One of the drawbacks of being self-employed is the lack of employee benefits, like sick pay and holiday pay. This leads to many small business owners working long hours and not taking regular time off.

But depending on your employment status, you might actually be able to get self-employed holiday entitlement.

Some self-employed people, including contractors and freelancers, could be entitled to self-employed holiday pay if they’re classed as workers or employees. You might be a worker or an employee if you have a contract to do work personally, or work through an agency or umbrella company.

It’s important to take time off regardless of whether you can access holiday pay. That’s why we’ve included tips from a real business owner on how to get your admin and cash flow in a good place so you can take a holiday.

This guide will cover:

- tips for taking a break from your business

- whether you’re entitled to holiday pay

- how to work out your employment status

- how holiday pay is calculated

- the downsides of no holiday pay when self-employed

Are the self-employed entitled to holiday pay?

It depends on the way you work and the type of contract you have with the people you work for.

A huge benefit of being self-employed is freedom – the ability to choose who to work for and when to work. If you work in this way, genuinely running your operation as a business, it’s likely that you’re classed as self-employed legally, too. You’ll have very few employment rights, which means no holiday entitlement.

But some contractors and freelancers might actually be classed as workers or employees depending on their contract and the way they work. In these cases, they’re entitled to holiday pay.

Workers – unlike self-employed people who are contracted to provide services for a customer or client, workers are people contracted to do work personally for a company. Workers can include casual workers, agency workers and some freelance workers. The contract will determine employment status. Workers get holiday pay.

Employees – while someone who thinks of themselves as self-employed isn’t likely to be an employee in the traditional sense, they might offer their services through an agency or umbrella company. In that case, they’re an employee of the agency or umbrella company and can get self-employed holiday pay (funded out of the contractor’s pay in the case of umbrella companies and fees in the case of agencies).

What’s my employment status?

It’s important to know your employment status to understand whether you get holiday entitlement.

Our guide to employment status has more information about the differences between workers, employees, and the self-employed.

Self-employed holiday entitlement: what do I get?

You’ve looked at your contract and the way you work and you think you have self-employed holiday pay rights. So, what are you entitled to?

Workers and employees get a minimum of 5.6 weeks’ holiday entitlement. This means most people who work five days a week should get at least 28 days paid leave (this can include bank holidays).

But calculating self-employed holiday pay isn’t straightforward. It’s based on the hours you work and how you’re paid for the hours. For some workers with no fixed hours, holiday pay will be worked out using the worker’s average pay from the previous 52 weeks (only counting weeks in which they were paid).

Agencies and umbrella companies will also calculate holiday pay at 12.07 per cent of your hourly rate. This figure is based on 5.6 weeks (the holiday entitlement) divided by the weeks left over in the year (which is 46.4).

Holiday pay will be clearly noted on your payslip and you’ll receive holiday pay either when you take time off or on a ‘rolled up’ basis, which means weekly or monthly in your pay.

You can use a holiday pay calculator to work out what you’re entitled to.

What happens without self-employed holiday pay

Many small businesses and freelancers find it difficult to take unpaid time away from work. This can mean a drive to keep on working when jobs and clients are available and not prioritising a break for yourself.

Simply Business research with 700 small business owners (in collaboration with mental health charity Mind) revealed that one in three are feeling the effects of burnout.

This is no surprise when one third are working more than 46 hours a week – 10 hours more than the average UK worker.

An overwhelming 73 per cent of small business owners report taking fewer than 20 days of holiday a year. But taking regular time off is important for your health and wellbeing – especially when it comes to managing stress levels.

1 in 3

Work more than 46 hours a week

73%

Take fewer than 20 day of holiday a year

How can I take a self-employed holiday?

If you’re classed as self-employed, going on holiday means that you need to put your business out of your mind while you enjoy yourself. This can be worrying – especially if you don’t have other people working for you and you won’t have any money coming in.

While it can be difficult to know how and when to take a break, even a short time away from your business can give you renewed focus and creativity. So, these tips can help you get your finances and admin in order and take a self-employed holiday without worrying about work.

