We all do our best to avoid it, but sometimes small businesses and the self-employed can end up with a penalty from HMRC.

HMRC penalties can be expensive and stressful – but, thankfully, sometimes they can be appealed. If you have a reasonable excuse, your penalty may be amended or waived after an appeal.

HMRC issues penalties for late payment of Self Assessment tax, VAT, and corporation tax, as well as late filing, and making mistakes on your tax return. You can also be charged HMRC interest on late payment if you miss your tax bill deadline.

Changes to late payment penalties

New late payment penalties were introduced for VAT and income tax Self Assessment following the 2025 Spring Statement.

The table below highlights how much late payment penalties will go up for the 2025-26 tax year (and beyond). But the changes won’t apply to Self Assessment taxpayers until the January 2027 tax return deadline.

| Tax payment | Penalties (2024-25 tax year) | Penalties (2025-26 tax year onwards) |

| Within 15 days | No penalty | No penalty |

| Within 16 to 30 days | 2 per cent of tax owed at day 15 | 3 per cent of tax owed at day 15 |

| 31 days or more | A first and second late payment penalty applies (2 per cent of tax owed at day 15 plus 2 per cent of tax owed at day 30). From day 31, penalties are calculated at a daily rate of 4 per cent a year on the balance due. | A first and second late payment penalty applies (3 per cent of tax owed at day 15 plus 3 per cent of tax owed at day 30). From day 31, penalties are calculated at a daily rate of 10 per cent a year on the balance due. |

This is different to the penalties for late filing, which we explain more about below.

In this article, we’ll cover:

- Why might I get an HMRC penalty?

- Avoiding HMRC penalties – dates to stay on top of

- Key types of HMRC penalties

- Reasonable excuses for filing your tax return late

- How to appeal HMRC penalty charges

Why might I get an HMRC tax penalty?

It’s important to understand the common mistakes that can lead to a penalty. Reasons HMRC might issue a penalty include:

- inaccuracies or errors on your return

- filing a late tax return

- late payment

- failing to keep adequate records

Avoiding HMRC penalties – dates to stay on top of

You need to register for Self Assessment by 5 October – read our guide on how to register for and complete your Self Assessment if you’re unsure what you need to do.

The deadline for filing your tax return is 31 October for paper forms and 31 January for online returns. You must pay your tax bill by 31 January. There will also be quarterly deadlines if you’re signed up to Making Tax Digital.

Check out our full list of tax year dates you need to know when running a business.

You can set up a payment plan if you need more time to pay. You’ll be charged interest though, so only use this service if you’re struggling to pay your bill.

Key types of HMRC penalties

There are a range of different types of penalties, based on what kind of tax you’re supposed to be paying, how much, and how late you are.

You can calculate how much HMRC interest, tax, and penalties you might have to pay using this interactive form.

HMRC late filing penalty

If you miss the tax filing deadline then you may have to pay a penalty.

How long since the deadline? | Penalty |

|---|---|

One day | £100 |

Three months | £10 for each additional day, up to 90 days – plus the previous penalty |

Six months | Whichever is higher of £300 or 5 per cent of the tax you owe – plus the previous penalties |

12 months | An additional £300 or 5 per cent of the tax you owe – or, in some circumstances, 100 per cent of the tax you owe |

Making Tax Digital for income tax penalties

If you’re signed up to Making Tax Digital (MTD) then a new points-based system will apply for late filing. This will only apply to Self Assessment taxpayers in January 2026 who have already voluntarily signed up to HMRC’s digital scheme.

It will then apply to more Self Assessment taxpayers from April 2026, as MTD for income tax is phased in for businesses and landlords.

How will the new penalty points will work?

For volunteers signed up to MTD:

- each time you miss a filing deadline, you’ll get a penalty point

- a financial penalty is only issued if you reach a threshold for penalty points (currently two points)

- there aren’t any penalty points for missing quarterly reporting deadlines (at the moment)

- any penalty points will be removed after 24 months (if you haven’t reached the threshold)

| MTD penalties | For volunteers | For MTD from April 2026 |

| Late submission | 2 point threshold | 4 point threshold |

| Late quarterly updates | No penalty points | 4 point threshold |

Financial penalties and MTD

You’ll be charged a £200 penalty if you reach the threshold for penalty points while signed up to Making Tax Digital. A further £200 penalty will be charged if you miss any more MTD deadlines.

