The self-employed usually need to do a Self Assessment tax return and pay their tax bill each year.

This is a step-by-step guide on how to do a Self Assessment tax return, who needs to file one, and important deadlines you need to remember.

Contents:

- What is a Self Assessment tax return?

- When is Self Assessment due?

- Why is completing a Self Assessment online preferable?

- Example: when to file my online Self Assessment

- Sole trader Self Assessment

- How to file a partnership tax return

- Paying tax as a limited company

- Do I need to file a Self Assessment tax return?

- What if I don’t file a self assessment?

- Step-by-step guide to a Self Assessment tax return online

- How to pay Self Assessment tax

- What if I miss the deadline for paying my online Self Assessment tax?

- What is a tax return – and what does it look like?

Get your free guide on completing your tax return

Download your free in-depth guide to completing your self-employed tax return. Why not save it and refer back to the guide when filling in your Self Assessment?

What is a Self Assessment tax return?

Self Assessment is the tax return process for self-employed people.

Whereas HMRC collects income tax from employees directly through the PAYE system, the self-employed need to work out their income and expenses and then pay their bill each January.

You might even need to complete a Self Assessment return if you’re not self-employed. For example, if you earn money from renting out a property or earn additional income outside of your full-time employment.

You’ll also need to complete a tax return if you have significant income from savings, investments, and dividends.

Read up on the latest tax changes affecting the self-employed, plus everything you need to know about thresholds and allowances.

When is Self Assessment due?

You have to submit your tax return by 31 January whether you’re a sole trader, in a business partnership, or run a limited company.

The tax return deadline is earlier if you’re filing a paper return, on 31 October.

You file a Self Assessment for the previous tax year. So for tax year 2024-2025, the deadline for filing your return online and paying your bill is 31 January 2026. There’s no need to wait until the deadline for Self Assessment to file your online tax return – read our five benefits of submitting early.

Why is completing a Self Assessment online preferable?

From April 2026, Making Tax Digital (MTD) will be phased in, meaning you’ll eventually need to file your tax return online.

Filing your Self Assessment online is much more convenient than by paper. You can save your progress with your tax return at any time and submit it from anywhere.

You also get instant confirmation from HMRC that they’ve received your tax return.

How much is Self Assessment?

The amount of tax you owe each year depends on how much you earn. Read our guide to self-employed tax rates and bands to see how much you might need to pay.

You can also use the government’s Self Assessment tax calculator to get an estimate of how much you’ll need to pay HMRC.

Example: when to file my online Self Assessment

If you’re self-employed and earned a gross income of £100,000 in 2023-24, for example, you’d need to complete your tax return for that year’s earnings by January 31 2025.

Based on the £100,000 income, and claimed back £8,000 in business expenses, your tax liability for the 2023-24 tax year would look something like this:

- income tax: £24,232

- class 4 National Insurance: £3,097

- total tax owed: £35,329

Online Self Assessment for different business types

Depending on your business structure, there’ll be slight differences in how you complete your tax return.

Sole trader Self Assessment

If you’re a sole trader, you’ll declare your business earnings and allowable expenses on your Self Assessment, as your business isn’t a separate legal entity.

How to file a partnership tax return

For those in a general business partnership, you’ll need to fill in a SA800 Partnership Tax Return form. This is so you can declare:

- trading and professional income

- taxed interest and finance receipts from banks and building societies

You can find the SA800 form on the government website (along with supplementary forms) if you’re completing a paper return, otherwise you can submit your tax return online.

Paying tax as a limited company

When becoming a freelancer, for example, you might choose to set up a limited company instead of being a sole trader.

Limited companies and limited liability partnerships are separate to you personally, and taxed through a company tax return. But you’ll still usually have to send a personal tax return, including your salary and dividends received through the company.

Related Guides

- How to get a self-employed tax refund if you’ve overpaid

- SA302 – your guide to getting your tax calculation

- Can HMRC check your bank account without your permission?

Do I need to fill in a Self Assessment tax return?

