One of the most important dates to remember if you’re self-employed or run your own business is the Self Assessment deadline. Your tax return shows your income and expenditure for the previous tax year and is how your tax bill is calculated.

If you’re a sole trader or in a business partnership, or if you’re a company director, then you’ll need to file a tax return to HMRC every year. Landlords earning money from renting out property may also need to complete a Self Assessment, but we have a separate guide for that.

When is the Self Assessment deadline?

The Self Assessment tax return deadline is on 31 January each year. This means that the deadline for filing your 2024-25 taxes is 11.59pm on 31 January 2026. This is also the deadline for paying any tax owed for the previous tax year (and your first instalment of payment on account).

Remember, this deadline is if you choose to file your taxes online – there’s a different date to remember if you want to file a paper return.

There are other important company and self-employed tax return dates too – keep reading and mark your diary with the key tax year dates to remember.

Self Assessment tax – when to file?

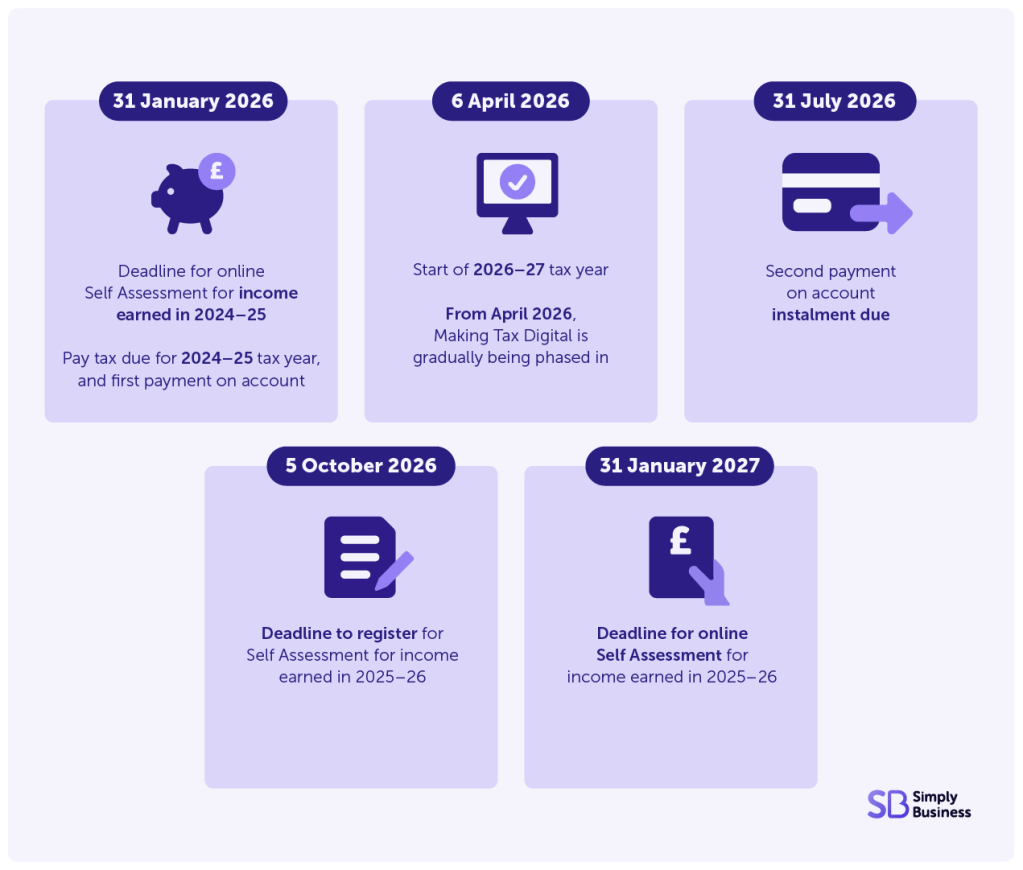

| Date | Deadline |

| 6 April 2025 | Start of 2025-26 tax year |

| 5 October 2025 | Deadline to register for Self Assessment for income earned in 2024-25 tax year |

| 31 October 2025 | Paper Self Assessment tax return to be submitted for income earned in 2024-25 tax year |

| 31 January 2026 | Deadline for online Self Assessment tax return for income earned in 2024-25 tax year Pay any remaining tax due for 2024-25 tax year, and first payment on account instalment |

| 6 April 2026 | Start of 2026-27 tax year From April 2026, Making Tax Digital is gradually replacing the annual Self Assessment process. In future, you’ll need to file online every quarter |

| 31 July 2026 | Second payment on account instalment due |

| 5 October 2026 | Deadline to register for Self Assessment for income earned in 2025-26 tax year |

| 31 January 2027 | Deadline for online Self Assessment tax return for income earned in 2025-26 tax year |

You’ll no longer be able to file your Self Assessment tax return on paper from April 2026 with HMRC’s Making Tax Digital programme.

