Retail is one of the world’s oldest trades so it’s no surprise that so many entrepreneurs are still drawn to it. And with today’s technology, ecommerce gives you even more opportunities to expand your customer base and sell from anywhere.

So whether you want to sell your handmade goods or you’re curating a selection of products from other suppliers, our guide on how to start an ecommerce business covers everything from choosing a retail platform to shipping your products.

Contents:

- Choosing an online sales platform

- Legal considerations when selling online

- Tax considerations

- Choosing your ecommerce business model

- Shipping costs – choosing a courier

- Opening a physical store

- Retail insurance

- Retail skills – how to succeed

Choosing an online sales platform

The first step in how to start an online store is to choose the best ecommerce platform for your needs. The increased popularity of selling online means there are now more ways than ever to sell your goods – so it’s important you choose the right fit for your business.

A couple of options to consider include:

Adding an ecommerce platform to your website

If you already have an existing website, one option is to add an ecommerce platform to it. This is a great option if your website serves another business purpose – such as hosting a blog, providing information, or even as a marketing tool.

Most of the time you’ll have to pay a fee to use these platforms to sell your products. Depending on the platform, this could be either a monthly fee or a transaction fee on every sale made through your site.

Here’s a few of the most popular platforms out there:

- Shopify: a great option for small businesses, Shopify’s fees start at just £19 to sell an unlimited number of products – with the option to scale up to higher plans as your business grows

- Square: both a point-of-sale system and an ecommerce platform, Square allows you to sell both in person and online. Plans start from free options, plus a 1.4 per cent + 25p transaction fee

- Wix: Wix allows you to build a website and online store all in one place, with prices starting at £7.50 a month – including a free web domain for a year

Pros of adding an ecommerce platform to your existing website include:

- existing customers can find you easily

- you can stand out from the crowd with your own brand

- you have a greater level of control

However, some cons of this option include:

- it requires some technical know-how

- it’s up to you to do all your own marketing

- if people don’t visit your website already, it’ll be harder for them to find you

Read more about how to create a business website if this is the route you want to take. For a broader view, learn how to start an online business in seven simple steps.

Selling through an online platform – Shopify alternatives

However, an increasingly popular option nowadays is to sell through an online retail platform. And if your shop forms part of an existing marketing or business strategy (such as a strong social media presence) this can be a great way to integrate the two.

Some Shopify alternatives you can consider include:

- Amazon

- Facebook Marketplace

- Depop and Vinted

- Etsy

The pros of setting up your online shop through an existing platform include:

- ease of set-up

- access to a huge pool of potential customers

- you can make use of the tools those websites offer

Cons of this option include:

- you’ll be in among a lot of other retailers

- you have less control over the set-up and how you personalise it

- you’ll need to work out how to re-route your existing customers to this platform

Amazon

Amazon is one of the largest, and arguably most well known, online retailers. Its convenience and large product selection makes it a popular choice for customers. And as a small business owner, you can list and sell your products there too.

You’ll be able to choose between an individual and professional plan, which will depend on the number of sales you make. You can also choose to either ship your products yourself or have this fulfilled by Amazon for an additional fee.

