-

Public liability insurance

In case your business and products cause an injury or property damage.

What’s typically covered by public liability insurance?

Claims against your business for:

- damage to someone else’s property while you’re working, or because of your work

- injury to someone as a result of your work

- accidental injuries caused by your employees at work

For example:

- you’re with a client and you accidentally spill coffee onto their designer handbag, causing a permanent stain

- your client trips over your laptop charger cable while you’re setting up for an appointment, breaking their wrist

- your employee damages a neighbouring business’s property while bringing equipment into your premises

**If you do employ anyone, you’re usually required by law to have employers’ liability insurance too.**

Read more about public liability insurance

-

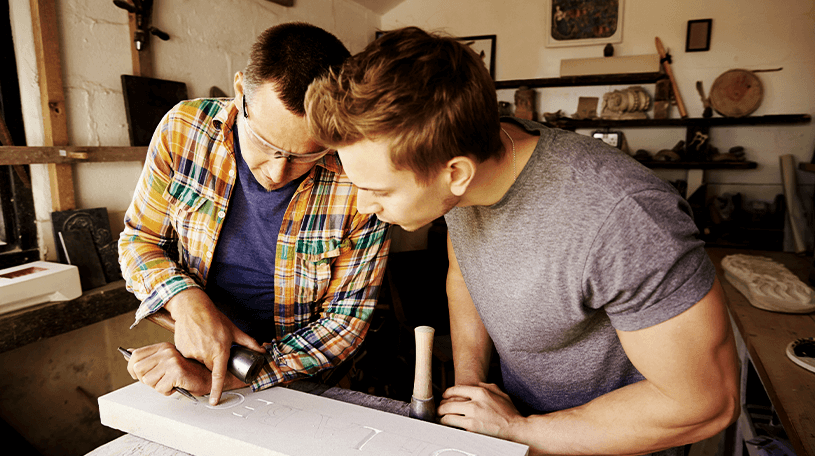

Employers’ liability insurance

In case anyone gets ill or injured while working for your stonemasonry business.

What’s typically covered by employers’ liability insurance?

Claims against your business for:

- injuries to staff (including casual labourers and contractors) that are caused as a result of your business

- illness suffered by an employee (including temps and casual workers) caused by working for you

**Employers’ liability insurance is required by law if you have people working for you. Without it, you could be fined up to £2,500 a day for each employee.**

For example:

- your office manager breaks their finger while trying to close a faulty window at your business premises

- your receptionist trips over a cable running across the floor of your office, breaking their ankle

- a temp worker scratches their arm on one of your tools, and the injury becomes infected

-

Contents insurance

In case something happens to your fixtures, fittings, or operational equipment.

What’s typically covered by business equipment insurance?

Claims against your business for:

- damage and destruction caused by flood, fire, vandalism, or theft

- cover for your contents and the equipment needed to run your business

For example:

- a flood spreads to your office floor and means you need to replace several desk chairs

- your photocopier and fax machine are badly damaged during a break-in

- four business smartphones are stolen from your premises

Read more about business equipment insurance

-

Stock insurance

In case something happens to your products and consumables.

What’s typically covered by stock insurance?

Claims against your business for:

- loss, damage or theft of essential stock

- destruction of stock caused by fire or flood

- the cost of replacing items that you’re going to sell

For example :

- a fire in your shop destroys key stock

- your stockroom gets flooded by a leaking pipe

- someone breaks into your shop, stealing stock and damaging stock they leave behind

Read more about stock insurance

-

Tool insurance

In case your tools are lost, stolen or damaged.

What’s typically covered by tool insurance?

Claims against your business for:

- damage to the tools you use for work

- loss of your business tools or specialist equipment

- theft of your stonemasonry tools and equipment

For example:

- your work laptop is damaged accidentally and it stops working

- you lose your work phone while you’re out and about

- someone steals your tools from your locked van

Read more about tool insurance

-

Own plant insurance

In case plant machinery, like excavators, you own is lost, stolen, or damaged.

What’s typically covered by own plant insurance?

Claims against your business for:

- damaging someone else’s property while working on a development site, or afterwards as a result of your work

- damage or destruction caused by vandalism

- damage or loss to your plant machinery, like a digger

For example :

- your forklift damages a van parked nearby, while you’re manoeuvring on site

- you’re building an extension for a customer and someone breaks into your works site, vandalising the premises and causing substantial damage

- you’re parked up outside a service station and thieves steal a generator from your trailer

Read more about plant machinery insurance

-

Hired-in plant insurance

In case plant machinery, like excavators, you’ve hired in is lost, stolen, or damaged.

What’s typically covered by hired-in plant insurance?

Claims against your business for:

- expensive costs and charges, if hired equipment gets damaged, lost, or stolen

- equipment that’s on-site or in transit

- causing injury or property damage while you’re working, or afterwards following your work

For example :

- thieves steal a generator from your trailer while you’re taking a break at a service station

- you accidentally drive a digger through someone’s fence while working on site

- a hired cement mixer and generator are made unusable following a flood

Read more about plant machinery insurance

-

Contract works insurance

In case your building work in progress is damaged by something like a fire, flood or vandalism.

What’s typically covered by contract works insurance?

Claims against your business for:

- repair costs for work that’s been damaged or destroyed while on the job

- labour, materials and tools that’ll get your work back to the stage it was in before the damage

- damage caused by fires, floods, storms, vandalism, or theft

For example :

- a storm causes damage to your place of work, setting back the project

- a fire destroys your tools that you left at work

- your work is damaged after a break-in, meaning you’ll have to start from scratch

Read more about contract works insurance

-

Business interruption insurance

In case something is stolen or damaged and you lose income.

What’s typically covered by business interruption insurance?

- you can’t trade because of stock, contents, or building damage

For example:

- your inventory is damaged and you lose income because you’re unable to sell

- your work laptop is stolen or damaged and you can’t run your business

Read more about business interruption insurance

-

Business legal insurance

In case you’re hit with legal expenses connected to your business.

What’s typically covered by business legal insurance?

Claims against your business for:

- costs and expenses for legal representation to recover debts or unpaid invoices

- costs and expenses following identity theft

- tax protection if there’s an investigation into your business

For example:

- one of your clients is unhappy with your work and believes you haven’t met the contractual requirements – as a result they’re refusing to pay their outstanding invoice

- your CEO’s contact details are used by a fraudster to set up a new line of credit with a business bank

- HMRC is investigating your recent tax return as they noticed a fluctuation in your business income

Read more about business legal insurance

-

Personal accident insurance

In case anyone you’ve covered is accidentally injured, at work or away from work.

What’s typically covered by personal accident insurance?

- compensation if you or an employee are injured in an accident, including weekly payments if you or they are unable to work for two weeks or more

- virtual Medical Care service with unlimited 24/7 access to medical advice, consultations, referrals and prescriptions

- 24/7 access to myStrength emotional health support app

You can buy this cover for:

For example:

- imagine one of your employees breaks their leg in an accident and is out of work for six weeks. Personal accident insurance would provide £300 for the broken leg diagnosis. After the employee’s second week off, you’d receive four weekly payments to assist with costs during their absence. You could use the money as you wish – whether for loss of earnings, hiring a temporary replacement, or compensating the injured employee.

What’s not covered?

- issues caused by sickness, illness, or disease

- conditions that develop over time without a direct connection to an accident

- mental illness, even if triggered by an accident

- self-inflicted injuries

- accidents that occur under the influence of drugs or misuse of medication

- deliberate exposure to danger, except when attempting to save a life

- injuries caused by taking part in a professional or semi-professional sport

Read more about personal accident insurance