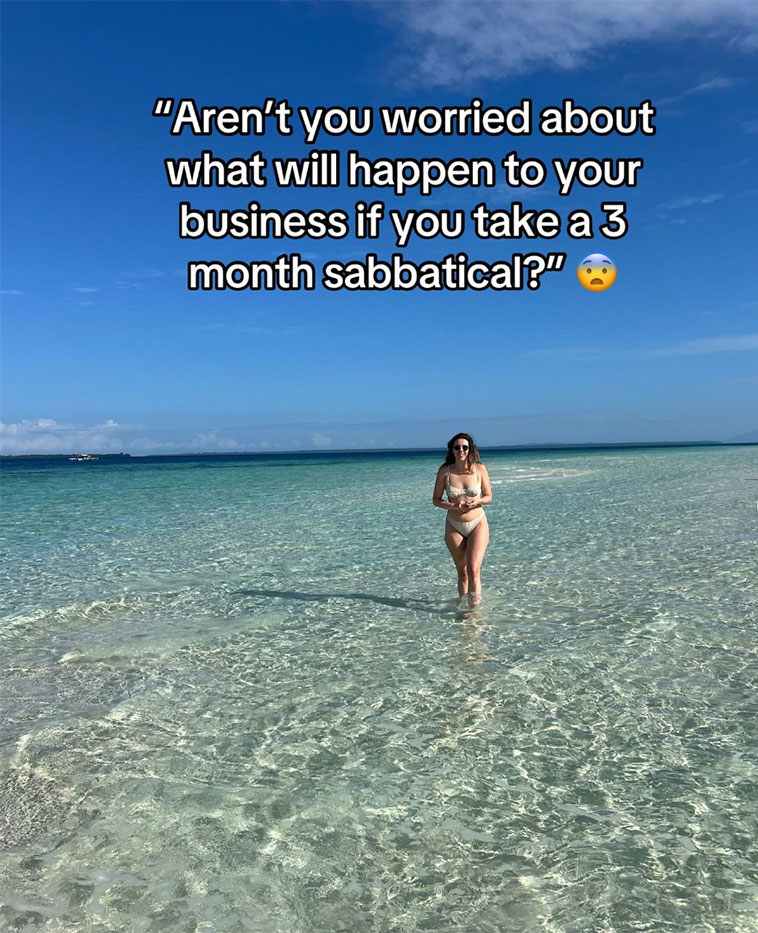

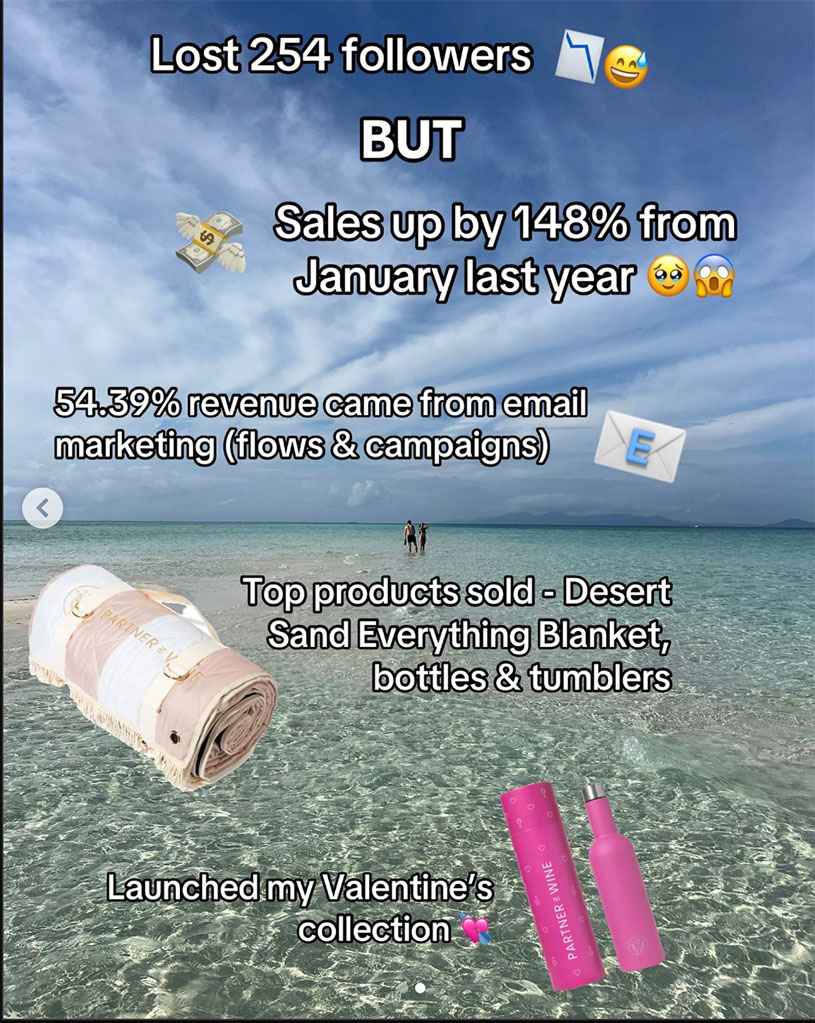

Taking a sabbatical as a business owner

Partner in Wine is an online business specialising in insulated wine tumblers and bottles. Founder Lucy Hitchcock shared her journey when taking a three-month sabbatical – and what she did to make sure money was still coming in:

- relying on email marketing over regular social posts

- taking a full year to prepare

- going away in her quieter sales month of January

- planning a product launch for mid-trip to keep people interested

7 tips before you take a self-employed holiday

1. Keep money aside

Saving can be difficult, especially if you don’t have a regular income. But keeping a pot of money aside for holidays can help you feel more secure when you decide to take one.

A business budget and cash flow forecast can help you keep on top of your finances and plan for breaks in earnings. Otherwise, is there extra work you can take on before your holiday to build a safety net quickly?

2. Choose a quieter time

Many businesses have lulls in the year when things are a little less busy, but you’re confident work will pick up later. Can you maximise the work you do in busier periods and take time away when things are slower?

For example, if you run a personal training business then you might expect your busiest time to be January when people are setting new fitness goals for the year ahead. With this in mind, you decide to book a holiday in December as you tend to have fewer clients at this time.

3. Plan ahead

Blocking out time away in advance will help you plan work around your holiday, giving you enough opportunity to let customers and clients know that you’ll be away. You can get important work done before your holiday and de-prioritise other work, picking it up when you get back.

4. Schedule everything you can

Set up your marketing activities so they can run while you’re away. For example, use social media management tools, schedule posts on Instagram, and plan your email campaigns in advance. You could even set up payment reminders and invoicing to tick over while you’re away.

