Best buy-to-let areas in the UK for 2024

3-minute read

Buying property in the right areas is crucial for landlords, so where in the UK can you benefit from attractive returns in 2024?

Read on to find out the top towns and cities attracting property investors based on analysis of data from Simply Business and Rightmove.

In this article we cover:

Where are the fastest-growing buy-to-let areas?

A fast-growing rental market could indicate high demand from tenants and strong average rental growth.

All of this could contribute to higher annual returns for landlords, particularly if they target areas with lower average property prices.

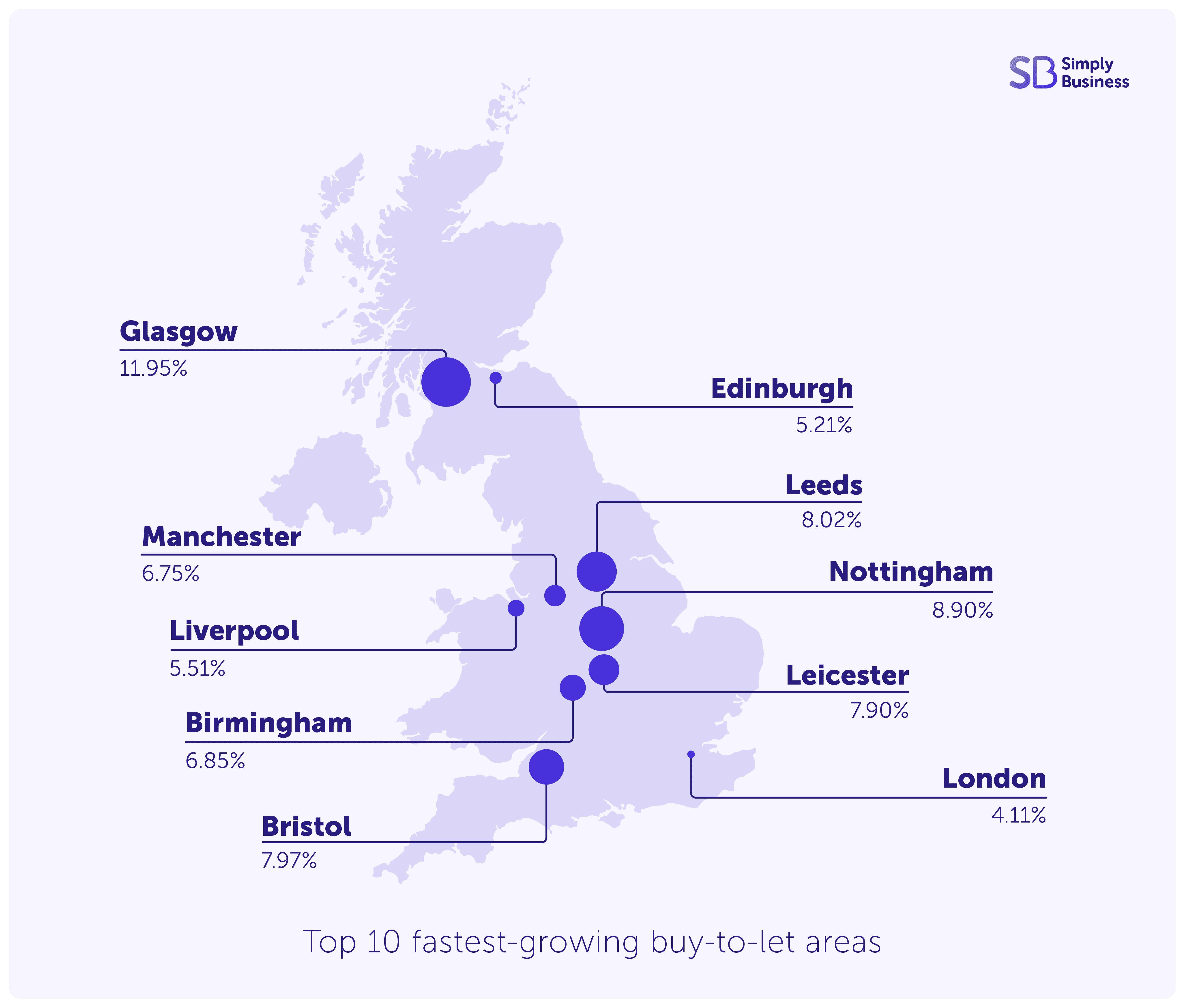

Our analysis of over 100,000 landlord insurance policies found that Glasgow had the highest growth* (12 per cent) in new policies between 2022 and 2023.

