Small business grants: everything you need to know

9-minute read

Small business grants can help you to grow your business with money you don’t have to pay back.

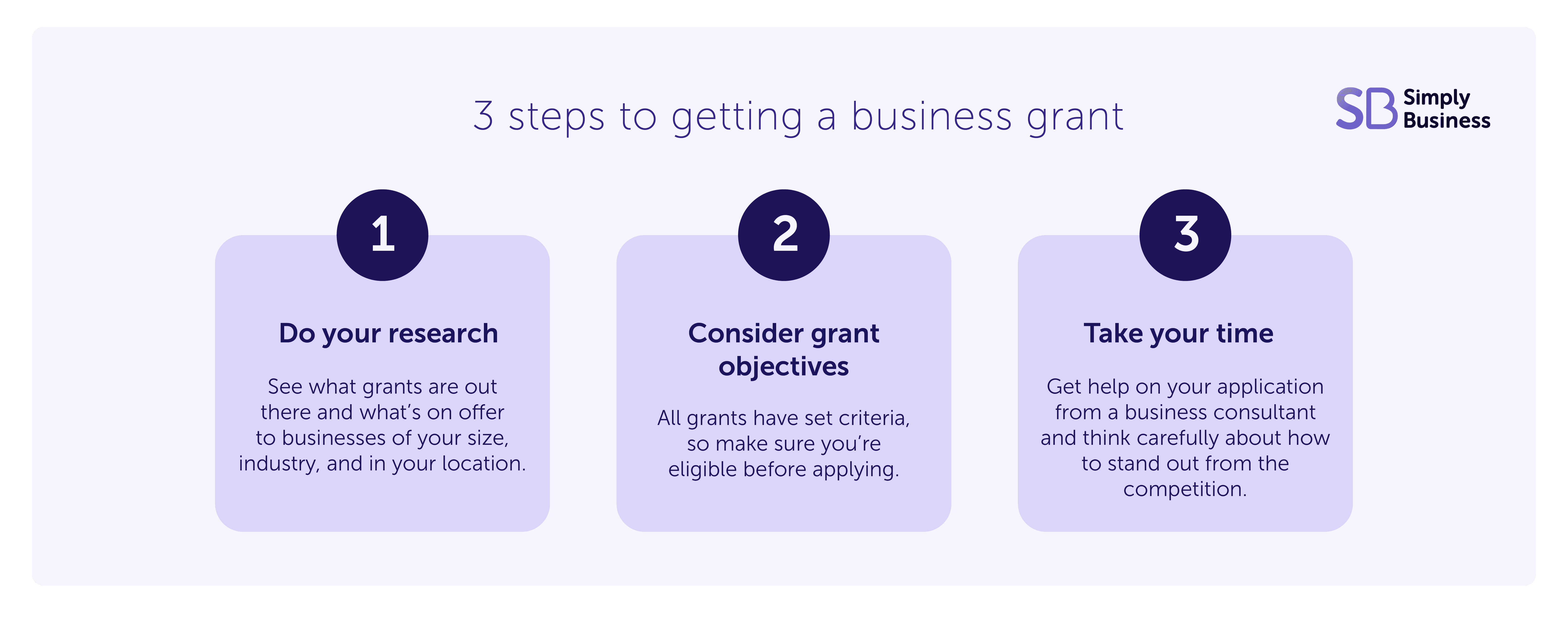

That being said, it’s important to do your research before applying for a business grant as eligibility can depend on a whole range of factors.

With this in mind, here’s a comprehensive list to help take some of the initial investigation effort out of applying for funding.

This guide gives an overview of a range of small business grants, both from the government and other organisations across the UK.

You can jump straight to the type of grant you’re looking for by following these links:

Government small business grants – what can you get?

The government provides a range of grants for all different types of businesses. You could receive government funding for hiring an apprentice, doing valuable industry research, or taking steps to be more sustainable.

Here’s an overview of the small business grants available from the government:

Innovate UK

Innovate UK provides government grants to “develop and realise the potential of new ideas, including those from the UK’s world-class research base”. Read about the Innovate UK grant.

R&D tax reliefs

Research and Development (R&D) tax reliefs support companies seeking to research or develop an advancement in their field (even if the project is unsuccessful). This means you can reduce your tax bill by claiming relief on things related to the research project, including staff wages, and project materials, and utilities.

You can claim R&D tax relief if you have:

- fewer than 500 staff

- a turnover of less than €100m or a balance sheet total less than €86m

Our guide to R&D tax relief explains more about what an R&D project is, as well as how to claim tax relief for it.

Grants for unemployed entrepreneurs

Although there’s no grant available, if you claim Universal Credit (UC) you may be eligible for a 12-month start-up period. This just means that your UC payments will be based on your self-employed earnings and you don’t need to look for other work. Our overview of self-employed benefits explains more.

You’ll also get support from a specialist work coach who’s experienced in working with self-employed people.

Another option to consider is a Start Up Loan, which could be useful if your business is less than two years old.