Now you’ve got the dates for your diary, make sure you follow the steps to filing your Self Assessment tax return. And wondering how much tax you’ll pay? Read our guide to income tax.

Do I need to pay tax through Self Assessment?

Yes, if you’re:

- self-employed with earnings over £1,000 in one tax year

- in a business partnership

- making money from renting out a property

- claiming Child Benefit when you or your partner earn more than £60,000 a year (£50,000 a year for tax years up to and including 2023-2024)

There are other reasons too, so have a read of our guide to registering for Self Assessment to check if the Self Assessment deadline applies to you. HMRC has a checker tool you can use if you’re not sure you need to complete a tax return for the 2024-25 tax year.

Tax return deadlines and dates for small businesses

Key Self Assessment deadlines:

Other tax dates and deadlines:

- Tax year dates

- Deadline for registering for Self Assessment

- Paper tax return deadline

- Tax return deadline for tax collected via PAYE

- Payment on account tax deadline

- Tax year dates for VAT

- Tax year dates for PAYE and National Insurance contributions

The deadline for Self Assessment 2024-25

Online Self Assessment deadline: For untaxed income earned during the 2024-25 tax year, the online deadline for filing your Self Assessment tax return and paying your bill is 11.59pm on 31 January 2026.

Paper Self Assessment deadline: The deadline for filing a paper tax return is 31 October 2025.

You can file your tax return at any time before the deadline. In fact, 299,419 people filed their 2024-25 Self Assessment in the first week of the new tax year, according to HMRC.

There are a number of benefits in filing it early. It can make it easier to plan your finances, plus help you minimise the risk of fines. Here are five reasons to do your tax return early.

Under current rules, you’ll need to register for Self Assessment and file your tax return if you earn more than £1,000 from your business. This threshold will increase to £3,000 before the end of this parliament in 2029, meaning thousands of businesses will benefit from not having to file each year.

Do you sell on Vinted, eBay, Etsy, or list a service or property on Airbnb?

Digital platforms are now required to share sellers’ income to HMRC, which means you need to be on top of your tax responsibilities. If you earn less than £1,000 in the tax year, then you don’t need to register for Self Assessment or pay tax on your income.

The deadline for Self Assessment 2023-2024

If you brought home untaxed income between 6 April 2023 and 5 April 2024 (for example, through self-employment or earning money from a rental property) the UK tax return deadline was 31 January 2025.

If you’ve missed this filing deadline you’ve probably already received a fine. But the fines keep piling up the longer you delay, so it’s important to file your tax return and pay any tax owed as soon as possible.

If you need a hand, check out our ultimate guide to completing a Self Assessment tax return.

The deadline for Self Assessment 2025-2026

If you continue to be registered for Self Assessment, any income you earn from 6 April 2025 falls into the tax year 2025-26.

The deadline for filing a 2025-26 Self Assessment tax return will be 11.59 on 31 January 2027.

Alongside getting to grips with quarterly updates due to Making Tax Digital, here are some of the things you can do to prepare for your tax return:

- consider opening a business bank account to keep business and personal finances separate

- keep all your receipts for tax deductible expenses

- use an accounting app to keep track of your income, which should make everything much easier when it comes to filing your tax return

- follow our bookkeeping tips to keep your accounts in order

Beat the Self Assessment deadline to avoid an HMRC fine

If you miss a Self Assessment deadline, such as registration, payment, or filing, you could receive a late payment penalty from HMRC.

For example, you could be fined £100 for missing the filing deadline by one day. And if you also miss the payment deadline, you could receive a penalty plus interest.

HMRC late payment penalties were increased in April 2025 – read up on everything you need to know.

Tax year dates

We’re currently in the 2025-26 tax year, and from 6 April 2026 we’ll be in the 2026-27 tax year.

Making Tax Digital will be phased in from April 2026, replacing the annual Self Assessment process with quarterly tax returns. These will have to be filed online using HMRC approved software.

It’s important to remember that you’ll still need to report your earnings for 2025-26 via Self Assessment by 31 January 2027.

When does the tax year end?

The UK tax year ends on 5 April each year.

The end of the tax year is one of the most important tax dates in the calendar. That’s because rates and allowances usually change each year.

