Why are 1 in 4 landlords planning to sell in the next year?

2-minute read

A combination of rising costs and increased regulation means a quarter (25 per cent) of landlords are planning to sell a property in the next 12 months.

We asked over 1,500 landlords what it’s like to be a landlord in 2023. In response, we created our Landlord Report: a detailed analysis of the UK’s buy-to-let market, covering the key issues facing the nation’s landlords.

With major rental reforms on the horizon and rising costs to manage, it’s no surprise that many landlords are worried about the future of the buy-to-let market.

Keep reading to learn why so many landlords are selling up, and more...

What do rental reforms mean for landlords?

After a four year wait, the government finally published draft legislation of the Renters’ Reform Bill in May 2023.

As the bill makes its way through parliament before becoming law, we asked landlords about the impact it could have on the rental market.

- 20 per cent said the Renters’ Reform Bill is the single biggest threat to the rental market

- of landlords planning to sell a property, 49 per cent are doing so because of new legislation

- 63 per cent think that landlords will have to increase rent if it becomes easier for tenants to keep pets

- 54 per cent think abolishing Section 21 evictions will cause landlords to sell up and leave the buy-to-let market

Rising interest rates and mortgage costs is another key reason, with 43 per cent of landlords mentioning this when asked why they're planning to sell.

Tax increases are also cited by 32 per cent of landlords planning to sell.

And this exodus of landlords from the rental market could put pressure on already limited supply, pushing up average rents, which are already at record highs.

A landlord from the South East who took part in the survey said they’re in the process of selling their rental property.

“I feel guilty about the fact that this will mean one less property in the pool from which hard-pressed renters can now choose.

“However, botched government plans, combined with a massive rise in mortgage payments, has left me with no alternative.”

