How early can I submit my tax return? 5 benefits of getting ahead

2-minute read

Filing an early tax return could be a great help to future you – and remember you don’t need to pay your bill at the same time, so you can still leave that until 31 January.

Tax returns aren't fun and it's easy to see why they fall down the to-do list. But if you’re faced with some down time, there are real benefits to filing your tax return early in the tax year.

Read on for all the information you need about early tax returns, plus five reasons why completing your Self Assessment as early as possible could benefit your business.

Can I submit my tax return early?

You may be wondering when can I submit my tax return for 2023 and can I complete my Self Assessment early? It’s important to know that you can actually file one for the previous tax year any time after the new tax year starts.

This means you can file a tax return for 2023-24 Self Assessment after 6 April 2024.

Increasing number of 'early birds'

More than 77,500 submitted their 2022-23 tax return on 6 April 2023 – the first day they were able to do so. This is more than double the number (36,939) who submitted their return on the first day of the tax year in 2018.

Myrtle Lloyd, HMRC’s Director General for Customer Services, said: "Filing your Self Assessment early means you can spend more time building your business or doing the things that you enjoy and less time worrying about completing your tax return."

5 reasons to file a tax return early

1. Earlier refunds if you’ve overpaid tax

Payments on account are future payments towards your next tax bill, based on estimates for your previous one.

One payment on account is due on 31 January and the next one is due on 31 July.

If you complete an early tax return at the start of the tax year in April, you know how much your bill actually is.

This helps with planning for your future payments – and if you’ve overpaid tax, you should get your refund sooner.

Read more about payment on account.

2. It’s easier to plan your finances

Rising costs, high inflation, and the cost of living have hit small businesses hard, with uncertain conditions making it hard to budget and plan ahead.

Knowing the actual cost of your tax bill well before the deadline should help you set aside the money for paying it on 31 January.

Having a completed tax return early should put you in a better negotiating position if it gets to January and you don’t think that you’ll be able to pay your bill.

Read more about HMRC Time to Pay.

