If you’re buying or selling a property that’s recently had work done, solicitors will need to see evidence that it meets building regulations.

But if this evidence isn’t available, you may need to get building regulations indemnity insurance. But what exactly is it – and do you need it as a landlord?

In this guide, we explain what building regulations indemnity insurance is, when it’s needed, how much it typically costs, and what it does (and doesn’t) cover.

Building regulations indemnity insurance – what you need to know

Building regulations indemnity insurance helps to protect property buyers, sellers, and mortgage lenders from legal issues if a local authority takes action over past building work that lacked proper approval. It’s a one-off payment that covers legal costs and financial loss from enforcement, not the cost of repairs.

It’s arranged through a solicitor and provides long-term peace of mind, especially for landlords who are legally responsible for their property’s safety.

What is building regulations indemnity insurance?

Building regulations indemnity insurance is a special type of policy that helps protect property buyers or mortgage lenders if past building work doesn’t meet legal standards – and the local authority raises concern.

It doesn’t cover the cost of fixing the problem – just the legal or enforcement risks.

It’s typically used when:

- property alterations (like an extension or wall removal) were completed without building control sign-off

- there’s no completion certificate or formal approval for the work

- you’re buying or selling a property and want to help avoid delays or liability

When might you need building regulations indemnity insurance?

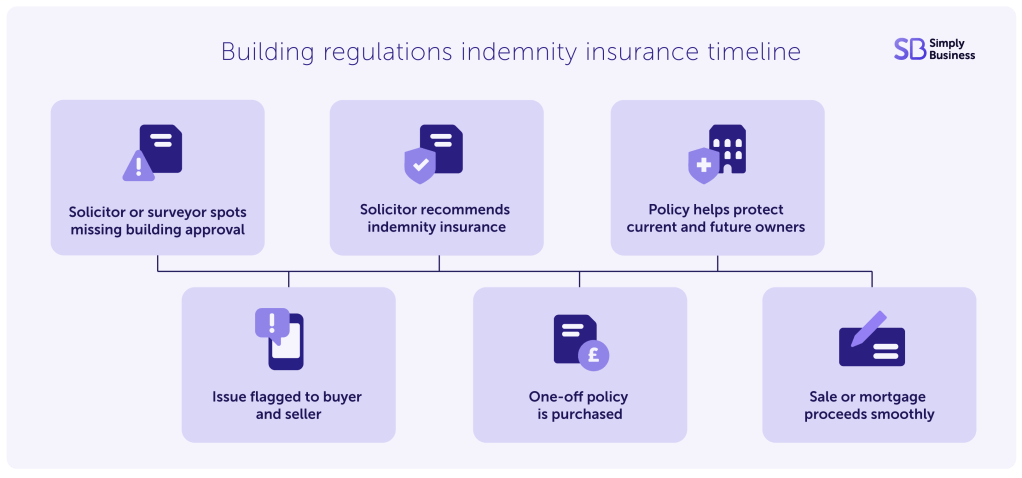

You might need building regulations indemnity insurance during the conveying process – usually after a solicitor or surveyor spots undocumented building work.

Common scenarios include:

- selling a home where loft conversions, garage builds, or chimney removals were done without approval

- buying a property where past owners didn’t keep records of planning or building control documents

- letting out a property that’s been altered – and your landlord insurance provider requests cover or clarification

Your solicitor may flag the issue and recommend an indemnity policy to keep the transaction moving.

The Home Owners Alliance has more information on indemnity insurance when buying or selling a property on their website.

Building regulations indemnity insurance example

Problem: Alex owned a Victorian terrace house that he’d been letting for five years. When he decided to sell, the buyer’s solicitor noticed the kitchen had been extended 12 years ago – but there was no record of building regulation sign-off.

Alex had no paperwork and no way to contact the previous owner. The buyer’s mortgage lender flagged it as a problem, putting the sale at risk.