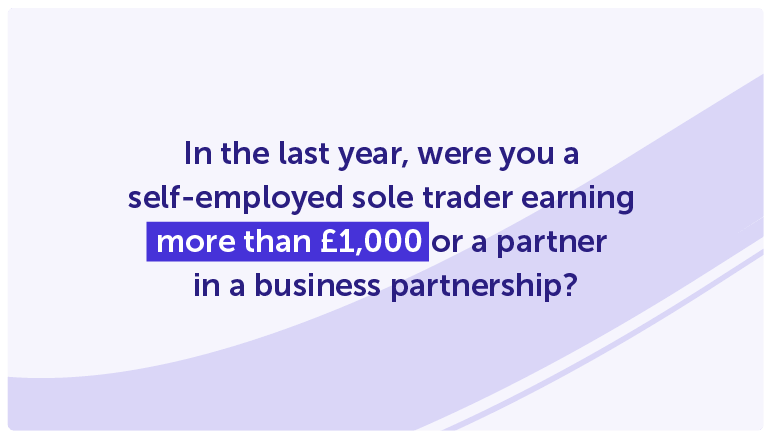

HMRC says that you need to send a tax return and pay your bill through Self Assessment if in the last tax year you were:

- a self-employed sole trader earning more than £1,000

- a partner in a business partnership

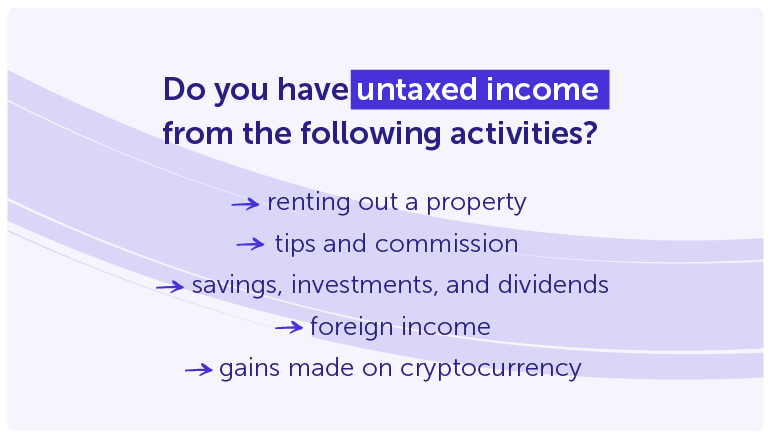

HMRC also says you might need to send a return if you have untaxed income from:

- renting out a property (read more about Self Assessment for landlords)

- tips and commission (for example, if you’ve started a window cleaning business and a customer tips you for a job well done)

- savings, investments, and dividends

- foreign income

- gains made on cryptocurrency

HMRC has a tool you can use to check whether you need to file a Self Assessment tax return.

What if I don’t file a Self Assessment?

If you don’t file your Self Assessment (and you earned over £1,000 in gross income), you could face a variety of penalties:

- late filing penalty – if you miss the deadline, you’ll receive an automatic £100 penalty

- daily penalties – if your return is still not paid three months after the deadline, you’ll be charged £10 per day, up to a maximum of £900

- fixed penalties – after six months, you’ll receive a fixed penalty of £300 or five per cent of the tax due, whichever is bigger. This penalty is also applied after 12 months

If the debt isn’t paid after this, HMRC could escalate to debt collection, court action, and even business closure.

Step-by-step guide to completing a Self Assessment tax return online

Thought about the criteria above and know that you need to file a tax return? Follow these steps below.

Step 1: Register for Self Assessment

You have to register with HMRC for Self Assessment by 5 October in your business’s second tax year. HMRC might fine you if you don’t register by this deadline.

Registering for Self Assessment should also give you a Government Gateway user ID, which you can then use to set up your personal tax account. When you log in, you can manage different elements of your taxes online.

Once you’re registered for Self Assessment you’re then able to file your tax return online or on paper – but HMRC will eventually phase out paper tax returns under Making Tax Digital.

Step 2: Gather your tax return information

For self-employed Self Assessment, the key information is likely to be your income and expenditure details, so you should have all your invoices and receipts to hand.

There are costs you can deduct from your turnover to work out your total taxable profit. You can claim for things like office, travel, marketing, and business insurance costs, as long as they’re used solely for your business.