The Scottish city was followed by Nottingham in second place with growth of nine per cent.

The top five was completed by Leeds, Bristol, and Leicester, all with annual growth of eight per cent.

London just made the top 10 with annual growth of four per cent. However, the UK’s largest city had by far the highest number of landlord insurance policies.

Top 10 fastest-growing buy-to-let areas

2024 ranking | Area | Region | Annual growth* | 2023 ranking |

1 | Glasgow | Scotland | 11.95% | 10 |

2 | Nottingham | East Midlands | 8.90% | 4 |

3 | Leeds | Yorkshire and the Humber | 8.02% | 8 |

4 | Bristol | South West | 7.97% | 9 |

5 | Leicester | East Midlands | 7.90% | 2 |

6 | Birmingham | West Midlands | 6.85% | 3 |

7 | Manchester | North West | 6.75% | 5 |

8 | Liverpool | North West | 5.51% | 7 |

9 | Edinburgh | Scotland | 5.21% | 1 |

10 | London | London | 4.11% | 6 |

*The difference in new Simply Business landlord insurance policies bought between 2022 and 2023

Revealed: The UK’s five busiest rental markets

A busy rental market tends to be a positive sign for landlords. It usually means there’s a supply/demand imbalance, with more renters than properties available.

This can improve the chances of landlords letting their properties quickly and having the option to choose the most suitable tenants.

Property website Rightmove analysed rental markets across the UK to find the highest number of tenant enquiries for each property.

Wrexham in North Wales had the busiest rental market in 2023, with an average of 56 tenant enquiries for each available property.

The rest of the top five were:

- Redbridge, East London (49 average tenant enquiries for each property)

- Tameside, Greater Manchester (48 average tenant enquiries for each property)

- Stockport, Greater Manchester (48 average tenant enquiries for each property)

- Glasgow City, Glasgow (47 average tenant enquiries for each property)

The research shows how demand for rental properties has surged since the Covid-19 pandemic. The number of tenant enquiries for each property in Wrexham increased by 600 per cent between 2019 and 2023.

Across the whole of the UK, available rental properties received an average of 20 tenant enquiries in 2023, up from six (more than 200 per cent higher) in 2019.

