A budget is an essential part of running a business (and your personal life too). It helps you keep track of income, anticipate expenses, and plan for the future. This guide includes a free budget calculator you can download and start keeping track of your money.

How to create a budget

You probably mapped out the financials of your business when writing your business plan, but how do you make sure you’re staying on budget as your business grows?

This step-by-step guide explains more about how to approach creating a budget, for yourself and your business.

Download a free budget calculator template

Our article below explains how to budget for your business. Why not download your free business budget calculator template, which you can fill in after reading our step-by-step guide?

Download your free template – it’s editable, so you can fill it in on your computer, or you can print a copy.

Budgeting tips for business owners

From rent and materials to marketing and client invoices, as a business owner you need to be on top of your finances. Read our five tips on how to budget.

1. Get organised

Make sure you have a system for organising your receipts, invoices, and bills – you’ll need this information when it comes to filing your tax return each year.

Invoices are an important part of accounting, so check out our article on how to write an invoice, which includes a free template, if you’re not sure what to record in your books.

2. Calculate your budget

Next you need to work out how much money you need to survive, to run your business, and to keep up with financial commitments. What’s left is your spending money, which you can use to invest, save or spend.

When it comes to financial planning, you can use a few different types of budget depending on how detailed you want it to be. You might find it useful to record your monthly outgoings, and even weekly ones, as well as predicting your annual income and expenses for your business. At the end of the year or quarter you can then compare your budget with actual financials.

3. Estimate your spending

An important part of creating a budget is working out how much you expect to spend. You should include your essential outgoings like bills and rent, and estimate your other personal and business expenses in a monthly and weekly budget.

4. Record your transactions

You need to know how much money is going in and out of your business, and keep track of your personal finances.

Invoicing apps can take the stress out of organising your payments and managing cashflow. Our guide goes into detail about the best invoice apps on the market right now, including a number of free options.

5. Create a balance sheet

A balance sheet shows the value of everything your company owns, owes and is owed over the financial year. You’ll need to add up your current assets, long-term assets, and liabilities to form a financial statement for your business.

And when you’re setting up a business or developing a new product, it can be useful to do a break even analysis to work out how long it might take to make a profit.

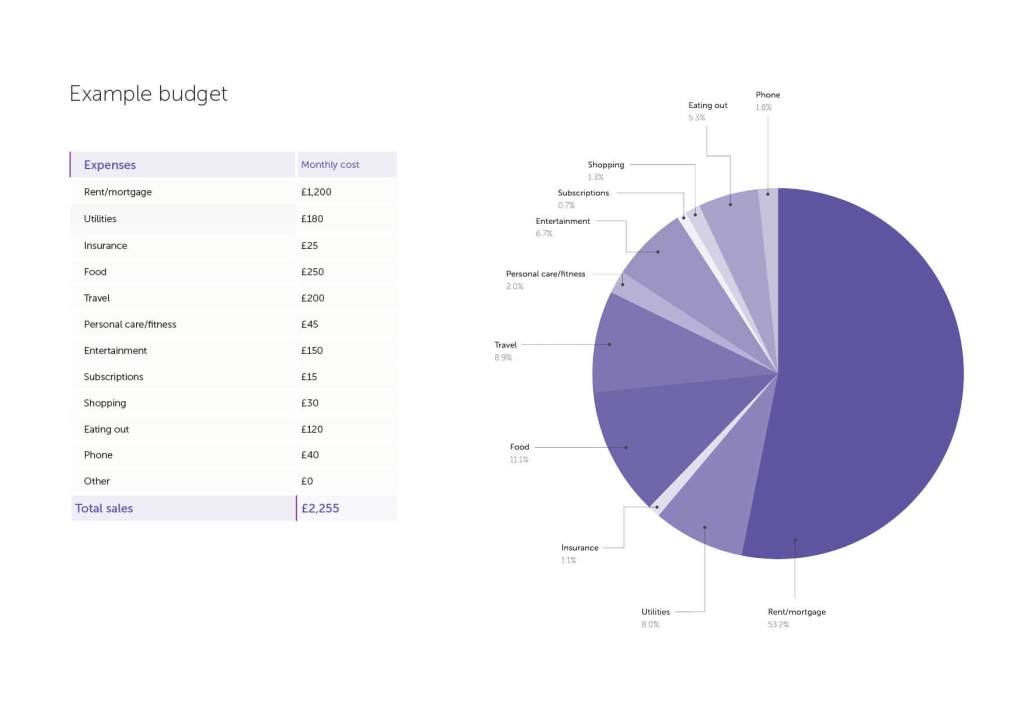

Monthly budget calculator example

While our budget calculator above includes a template for recording your monthly spending, you might like to use Excel to create a budget that shows predicted outgoings in a pie chart.

The example below is simply a table of predicted personal spending for an average month and a pie chart showing outgoings as a percentage, from travel and rent to food and entertainment. This can help you identify areas of high-spend and where you might be able to make cost savings.

Another type of budgeting you could try is ‘zero-based budgeting,‘ which involves allocating every expense until your income minus your expenses equals zero.

Useful small business guides

- How to start a business

- Self-employed tax resources

- Cost of living support for small businesses and the self-employed

- A guide to allowable business expenses

- What is asset finance?

- Do I need business insurance?

Ready to set up your cover?

As one of the UK’s biggest business insurance providers, we specialise in public liability insurance and protect more trades than anybody else. Why not take a look now and build a quick, tailored quote?