It’s important to keep good records throughout the year. Not only does this make filling in your return easier, HMRC may check your return after you’ve filed and ask to see your records. You’re required to keep your records for five years after the 31 January deadline.

You’re likely to need details of:

- employment income (if you’re also employed)

- dividends

- partnership income

- interest

- rental income

- foreign income

- pension contributions

- Gift Aid

- payment on account

- redundancy lump payment or unemployment benefit

- P11D

- capital gains

- reliefs

- allowances

- benefits

If you need to ask third parties (like banks and building societies) for information, make sure you leave enough time for them to give it to you.

You’ll also need your unique taxpayer reference number (UTR). You get this when you register for Self Assessment.

The self-employed don’t have a tax code as such, but you can read up on the important codes you need to be aware of.

If you need help with your records and filing, you might want to consider hiring an accountant – also keep in mind that you can use accounting or Self Assessment software to help you keep records and check out our bookkeeping tips.

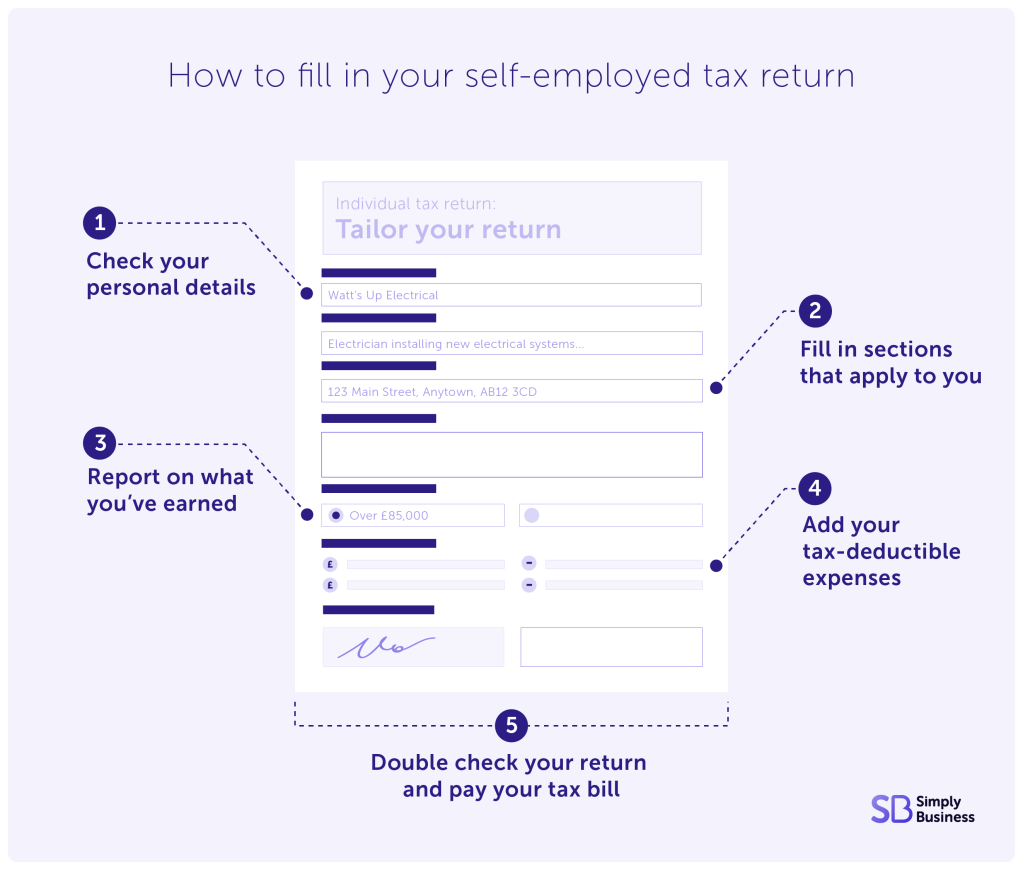

Step 3: Fill in your self-employed tax return

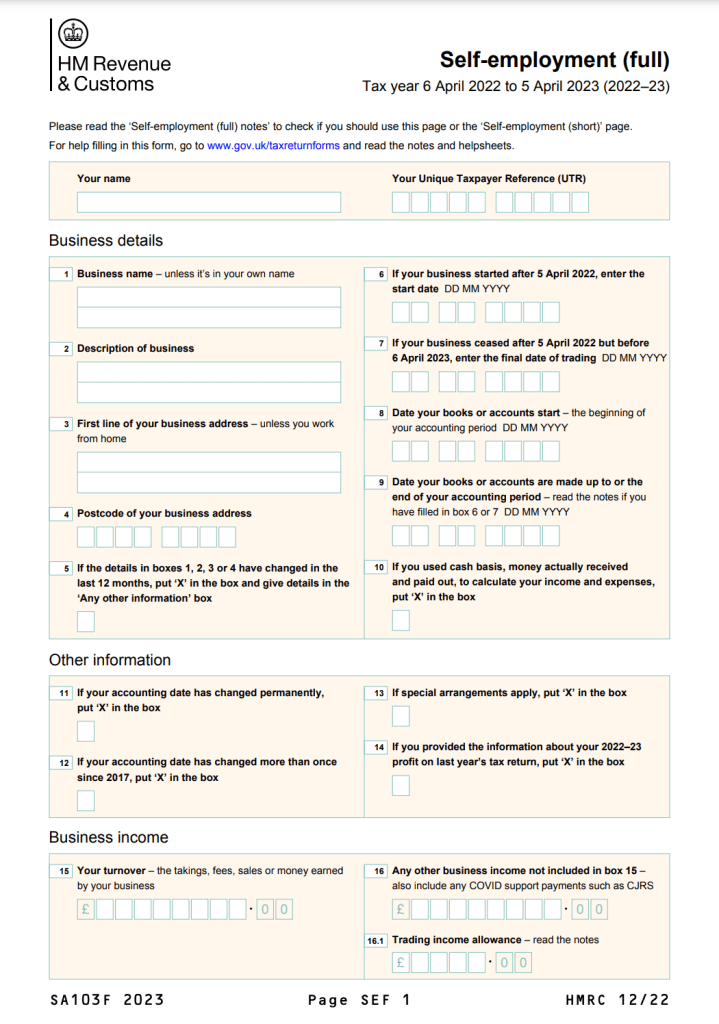

If you’re filing a paper return, you’ll need to complete form SA100 and the self-employed supplement form SA103.

But filing your Self Assessment online gives you three more months to submit. HMRC says it’s “quick, easy and secure” – its system reacts to your details as you enter them and gives you reminders on where to find information if you get stuck.

If you’re filing online (or using the app) and you’ve gathered all the information you need, below is a checklist of what to do when you’ve logged in.

Check your personal details