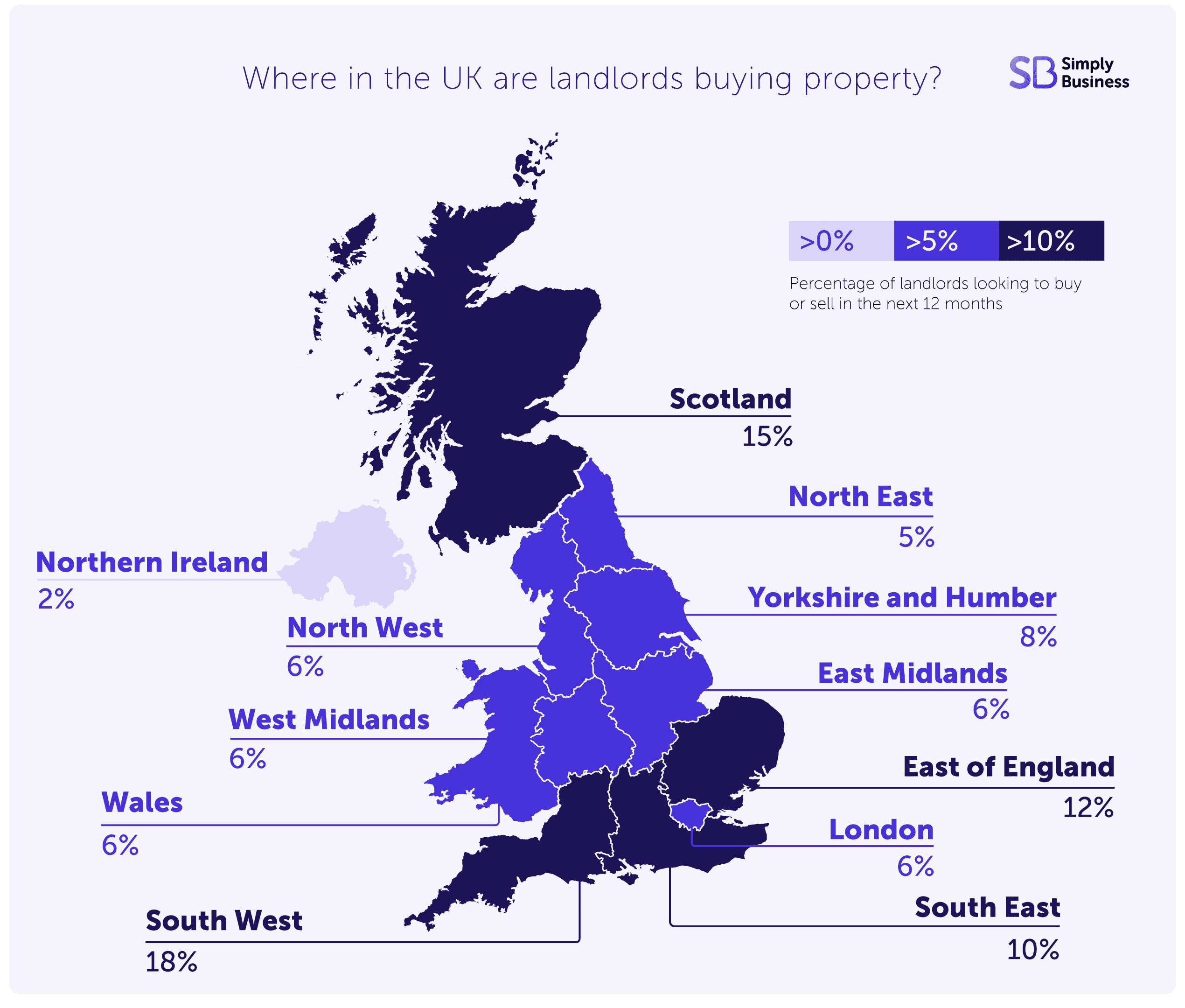

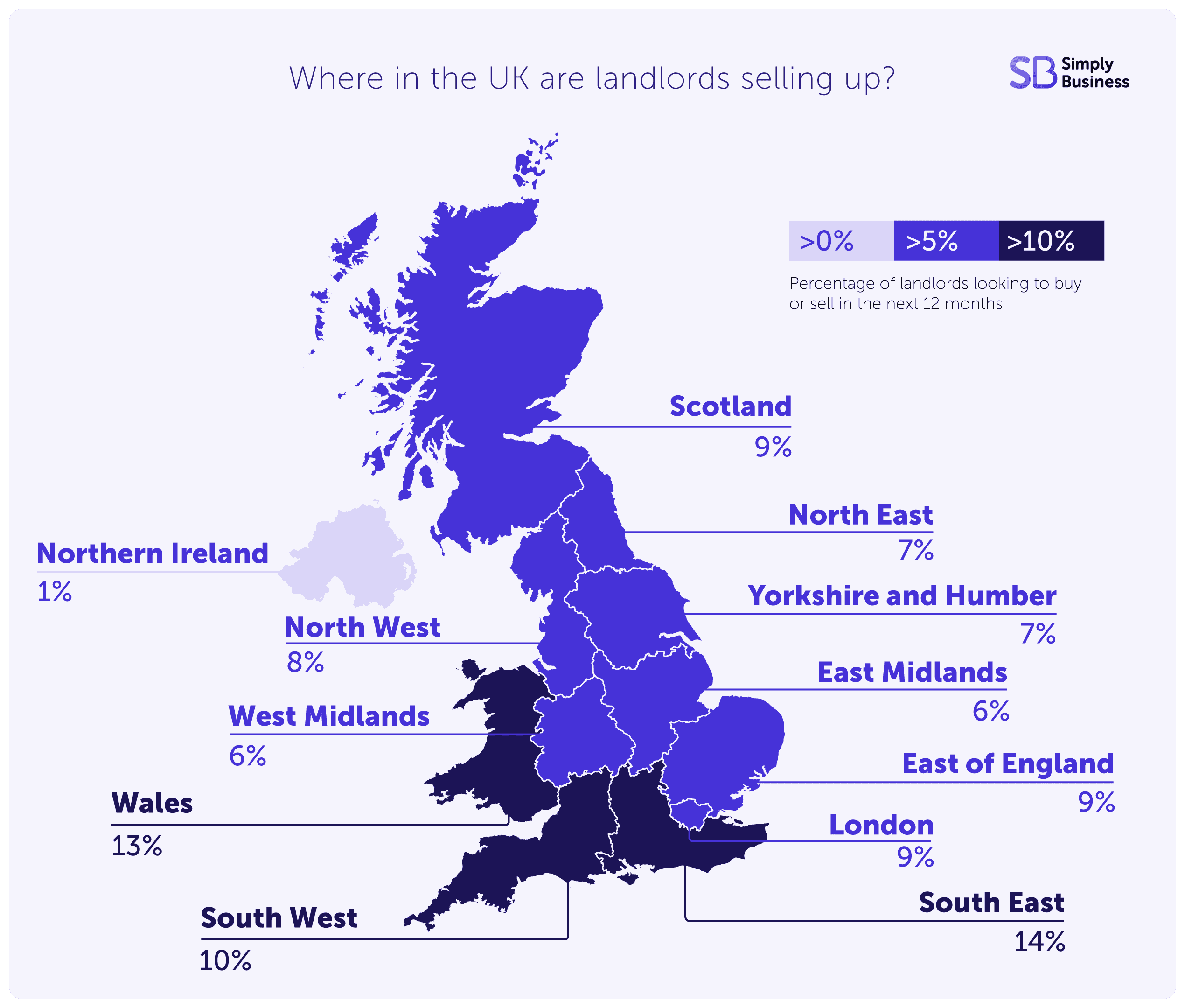

Buying and selling hotspots

Where in the UK are landlords planning to buy and sell properties?

Challenging conditions mean a quarter of landlords are planning to sell a property in the next 12 months.

Despite lower than average house prices and consistently high rental demand, just three per cent of landlords are planning to buy another property in the next 12 months.

Our maps reveal the UK locations where the highest proportion of landlords are planning to buy or sell properties in the next year.

UK property buying hotspots

UK property selling hotspots

Download the Landlord Report 2023

The findings from our Landlord Report are based on a survey of almost 1,500 landlords in August 2023. We spoke to accidental landlords with one property, all the way up to those with more than 10 properties.

The report provides a snapshot of the current buy-to-let market and what it’s like to be a landlord in 2023.

Download your free copy of the report for more buy-to-let trends, including where landlords are looking to buy and sell property plus their thoughts on the future of the rental market.

