Commodity code checker – what you need to know

If your business exports or imports goods, you’ll need to classify them with a commodity code.

Commodity codes are used to declare the value and the content of the goods you’re importing or exporting to customs.

To find a commodity code for an item, you need to use HMRC’s trade tariff tool and follow these steps:

- Search for your item – information like the type of product and what it’s made of can be useful

- Find a relevant result – choose the result that most accurately describes what you’re looking for (try a new search if nothing matches)

- Narrow down your category – you’ll be shown a list of more specific subheadings, choose the one that is the closest your product

- Check your commodity code – click through and see the commodity code for the product, as well as duties and licensing information

It’s likely you’ll need to use a commodity code checker if your business imports or exports goods. But what is a commodity code and how do they work?

If you use the wrong trade tariff codes, your goods could be held up at customs and you could be fined.

Follow our step-by-step guide, with examples, to make sure you use the right commodity codes.

- What is a commodity code?

- What are commodity codes used for?

- Commodity codes: what do they look like?

- Commodity code checker: how to check a commodity code

- Make sure you use the right commodity codes

- Commodity code FAQs

What is a commodity code?

You need to use commodity codes to classify your goods when you’re importing and exporting them.

You use a commodity code to make your import or export declaration. It helps you work out:

- what rate of duty and import VAT you should pay

- whether the duty is suspended

- whether you need a licence to move your goods

- if your goods are covered by Agricultural Policy, anti-dumping duties, or tariff quotas

Commodity codes are also known as trade tariff codes or HS codes (harmonised system tariff codes).

Tariff codes mean your product can be recognised worldwide using a specific code, so there’s no hold-up due to language barriers.

What is an HS code?

An HS (harmonised system) code is a six digit code, which is set by the World Customs Organisation and used globally. Most commodity codes use an HS code as a base, with extra digits added depending on the country or territory the goods are passing through.

It’s important to note that while the terms HS code and commodity code are often used interchangeably, they’re not exactly the same thing.

What are commodity codes used for?

Commodity codes are used for making customs declarations when importing and exporting goods to and from the UK. You declare the value and content of the goods that you’re importing or exporting.

The declaration is a legal document that lets customs authorities know you’re paying the right amount in tax and duties. The declaration also lets you and the authorities know whether the items are subject to licences or permits.

Problems with the declaration can hold up your items at the border – so it’s important that the information you provide (including your commodity code) is accurate.

Following Brexit, you now need to make customs declarations when importing and exporting goods from the European Union (EU). You might hear the term ‘TARIC codes’, which relate to the EU customs tariff system and are often also referred to as commodity codes.

Simpler process for moving goods within the UK

Since 1 May 2025, businesses have been able to check if they’re eligible to use a simplified process for importing and exporting goods.

If your business is based in England, Scotland, or Wales and you import or export goods to or from Northern Ireland, you can benefit from the UK Internal Market Scheme.

This allows you to submit a simplified data set rather than a full declaration when moving goods, as well as benefitting from zero customs duties.

Use the government’s new tool to see if you’re eligible.

Commodity codes: what do they look like?

Commodity codes vary in length depending on:

- the type of item

- whether they’re being imported or exported

- how they’re made

That’s because commodity codes are specific, which lets the authorities know exactly what they’re dealing with.

The government website gives the example of a pair of men’s trousers. You need to know how they’re made and what they’re made of before using the HMRC trade tariff tool.

For example, if you run a clothing business, men’s trousers made from a knitted material that’s made primarily of cotton will have:

- an export commodity code of 61 03 4200

- an import commodity code of 61 03 420000

Commodity code checker: how to check a commodity code

You can use the HMRC trade tariff tool to find the right commodity codes for your business.

Commodity codes are made up of different elements based on:

- the type of product

- the material used to make it

- the production method

So you need to have all of this information available when using the commodity code checker.

HMRC lists four steps when using this tool:

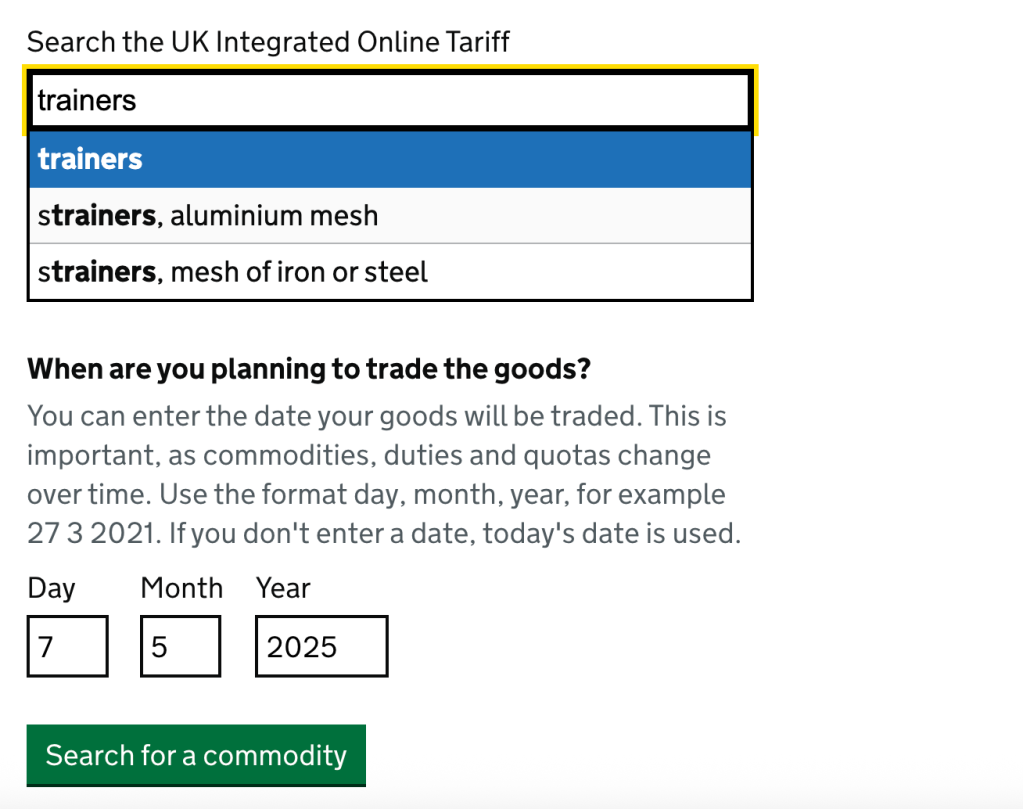

Step 1: Search for your item

You’ll see a search bar when you access the tool – put the type of goods that you’re importing or exporting here and see what it comes up with.

If the goods don’t come up by name, you can try searching for what they’re used for or made from.

In this example, we’re searching trainers – for example, trainers with a leather upper and rubber sole.

Source: gov.uk

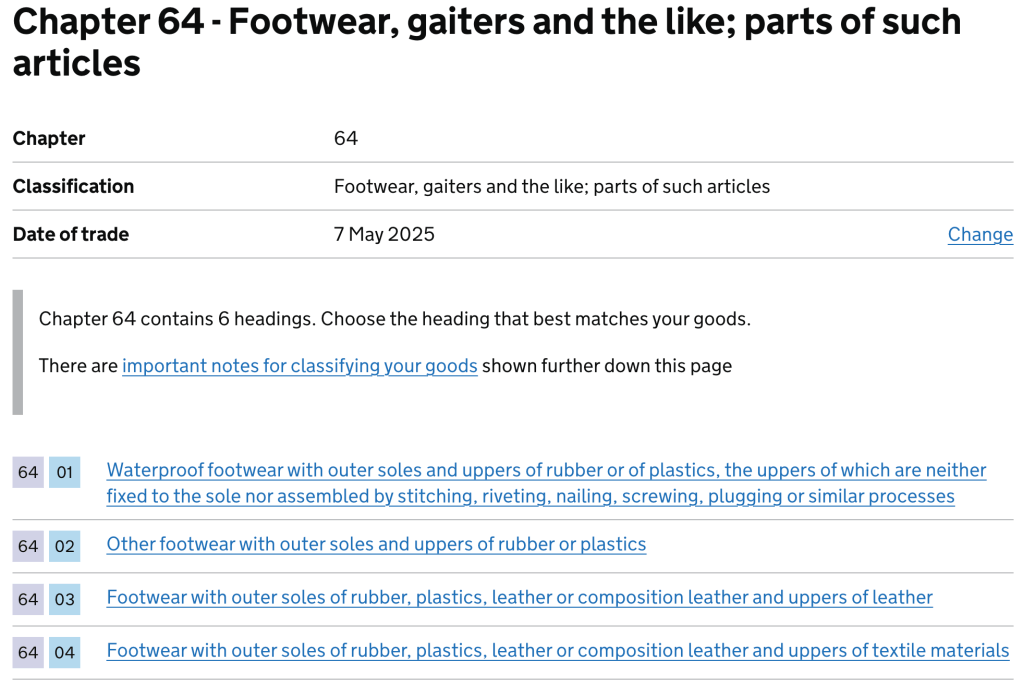

Step 2: Consider the sections

After searching the item, different sections will show. You should check to see whether your goods are accurately described under these sections.

In this example, the ‘Footwear with outer soles of rubber, plastics, leather or composition leather and uppers of leather’ section, with a commodity code starting 64 03, most accurately describes what we mean by trainers.