The government has more information on moving from benefits to work and starting your own business.

Grants for taking on an apprentice

You can get financial help from the government to train an apprentice in your small business.

If your pay bill is less than £3 million a year, you won’t pay the apprenticeship levy. This means you get five per cent towards the cost of training and assessment for your apprentice, if the apprenticeship started on or after 1 April 2019.

The government pays their 95 per cent share directly to the training organisation. You also pay your share directly, according to a payment schedule you agree with the training organisation.

From 1 April 2024, apprenticeships in small businesses for anyone up to the age of 21 will be fully funded. This means the full cost of training will be covered by an additional £60 million of funding made available by the government.

The amount of funding that employers can pass on to other businesses through the apprenticeship levy is also being increased.

It’s estimated that these measures combined could lead to the creation of 20,000 more apprenticeships.

Use the government’s enquiry form to ask the National Apprenticeship Service about the funding available.

Grants for installing high-speed broadband

Businesses in rural areas may be eligible for vouchers towards the cost of installing new gigabit-capable connections. Vouchers are worth up to £3,500 for businesses.

Find out more about the gigabit voucher scheme and check if you’re eligible.

Air quality grant schemes

The government has made funding available to some local authorities in England that are introducing clean air zones. Make sure you keep up to date with the new low emissions zones in UK cities. And you may be eligible for a grant to support your business with upgrading your vehicles or paying for the new charges.

Find out more about the air quality grant scheme.

Grants for low-emission vehicles

If you drive a van for your business, you can receive a government grant when you buy a low-emission vehicle.

You don’t have to apply for the grant, but you’ll get a discount when you buy the van. There are also vouchers available for installing an electric vehicle charge point at a workplace.

Read our guide on electric cars and vans for business for more information.

Government funding for the arts

The Arts Council England has a number of grants and funds for creative businesses and organisations. Find out more on their website.

How to apply for government business grants

The application process will vary depending on the grant you’re applying for, however here are some general tips to get you started:

- talk to the body awarding the grant – find out what they’re looking for and tailor your application to the objectives (for example sustainability or job creation)

- write a thorough business plan

- explain how you’ll use the money – be specific here and show how the funding will help you grow your business

- apply early – some grants have a limited pot of money so it’s always worth getting your application in as early as possible

- create a cash flow forecast – this is useful for managing your business finance and is sometimes needed when applying for finance (although more commonly with loan applications)

You can also ask your local authority about grants for small businesses available in your region and funding specific to your industry.

Just starting out as a small business owner? Make sure you read our guide to starting a business and don’t forget to organise business insurance.

If you're looking for financial guides and resources for your business, visit our cost of living support hub.

Grants to help you start or grow your business

Simply Business runs an annual competition to support small businesses to set up or grow their business. Business Boost gives away a cash grant to one winning business that captures the imagination of our judges.

Our 2023 winner was awarded £25,000 for their eco-friendly, low waste wholefoods store and delivery service.

You can register your interest now and be the first to know about how you can win funding for your business.

Small business startup grants

A range of startup business grants are available depending on the sector you want to go into. For example:

The National Lottery Heritage Fund

This new business grant supports heritage projects ranging from designed landscapes to cultural traditions.

Heritage Grants offer funding at two levels:

- £10,000 to £250,000 – no deadline so you can apply whenever you’re ready

- £250,000 to £10 million – you must submit an expression of interest before being invited to formally apply

Learn more about the National Lottery business grant.

Small business grants for young people

The Prince’s Trust has helped over 90,000 young people aged 18 to 30 to start and run their own business. Besides funding and resources, they also provide training and mentoring.

The Prince’s Trust runs an Enterprise Course, which involves info sessions and workshops to help you launch your business.

You can apply for:

- a business start up grant of up to £5,000

- a business start up loan between £500 to £25,000

If you’re an entrepreneur who’s building a solution to social problems in the UK, check out UnLtd awards. If you’re 16 or older, willing to participate in learning, and working for the benefit of others, UnLtd could help you start out. They offer awards up to £18,000 across two separate startup packages.

Wondering what mentoring is all about? Read our article on the benefits of having a mentor for your small business to learn more.

Just starting your business? Read our side hustle guide for students to help plan where you want to go with your business and what funding you might need to get started.

Small business grants for women

A Simply Business survey of over 900 women business owners found that 45 per cent would like greater access to business funding to overcome the barriers they face.

There are some grants and awards aimed at female business owners, including:

Where can I find small business grants in the UK?

Other financial help available to your small business will depend on where in the country you’re located, the size of your business, the industry you’re in – and whether you’re looking for business startup grants or funding to grow your business.

You can use the government’s finance and support online tool by selecting the ‘grants’ tick box. You can also filter by how long you’ve been trading (useful if you’re only looking for startup business grants), industry, number of employees, and region of the UK.

There’s also more information on the grants available in the different nations of the UK on the following portals.