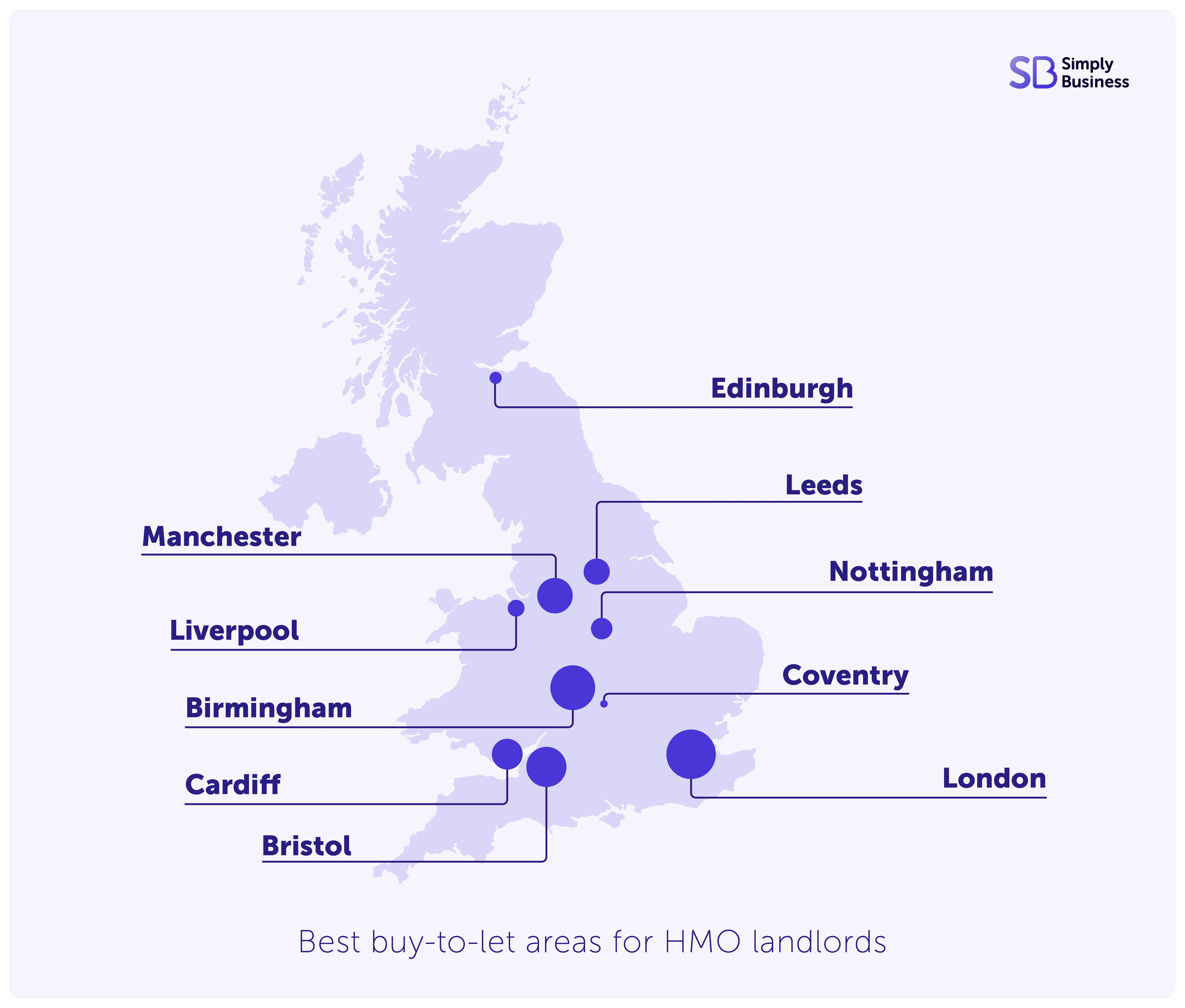

Where are the best investment properties for HMO landlords?

Houses in multiple occupation (HMOs) are larger properties that can be let to three or more people from more than one household who share living facilities.

For example, a house share of five young professionals would count as a ‘large HMO’. Read our guide to HMOs for further details.

To successfully let an HMO, you need to be operating in the right market – somewhere with lots of students or young professionals could be an ideal location.

If you’re looking to buy and rent out a larger property, here are the top five hotspots where we insured the most HMO landlords during 2023:

- London

- Birmingham

- Bristol

- Manchester

- Cardiff

It’s no surprise that all of these cities have multiple universities and strong employment markets, making them popular with young professionals – and so appealing to HMO landlords.

