Compare quotes from leading brands

UK-based claims helpline available 24/7

from our specialist claims partner, Sedgwick

Satisfaction score of 9/10

for public liability insurance

Trusted by nearly a million customers

to provide business and landlord insurance

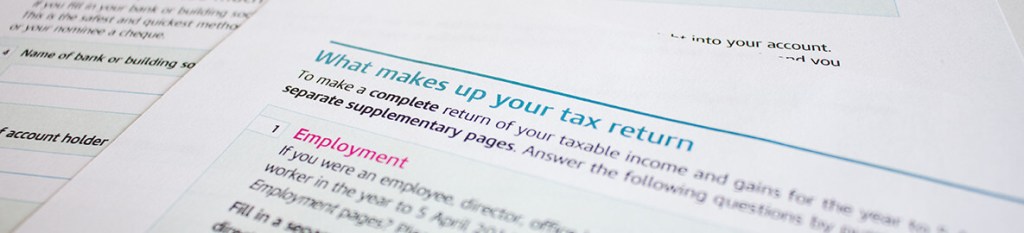

How much tax does a landlord pay on rental income?

Landlords are business owners, and you’ll pay tax depending on how your business is run. As a quick start pointer, it’s worth getting familiar with things like ‘allowable expenses’, and you’ll need to register as a Self Assessment taxpayer. Remember, tax needn’t be taxing – you just need to find out where you stand.

Working out your landlord tax

The amount of tax you pay will depend on how your property is rented, your rental income, and your total ‘allowable expenses’. These are the costs that HMRC permits you to deduct from your earnings for tax purposes, and can include:

- Agent fees

- Legal fees associated with signing or renewing a lease

- Accounting fees

- Landlord insurance

- Interest on mortgages

- Property maintenance and repair costs

- Utility bills (water, gas, and electricity)

- Ground rent

- Council Tax

- Domestic services (eg gardening)

- Other costs directly associated with renting out a property

To find out the figure on which your tax will be based (your net income), you can subtract your allowable expenses from your total income. You may also be able to deduct a wear and tear or renewals allowance. If you have more than one property, remember that HMRC will treat them all as one business.

Exceptions and room rentals

The situation is different if you want to let a furnished room or a floor in your own house or flat. In this case you may be able to use the Rent A Room scheme, under which you can earn up to £7,500 a year tax-free. You also won’t need to complete a tax return, provided that your rental earnings remain below that threshold. You must be a resident landlord in order to qualify for Rent A Room.

Landlord insurance covers

- Buildings insurance

- Contents insurance

- Fixtures and fittings insurance

- Loss of rent

- Property owners’ liability

- Alternative accommodation insurance

- Accidental damage insurance

- Landlord home emergency cover

- Landlord boiler breakdown cover

- Unoccupied property insurance

- Tenant default insurance

- Rent guarantee insurance

- Landlord legal expenses insurance

Landlord insurance FAQs

- What is landlord insurance?

- What does landlord insurance cover?

- Why do I need landlord insurance?

- Why not just home insurance?

- Is landlord insurance mandatory?

- How much does landlord insurance cost?

- What type of landlord insurance do I need?

- How much landlord insurance do I need?

- How do I find cheap landlord insurance?

- Landlord insurance FAQs

Rated 4.6/5 by customers

Our score is based on the reviews we’ve collected on Feefo, the independent customer research specialist.

“A fantastic and well informed quotation for our business needs. Simply Business was clear, concise and timely from start to finish. Everything we look for within a company with the pros of a tailored package and cost effective premiums.”

Nathan, February 2025