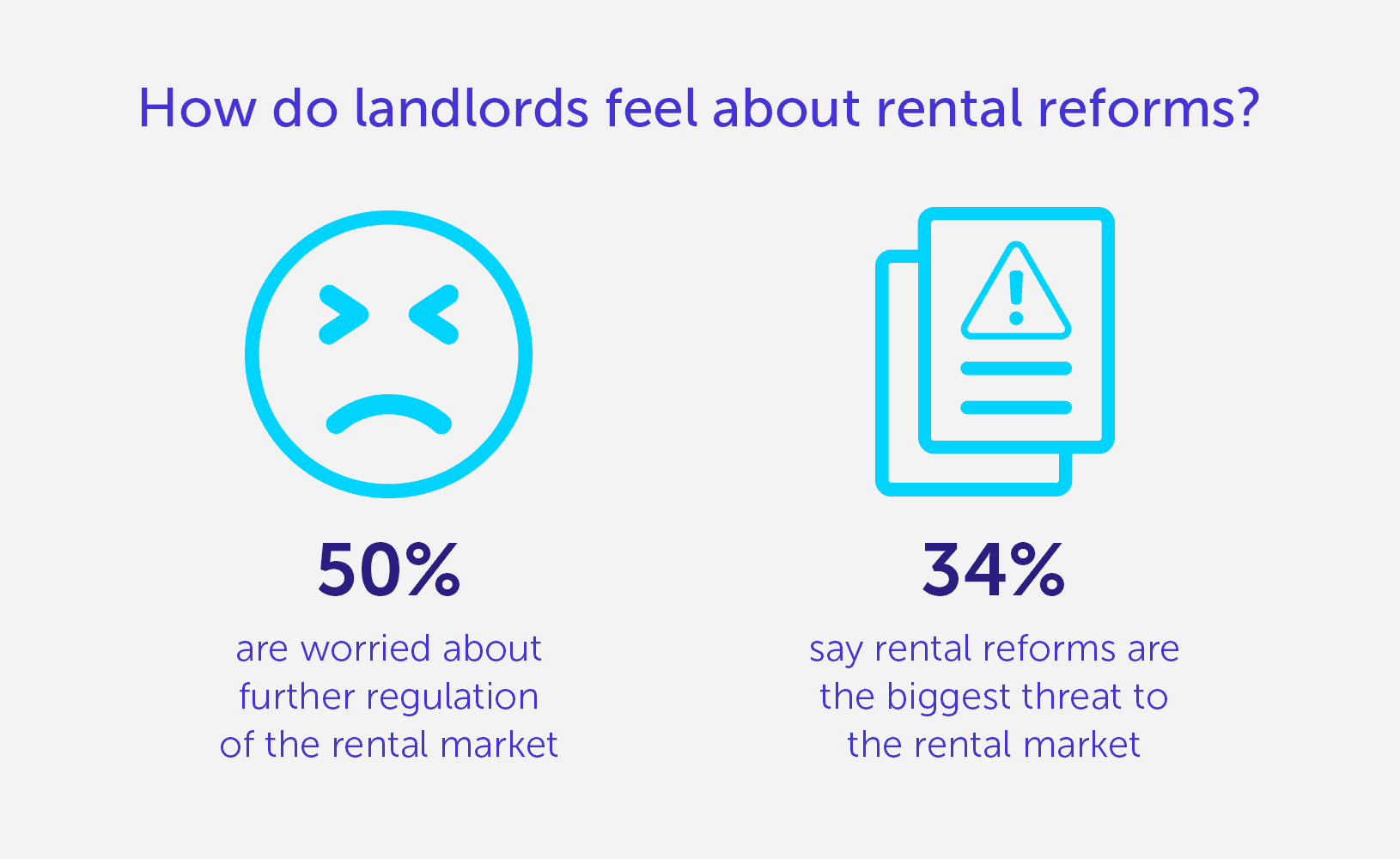

34% of landlords say rental reforms are the greatest threat to the market

2-minute read

A third of UK landlords believe that rental reforms are currently the greatest threat to the market, with one in five (20 per cent) planning to sell as a result.

The government has announced far-reaching rental reforms, which include measures to encourage pet ownership and scrap Section 21 eviction.

We surveyed over 600 buy-to-let landlords as part of our UK Landlord Report, revealing what landlords think about rental reforms, the removal of tax relief, and the future of the market overall.