Solution: Alex’s solicitor arranged a building regulations indemnity policy. This one-off policy helped to protect the buyer and lender against future enforcement by the local authority. This meant the sale was completed without delay.

How much does building regulations indemnity insurance cost?

The cost of building regulations indemnity insurance can vary – but can be significantly cheaper than having to redo the work or delaying the sale. Most policies don’t cost more than a few hundred pounds, but will depend on:

- the value of the property

- the work that’s been carried out

Your conveyancing solicitor will usually be able to help you get a building regulations indemnity insurance quote.

Good news: the policy only needs to be paid once and lasts indefinitely (including for future owners and mortgage lenders).

Sometimes the buyer pays the cost, as they’re the one who’ll benefit from the policy. Other times, the sellers pay as they’re the ones lacking the building regulations paperwork. And often, the cost is split between the buyer and seller to move the sale forward.

What does building regulations indemnity insurance cover?

Building regulations indemnity insurance typically covers:

- legal costs if a local authority takes enforcement action

- financial loss from the action (e.g. reduced property value or blocked sale)

- protection for future mortgage lenders and buyers

It doesn’t cover:

- the cost of correcting or repairing the work

- new building projects – only past, completed work

- situations where you’ve already contacted the council about the work (which invalidates eligibility)

- injuries caused by faulty building works that don’t meet regulations

What if you’ve already notified the council?

If a local council is already aware of the issue – or if you’ve applied for retrospective approval – you likely won’t be eligible for indemnity insurance.

In those cases, you might need to:

- apply for a regulation certificate through building control

- get professional advice from a surveyor or solicitor

How do you get building regulations indemnity insurance?

This type of policy is usually arranged through a conveyancing solicitor during the buying or selling process.

It’s important to act early – as delays during conveyance can slow down or delay property sales.

Why building regulations indemnity insurance matters for landlords

As a landlord, you’re legally responsible for the safety of the property you rent out. If previous owners didn’t get approval for alternations – or if you’ve lost the paperwork – this policy can give you peace of mind and help to avoid expensive legal issues in the future.

It also keeps property sales and refinancing moving smoothly.

What other types of insurance do landlords need?

If you’re buying a rental property, you’ll need to consider insurance covers. At Simply Business, you can get tailored landlord insurance cover such as:

- Buildings insurance

- Contents insurance

- Property owners’ liability insurance

- Loss of rent insurance

- Fixtures and fittings insurance

- Accidental damage insurance

- Alternative accommodation insurance

- Unoccupied property insurance

- Legal expenses insurance

- Home emergency insurance

Building regulations indemnity insurance – key takeaways

- building regulations indemnity insurance helps protect you against legal enforcement, not repair costs

- it’s needed when past alterations were made without formal approval

- it’s usually required during a property sale or purchase – especially if your solicitor flags a missing document

- it’s a one-time cost with long-term coverage for future buyers or lenders

- it’s often essential for landlords and property investors dealing with legacy issues

Buildings regulations and planning permission are complex subjects. If you’re unsure of anything, you should get in touch with a planning expert or your local authority. Please use this article as a guide only.

FAQs: building regulations indemnity insurance

Do landlords need building regulations indemnity insurance?

If you’re letting a property that’s had alternations without approval, your insurer or mortgage lender may require this policy – especially during refinancing or sale.

Can I buy this insurance myself?

You can’t usually buy building regulations indemnity insurance yourself. It’s typically arranged by a solicitor or insurance broker specialising in property transactions.

Is building regulations indemnity insurance mandatory?

No, but many lenders and buyers insist on it when approval documentation is missing.

Useful guides for buy-to-let landlords

- Best buy-to-let areas in the UK

- Renting out your property: rules for landlords in 2025

- The ultimate guide to buy-to-let property investment in the UK

- Buy-to-let mortgage rates explained

Get set with tailored landlord cover

Over 200,000 UK landlord policies, a 9/10 customer rating and claims handled by an award-winning team. Looking to switch or start a new policy? Run a quick landlord insurance quote today.