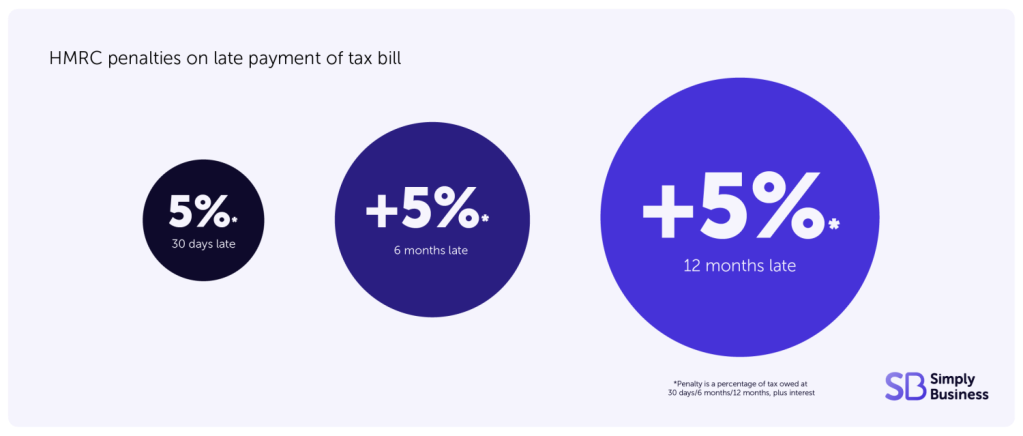

HMRC late payment interest and penalties for Self Assessment

HMRC issues Self Assessment late payment penalties, plus interest, if you pay your tax bill late. If you miss a deadline you must contact HMRC as soon as possible.

The UK government website has a tool that helps you estimate your penalty for late payment, including the likely HMRC interest on late payment.

Companies House late filing penalties for corporation tax

If you’re a limited company, your corporation tax return is due 12 months after the end of the accounting period it covers, and the deadline to pay your corporation tax bill is usually nine months and one day after the end of your accounting period.

This table shows the corporation tax late filing penalties, based on how long after the deadline you file.

How long since the deadline? | Penalty |

|---|---|

One day | £100 |

Three months | Another £100 |

Six months | HMRC’s estimate of your corporation tax bill plus 10 per cent of the unpaid tax |

12 months | Another 10 per cent of any unpaid tax |

VAT late payment penalty

Businesses pay a penalty for paying their VAT bill late.

- 15 to 30 days overdue – a first late payment penalty is due

- 31 days overdue – first late payment and second late payment penalty is due, plus a daily rate for every day the tax bill remains unpaid

These late payment penalties for VAT apply from 1 April 2025.

How will late payment penalties work for businesses that don’t pay VAT on time?

The first late payment penalty is three per cent on the VAT owed at day 15. This is the penalty for VAT between 16 and 30 days overdue.

The second late payment penalty is calculated at three per cent of VAT outstanding at day 30, and then a daily rate of 10 per cent a year on the VAT balance left to pay.

It’s possible to use HMRC’s Time to Pay service if you’re struggling to pay on time.

HMRC penalties for undeclared income

If you’ve failed to declare income that you owe tax on, HMRC can issue penalties and charge interest on the amount you owe. This is called a ‘failure to notify’ penalty.

For example, this could be related to a new source of taxable income or you sell an asset and fail to declare the capital gain that you’ll owe tax on.

The penalty will depend on the amount of unpaid tax as a result of failure to notify. You may be able to reduce a penalty if you tell HMRC about the failure.

HMRC penalties for inaccuracies: what happens if you make a mistake on your tax return?

If you make a mistake on your tax return, it’s possible to amend it after filing (within a certain time frame). However HMRC does issue penalties for inaccuracies as a result of carelessness, or if you try to conceal your tax liability deliberately.

