Wondering how to file a VAT return and pay your tax bill to HMRC? It can feel overwhelming if you’re a newly-registered small business and trying to understand all the forms and processes.

All VAT-registered businesses must be signed up to Making Tax Digital to file and pay their VAT bill. This means filing online using compatible software and keeping digital records. Make sure you’re clear how to pay VAT and how to apply for a Making Tax Digital exemption, if you need to.

This guide covers:

Keep reading to learn more about filing and paying VAT, or take a look at our other guides on how to register for VAT, how much VAT costs and Making Tax Digital for income tax.

What is a VAT return?

A VAT return is a digital form you send to HMRC showing how much VAT you owe.

It includes how much VAT you’ve charged on sales minus the amount you can reclaim on business-related goods and services you’ve paid for.

It’s a form that’s usually submitted every three months, based on your business’s accounting period.

Making Tax Digital for VAT (how to record, file, and pay VAT)

You’ll be automatically registered for Making Tax Digital when you register for VAT – unless you apply for an exemption.

HMRC introduced Making Tax Digital for VAT gradually from 1 April 2019, and it’s applied to all VAT-registered businesses from 1 April 2022.

All VAT-registered businesses are required to use MTD compatible software and keep records with a MTD account.

Applying for an exemption

You might be able to apply for a MTD exemption if it’s not ‘reasonable or practical for you to use computers, software, or the internet’. The government website gives a few examples of when you might be exempt:

- because of your age, health condition, disability, or where you live

- you object to using computers on religious grounds

- you don’t have access to the internet

If you’ve cancelled your VAT registration or your business is subject to an insolvency process, then you’ll already be exempt from Making Tax Digital for VAT.

How to keep digital records

All VAT-registered businesses need to keep digital records and send digital VAT returns.

Your first step is to start using compatible software to submit your returns. This pulls information from your digital records, which need to be preserved for up to six years.

Digital records you need to keep include:

- business name and contact details

- VAT number and details of any schemes used

- VAT on goods and services you supply (supplies made)

- VAT on goods and services you receive (supplies received)

- adjustments to returns

- time of supply (tax point)

- rate of VAT charged on supplies made

- reverse charge transactions (if your software doesn’t record them, you need to record them twice as a supply made and a supply received)

- daily gross takings (DGT) if you use a retail scheme

- purchases of assets you can reclaim tax on if you use the Flat Rate Scheme

- value of sales made and total output tax on Gold Accounting Scheme purchases (if applicable)

- documents covering multiple supplies made or received on behalf of your business (by volunteers, third party businesses, or employees)

You can use spreadsheets to calculate or summarise VAT transactions and work out what information you need to send to HMRC. But ultimately you’ll need to use compatible software to send that information.

If you use different software to keep records and submit your returns, you might also need what HMRC calls ‘bridging software’ to digitally link them together.

Best software for Making Tax Digital for VAT

HMRC has a list of compatible software you can use, including Xero, Quickbooks, and Zoho.

You can link software by emailing records, linking cells in spreadsheets, and downloading and uploading files.Many businesses choose to pay an accountant to take the stress out of organising tax returns and paying their VAT bill. But if you’re doing it yourself then read our guide to the best accounting software.

How to file a VAT return

All VAT returns must be filed online:

- using your VAT online account

- through third-party VAT return accounting software

- or with help from an accountant

It’s important to note that you can only use the government’s VAT online account if you use the annual accounting scheme.

Filing your return by post is only allowed if you have an exemption from Making Tax Digital for VAT.

How to submit a VAT tax return

If your business has registered for VAT then you’ll need to file a VAT return and pay HMRC, which is usually every three months.

To submit your VAT return, here’s what you need to do:

1.

Calculate your VAT liability (how much you owe)

2.

Fill in your VAT return form

3.

Submit your VAT return online

4.

Pay your VAT bill

When you file a VAT return, you’re telling HMRC how much VAT you’ve charged and paid to other businesses (we also have a guide on how to work out how much VAT to add to your prices).