Get the Simply Business Landlord Report 2022

Download your free in-depth report on challenges and trends in the buy-to-let sector.

DownloadLandlords are planning to sell properties this year

Just over three fifths of landlords (61 per cent) are planning to sell properties this year, with 20 per cent doing so as a direct result of rental reforms.

A further quarter (26 per cent) are selling because of rising costs, whether that’s interest rates, surging energy prices or reduced tax relief.

As we’ve previously reported, the Bank of England raised the base interest rate from 1.25 per cent to 1.75 per cent in August. A higher base rate could lead to more expensive mortgage repayments for landlords on a variable buy-to-let mortgage.

This, along with the reduction in tax relief on buy-to-let mortgages, is eating into landlords’ profits. Landlords may be looking either to make large rent increases or sell off part (or in some cases all) of their portfolio.

Concerns about the future of the market

Changes and uncertainty are making it difficult for landlords to plan for the future. Our Landlord Report reveals that:

- a third (33 per cent) of landlords’ properties are no longer as profitable due to the reduction of buy-to-let mortgage tax relief

- one in five (21 per cent) expect yields to decrease by up to 15 per cent this year

- just under half (45 per cent) of landlords say rising costs are the most significant threat to the future of the rental market overall

- half are specifically concerned about further regulation of the rental market, which has the potential to impact profits further when many are barely breaking even

Are landlords looking to the government for support?

Landlords would like to see more help from the government to navigate tax changes and rising costs.

Our study found that nearly a third (29 per cent) said they’d reconsider selling if more tax relief was introduced. Over a fifth (22 per cent) said more clarity on legislation would discourage them from putting their property on the market.

But property is still a worthwhile investment for many

While challenges are causing some landlords to sell up, many are still confident in the long-term prospects of buy-to-let:

- just under half (45 per cent) still believe that letting out a property is a worthwhile investment

- well over a third (37 per cent) even expect to see their yield increase by up to 10 per cent

- overall, 18 per cent are optimistic about their ability to generate an income

One landlord commented: “Whilst costs are increasing, prices are rising and there is uncertainty going forward, I still see property investment as long-term wealth generation and will continue to pursue this.”

Alan Thomas, UK CEO at Simply Business, said: “Our study found that almost half of landlords have sold a property in the last year or are planning to do so. This comes as little surprise when you consider the pace of market change, as well as tax disincentives such as Section 24 and the stamp duty surcharge.

“A buy-to-let exodus would not only remove rental housing at a time when it’s needed more than ever, but it would also significantly reduce the vital £16 billion annual contribution landlords make to the economy.

“As regulation of the rental sector continues against a backdrop of rising costs, it’s vital that landlords get the necessary government support, education, and clarity to rent out high quality homes that are compliant with the law. Landlords play a significant role in providing safe and affordable housing for over 4.4 million households across our towns and cities and it’s clear the market is under threat.”

What are your plans for the future as a landlord? Let us know in the comments below.

More guides for buy-to-let landlords

Get set with tailored landlord cover

Over 200,000 UK landlord policies, a 9/10 customer rating and claims handled by an award-winning team. Looking to switch or start a new policy? Run a quick landlord insurance quote today.

Start your quote

Written by

Sam Bromley

Sam has more than 10 years of experience in writing for financial services. He specialises in illuminating complicated topics, from IR35 to ISAs, and identifying emerging trends that audiences want to know about. Sam spent five years at Simply Business, where he was Senior Copywriter.

We create this content for general information purposes and it should not be taken as advice. Always take professional advice. Read our full disclaimer

Keep up to date with Simply Business. Subscribe to our monthly newsletter and follow us on social media.

Subscribe to our newsletterInsurance

Public liability insuranceBusiness insuranceProfessional indemnity insuranceEmployers’ liability insuranceLandlord insuranceTradesman insuranceSelf-employed insuranceRestaurant insuranceVan insuranceInsurersAbout

About usOur teamAwardsPress releasesPartners & affiliatesOur charitable workModern Slavery ActSection 172 statementSocial mediaSite mapAddress

6th Floor99 Gresham StreetLondonEC2V 7NG

Northampton 900900 Pavilion DriveNorthamptonNN4 7RG

© Copyright 2024 Simply Business. All Rights Reserved. Simply Business is a trading name of Xbridge Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Registration No: 313348). Xbridge Limited (No: 3967717) has its registered office at 6th Floor, 99 Gresham Street, London, EC2V 7NG.