Small business grants in England

The Local Enterprise Partnerships (LEP) Network website lists the 38 regional Growth Hubs. They’ve been set up to provide business funding, support and guidance in their local areas.

They make it easier for business owners to find the support they need by bringing together all of the available national and local business support in one hub.

You can search for business support available in your local area on the LEP Network website.

Small business grants in Scotland

If you’re based in Scotland, you might be able to apply for a business grant from Scottish Enterprise.

These include:

- SMART: Scotland – a R&D grant for highly ambitious projects

- Regional Selective Assistance funding – grants aimed at helping job creation across Scotland

Small business grants in Northern Ireland

Enterprise Ireland has a range of funding opportunities and grants for established businesses and startups. This includes funding for “high potential” startups, with awards of up to €1.2 million available.

Meanwhile, the British Business Bank launched a €70 million investment fund for small businesses in Northern Ireland.

The fund, opened in 2023 to close a “funding gap”, provides business owners with access to loans and investment programs.

Small business grants in Wales

If your small business is located in Wales, you can use the Welsh government’s Funding Locator to find and apply for various grants. Sources of funding include:

- the Welsh Government

- the UK Government

- the European Union

- local authorities

- charitable organisations

Small business training grants

While not strictly a grant, the government does offer funding for training through the National Skills Fund. Eligible adults can access free Level 3 training courses, from horticulture and hospitality to business management and digital skills.

You could also look into free courses, for example in bookkeeping to help you run your business smoothly.

If you’re a larger company, the Help to Grow managementscheme is government funded and offers free training in management.

What are the pros and cons of small business grants?

While being given money that you don’t have to pay back may seem like a win-win situation, business grants do have their downsides.

Here’s an overview of the main advantages and disadvantages to consider before applying for a business grant.

Advantages of small business grants

- free money – getting a cash injection that you don’t have to pay back is hugely appealing and could take your business to the next level

- keep control of your business – unlike private equity investment, you won’t have to give up a stake in your business

- range of options – as you can see from our list, there are so many different types of grants available to businesses of all sizes and industries

- advice and training – a lot of grants also come with the opportunity to get business support or free training

- prestige and reputation – winning a grant is a big achievement and can open the door to future opportunities for your business

Disadvantages of small business grants

- competition – the prospect of receiving money you don’t have to pay back means there will always be lots of applicants for every grant

- eligibility requirements – whether it’s location or the size of your business, all grants have eligibility requirements which can be restrictive

- time consuming – those awarding grants will want to make sure that the money is going to a good home, so the application process is likely to be detailed

- limited funding or winners – business grants are an inconsistent source of funding as they’re usually paid as a one-off. Most of the time there will only be a certain number of winners and a limited pot of money

- cost considerations – some grants require you to invest your own money first before being reimbursed, while others require you to match the grant investment with your own funds

What’s the difference between a small business grant and a loan?

A small business loan is money for your business you’ll have to pay back within an agreed timescale. This is different to a small business grant, which you won’t be expected to pay back.

Some grants will be offered on the basis that you must also invest the equivalent amount in your business. For example, if you’re given a £10,000 grant, you’ll need to have £10,000 to invest too.

Read our ultimate guide to small business funding and investment for more information.

Small business funding options

If you’re looking for small business funding but aren’t able to access the grants we’ve mentioned in this article, you may also want to consider:

Remember, business finance is a complex topic, so it’s important to speak to a professional financial advisor or accountant if you're not sure of anything.

What’s been your experience of getting funding for your small business? Let us know in the comments.

More guides for small business owners

Ready to set up your cover?

As one of the UK's biggest business insurance providers, we specialise in public liability insurance and protect more trades than anybody else. Why not take a look now and build a quick, tailored quote?

Start your quote

Written by

Conor Shilling

Conor Shilling is a Copywriter at Simply Business with over two years’ experience in the insurance industry. A trained journalist, Conor has worked as a professional writer for 10 years. His previous experience includes writing for several leading online property trade publications. Conor specialises in the buy-to-let market, landlords, and small business finance.

We create this content for general information purposes and it should not be taken as advice. Always take professional advice. Read our full disclaimer

Keep up to date with Simply Business. Subscribe to our monthly newsletter and follow us on social media.

Subscribe to our newsletterInsurance

Public liability insuranceBusiness insuranceProfessional indemnity insuranceEmployers’ liability insuranceLandlord insuranceTradesman insuranceSelf-employed insuranceRestaurant insuranceVan insuranceInsurersAbout

About usOur teamAwardsPress releasesPartners & affiliatesOur charitable workModern Slavery ActSection 172 statementSocial mediaSite mapAddress

6th Floor99 Gresham StreetLondonEC2V 7NG

Northampton 900900 Pavilion DriveNorthamptonNN4 7RG

© Copyright 2024 Simply Business. All Rights Reserved. Simply Business is a trading name of Xbridge Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Registration No: 313348). Xbridge Limited (No: 3967717) has its registered office at 6th Floor, 99 Gresham Street, London, EC2V 7NG.