HMRC should be kept up to date with any changes to your address or your name, for example. You can check and update them during the Self Assessment process.

Fill in the sections that apply to you

HMRC’s system reacts to your details as you enter them. This means that as you fill in the Self Assessment form, it may remove sections that aren’t relevant to you.

Report on what you’ve earned

This is where you enter your turnover before expenses, so have your sales invoices to hand. Remember that you might also need to enter other income elsewhere, like property income or gains on investments.

Add your tax-deductible expenses

Use your expense receipts when filling in this section. Our guide to what you can claim as self-employed tax deductible expenses has more details.

You can also use simplified expenses (based on a flat rate) if you have relatively few business expenses.

Double check your return

If you need to, you can save everything you’ve entered and come back to your tax return, which is useful if you want to check your numbers.

You can still make an amendment even if you notice a mistake after you’ve submitted your Self Assessment. Read up on how to amend errors and mistakes with HMRC.

Pay your tax bill

When you submit your tax return, you should get a confirmation message and a reference number. HMRC will calculate the tax you owe, as well as the National Insurance contributions you need to pay.

Contact HMRC if you need any help

If you need some assistance with your online tax return, you can get in touch with HMRC in a few different ways depending on what you need:

- income tax helpline – 0300 200 3300

- Self Assessment helpline – 0300 200 3310

- National Insurance helpline – 0300 200 3500

- webchat – HMRC offers webchat support for some issues

Related Guides

- Tax avoidance vs tax evasion – what’s the difference?

