Wondering how to work out tax on a second job? If you’re joining the growing trend of running a small business on the side, it’s important to make sure you’re paying the right tax.

Perhaps you’re looking for additional income, or you want to turn a hobby into a business. Maybe you’ve even found a passive income stream alongside your full time job. Whatever your reason for working a side hustle, it’s important that you’re clued up on the tax implications of having two jobs.

How much tax do you pay on a second job?

The amount of tax you pay depends on how much you’re earning in both your jobs, whether you’re employed and self-employed or own two businesses yourself.

Key things to look for:

- freelancing might push you into a higher tax bracket

- there might be a conflict of interest with your main job

- you’ll need to complete a Self Assessment every year

Read on to find out about side hustle tax, and what self-employed tax and National Insurance you need to pay if you’re both self-employed and employed.

Do you get taxed more on a second job?

If both of your jobs pay you through PAYE then you won’t need to tell HMRC. Your tax will be worked out based on your combined income. Bear in mind though, having a second job could put you into a higher tax bracket.

Paying tax on a side business works differently if you’re self-employed. You’ll be able to earn a certain amount before paying any tax on your side hustle.

We explain more about tax on second income rules below.

Legal implications of working two jobs in the UK

Legally, there isn’t anything stopping you from working two jobs. You don’t have to tell your employer, but it can be a good idea to make sure there’s nothing in your employment contract that would prevent you from starting your own business – if there’s a conflict of interest, for example.

It’s worth remembering that if you choose to register as a limited company your business will appear on Companies House and information will be public anyway.

Can you be employed and self-employed?

It’s possible to be self-employed and work a full-time job. This can be a good idea to reduce any financial risk while you’re building your business.

If you’re still weighing up the pros and cons of being your own boss and taking the leap into the world of contracting, read our tips on going self-employed.

How much can I earn before tax?

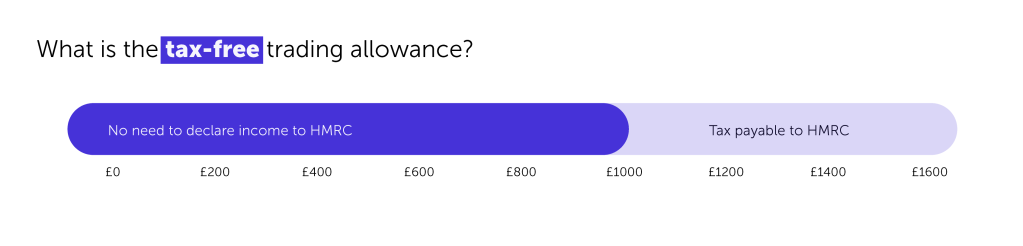

You’re allowed a £1,000 tax-free trading allowance, which means you don’t need to tell HMRC about any income until you make more than that in one tax year. However you may still want to register as self-employed as it can have other benefits.

This is separate to any income you make through your employed job.

Image credit: Simply Business

Register as self employed

When it comes to starting a business (even when you still have a main job), one of the first things you’ll need to do is register as self-employed with HMRC – you’ll need to do this before 5 October to avoid any penalties.

This is so you pay the right amount of side hustle tax, as this income won’t be taxed through PAYE.

File your Self Assessment tax return

You’ll need to file your Self Assessment tax return by 31 January each year. Read our guide on how to do a self-employed tax return and check important tax year dates you need to be aware of.

It’s important that you’re correctly reporting the income from your second job on your tax return. As of 1 January 2024, HMRC has been asking many popular side hustle platforms to report how much money individual users are making on the platform.

This means that HMRC are able to cross check the information on your tax returns with the numbers provided by the digital platforms.

These changes are part of a wider crackdown on tax avoidance, so won’t affect you if you’re correctly reporting your second job income. You can learn more about the latest HMRC reporting changes in our guide.

Second job tax calculator

Income tax is levied on profits or income in each tax year. This is based on combined income from both your main job and self-employment. So this could mean your profits as a sole trader push you into a higher tax band.