It’s easy to get confused by the boxes on a VAT return and what information you need to include. The government website has more information about sending a VAT return.

Make sure you submit your VAT return on time to avoid penalty points and late payment penalties.

How to pay VAT online

There’s a few ways you can pay your VAT bill to HMRC:

Direct Debit – you can use your VAT online account to set up a Direct Debit. This should be set up at least three working days before you file your VAT return.

Payment on account – you can set up advance payments towards your VAT bill, where HMRC will work out instalments.

Bank transfer – pay HMRC from a UK bank account using the bank details on the government website.

Debit or corporate credit card – pay online using a debit or credit card. There’s a fee if you pay with a corporate credit or debit card, but no fee if you pay with a personal debit card.

Standing order – if you use the annual accounting scheme, then you may choose to pay by standing order (you’ll need to request this payment method on your application form for the annual accounting scheme).

The government website has a full list of ways to pay your VAT bill.

When is the VAT return deadline?

VAT returns are usually due four times a year (quarterly) but you might choose to pay monthly or even file once a year through the annual accounting scheme.

The deadline is usually one calendar month and seven days after the end of your accounting period.

For most businesses though, your deadline for VAT return will be quarterly – and this will also be when you need to pay your bill.

If you log into your VAT online account you can see when payments are due.

VAT return due date

You send your return and pay VAT due one calendar month and seven days after the end of your VAT period.

Some businesses can pay monthly, which means a different VAT return date.

Others might join the annual accounting scheme. This removes quarterly VAT return deadlines. Instead, you make advance payments towards your bill and only send one return a year.

Your VAT due date if you’re using the annual accounting scheme is two months after the end of the period.

Because of the annual frequency, this scheme won’t suit businesses that regularly reclaim VAT, as they’ll only get one refund a year. Speak to an adviser if you’re not sure.

You can always check your VAT online account on the government website to find out your VAT deadlines.

What if you miss your VAT return deadline?

HMRC has a penalty points system. You’ll get a penalty point for each VAT return you submit late. You’ll get a separate penalty for each late payment.

There’s a penalty point threshold, and once you reach this you’ll be charged £200.

Make sure you file and pay on time to avoid a £200 penalty. Remember to file even if you have nothing to declare. Read more about how late returns and payment works.

VAT return example

If you’re filing your VAT return on a quarterly basis, here’s an example of when VAT might be due based on an example accounting period.

If the end of your VAT period is 30 September 2025, the VAT deadline for sending a return and paying your bill is 7 November 2025.