- Do I qualify for business asset disposal relief?

How to pay Self Assessment tax

The quickest way to pay your tax bill is using the HMRC app. And it’s fast-becoming one of the main ways of paying.

HMRC figures show that between April and September 2023, 97,365 customers used the app to pay their tax bill for the 2022-23 tax year – that’s three times the number of people who used it in the same period the previous year.

You can download the app on iOS and Android – you’ll need your Government Gateway user ID and password to sign in for the first time.

HMRC created this video with step-by-step instructions for paying your self-employed tax using the app:

You can also use the app to check your tax details, National Insurance, tax credits, and benefits.

Other ways to pay your tax bill:

- online bank account

- online or telephone banking

- CHAPS

- debit or corporate credit card online

- at your bank or building society

You can also pay by Bacs, cheque, or Direct Debit, but these take longer.

Remember that most self-employed people usually need to make a payment on account too, which can catch newly self-employed people out – make sure you have enough set aside.

Payment on account is when you make two payments towards your next tax bill (one in January and one in July).

Once you’ve filed your first tax return, you can set up a budget payment plan to pay your tax bill in weekly or monthly instalments. But you must be up to date with your Self Assessment payments.

Find out which Self Assessment payment plan is right for you.

What if I miss the deadline for paying my Self Assessment?

The deadline for paying your tax return is the same day as the deadline for filing – 31 January.

If you file your tax return late, you’ll get a £100 penalty (if it’s up to three months late – the fine is more if it’s later). After that, HMRC uses a points-based system to apply penalties.

Read more about penalties for missing the tax deadline as well as proposed changes to the penalty points system.

What is a tax return – and what does it look like?

A tax return is a document that tells HMRC how much income you’ve received during the tax year. This is then used to work out how much tax you need to pay.

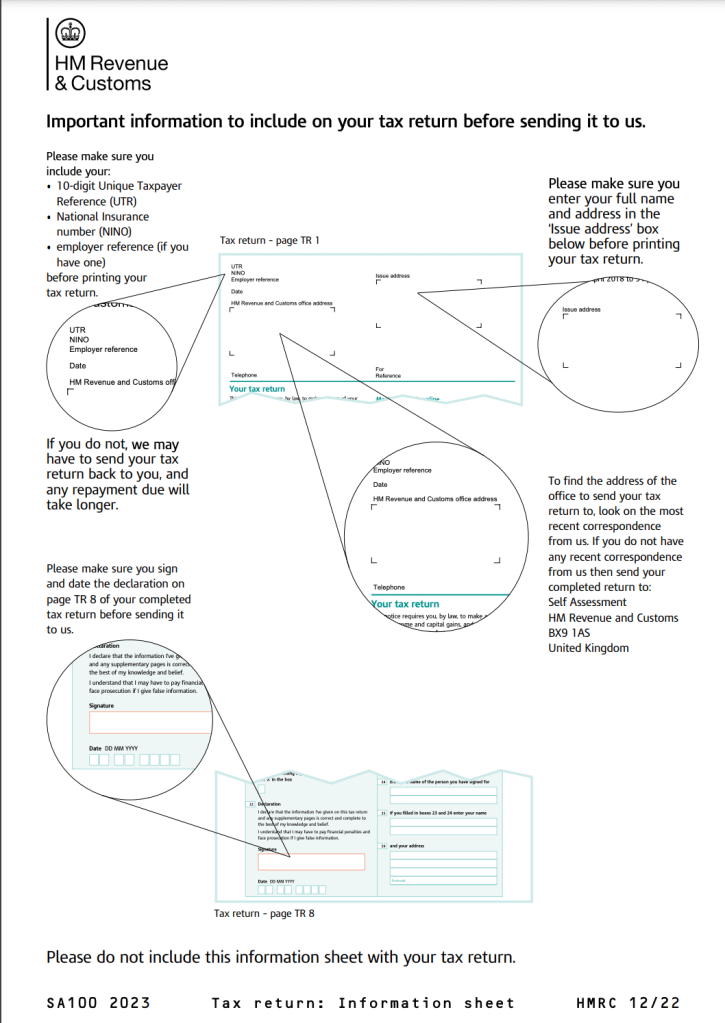

HMRC has plenty of guidance on what you need to include on your tax return. The easiest thing to do is to get the HMRC app, but the pictures below give you an idea of what a paper tax return looks like.

