Freelance work means choosing when and where you work, as well as picking the type of jobs and clients that most appeal to you.

But what is freelancing and how do you take the first steps to becoming a freelancer? We speak to Jasmin, an experienced freelance videographer, to get her best tips and insights. Watch the video to hear her tips – or keep reading to learn more.

What is freelancing?

Freelancing is a flexible way of working, allowing you to take on projects for a variety of clients while remaining self-employed.

Freelancers are attractive to employers who need industry experts on short term projects. It gives them access to key skills without the need for long-term employment commitments, which is particularly useful for start-ups and earlier-stage businesses.

Are you a business owner looking to hire a freelancer? We have a guide covering that too.

Freelance vs self-employed – what’s the difference?

All freelancers are self-employed but not all self-employed people are freelancers. While both have the same legal obligations, freelancers often work solo – while self-employed people may build their own team.

Whatever you call yourself, remember that working as a freelancer is much the same as running your own business. You have to actively win work and deal with admin like tax and invoicing.

Freelancers vs contractors

Some freelancers refer to themselves as contractors. There are no legal differences between the two, and it often comes down to the type of projects you take on.

For example, contractors often take on longer term projects and may even work in the offices of their client. Contracting can be a more common term in certain industries (such as IT and construction) – so depending on the industry you’re working in, you may hear this term more frequently.

How to become a freelancer

Taking the leap to become a freelancer can seem daunting at first but our guide covers everything you need to know to get started. You may already have an idea of the work you want to do, or you may still be looking for inspiration. If so, check out these guides to some of the top freelance jobs:

Once you have an idea in mind, follow these next steps.

Register as self-employed

Whether you consider yourself a freelancer or self-employed, the tax implications are the same, meaning you still need to register with HMRC or Companies House. This is the first step you need to take as a freelancer – and once it’s out of the way, you can focus more on doing the work you love.

The most common freelancer legal structure is to register as a sole trader with HMRC. Typically, sole traders have less paperwork and more privacy than limited companies (although don’t underestimate the work you’ll be putting into your annual tax return).

But because, legally, sole traders aren’t separate from their businesses, it does carry more risk – such as debt and other financial liabilities.

Alternatively, you could set up your own limited company. Limited companies are separate legal entities, meaning your personal assets won’t be liable if your business goes into debt.

Some freelancers choose to run a limited company, as it can make their business look more professional to clients. But there’s much more paperwork, and more rules and regulations involved when setting up (and running) a limited company. You’ll need to register with Companies House and complete a company tax return, as well as your own Self Assessment.

Whichever route you pick, read our full guide to registering as self-employed to get started.

Find freelance jobs

In order to make a steady income as a freelancer, you’ll need to find clients.

When you’re first starting out freelancing, one popular way to find clients is through specialised online platforms – such as Upwork, Fiverr, or LinkedIn. Check out our guides to finding freelance clients on:

Another way to find clients is through networking and word of mouth.

But no matter how you choose to advertise your services, you’ll likely need a good portfolio in order to sell yourself. Your portfolio acts as a collection of your past work and gives potential clients a better understanding of what they can expect from you.

Freelance videographer Jasmin recommends beginners include examples of the type of work they want to do in their portfolios – even if they haven’t had a chance to work on them yet. She also recommends creating examples for fun on the weekends, and including those as examples of your work.

“You have to create examples of the kind of work that you want to be hired for, even if it starts with personal projects. When I first started going freelance, I made branded content on the weekends just for fun. This gave me something to show in my portfolio and help me work out what I actually like making.”

Jasmin

Freelance videographer

While portfolios are traditionally used in creative industries, you can use them in just about any field. And if your work is more about providing a service rather than a product, you can consider using customer testimonials instead.

Richard, who owns his own gardening business, agrees, saying: “I’ve got a book with recommendations from my customers. So if I need to convince anyone I’m right for the job, I’ll show them what my customers think. And if you go on my Facebook page, you’ll see before and after pictures of gardens I’ve worked on. Once they’ve seen that, it normally convinces them.”

Set your freelance rates

Another important part of establishing yourself as a freelancer is setting your rates. Depending on the project, you may charge a day rate or an hourly rate, so it’s important to consider what both of these will be ahead of time, so you can get back to any queries quickly.

We have an hourly rate calculator you can use to get started but it’s also important to do your own research. Look at what your competitors are charging, paying particular attention to those in your local area and those with the same level of experience as you.

And remember that as your experience and client list grows, you’ll be able to gradually increase your freelance rates.

Jasmin agrees, saying: “As you grow, your rate should reflect more than your time. It includes your skills, your experience, the tools or software you use, and the time it takes to plan. A client isn’t just paying for your time, they’re also getting access to everything you’ve invested in to do the job well.”

If you’re a contractor, we also have a separate guide on how to price contractor jobs.

Depending on the project, it’s also possible your client will ask you to keep a timesheet of your hours worked. This is important for both parties, as it makes sure you’re getting paid accurately for the work you do.

Keep your income steady

As a freelancer, you won’t get a regular paycheck each month, so it’s important you plan the work you take on to keep your income steady. Jasmin uses a mixture of the following project types to add stability to her income:

Bigger projects: less frequent projects which can take longer to get paid for – but use many of your favourite skills and can be creatively fulfilling

Retainer clients: regular clients with steady and familiar work

Ongoing jobs: quick jobs that are always needed – usually with clients you have a good relationship with

Understand your employment status

Remember that as a freelancer, you’ll be working on a self-employed basis. Because of this, if you’re hired for a longer term project by another business, you’ll need to make sure you’ve been hired on a freelance contract.