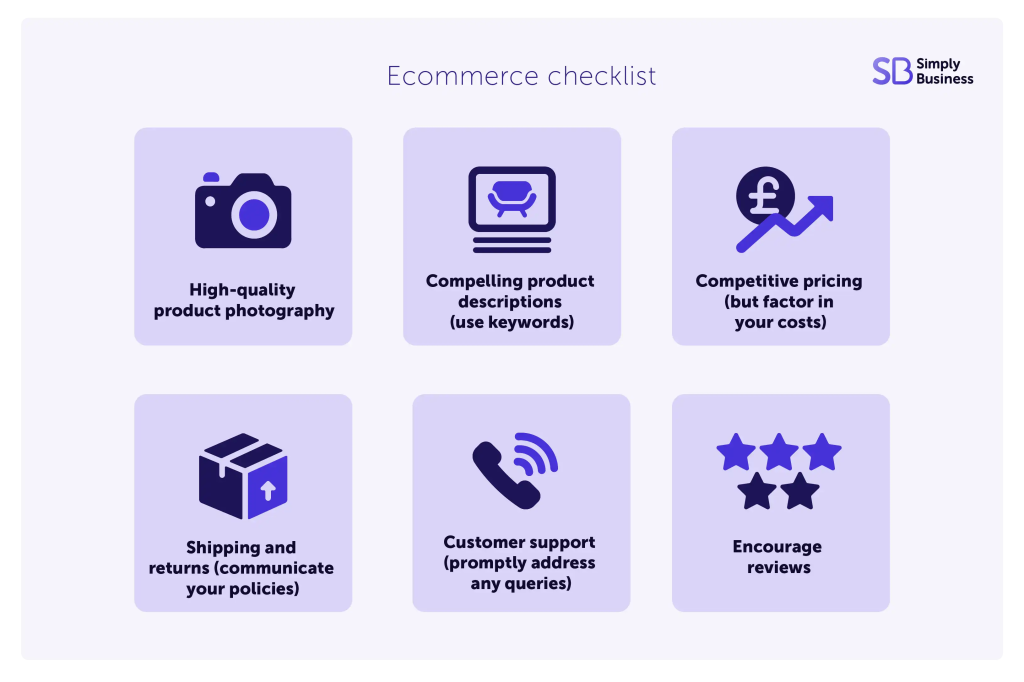

While selling your products on Amazon can give you more visibility, you’ll have to think carefully about your product descriptions and images in order to compete with other sellers on the platform.

With the rise of social media, selling your products on these platforms can give you a wider customer reach. When choosing which platform to sell your products on, think about your strengths. If you have a particular affinity for social media or photography, selling on Instagram could be how you give yourself a competitive edge.

Selling your products on Instagram is free to use and could be a great option if your products match the app’s user demographic – predominantly 18 to 34 year olds.

An alternative to selling on Instagram could be TikTok Shop. The app’s popularity, which is expected to reach 955.3 million global users by 2025 (Statista), makes it an appealing platform for those wanting to reach a large number of potential customers.

However, TikTok Shop has a reputation for poor quality products and payment troubles – so may not be the best option if you’re still building credibility as a business.

Facebook Marketplace

Despite its waning popularity as a social media platform, Facebook remains a popular way to sell products. If you’re just starting out your ecommerce business or if you want to focus on your local area, Facebook Marketplace can be a great way to target these customers.

However, it’s important to note that Facebook Marketplace doesn’t allow you to take online payments. While this is great if you want to trade cash in hand, it does limit you to your local area. Workarounds include taking payments through PayPal or through Facebook Pay – but these can leave you open to scams.

Want to sell on Facebook but would prefer an integrated payment option? Facebook Shops allows you to list your products on Facebook while reaching a wider customer base.

It also links to your Instagram account (and shop) meaning you can target both platforms at once. As Facebook and Instagram have different user audiences, this can be a smart way to develop both your ecommerce and marketing strategies.

Selling clothes online

If you’re solely selling clothes online, you could benefit from choosing dedicated platforms such as Depop and Vinted. These platforms take a percentage of each transaction.

Whether you’re selling vintage clothing or your handmade creations, you can use these platforms to market directly to the fashion conscious. One way to gain a competitive edge on these apps is to think about your product photography and styling, which can entice a user to click on your listings.

Etsy

Hand making your goods? Etsy is a popular platform for creatives across the world – as well as home to a built-in large customer base that appreciates unique handmade goods. It’s free to create your Etsy shop, but you’ll be charged a fee for each sale.

Interested in how to start selling on Etsy? Learn more about selling on Etsy in our complete guide.

Pinterest shopping

Although you might not expect it, Pinterest is another platform you can use to sell your products. To do this, you’ll need to connect your online shop to your Pinterest account (choose one of the other options in our guide if you’re still deciding on your sales platform) or include links to your product pages when you post content on Pinterest.

Pinterest is a great online selling option if you’re a pro at product photography or sell products that are highly visual or aesthetic in nature.

Taking online payments

No matter which selling platform you choose, you’ll need to know how to take payments online. Some platforms have built in payment systems whereas others give you more control over what payment methods you can accept.

Some payment methods include debit and credit cards, bank transfers, and cryptocurrency – or you can use an online payment system like PayPal.

And whether you’re buying or selling online, it’s important to always watch out for online fraud and scams that target small businesses.

