Self-employed suffering from lack of sleep and burnout

3-minute read

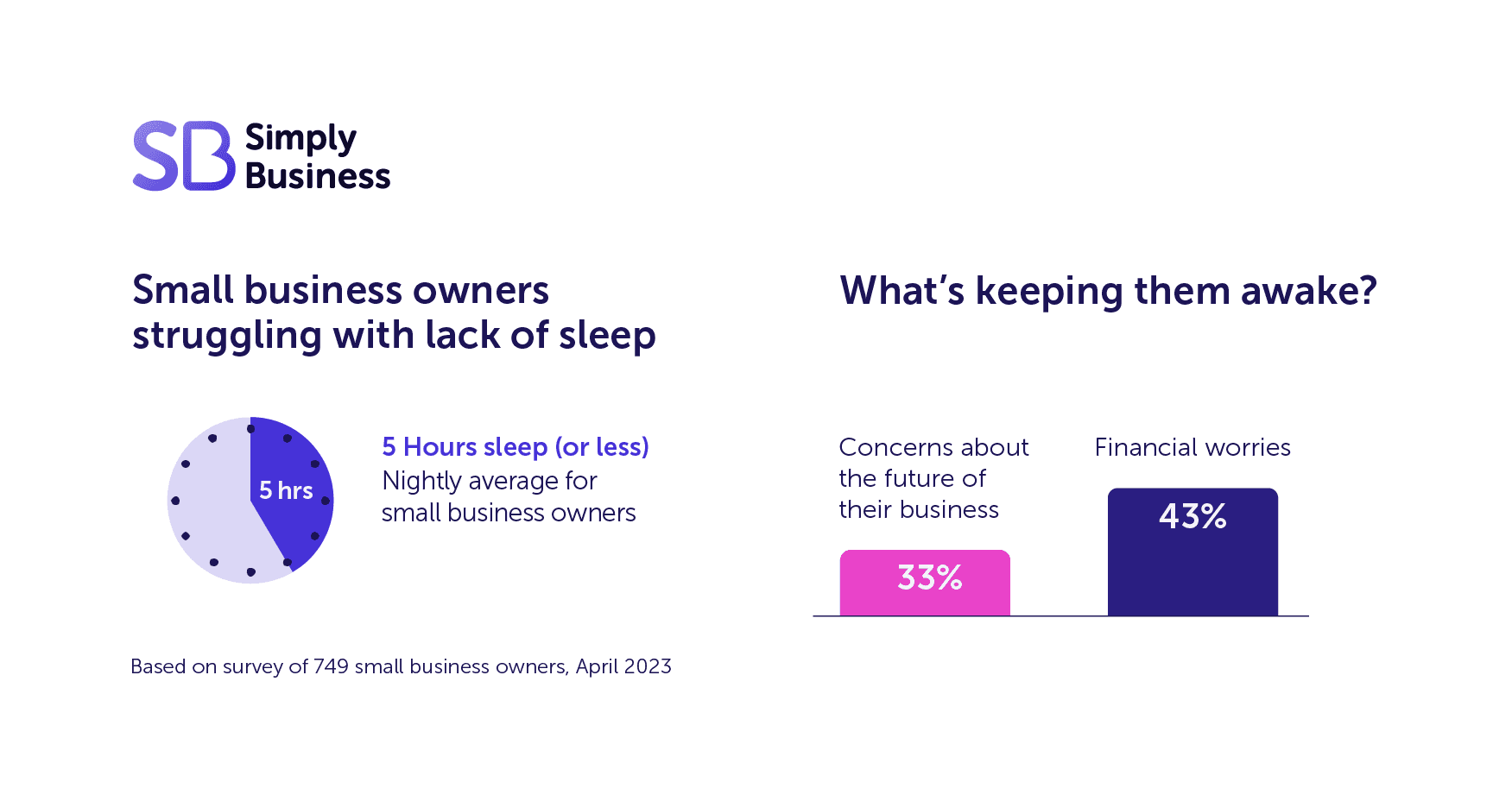

A third of small business owners are operating on less than five hours sleep a night, which is significantly less than the amount needed for a healthy lifestyle. Financial worries and concerns about the future of their business are highlighted as the main reasons for keeping them awake.

New research by Simply Business has uncovered the full extent of the mental health crisis facing the UK’s self-employed. Half of small business owners in the UK say they've experienced poor mental health over the past 12 months.