Read our guide to how to amend your tax return for more information.

HMRC penalty calculator

If you’ve made a mistake or filed your Self Assessment too late, you can get an estimate of how much your penalty will be by using a HMRC penalty calculator. Using a calculator can’t give you an exact figure, but it can give you a rough estimate of your fine to help you plan your finances.

Reasonable excuses for filing your tax return late

We all know that sometimes the unexpected happens and life events can send us off course. That’s why HMRC details what it deems a ‘reasonable excuse’ for late filing or payment.

If you receive a penalty, there’s a chance you’ll be able to appeal if there were extenuating circumstances that prevented you from filing your tax return on time.

Examples of reasonable excuses include:

- your partner or another close relative died shortly before the deadline for submitting a tax return or payment

- you had an unexpected hospital stay that meant you couldn’t meet your obligations

- you suffered from a serious or life-threatening illness

- the software you use to complete your returns failed just before the deadline, despite you taking reasonable care to maintain it

- HMRC experienced technical problems – for example, the Self Assessment portal went down

- fire, flood, or theft stopped you from completing your return on time

- your delay was in relation to a disability

Your case will be considered on an individual basis, and HMRC will still want to see that you took reasonable care to meet your tax obligations.

How to appeal an HMRC penalty

The appeal process varies depending on the penalty you’ve received. You should usually appeal within 30 days of the date on your penalty notice.

To appeal a Self Assessment penalty…

To appeal against the £100 fine for filing your Self Assessment tax return late, you first need to have either filed your return or told HMRC you don’t need to complete one.

You can use the Self Assessment online portal to appeal any penalties from 2016-17 tax year or later. If you have an earlier penalty, or prefer to use a postal form, you can download form SA370 and send the completed form to HMRC.

To appeal a corporation tax or VAT late filing penalty…

You can use your HMRC online account if you’re a business appealing against a penalty for filing a VAT or corporation tax return late.

There are also specific online forms for certain types of appeal, which you’ll need to complete online and print before posting to HMRC. Examples of claim forms include:

- reasonable excuse for filing a VAT return late

- IT problems stopped you from filing your tax return on time

To appeal HMRC fines relating to PAYE…

If you’re an employer appealing against a penalty relating to PAYE, you should use your account at HMRC’s online PAYE for employers portal.

Who handles an HMRC penalty appeal?

Your appeal will be investigated by an HMRC tax officer who wasn’t involved in the original penalty decision.

Alternatively, if you’re appealing a penalty related to an indirect tax such as VAT or excise duty, you might choose to appeal directly to the tax tribunal. You can also request a review from HMRC if you’d prefer.

What if I disagree with HMRC’s decision?

If you disagree with HMRC’s review of your penalty, you can make a further appeal to the tax tribunal. This is an independent body that’ll take evidence from both parties and then make its own decision.

If you want to take your case to tribunal, you must do so within 30 days of the review decision.

Alternatively, you might consider applying for alternative dispute resolution (ADR) to avoid a court hearing. You can apply for ADR if you’re trying to resolve a dispute with your personal tax and haven’t been successful through HRMC’s appeal process.

During ADR, an impartial third party will act as a mediator between you and HMRC. The idea is that they’ll help you identify the areas that need attention and, where relevant, help to re-establish contact between the two parties.

ADR is particularly useful if you disagree with HMRC over the facts of your case, or if communication between you and HMRC has broken down.

However, you should note that ADR isn’t an option if you’re appealing a fixed penalty, or if you’re disputing your payment deadline.

Tax guides for small business owners

- When is the Self Assessment deadline?

- Bookkeeping tips for small businesses and the self-employed

- How to use HMRC Time to Pay if you can’t pay your Self Assessment tax bill

- A guide to income tax for the self-employed

- What type of business insurance do I need?

Is your business insured?

We have 800,000 UK policies plus a 9/10 satisfaction score. Why not take a look at our expert business insurance options – including public liability insurance and professional indemnity – and run a quick quote to get started?