How small business owners pay income tax is set to change. From 2026, there’ll be a phased switch to Making Tax Digital (MTD) – which will replace the annual Self Assessment process with quarterly tax returns.

Find out how to prepare for these MTD Self Assessment changes – plus the key dates you need to know.

And if you’re a landlord looking to learn about Making Tax Digital, we have a whole other guide for you.

What is Making Tax Digital?

Making Tax Digital, or MTD, is a government initiative which will require small business owners and the self-employed to complete digital tax records and returns.

The government says that MTD aims “to help businesses get their tax right first time by reducing errors, making it easier for them to manage their tax affairs by going digital, and consequently helping them to grow.”

Making Tax Digital is being introduced in phases – with the changes to Self Assessment and income tax set to come into place in 2026. MTD is already in place for VAT-registered businesses.

MTD for income tax

Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) means that business owners will need to keep digital records of their finances and complete quarterly tax returns.

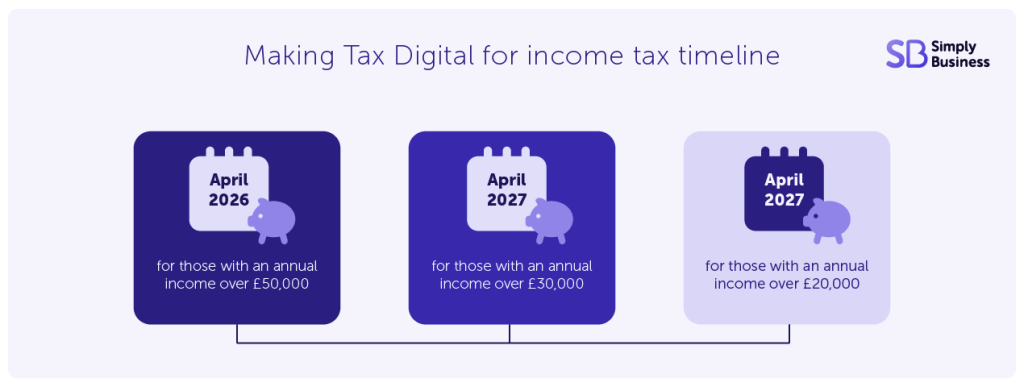

MTD will apply to your business from the following dates:

- April 2026: for those with an annual income of over £50,000

- April 2027: for those with an annual income over £30,000

- April 2028: for those with an annual income over £20,000

These dates will be based on your reported income from your 2024/25 tax return, which will be filed on 31 January 2026.

From these dates, you’ll need to submit your quarterly tax returns using a Making Tax Digital-compatible software. We’ve reviewed the best Making Tax Digital accounting software here.

If you’re in a business partnership, MTD will also affect your business, though this date has yet to be confirmed.

Read more: Business tax – a guide for small businesses

MTD deadlines

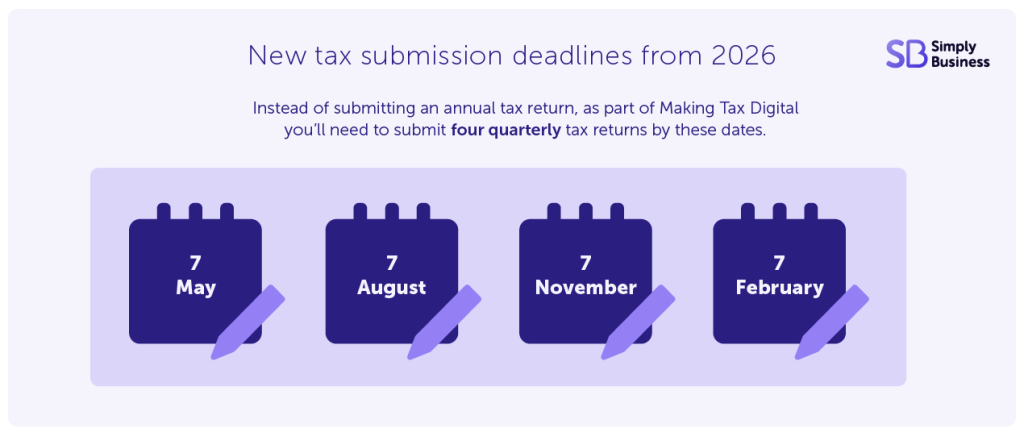

Once you’ve found an MTD-compliant accounting software, you’ll need to remember to report your income for the following dates.

Quarterly MTD deadlines

Instead of submitting an annual tax return, you’ll need to submit four quarterly tax returns by these dates:

- 7 May

- 7 August

- 7 November

- 7 February

You can submit these returns up to 10 days early if you know the quarterly information won’t change.

MTD deadline for final declaration

You’ll then need to submit a final declaration, or year-end tax return, by 31 January each year. This final declaration will confirm that the quarterly updates were accurate. You’ll also use this stage to make declarations about any other sources of income or claims.

Much like the current Self Assessment system, the tax you owe for the previous tax year will need to be paid by a 31 January deadline.

Making Tax Digital records

The mandatory digital records you’ll need to keep include:

- self-employment income

- self-employment expenses

You’ll need to record the amount, date, and category for each item you record. You should also try to create your digital records as close to the date of the transaction as possible to get the most accurate financial impression of your business.

On top of this, you can choose to keep digital records of:

- other income sources (such as PAYE and dividends)

- disallowable expenses (such as expenses that weren’t fully for business use)

- simplified expenses

You’ll need to keep any digital records for at least five years after the 31 January tax year deadline – which is the same time needed for Self Assessment record keeping.

Register for MTD

Business owners are being encouraged to sign up for MTD early to avoid delays in their quarterly reporting. If you sign up before the deadline, you’ll still need to submit a Self Assessment tax return for the 2024/25 tax year by 31 January 2026.

You can register for MTD on the government website, as long as:

- your personal details are up to date with HMRC

- you’re a UK resident

- you have a National Insurance number

- you’ve submitted at least one Self Assessment tax return

- you’re up to date with your tax records

- you use one of the following accounting periods:

- 6 April to 5 April

- 1 April to 31 March

Making Tax Digital penalties

The penalties for failing to comply with Making Tax Digital are similar to Self Assessment. You could receive a penalty or fine for:

- missing a quarterly update or final declaration deadline

- missing a tax payment deadline

- persistently missing reporting or payment deadlines

HMTD for income tax FAQs

When does MTD for Self Assessment start?

MTD will replace the current Self Assessment system from April 2026 for businesses that report an income over £50,000. Businesses that have an income of over £30,000 will begin using MTD in April 2027 and those with an income of over £20,000 will begin using it in April 2028.

How does Making Tax Digital work?

Making Tax Digital means that businesses will have to keep digital records of their income. They’ll then need to submit quarterly reports to HMRC – as well as one final declaration and payment before 31 January of each tax year.

How does MTD work for business owners with multiple income streams?

If you have multiple sources of income, such as running multiple businesses, you’ll need to sign up for Making Tax Digital separately for each of them.

More tax guides for small business owners

- Small business tax changes: new thresholds, rates, and allowances

- Self-employed expenses in the UK – what can you claim?

- HMRC penalties for late tax returns and late payment

- Business tax – a guide for small businesses

Ready to set up your cover?

As one of the UK’s biggest business insurance providers, we specialise in public liability insurance and protect more trades than anybody else. Why not take a look now and build a quick, tailored quote?