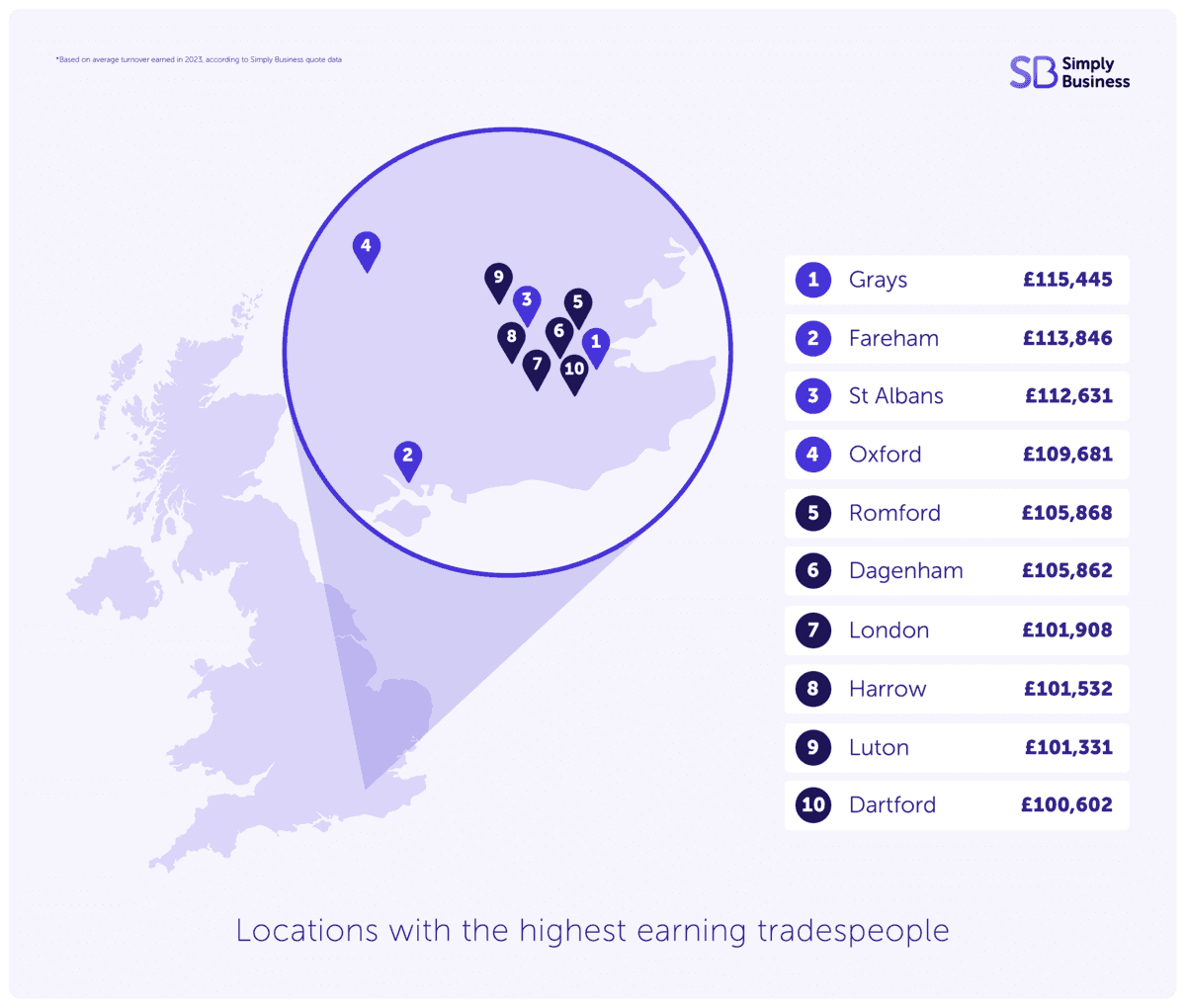

But as you can see from the image below, location also plays a role in your earning potential as a tradesperson.

Becoming a self-employed builder: a 7-step guide

If you’re thinking of starting your own business, read on for our seven-step guide to becoming a self-employed builder.

1. Consider builder qualifications and training

If you’re becoming a builder for the first time, you’ll need some training. Many builders learn on the job or through apprenticeships, but there are other options available if this isn’t possible.

You could go down the route of formal construction qualifications and adult courses at your local training provider. For example, City and Guilds offers a General Construction course, plus specialist courses in:

Depending on your long-term goals and business plan, you may start by building general skills, and consider specialising further when you have some experience.

2. Setting up your business

You have two main choices when it comes to choosing a legal structure for your business: sole trader or running a limited company.

Being a sole trader is likely to be the simplest option, though you’ll still need to register with HMRC and complete an annual Self Assessment tax return. That said, there can be advantages to setting up a limited company and paying yourself that way, depending on your earnings and other factors.