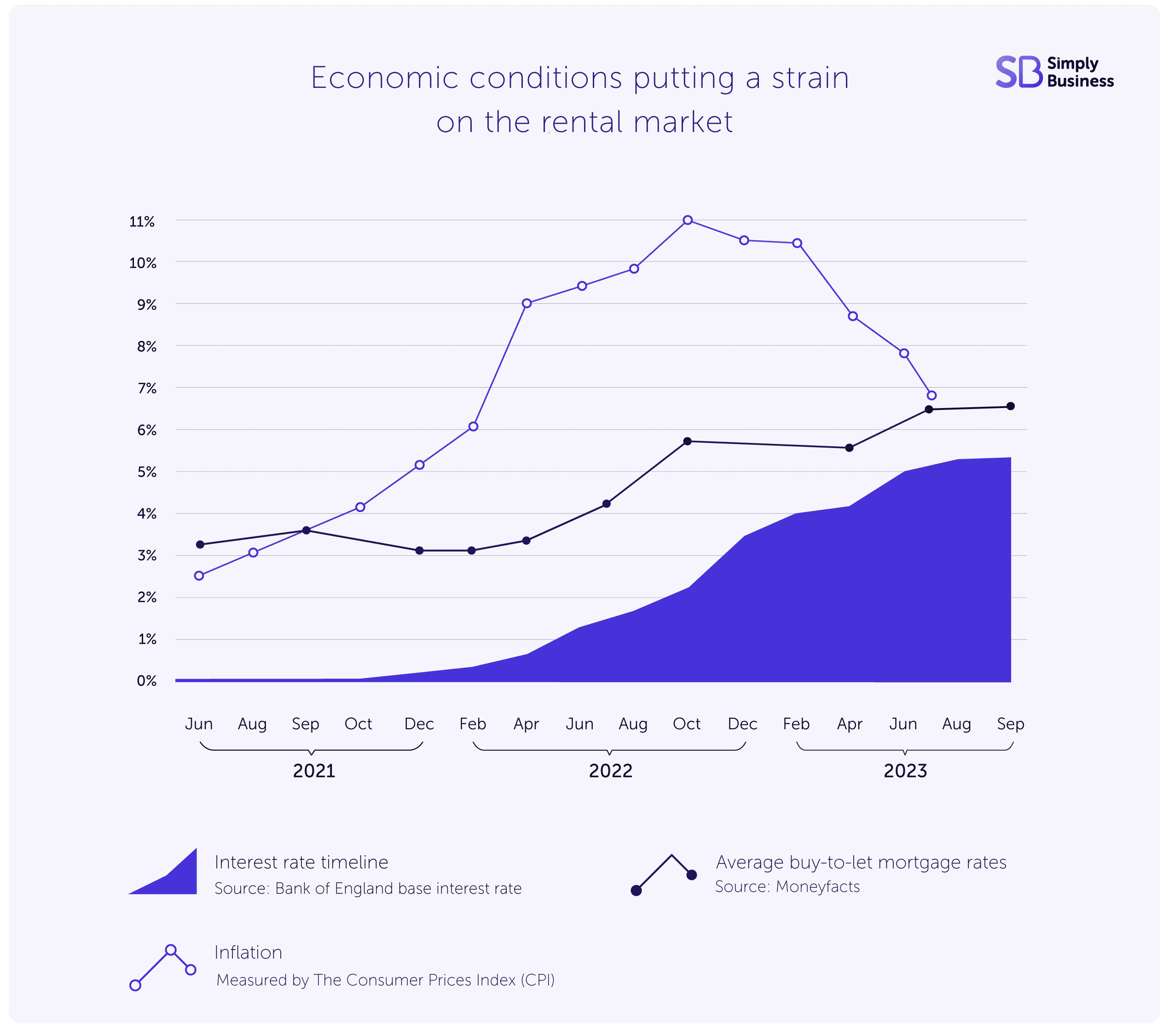

Economic conditions put a strain on the rental market

Over the last year, the economic outlook in the UK has been uncertain. During the cost of living crisis, inflation has remained high and interest rates have been steadily rising.

At the same time, average house prices have started to dip after a sustained period of growth.

This creates a perfect storm – many tenants are struggling with affordability as landlords’ mortgage costs rise and their return on investment diminishes.

Landlords reveal their challenges and concerns

Despite a challenging landscape, half (50%) of landlords still think buy-to-let is a good investment.

However, due to issues such as rising costs and changing legislation, two thirds (66%) are concerned about the future of the rental market.

From rogue landlords and government intervention, to energy efficiency and pets in properties, here’s an overview of how landlords are feeling:

What are your biggest concerns about the future of the rental market? Let us know in the comments below.

More guides for buy-to-let landlords

Get set with tailored landlord cover

Over 200,000 UK landlord policies, a 9/10 customer rating and claims handled by an award-winning team. Looking to switch or start a new policy? Run a quick landlord insurance quote today.

Start your quote

Written by

Conor Shilling

Conor Shilling is a Copywriter at Simply Business with over two years’ experience in the insurance industry. A trained journalist, Conor has worked as a professional writer for 10 years. His previous experience includes writing for several leading online property trade publications. Conor specialises in the buy-to-let market, landlords, and small business finance.

We create this content for general information purposes and it should not be taken as advice. Always take professional advice. Read our full disclaimer

Keep up to date with Simply Business. Subscribe to our monthly newsletter and follow us on social media.

Subscribe to our newsletterInsurance

Public liability insuranceBusiness insuranceProfessional indemnity insuranceEmployers’ liability insuranceLandlord insuranceTradesman insuranceSelf-employed insuranceRestaurant insuranceVan insuranceInsurersAbout

About usOur teamAwardsPress releasesPartners & affiliatesOur charitable workModern Slavery ActSection 172 statementSocial mediaSite mapAddress

6th Floor99 Gresham StreetLondonEC2V 7NG

Northampton 900900 Pavilion DriveNorthamptonNN4 7RG

© Copyright 2024 Simply Business. All Rights Reserved. Simply Business is a trading name of Xbridge Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Registration No: 313348). Xbridge Limited (No: 3967717) has its registered office at 6th Floor, 99 Gresham Street, London, EC2V 7NG.