Source: gov.uk

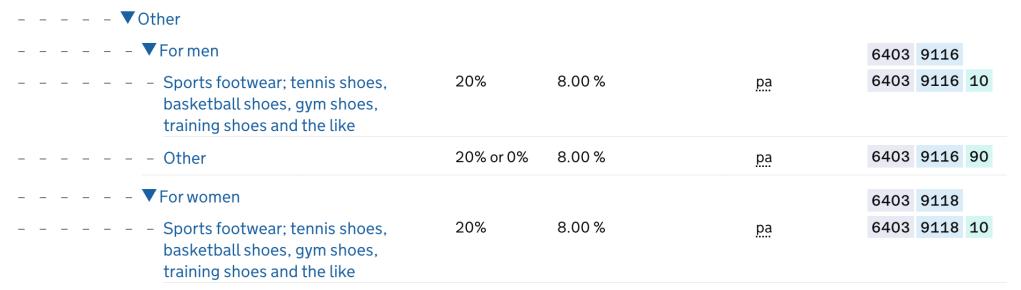

Step 3: Check the subheadings

After clicking through on a section, you’ll see more subheadings. If your goods are specifically described under a subheading, choose that.

In this example, we’re specifically looking for women’s sports trainers, which are best described by the subheading: ‘For women: Sports footwear; tennis shoes, basketball shoes, gym shoes, training shoes and the like’.

