If you employ people to work for your small business then you’ll need to produce a payslip for them with every paycheque. This could be monthly or weekly, or however often you run payroll.

Whether you employ casual or temporary workers or have full-time staff, it’s important you put the right information on your payslip. Keep reading for an overview of what you need to include, and download a free payslip template to get you started.

What is a payslip?

A payslip, or paycheque, is a statement that you must produce for your employees to show earnings, tax deductions, and pension contributions.

It should be sent to your employees on or before payday, and can be in digital or print format.

You don’t need to do a payslip for any freelancers or contractors as they’ll invoice you for their work separately.

What’s on a payslip?

Your employees will be able to use a payslip to see:

- their earnings (before and after tax and other deductions) – this is gross pay and net pay

- tax paid

- National Insurance

- number of hours worked (if this affects pay)

- pension contributions

- student loan repayments

As well as that, information that should be on a payslip should cover:

- pay date and pay range

- pay rate (hourly or salary)

- year to date pay

You can download our payslip template below to see how to set up your payslips.

What is PAYE on payslip statements?

Employees can see the amount of tax through PAYE on their payslip by looking at deductions labelled ‘PAYE’. They’ll also be able to see National Insurance contributions and student loan repayments.

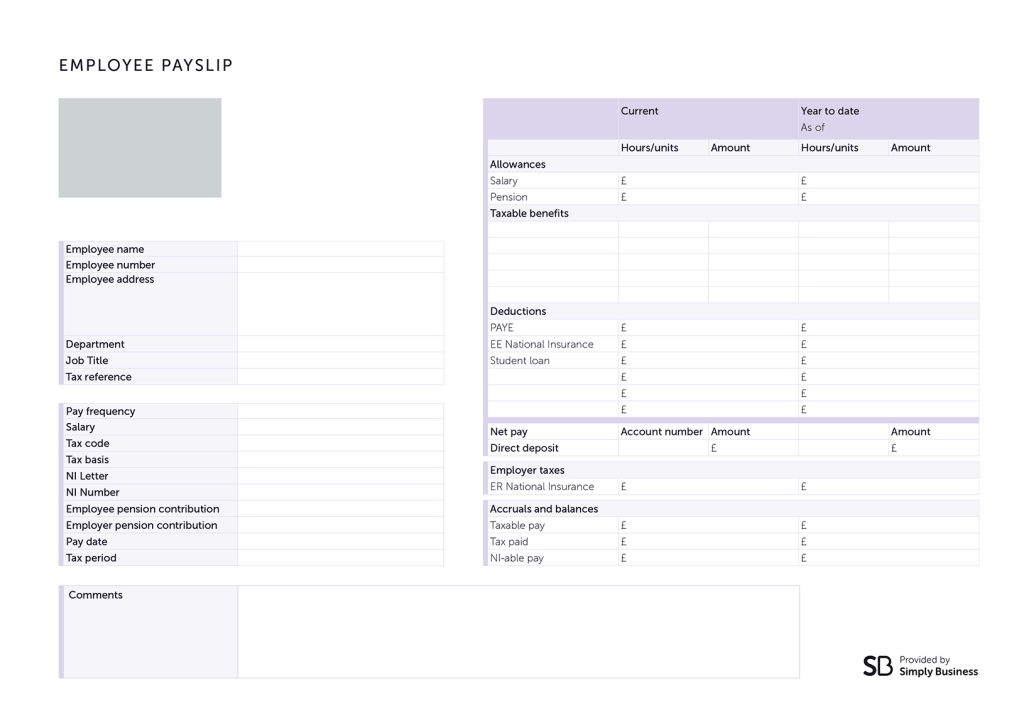

Free Payslip template – editable for your business

If you’re new to hiring staff and want to put together a payslip yourself (rather than using payroll software) then you might not know where to start.

That’s why we’ve worked with finance experts to create a free payslip template. It’s editable so you can start using it for your business right away.

Download your free Excel payslip template for UK businesses

Payslip template example

You can use our downloadble payslip template, or use it as inspiration to create your own.

You’re legally required to report to HMRC every time you run the payroll on or before each payday. Your payroll software will calculate the deductions for you.

Keeping records is very important, and you’ll need to keep them for three years from the end of the tax year they relate to.

Read our guide on the best payroll software for businesses – some even include payslip templates for you.

This template and article is created as a guide. Always speak to a finance expert or accounting professional if you’re not sure of anything.

Have you used our payslip template for your business? Let us know how you get on in the comments.

More small business guides

- What is an employer reference number (ERN)?

- What employee benefits can attract new hires to your business?

- Workplace pensions: an employer’s guide

- Public liability vs employers’ liability insurance

Get personalised insurance for your business

Whether your company needs public liability insurance, business interruption insurance, or something else entirely, we’ll work with you to find the cover you need. Get a quote online, or talk to our expert team on 0333 016 4307.

Photograph: Pormezz/stock.adobe.com