Legal considerations when selling online

Whether you’re selling online or in-person, there are certain legal considerations to be aware of. One of these is the Consumer Rights Act 2015, which means that traders (such as yourself) need to meet specific obligations when they supply goods to a consumer. This can include both physical and digital products.

Online sales specifically are also affected by the Consumer Contracts (Information, Cancellation and Additional Charges) Regulations 2013. This gives your customers a 14-day ‘cooling off period’ in order to cancel their order for any reason and still get their money back.

Importing and exporting products

If you’re exporting (and importing) goods to and from the UK, you’ll also need to make sure that you use a commodity code to declare the value and content of the goods you’re importing or exporting.

Your commodity code is a legal document that tells customs authorities that you’re paying the right amount in tax and duties. It also lets the authorities know whether your items are subject to licences or permits.

Making mistakes, such as using the wrong commodity codes, could hold up your deliveries as well as cost you extra in fees and charges.

Another number you’ll need to be aware of when you’re importing and exporting from the UK is your EORI number. This number helps customs authorities to identify traders that import or export goods to other countries, as well as complete customs declarations and clearances.

You only need an EORI number if you sell physical goods across borders – so it’s not needed if you only sell services.

Unlike commodity codes, you’ll only have one EORI number for your business. But like commodity codes, not including an EORI number on your exports can cause additional fees and delays.

And if you’re importing or exporting large quantities, you may even need to look into the rules surrounding freight forwarders. These services can help you with shipping administration, customs, and the surrounding documentation.

And if you’re selling on the high street, it’s also important to remember that you’ll need to follow Sunday trading laws.

What about sending goods to customers in the EU?

If you’re selling to customers in the EU, it’s important to note that since 2021, all commercial goods imported to the EU are now subject to VAT – regardless of their value. This means that you’ll need to collect VAT on these items at checkout, declare VAT at customs, and submit VAT returns.

Because of these changes, the UK government launched the Import One-Stop-Shop (IOSS), which allows you to have a single VAT ID that works on sales to each EU country. Whilst it’s not mandatory to register for an IOSS number, it can make things easier when you’re selling to customers within the EU.

Tax considerations

As a self-employed business owner, you’ll have to pay tax on your earnings. These include:

You should take these taxations into account when you’re budgeting for your business. Keeping a record of your business transactions throughout the year can help you when it’s time to submit your annual tax return.

You should also remember that you have a £1,000 tax-free trading allowance – meaning anything you earn up to this point can’t be taxed.

Choosing your ecommerce business model

Now that you’ve chosen your ecommerce platform and are aware of your legal responsibilities, it’s time to finalise your ecommerce business model and manage your order fulfilment (which means you deliver any goods as promised at the time of sale) and supply chain management.

Manufacturing your own products

If the purpose of your online shop is to sell products you make yourself, you’ll need an efficient manufacturing process. One popular process is known as lean manufacturing and is designed around eliminating waste (in this instance, meaning anything that doesn’t add value) and maximising efficiency.

And speaking of waste, you may want to consider the amount of waste made by your business. With sustainability such an important area for many consumers, it could work as a great KSP (key selling point) for your business – as well as doing some good for the planet. After all, 22 per cent of shoppers worldwide are considered ‘sustainability-conscious’ (Kantar).

One example of this would be to make items specifically to order, or in small quantities, in order to avoid waste if they don’t sell. You’d then be able to classify yourself as a sustainable or eco-friendly business.

No matter how much stock you have at any given moment, it’s important to make sure you’re keeping proper track of your inventory. Doing a stock take helps you track the popularity of your products as well as manage any ingredients or parts you’re lacking. It’s a healthy habit to get into if you want to make running your business go as smoothly as possible.

Direct to consumer

If you’re not manufacturing your own products, your ecommerce business model could be based around direct to consumer sales. This generally means that you’ll buy stock from a supplier and keep it in your inventory until a customer buys it. You’ll then ship it directly to the customer yourself.

<br />This also includes direct selling, which includes buying and selling products from multi-level marketing companies such as Avon.

Direct to consumer sales can help avoid issues with third-party suppliers – such as products going out of stock, back orders, or shipping delays. As long as you keep your online store updated, you’re able to avoid these issues which can help build your brand reputation and avoid negative feedback.