Source: gov.uk

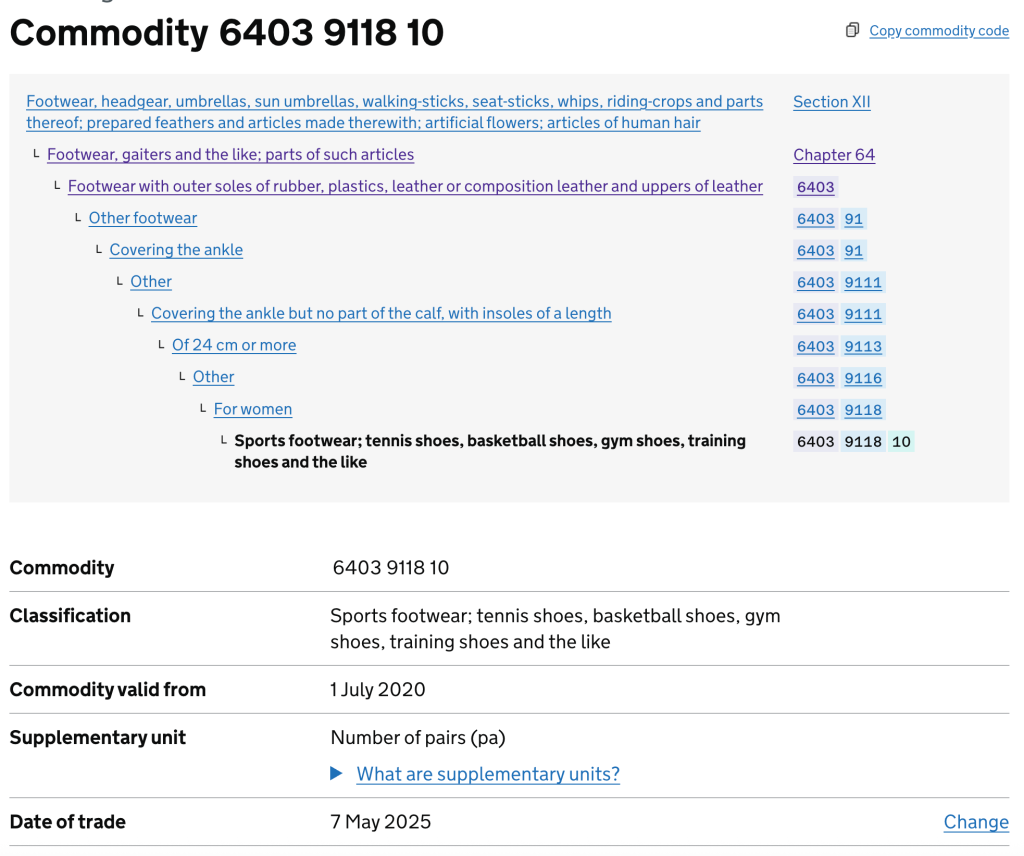

Step 4: Check for your commodity code

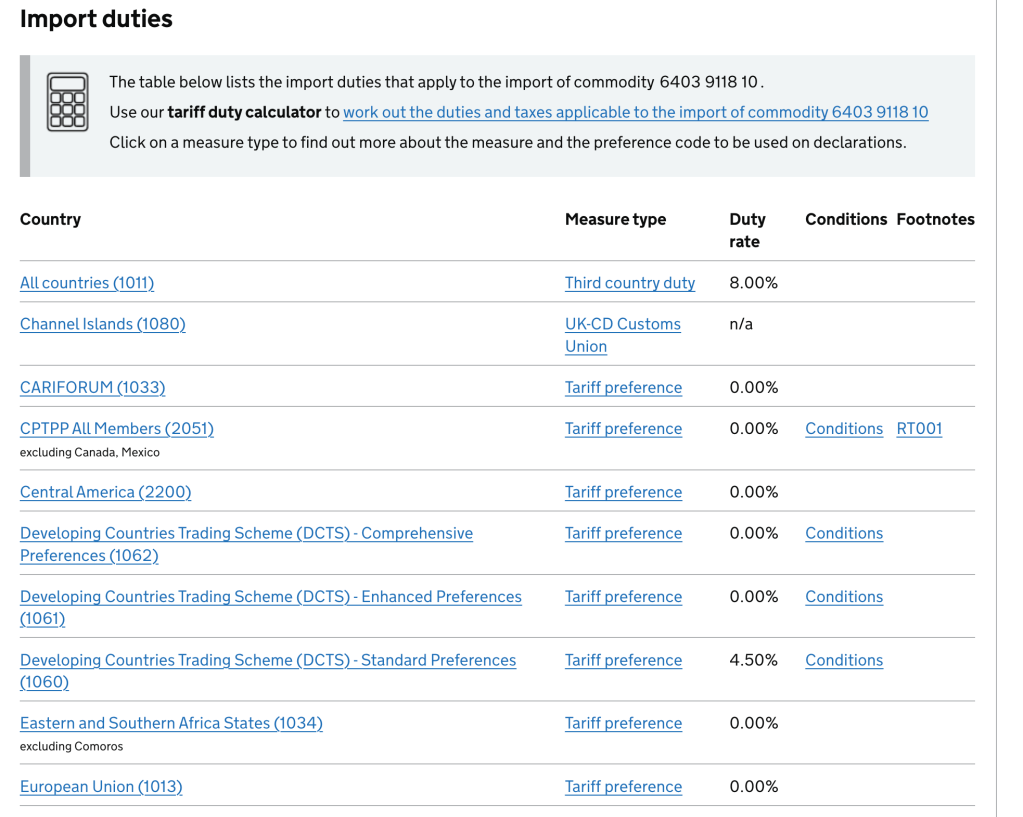

After clicking through, the tool should show you the commodity codes, as well as any duties, licences, and permits needed.

Source: gov.uk

For this example, we can see that women’s sports trainers have a commodity code of 6403 9118 10.

Source: gov.uk

Make sure you use the right commodity codes

If you make mistakes with the trade tariff tool and commodity codes, not only could it hold up your items, you might have to pay extra fees and charges.

In the worst cases, if you use the wrong commodity code and you don’t end up getting the right licences and permits, you’ll be breaking the law, so, it’s important to be accurate.

Commodity codes are complex, so you might want to get professional help if you import or export goods as a core part of your business.

Here’s what else you can do if you’re having trouble finding the right commodity codes:

- check HMRC’s specific guidance on hard to classify goods

- search the A-Z of classified goods for common products

- email HMRC’s Tariff Classification Service for informal advice – they aim to respond within five working days

- apply for a legally binding decision so that you’re confidently (and lawfully) using the right code – this is especially useful for new types of goods, or goods that are particularly hard to classify

Commodity code FAQs

How do I find the commodity code?

You can use the HMRC trade tariff tool to find the right commodity codes for your business.

To find the relevant commodity code for a specific product, you’ll need information such as:

- the type of product

- how it was made

- the material its made from

Are HS code and commodity code the same?

An HS code (a harmonised system code) isn’t the same as a commodity code, although the terms are often used interchangeably.

An HS code is a global code managed by the World Customs Organisation, whereas a commodity code is a more detailed code based on an HS code. Countries or groups like the EU may add extra digits to an HS code to create a commodity code.

Is a commodity code the same as EORI?

No, a commodity code is different from an EORI number.

A commodity code is used by businesses exporting or importing goods to identify a product. An EORI number identifies a business that imports or exports goods.

Read more about EORI numbers.

Is the UK commodity code 8 or 10 digits?

A commodity code for importing goods is usually 10 digits, while a commodity code for exporting goods is usually eight digits.

Commodity codes usually share the first six digits, which are part of the harmonised system (set by the World Customs Organisation).

Small business guides and resources

- How to start an online shop – the ultimate guide to selling online

- PayPal: red alert for businesses as sophisticated scams fool users

- How to do a stock take: a guide to taking inventory and stock control

- What’s the best UK courier for your small business?

Ready to set up your cover?

As one of the UK’s biggest business insurance providers, we specialise in public liability insurance and protect more trades than anybody else. Why not take a look now and build a quick, tailored quote?