For example, the amount you can save in an ISA resets each tax year. If you don’t use your allowance, you lose it. This means it’s important to contribute as much as you can before the new tax year starts.

When does the new tax year start?

The new tax year starts on 6 April each year.

The start of the tax year is often when new tax rules and regulations are introduced.

Deadline for registering for Self Assessment

The deadline for telling HMRC that you’re self-employed is 5 October. This is so that they know you need to complete a tax return the following year.

If you’re already registered as self-employed, there’s no need to do this again. Check out our guide to registering with HMRC for more information.

Paper tax return deadline

The HMRC Self Assessment deadline is 31 October if you want to file a paper return rather than filing online. However, most businesses find it easier to file their tax return online – and under Making Tax Digital plans, paper filing soon won’t be an option.

Tax return deadline for tax collected via PAYE

The deadline for filing your online tax return if you want the tax owed to be collected through PAYE via your tax code is 30 December.

This is only an option if you have some income that’s already taxed through PAYE (as in, you’re employed as well as self-employed), and if your Self Assessment tax bill is below £3,000. See our article on tax codes for more information.

Payment on account tax deadline

Payment on account is due in two instalments across the year – it’s how you pay your tax bill to HMRC. The first payment is due on 31 January and the second payment on account deadline is 31 July.

Payment on account applies to you if your Self Assessment tax bill was more than £1,000 when you submitted your tax return for the period.

It doesn’t apply if your tax bill was less than £1,000, or if 80 per cent or more of your tax was deducted at source (for example through your tax code, or because your bank has deducted interest on your savings).

Tax year dates for VAT

If you’re VAT-registered then you’ll need to account for VAT when declaring your income on your Self Assessment tax return.

All VAT returns must be filed online (unless you have an exemption from Making Tax Digital). This means you’ll need to use accounting software to keep digital records and submit VAT returns.

Our guide to filing and paying VAT explains everything you need to know.

Wondering how much VAT to charge on your products or services? Use our guide to working out VAT to help you.

Tax year dates for PAYE and National Insurance contributions

Monthly PAYE and Class 1 NIC payments – if you’re paying PAYE and Class 1 NICs monthly by an electronic method, payment must reach HMRC by the 22nd of each month. If you’re paying by cheque, payment must reach HMRC by the 19th of each month.

Quarterly PAYE and Class 1 NIC payments – you may be able to pay quarterly if you pay less than £1,500 a month. If you’re paying quarterly, you must pay by the 22nd after the end of the relevant quarter. You should speak to HMRC to find out whether you’re eligible.

Class 1A NIC payments – if you’re paying Class 1A NICs electronically, payment must reach HMRC by 22 July. If you’re paying by post, payment must reach HMRC by 19 July.

For a full list of important business dates to remember, see our key dates guide.

Getting help from HMRC

If you’re confused about the Self Assessment deadline or any other tax year dates, make sure you speak to HMRC to avoid mistakes and late payment penalties. If you need more time to pay your tax bill, you might be able to set up a time to pay plan.

You can use HMRC’s digital assistant to get help with your tax return online. It’s also possible to call or write to HMRC if you need extra support, but waiting times can be slow.

If you’re still unsure, you might want to consider hiring an accountant.

Self Assessment deadline FAQs

When is the Self Assessment deadline for 2024-25?

January 31 2026 is the online Self Assessment deadline for income earned in the 2024-25 tax year.

What happens if I miss the Self Assessment deadline?

If you miss the Self Assessment deadline, you could receive a late payment penalty from HMRC. For example, you’ll be fined £100 if you miss the deadline by one day.

Can I file my Self Assessment early?

Yes, you can file your Self Assessment early. Although the annual deadline for online tax returns is 31 January, you can file as soon as the tax year starts on 6 April.

According to HMRC, almost 300,000 people filed their Self Assessment for 2024-25 in the first week of the tax year.

In the future, there will be less pressure to file early due to mandatory quarterly updates through Making Tax Digital.

How do I register for Self Assessment?

You can register for Self Assessment through the government website. You’ll need to provide basic personal details, information about the job you do, and the date you started your business.

Related guides for small business owners

- How long do you need to keep tax records?

- Self-employed tax brackets: thresholds, rates, and allowances

- Your complete guide to business tax

- What type of business insurance do I need?

Looking for self-employed insurance?

With Simply Business you can build a single self employed insurance policy combining the covers that are relevant to you. Whether it’s public liability insurance, professional indemnity or whatever else you need, we’ll run you a quick quote online, and let you decide if we’re a good fit.