The main SA100 tax return form shows the information you’ll need to include.

Information to include on your SA100 form. Source: HMRC

Page one of the self-employed supplement form SA103 looks like this:

Page one of the SA103 form for filing your self-employed tax return. Source: HMRC

HMRC tax return guidance

There’s lots of Self Assessment guidance on the government website and you can also call the Self Assessment helpline on 0300 200 3310.

But in previous years HMRC’s phone lines have crashed, so make sure you leave enough time to get in touch with them if you need to.

HMRC also warns the self-employed to watch out for tax scams during Self Assessment.

Upcoming changes to Self Assessment tax returns

From January 2025, online platforms like Amazon, Airbnb, Deliveroo, and Uber will be required to report sellers’ income directly to HMRC.

So if you earn income through these platforms, make sure to keep detailed records of your earnings, as HMRC could cross-reference your tax return with the platform data.

Using an accountant to help with tax returns online

Using an accountant can make filing your Self Assessment simpler. While it’s still your responsibility to gather the correct information, an accountant can help you:

- understand what information you need for your tax return

- analyse what tax allowances you’re entitled to

- follow the latest tax regulations

- communicate your issues with HMRC

- organise your finances for future tax returns and make sure you’re working tax efficiently

Help if you’re struggling to pay Self Assessment tax

HMRC’s Time to Pay service is available if you can’t pay your tax bill by the 31 January deadline.

This is for those struggling financially – so if you can pay your tax bill, you should, not least because through Time to Pay you’ll pay interest on what you owe. This makes your bill more expensive.

You’ll need to complete your tax return first, so don’t leave it until the last minute. If you miss the deadline for either filing your return or paying your bill, HMRC may give you a fine.

You can call the HMRC Self Assessment payment helpline on 0300 200 3820 to discuss a Time to Pay plan.

Self Assessment – an important part of running a business

Calculating your taxes properly and submitting your tax return on time is a crucial annual job for small business owners.

That’s why you should take your time preparing your Self Assessment and making sure you don’t leave it to the last minute – especially if you’re new to the process.

And when it comes to taxes, there’s plenty of help available from dedicated software to professional accountants.

FAQ: common questions on tax return

Can I get a refund if I overpay my tax?

Yes, you can get a refund if you overpay your tax. HMRC will calculate your tax liability and send you a refund if you’ve overpaid.

What happens if I stop being self-employed?

It’s crucial that you tell HMRC if you stop being self-employed, don’t assume they’ll know just because you’ve stopped trading. And you’ll need to complete a final tax return for the year that you stopped being self-employed.

Can I file a tax return for previous years if I have forgotten?

You can file a tax return for previous years but you might be fined by HMRC for late filing. And if you’re filing over four years late, you’ll lose your chance to get a refund if you overpay tax.

Can I claim tax relief on working from home?

If you run your business from home, you can claim back some of your home expenses as business expenses. You’ll just need to determine the proportion of your home that’s used for business purposes.

This can be based on the number of rooms used exclusively for work or the percentage of your home’s square footage dedicated to your workspace.

How can I get my tax refund online?

You can claim a tax refund online through the government gateway or on the HMRC app. It usually takes a couple of weeks for them to process your tax return and see if you’ve overpaid.

Is there a deadline for tax returns in the UK?

Yes, there’s a deadline for tax returns in the UK. If you submit a paper Self Assessment, the deadline is 31 October, and 31 January for online submissions.

Can I do my own tax return without an accountant?

Yes, you can do your Self Assessment without an accountant. There’s no legal requirement to use an accountant, they can just make the process simpler if you’re unfamiliar with the Self Assessment process.

How do I download my HMRC tax return?

You can download your tax return through your personal tax account on the government website. Just click on the Self Assessment section, select the tax return you want, and download a PDF from there.

Ready to set up your cover?

As one of the UK’s biggest business insurance providers, we specialise in public liability insurance and protect more trades than anybody else. Why not take a look now and build a quick, tailored quote?