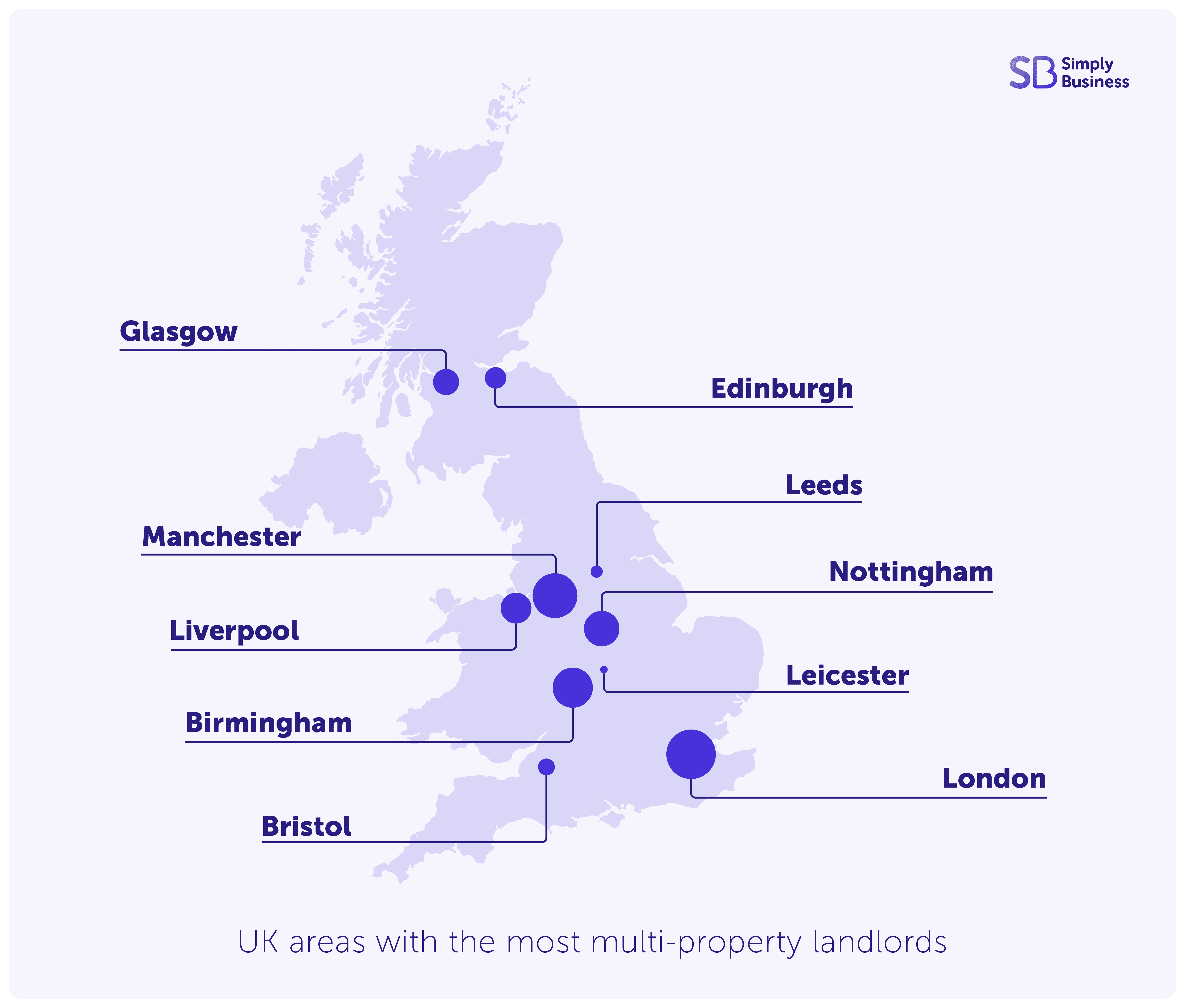

Where are the best buy-to-let areas for portfolio landlords?

Although the majority of landlords own one property, for some investors the ultimate aim is to build a property portfolio.

These landlords usually start out with one property, using the returns to buy their next property and so on.

Investors with several properties sometimes specialise in a particular niche, such as student property, or focus on a certain location.

If you’re looking to expand your portfolio in 2024, these are the areas with the most multi-property landlords:

- London

- Manchester

- Birmingham

- Nottingham

- Liverpool

Similar to the HMO hotspots, it’s unsurprising to see that portfolio landlords focus on big cities with high rental demand and lots of property options to choose from.