Read more about the differences between sole traders and limited companies to decide what works for your business.

3. Know your tax responsibilities

It’s important that you understand your tax responsibilities as a self-employed builder. You’ll need to register with HMRC as soon as you start trading, and you’ll need to complete and file an annual Self Assessment tax return.

You can subtract some self-employed expenses from your turnover when working out how much tax you need to pay.

As a builder, your tax-deductible expenses will likely include things like:

- vehicle costs (fuel, insurance, and vehicle tax)

- professional clothing

- tools

- equipment

If you’re working from a temporary workplace, you can also claim for travel and subsistence costs.

Our guide to what tax you need to pay explains more about how this works.

4. Follow health and safety guidelines

Working on building and construction sites comes with risks. Working at height, noisy environments, and asbestos are just some of the dangers of a building site, so you must always use the correct personal protective equipment (PPE) and follow health and safety regulations.

Make sure you’re familiar with government guidance on health and safety in construction and read our guide to carrying out a risk assessment.

The Health and Safety Executive also has specific guidance for builders, including resources on preventing injury when handling plasterboard, working in dusty environments, and lifting heavy materials.

5. Look for builders insurance

You’ll need a tailored builders insurance policy to protect you and your business. These can be different depending on the nature of your work – for example, you might need specialist cover if you’re working at height.

These are some of the common covers for builders:

- tools insurance – insure your tools against loss, damage, or theft

- public liability insurance – covers legal expenses or compensation claims if clients or members of the public get injured or lose out financially because of your work

- personal accident insurance – a cash payout in case of bodily injury or death following an accident

- employers’ liability insurance – this is a legal requirement if you employ anyone in your business

With Simply Business, you can combine the covers you need into a single, tailored builders insurance policy.

6. Win clients and build your business

Now that you’re all set up, it’s time to start winning business.

It pays to stay local when you’re just starting out. You might consider putting up cards in local businesses, dropping flyers around your neighbourhood, or contacting businesses directly.

While there are many ways to market a business, it’s vital to have an online presence. In fact, research from Yell shows just how important it is to keep your trades business website updated.

Here are just a few tips to get you started:

- create a simple but attractive website – there are plenty of free website builders out there that you can use to show off your portfolio and make it easy for potential customers to contact you

- feature your business on online directories for tradespeople – sites like Checkatrade, Rated People, and MyBuilder are a great way to get your name out there

- set up a Google My Business profile – it’s the easiest way for customers to find you when they search online for builders in your area, and you can add your contact details and photos too (so make sure you keep it updated)

As your business grows, you might want to consider speaking to construction or architecture firms directly. Larger companies can also be a great source of repeat business, and could ultimately help you expand from a self-employed builder into a small construction business.

7. Get your books in order

Keeping track of your income and expenses is an important part of running a business. Not only for filing your tax return every year by 31 January, but for making sure your business is healthy and making a profit.

Here are some guides to help ease the pain of business admin:

Still weighing up your options?

If you’re not sure becoming a professional builder is for you, here are some other popular trades businesses you could explore:

Small business guides and resource

What’s your experience of becoming a builder? Let us know in the comments.

Are you protecting your tools?

As the UK's biggest business insurance provider, we know the importance of covering your tools. Why not take a look now and build a quick, tailored tool insurance quote?

Start your quote

Written by

Catriona Smith

Catriona Smith is a content and marketing professional with 12 years’ experience across the financial services, higher education, and insurance sectors. She’s also a trained NCTJ Gold Standard journalist. As a Senior Copywriter at Simply Business, Catriona has in-depth knowledge of small business concerns and specialises in tax, marketing, and business operations. Catriona lives in the seaside city of Brighton where she’s also a freelance yoga teacher.

We create this content for general information purposes and it should not be taken as advice. Always take professional advice. Read our full disclaimer

Keep up to date with Simply Business. Subscribe to our monthly newsletter and follow us on social media.

Subscribe to our newsletterInsurance

Public liability insuranceBusiness insuranceProfessional indemnity insuranceEmployers’ liability insuranceLandlord insuranceTradesman insuranceSelf-employed insuranceRestaurant insuranceVan insuranceInsurersAbout

About usOur teamAwardsPress releasesPartners & affiliatesOur charitable workModern Slavery ActSection 172 statementSocial mediaSite mapAddress

6th Floor99 Gresham StreetLondonEC2V 7NG

Northampton 900900 Pavilion DriveNorthamptonNN4 7RG

© Copyright 2024 Simply Business. All Rights Reserved. Simply Business is a trading name of Xbridge Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Registration No: 313348). Xbridge Limited (No: 3967717) has its registered office at 6th Floor, 99 Gresham Street, London, EC2V 7NG.