You could even consider using AI to automate repetitive tasks and make your work more efficient in the lead up to a break.

5. Monitor work while you’re off

Even though you’re away, you might not be able to escape work completely. If it gives you peace of mind, spend a limited time each day on phone calls and emails before enjoying yourself – but don’t let 30 minutes become three hours!

Setting boundaries can help you day-to-day and on holiday so you don’t end up doing more than you wanted to.

6. Give a thorough handover

If you have employees, make sure they know what to watch out for while you’re off. Otherwise, you might want to bring someone in specifically to keep work ticking over for customers and clients.

7. Communicate your plans

Make sure you update your website or online shop with the dates you’ll be away if you manage all the orders yourself. For example, if you run an Etsy shop then you’ll need to update your holiday dates so people expect a delay to shipping.

Email your clients and make sure deadlines will be met before you go away. It’s also a good idea to set up an email out of office message and post the dates you’re closing on your social media channels.

Still not sure if you’re able to make time for a holiday? Depending on your business, you could try working as a digital nomad and travelling while you work.

More guides for small business owners

- Self-employed pensions – what you need to know

- What’s the difference between a sole trader and a limited company?

- Self-employed mortgage: how to get a mortgage when self-employed

- How much is Statutory Sick Pay?

- What type of business insurance do I need?

Ready to set up your cover?

As one of the UK’s biggest business insurance providers, we specialise in public liability insurance and protect more trades than anybody else. Why not take a look now and build a quick, tailored quote?