Less than five hours sleep a night

Everyone needs a different amount of sleep with influencing factors like age, overall health, and lifestyle. But the NHS recommends that a healthy adult will need between seven and nine hours sleep a night, so it’s worrying that a third of people surveyed are getting less than five.

With the rising cost of doing business, it’s no surprise that financial worries are causing problems with sleep for 43 per cent of small business owners. Meanwhile, 33 per cent are worrying about the future of their business at night.

Sleep is critical for maintaining overall health. As well as the obvious physical need for a good night’s sleep, a lack of sleep can have a psychological impact with increased feelings of anxiety or stress.

Lack of sleep fueling burnout

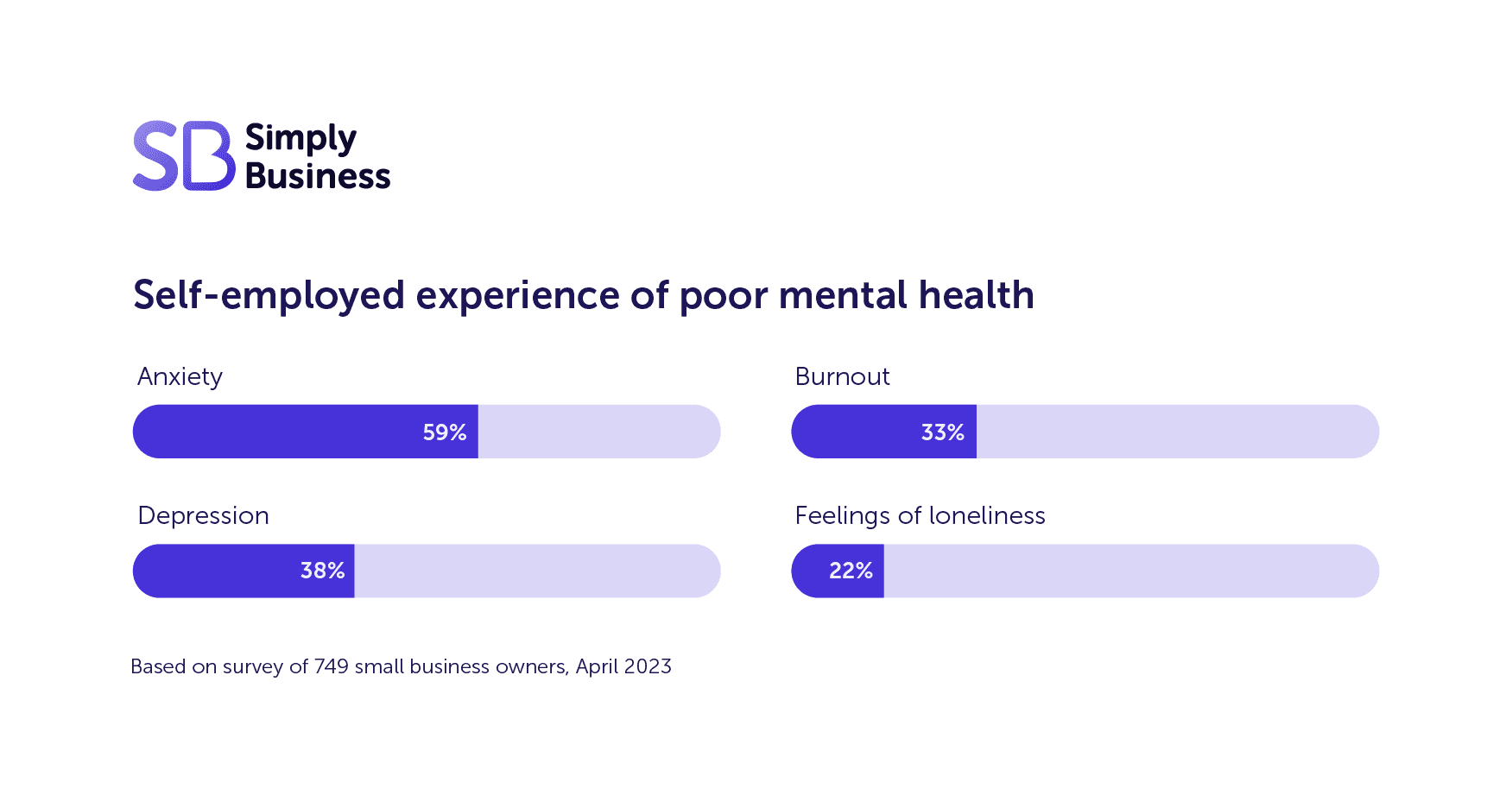

With one in three (33 per cent) opening up about experiencing burnout, it’s clear that the lack of rest is taking its toll on the country’s small business owners.