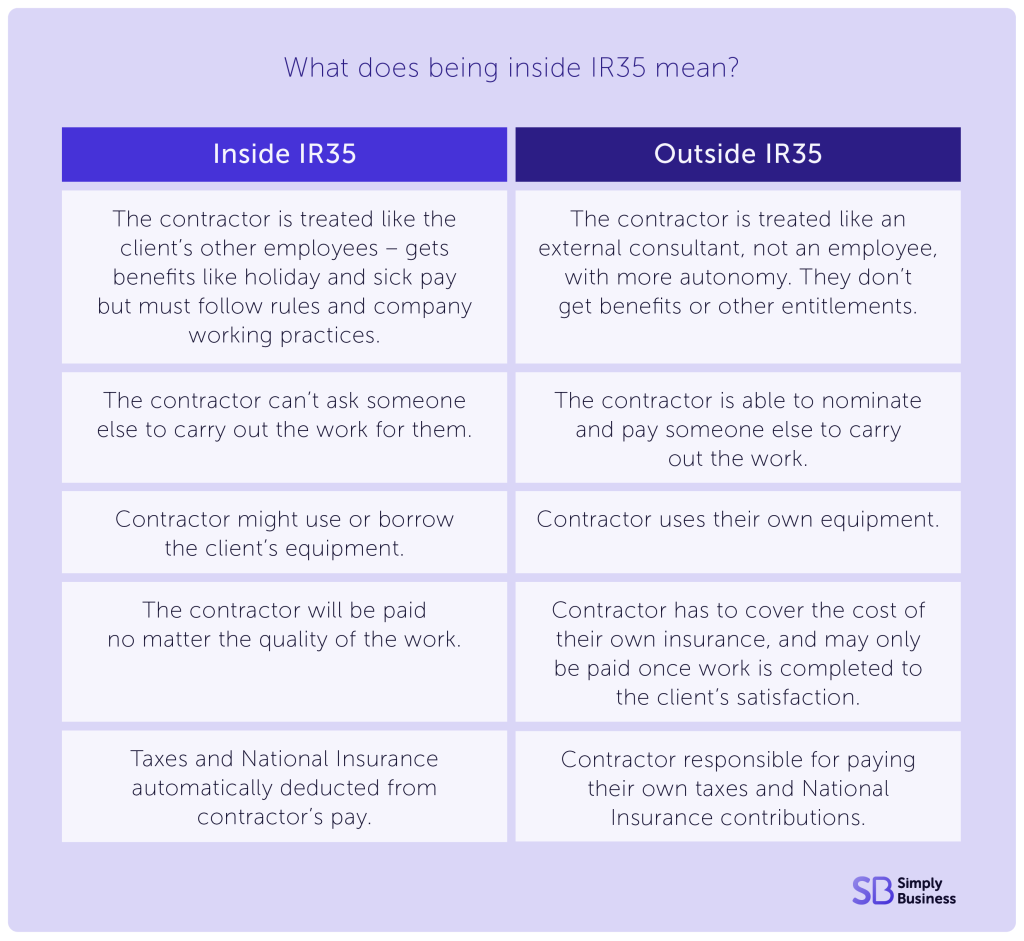

This is called being inside or outside IR35 and affects how you pay tax. Use the below chart to make sure your contract is definitely for freelance work.

Ultimately, whether or not you’re working on a freelance basis will come down to how you’re paid, as employees who work for others are paid through employee Pay As You Earn (PAYE). But if you’re self-employed, you’ll be paid differently and will have to pay your own tax to HMRC.

While most people fall into employed or self-employed status, there are actually five types of employment status. Check out our full guide to working out your employment status if you’re still unsure.

Contract work

One employment status you may encounter as a freelancer is contract work, which is working a long-term contract with a single employer. You’ll get to know the company culture and product well, and will likely receive a higher salary compared to those traditionally employed by the company.

Contract work can be appealing if you’re looking for a period of financial stability. However, remember that you won’t receive any other employee benefits such as sick days and holiday pay.

Be aware of your obligations

One of the biggest things that prevents people from beginning a freelance career is the idea of paying your own taxes. But if you’re registered as a sole trader (the most common way to freelance), you’ll only need to complete a Self Assessment once a year – and you can make this easier on yourself by tracking your earnings.

Check out our guide to completing a Self Assessment to learn more about paying tax as a freelancer. You may also want to consider:

- reading up on intellectual property law – if you’ve been commissioned to create something for another business, making sure the ownership rights are laid out in your contract can help you in the long run

- understanding confidentiality breaches – practising proper security measures (such as password protecting and encrypting your work) can help protect you and your business

- taking out a freelance insurance policy – while this isn’t a legal requirement, it can help to cover you if your work gets interrupted or a claim is made against you

Should I go freelance?

When becoming freelance, it’s important to fully understand the realities of this type of work. Think about your responsibilities, commitments, and personal ‘non-negotiables’ that make up your lifestyle. The obvious ones here are family commitments and financial responsibilities.

With a regular pay cheque, you have income – and often as a result of that secure income, you start building up liabilities. These might be rent or a mortgage, plus all those Direct Debits you know are going to go out each month, usually as soon as you’ve been paid.

But if you’re a freelancer, your pay cheques could come more sporadically. Late payments are a huge problem for the self-employed. Our 2025 SME Insights Report revealed that 23 per cent of small business owners are owed up to £5,000 in late payments.

If you’re giving up a regular salary to become a freelancer, make sure you have a complete picture of your income and outgoings, and minimise the risk of missed payments.

Looking for freelancer insurance?

As the UK’s biggest business insurance provider, we protect the self-employed workers who’re building Britain. Why not take a look now and build a quick, tailored freelancers insurance quote?

Photo credits: Jacob Lund /stock.adobe.com / Rawpixel.com/stock.adobe.com