A downside to direct to consumer sales is that you may buy too much of a particular product or material which then fails to sell – meaning you’ll be left with surplus stock and will have spent money upfront which you fail to see a return on.

Dropshipping – how to start

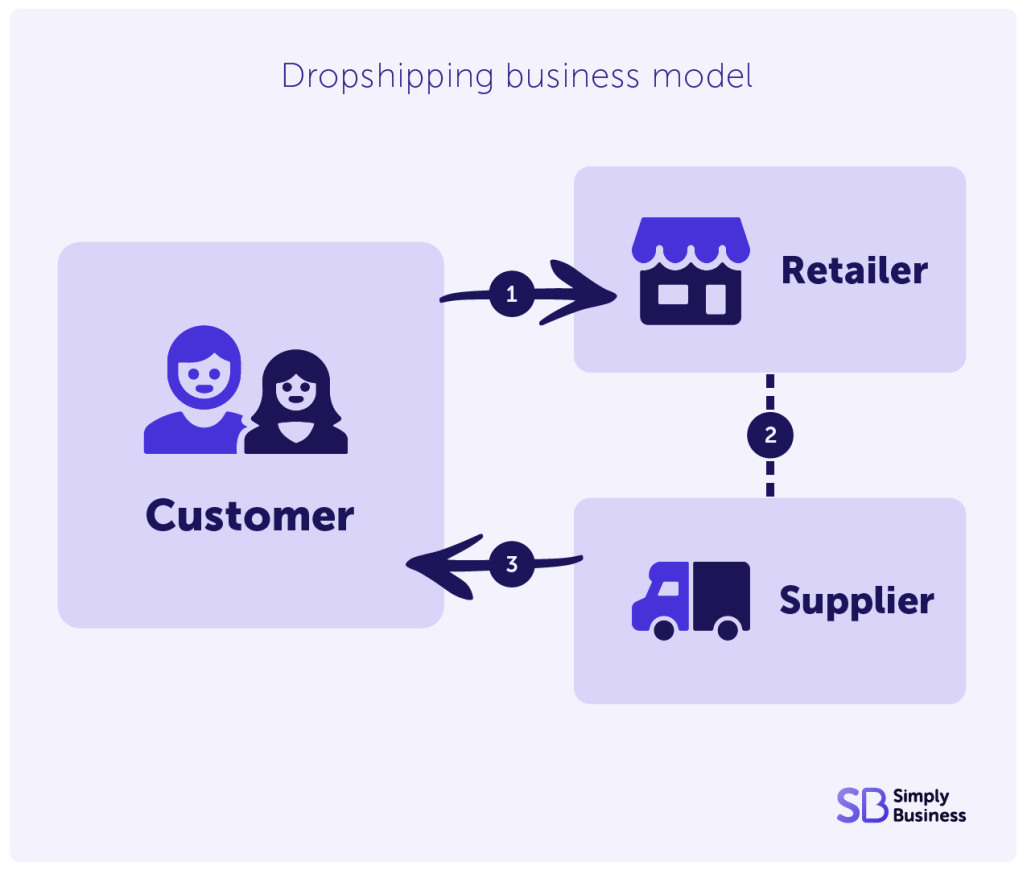

An alternative form of online selling is dropshipping. When dropshipping, you’ll curate your own selection of products from other sources and sell them on – all without ever owning the items yourself.

As a dropshipper, you can use one of the platforms listed above to sell products from other suppliers. When a customer orders the product from your online shop, it triggers your supplier to ship it directly to your customer on your behalf.

Dropshippers set their own prices and generally only pay their suppliers the wholesale price of the product, meaning it’s easy to make a profit as you’re not spending money upfront on products for your store.

Dropshipping also helps to avoid the above issue of buying too many items which fail to sell – though you are relying solely on your suppliers to ship your products in a timely manner. You also have less control over the quality of your items.

If this sounds like a business model that could work for you, you can learn more about how to start dropshipping.

Shipping costs – choosing a courier

So you’ve set up your shop, stocked your products, and made your first sale. Now it’s time to ship your product. The first question to ask yourself is who you’re going to use to send your items.

Choosing a courier for your small business will depend on both you and your customers’ needs. Different companies offer different prices, and it’ll depend on how much you have to send, what you’re sending, and how often you’re sending them.