3. You can minimise the risk of mistakes (and fines)

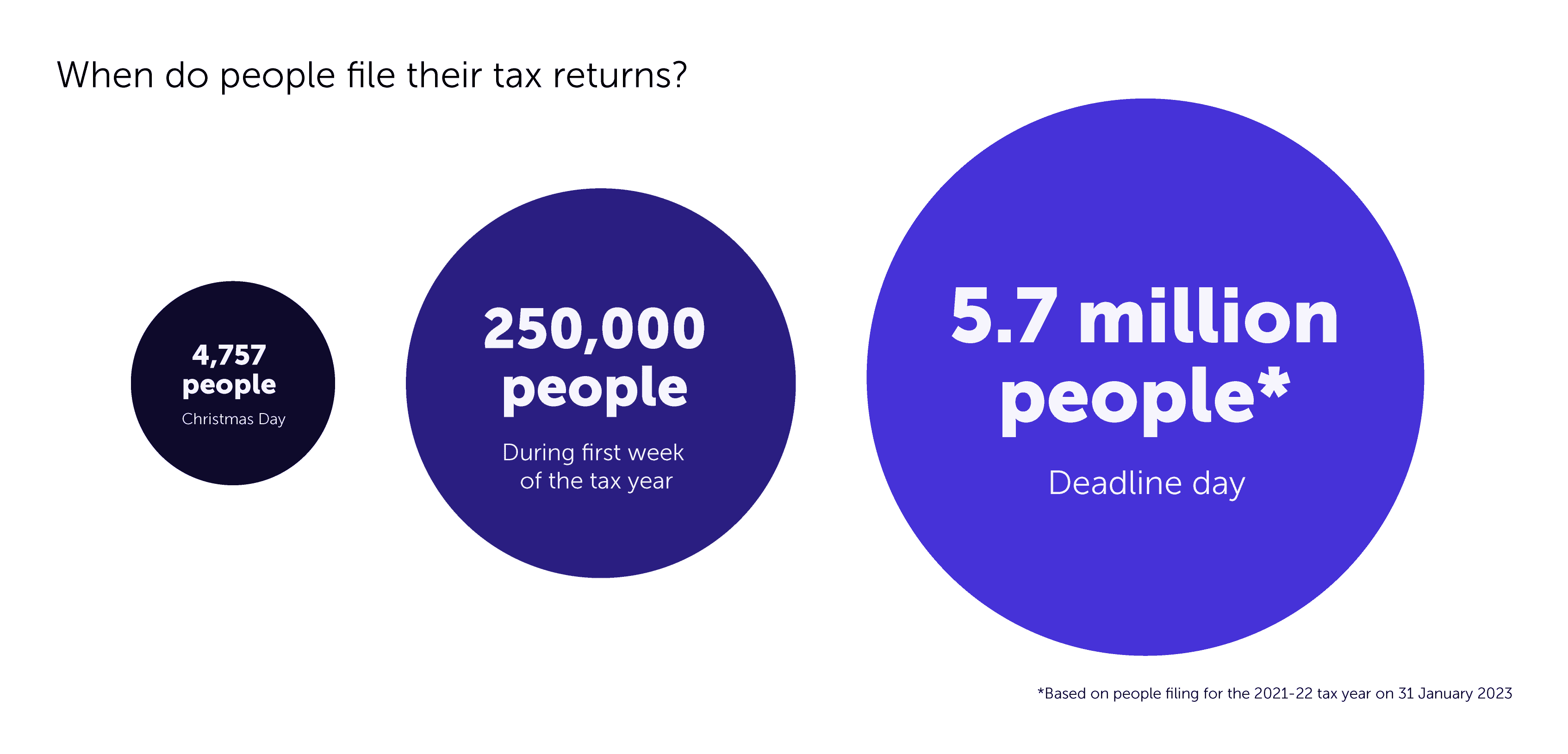

HMRC says that 861,085 people filed their tax return on 31 January 2023, with 36,767 filing between 11pm and 11:59pm. The peak hour for filing on deadline day was 4pm to 4:59pm, when 68,462 customers did their tax return.

While leaving it late might be unavoidable for some, it does carry the risk of making more errors than necessary.

And mistakes can lead to fines. While HMRC won’t issue penalties for people who’ve taken reasonable care when filling in returns, they charge 0 to 30 per cent of the tax due if people have been careless.

Read more about HMRC penalties and reasonable excuses.

4. Claim all the expenses you can

Having your records organised early not only helps you minimise the risk of mistakes. It also helps you claim all the right tax-deductible expenses.

Claiming expenses reduces your total taxable profit, meaning you pay less tax.

Allowable expenses include computer software, travel, and legal and financial costs. Doing your Self Assessment early means you can make sure you’ve included all your expenses.

Read more about allowable business expenses.

5. It gives you more time to research professional advice

You can include the costs of hiring a professional accountant or adviser as a tax-deductible expense.

If you start your tax return early and aren’t sure about the details, in the first instance you should be able to speak to someone at HMRC quicker (their phone lines are notoriously bad during Self Assessment).

But if you need more advice, it gives you time to find the right professional to help you out.

It’s important to do your research and make sure you find someone with a great reputation, as bad advice can cost you time and money.

Their advice can help you set up a proper record-keeping system, plus their knowledge of tax and expenses could go towards reducing your overall tax liability.

Read more about hiring an accountant and bookkeeping tips.

How early do you complete your tax return? Let us know in the comments below.

More guides to help you filing your tax return

Looking for self-employed insurance?

With Simply Business you can build a single self employed insurance policy combining the covers that are relevant to you. Whether it's public liability insurance, professional indemnity or whatever else you need, we'll run you a quick quote online, and let you decide if we're a good fit.

Start your quote

Written by

Sam Bromley

Sam has more than 10 years of experience in writing for financial services. He specialises in illuminating complicated topics, from IR35 to ISAs, and identifying emerging trends that audiences want to know about. Sam spent five years at Simply Business, where he was Senior Copywriter.

We create this content for general information purposes and it should not be taken as advice. Always take professional advice. Read our full disclaimer

Keep up to date with Simply Business. Subscribe to our monthly newsletter and follow us on social media.

Subscribe to our newsletterInsurance

Public liability insuranceBusiness insuranceProfessional indemnity insuranceEmployers’ liability insuranceLandlord insuranceTradesman insuranceSelf-employed insuranceRestaurant insuranceVan insuranceInsurersAbout

About usOur teamAwardsPress releasesPartners & affiliatesOur charitable workModern Slavery ActSection 172 statementSocial mediaSite mapAddress

6th Floor99 Gresham StreetLondonEC2V 7NG

Northampton 900900 Pavilion DriveNorthamptonNN4 7RG

© Copyright 2024 Simply Business. All Rights Reserved. Simply Business is a trading name of Xbridge Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Registration No: 313348). Xbridge Limited (No: 3967717) has its registered office at 6th Floor, 99 Gresham Street, London, EC2V 7NG.