Three in five (59 per cent) have experienced anxiety, while depression (38 per cent) and feelings of loneliness (22 per cent) are also common for small business owners.

As well as suffering from a lack of sleep, many are unable to take time off, further worsening their mental health and wellbeing. Three quarters (73 per cent) of small business owners take fewer than 20 days off work a year, and more than a third (40 per cent) state they wouldn’t take time off if they were experiencing poor mental health, even after acknowledging that a break would benefit them and their business.

The government is sleepwalking into a crisis

Recent research shows that nine in 10 (90 per cent) don’t believe that the government is doing enough to support and champion the mental health of vital self-employed workers across the UK. Small businesses are currently unable to claim the same rights as employees when it comes to statutory sick pay and holiday entitlement.

Bea Montoya, Chief Operating Officer at Simply Business, commented: “The worrying state of small business owners’ mental health has been laid bare in our recent research – with a third of SME owners operating on less than five hours sleep a night. The long hours, rare breaks and sleepless nights are leaving many on the brink of burnout. With over half suffering from poor mental health in the last 12 months alone. During a cost of living crisis, the self-employed are working at capacity.

“And the situation should concern us all. Small businesses are vital to both our economic recovery and the prosperity of our communities, and this will only compound the challenges of an increasingly economically inactive population.

“From financial worries and stress, to isolation and insomnia – it’s critical that the real people behind the country’s SMEs are given the support they need. That’s why we’ve partnered with Mental Health at Work to raise awareness of the challenges facing this audience, and create tailored resources designed to help.”

Relax and unwind

Chartered psychologist and mindfulness trainer, Susan Peacock, has recorded a short meditation to help small business owners unwind and improve sleep, along with these mindfulness tips.

Simply Business has partnered with Mental Health at Work, a programme curated by Mind, to support the UK’s self-employed with their mental health and wellbeing. Visit their Self-Employed Support Hub for more.

Expert tips for avoiding burnout

Subira Jones is an entrepreneur also known as The Corporate Hippie, and she shares her experiences of burnout in this blog from Mental Health at Work.

Alongside her personal experience, she also shares her tips for dealing with burnout, from taking breaks to setting boundaries.

Simply Business partnered with Mental Health at Work, a programme curated by Mind, to support the UK’s self-employed with their mental health and wellbeing. Together we surveyed more than 700 small business owners to understand their challenges. Now we want to start a conversation and end the stigma surrounding mental health at work through our Mind Your Business initiative.

Visit Mental Health at Work's dedicated Self-Employed Support Hub for toolkits, resources and powerful stories to help improve workplace wellbeing.

Guides for small businesses

Ready to set up your cover?

As one of the UK's biggest business insurance providers, we specialise in public liability insurance and protect more trades than anybody else. Why not take a look now and build a quick, tailored quote?

Start your quote

Written by

Catriona Smith

Catriona Smith is a content and marketing professional with 12 years’ experience across the financial services, higher education, and insurance sectors. She’s also a trained NCTJ Gold Standard journalist. As a Senior Copywriter at Simply Business, Catriona has in-depth knowledge of small business concerns and specialises in tax, marketing, and business operations. Catriona lives in the seaside city of Brighton where she’s also a freelance yoga teacher.

We create this content for general information purposes and it should not be taken as advice. Always take professional advice. Read our full disclaimer

Keep up to date with Simply Business. Subscribe to our monthly newsletter and follow us on social media.

Subscribe to our newsletterInsurance

Public liability insuranceBusiness insuranceProfessional indemnity insuranceEmployers’ liability insuranceLandlord insuranceTradesman insuranceSelf-employed insuranceRestaurant insuranceVan insuranceInsurersAbout

About usOur teamAwardsPress releasesPartners & affiliatesOur charitable workModern Slavery ActSection 172 statementSocial mediaSite mapAddress

6th Floor99 Gresham StreetLondonEC2V 7NG

Northampton 900900 Pavilion DriveNorthamptonNN4 7RG

© Copyright 2024 Simply Business. All Rights Reserved. Simply Business is a trading name of Xbridge Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Registration No: 313348). Xbridge Limited (No: 3967717) has its registered office at 6th Floor, 99 Gresham Street, London, EC2V 7NG.