For example, if you sell large products such as furniture and require a courier for large items, this will limit your choices. On top of this, only some couriers offer international shipping.

The courier you choose will also dictate the shipping options you offer to customers and not all will offer next day delivery.

Shipping is also a good time to think about your branding. Not only will you want to make sure your product is protected during shipping, but that it represents you and your business as well.

Think about including your branding on:

- shipping receipts

- package filling

- invoices

- the boxes themselves

And if you’re an eco-conscious small business, there are sustainable packaging materials to choose from.

You can also use this opportunity to encourage your customers to leave you an online review – a handwritten or designed thank you note is a great way to create a connection with your customers.

Postage and returns policies

If you’re selling through a third-party website, there will be rules that you have to agree to surrounding your postage, packaging and returns – so make sure you familiarise yourself with those.

Selling through your own website means you’re in charge of deciding the rules and letting your customers know about them. These rules can protect you if you get into legal trouble around your postage and returns, and they set expectations for your customers.

For example, if you’re clear that the wait time is two weeks, you won’t have people contacting you within five days asking why their package hasn’t arrived.

You may also choose to offer free postage and/or free returns – or have these as a bonus if people spend a certain amount or take part in a particular event.

Whatever you decide to do, make sure you balance the cost to you with how much you’re earning from each sale, and what sort of behaviours you want to incentivise in your customers. For example, if you run a clothing business and want to enable people to try on lots of options, free returns will make that more appealing.

Opening a physical store

If your ecommerce store is going well, or you want to spend more time nurturing relationships with your customers, moving to a physical location could be a great business opportunity.

To get things started, you could consider trialling selling in person. You could check out local market stalls in your area and see if there are any opportunities to get involved. Depending on the market, this could be a weekly, monthly, or even seasonal opportunity – making it easy to work around running your online store.

Another option, which is rising in popularity, is to set up a pop-up shop. Like a market stall, a pop-up shop gives you the opportunity to develop a relationship with your customers – which in turn can help you make smarter business decisions surrounding your products.

After experiencing in-person sales, you may decide you want to open a permanent shop in your area.

There are many benefits to running both a physical store and an online shop. While a physical shop lets customers interact with your products in person, it limits your customer base to a specific area. An online store lets you fill this gap, by giving you a wider customer reach.

If you know the area you want to run your store, you’ll first need to choose a business premises. Most shops will choose to rent their premises, but you can always choose to buy instead.

Some things you’ll need to consider include:

- your budget – this will affect both shop size and location

- how much space you’ll need – will you just need a shop, or a manufacturing and shipping warehouse too?

- local competition – are there any other similar businesses in your area? Or is there a gap in the market you can fill?

- increasing footfall – are there any things you can do to help increase foot traffic to your store?

- security – shoplifting can be a concern if you run a physical store

Once you have your store up and running, there’s a whole other type of marketing to consider: visual merchandising. Because it’s not just about the products you sell, but how you sell them. Consider your shop layout, the music you play, and how you entice customers to come inside. It’s completely different to selling online, but just as rewarding.

Retail insurance

One important step you can’t forget when opening a shop is your retail insurance – which is necessary whether you’re trading online or in-person. If you’re trading solely online, then you’ll need to consider cover for:

- product liability – if your products injure a customer

- stock insurance – if something happens to your inventory

- business interruption – if a theft or accident causes you to lose income

And if you’ve chosen to open a physical location, you’ll also need to consider:

- shop building insurance – in case anything happens to your business premises

- contents insurance – if anything happens to the fixtures of your shop

- employers’ liability insurance – in case your employees get injured when working on your premises

Retail skills – how to succeed

Opening a shop – whether online or on the highstreet – is a uniquely rewarding career which requires a range of different skills. To succeed in a retail or ecommerce environment, you’ll need to be strategic, creative, and tech savvy.

Everything from budgeting, communicating with customers and suppliers, and business acumen will play an important role in developing your business.

Once you’ve built a solid foundation for your business, you can work on marketing your business and providing the best customer service available to your customers.

Ready to set up your cover?

As one of the UK’s biggest business insurance providers, we specialise in public liability insurance and protect more trades than anybody else. Why not take a look now and build a quick, tailored quote?