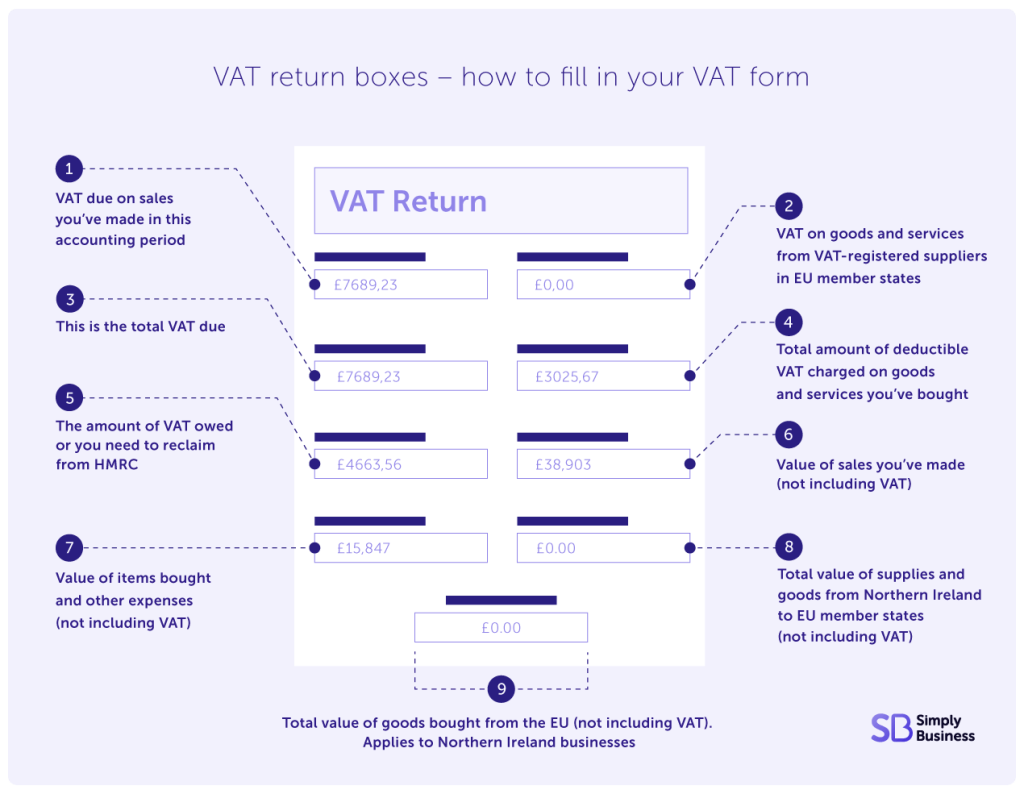

VAT return boxes – how to fill in your VAT form

Your VAT return form will have nine boxes.

It’s important to note that VAT accounting for businesses in Northern Ireland changed following Brexit – boxes 2, 4, 8, and 9 now have wording to reflect the Northern Ireland protocol. This means some boxes on the form won’t apply to you if you’re a UK business based outside of Northern Ireland.

There’s detailed information on what goes in each box on the government website, but here’s a quick overview of what to include in your VAT return box by box:

Box 1 – VAT due on sales you’ve made in this accounting period. This might also include VAT on other outputs, such as supplies to your staff and the sale of assets

Box 2 – VAT due on goods and services you’ve acquired from VAT-registered suppliers in EU member states. This applies to Northern Ireland based businesses only

Box 3 – this is the total VAT due (add the totals from box 1 and box 2 together)

Box 4 – this is the total amount of deductible VAT charged on goods and services you’ve bought for your business. This should include acquisitions in Northern Ireland from EU member states

Box 5 – the amount of VAT you owe HMRC or you need to reclaim from HMRC (based on the difference between box 3 and box 4)

Box 6 – value of sales you’ve made (not including VAT)

Box 7 – value of items you’ve bought and other expenses (not including VAT)

Box 8 – total value of supplies and goods from Northern Ireland to EU member states (not including VAT). This only applies to businesses operating in Northern Ireland and trading with the EU

Box 9 – total value of goods you’ve bought from the EU (not including VAT). This applies to Northern Ireland businesses only

Different VAT accounting schemes

The process for filing your VAT return is slightly different if you’re using one of the special accounting schemes, including:

- flat rate scheme

- cash basis accounting

- annual accounting

- payment on account

- reverse charge accounting

Flat rate scheme example

For example, if you’re using the flat rate scheme, completing VAT boxes 1, 4, 6, and 7 will follow a different process:

Box | Requirements |

|---|---|

Box 1 | Based on your flat rate percentage of your supplies |

Box 4 | Won’t usually need to be completed |

Box 6 | Based on your turnover you applied your flat rate to (including VAT) |

Box 7 | Won’t usually be needed. |

This article is a guide. As always, speak to a professional if you’re not sure of anything.

Related small business guides

- Your ultimate guide to business tax

- Important tax year dates for small businesses

- What is turnover – and how do you work it out?

- Is public liability insurance tax deductible?

Looking for self-employed insurance?

With Simply Business you can build a single self employed insurance policy combining the covers that are relevant to you. Whether it’s public liability insurance, professional indemnity or whatever else you need, we’ll run you a quick quote online, and let you decide if we’re a good fit.