Read more: The ultimate guide to building a property portfolio

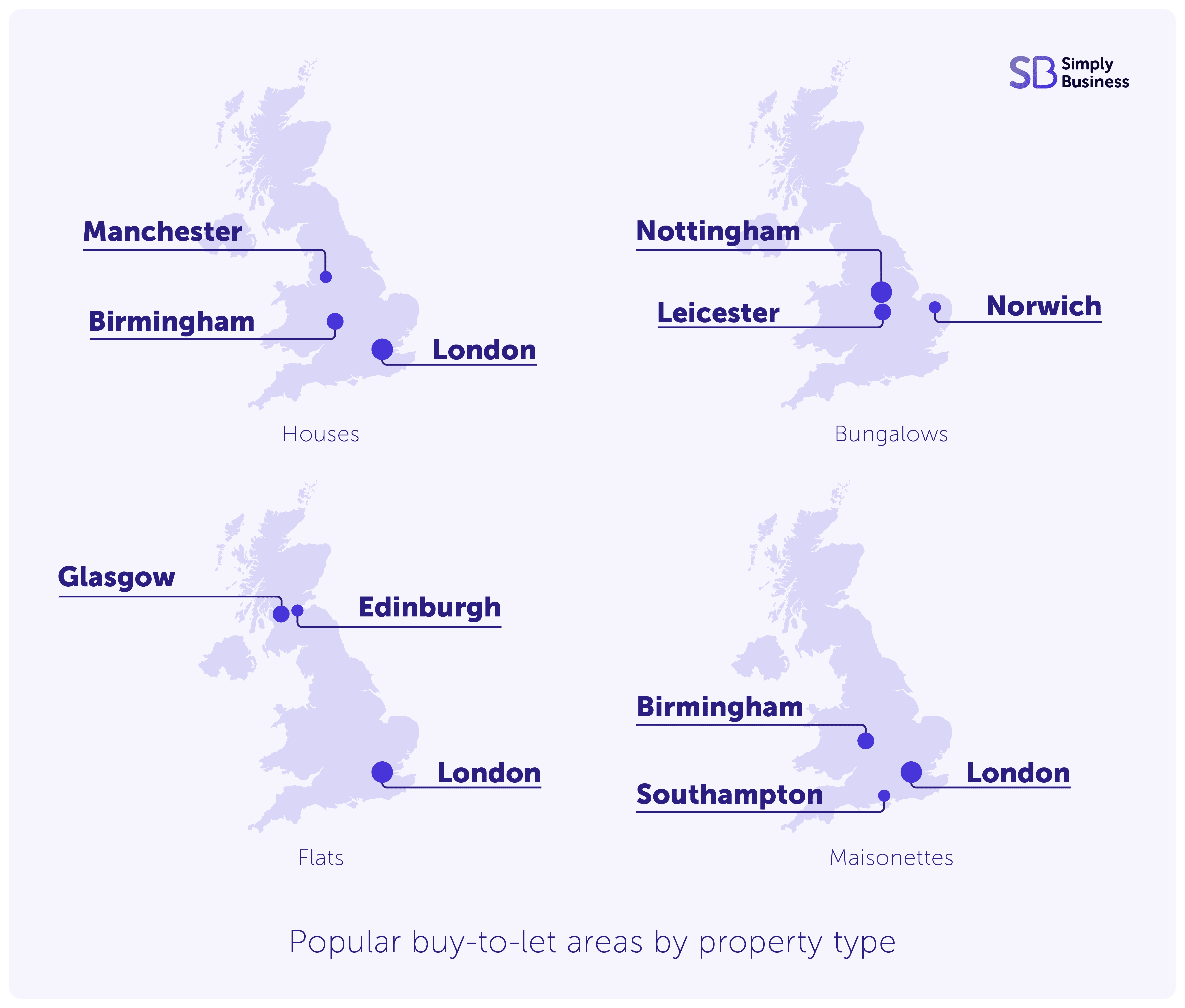

Revealed: Popular buy-to-let investment areas by property type

The type of property you rent out is likely to have an impact on the prospective tenants it attracts.

For example, houses could be more popular with families, while flats may appeal to young professionals, and bungalows could be more suitable for older renters.

We’ve taken a closer look at where the most landlords took out insurance policies for different property types during 2023.

Houses

The top hotspot for detached houses was Nottingham, while London was most popular for terraced and semi-detached houses.

Maisonettes and bungalows

London was the most popular location for landlords renting out maisonettes, followed by Birmingham, and Southampton.

Meanwhile, Nottingham, Norwich, and Leicester were the top buy-to-let areas for bungalows.

Flats

The top UK area for flats was London, followed by Scottish cities Edinburgh, Glasgow, and Aberdeen, with Manchester completing the top five.

Where are you looking to buy property in 2024? Let us know in the comments below.

Useful guides for buy-to-let landlords

Get set with tailored landlord cover

Over 200,000 UK landlord policies, a 9/10 customer rating and claims handled by an award-winning team. Looking to switch or start a new policy? Run a quick landlord insurance quote today.

Start your quote

Written by

Conor Shilling

Conor Shilling is a Copywriter at Simply Business with over two years’ experience in the insurance industry. A trained journalist, Conor has worked as a professional writer for 10 years. His previous experience includes writing for several leading online property trade publications. Conor specialises in the buy-to-let market, landlords, and small business finance.

We create this content for general information purposes and it should not be taken as advice. Always take professional advice. Read our full disclaimer

Keep up to date with Simply Business. Subscribe to our monthly newsletter and follow us on social media.

Subscribe to our newsletterInsurance

Public liability insuranceBusiness insuranceProfessional indemnity insuranceEmployers’ liability insuranceLandlord insuranceTradesman insuranceSelf-employed insuranceRestaurant insuranceVan insuranceInsurersAbout

About usOur teamAwardsPress releasesPartners & affiliatesOur charitable workModern Slavery ActSection 172 statementSocial mediaSite mapAddress

6th Floor99 Gresham StreetLondonEC2V 7NG

Northampton 900900 Pavilion DriveNorthamptonNN4 7RG

© Copyright 2024 Simply Business. All Rights Reserved. Simply Business is a trading name of Xbridge Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Registration No: 313348). Xbridge Limited (No: 3967717) has its registered office at 6th Floor, 99 Gresham Street, London, EC2V 7NG.