As an employee, your payslip will show how much income tax you pay and this will be automatically deducted from your salary. However you’ll need to also detail this on your Self Assessment tax return so HMRC knows what you’ve already paid.

If your second job is also on an employed basis, you’ll usually pay income tax at a basic rate on earnings over the £1,000 threshold.

As a self-employed person paying tax on a second income, you’ll need to work it out slightly differently. This is because income tax is based on your profits and you can deduct things like allowable expenses.

HMRC has a second job tax calculator to help you work out what you’ll need to pay on your side hustle.

How much tax do you pay?

The example below is based on 2024-2025 tax year rates detailed on gov.uk. Note that there are slightly different rates if you live in Scotland.

Tax year | 2024-2025 |

|---|---|

Income from employment | £40,000 |

Profits from self-employment | £14,000 |

Personal allowance (tax free) | £12,570 |

Taxable income | £41,430 |

Income tax to pay at 20% rate | £8,286 |

Read our guide to income tax to understand more about the tax rates when you’re self-employed.

Tax is complicated and this article is intended as a guide. If you aren’t sure, it’s best to seek financial advice from a professional.

Do you pay National Insurance on a second job?

As with income tax, your National Insurance Contributions (NICs) will come out of your salary automatically through PAYE. This is known as Class 1 National Insurance.

You’ll also need to pay National Insurance on income from your side business. You’ll pay Class 2 NICs if your profits are £6,725 or more a year, and Class 4 NICs if your profits are £12,570 or more a year – our National Insurance guide for the self-employed goes into more detail on rates and thresholds.

The government website also has a tool for you to check your National Insurance record.

Side business tax deductions

You can claim allowable business expenses on your side business just as you would as a sole trader without another job. This means you can deduct certain costs – such as office supplies and travel – from your annual turnover and only pay tax on your taxable profit.

HMRC second job tax codes

If your second job is on a self-employed basis, you’ll pay tax through Self Assessment and won’t need a tax code. You will however have a tax code for your employed job. This is because tax codes are part of the PAYE system and used by HMRC to tell your employer how much tax to deduct from your pay.

Read our guide to tax codes for more information.

Still deciding on your side hustle?

Popular side jobs can be anything, from home baking or jewellery making to running a courier business. To get set up, check out these guides:

- How to make money on TikTok

- How to make money on YouTube

- How to become a yoga teacher

- How to start a home baking business from home

Still haven’t found the right side hustle for you? We have a list of the best side hustles to start in 2024 for more inspiration.

Bailey Greetham-Clark is the owner of BeGreatFitness – which started out as a side hustle when Bailey was just 17 years old. While the company is now Bailey’s sole focus, he was in full time employment when BeGreatFitness started as his second job.

On working a second job, Bailey says: “I had a job in marketing and sales to support me starting a business. I was inspired to start BeGreatFitness because of my own personal struggles with mental health, as exercise helped to take me out of a really dark place as a young person.

“I was working in my job alongside starting my business for around ten months. I then had the opportunity to pick up a contract that would support half my weekly income and decided it was the very closest I would get to it being the ‘right time’.

“Now my business is going extremely well. We have a small team of three and work out in schools, care homes, and with charities to make fitness accessible to all.”

Do you have a side hustle? Tell us all about it in the comments.

Guides to help you start your business

Getting your head around business admin, legal and financial responsibilities, and important licences can feel overwhelming. These guides are created to help you understand every step to setting up your side business:

- How to start a side hustle

- How to become a freelancer

- How to achieve work life balance when you have a side hustle

- What business insurance do I need?

Ready to set up your cover?

As one of the UK’s biggest business insurance providers, we specialise in public liability insurance and protect more trades than anybody else. Why not take a look now and build a quick, tailored quote?

Photograph: Luciano/stock.adobe.com

This block is configured using JavaScript. A preview is not available in the editor.