Significant changes to the way many landlords pay their income tax return are coming into force from next year. Making Tax Digital (MTD) will replace the annual Self Assessment process with quarterly returns.

With changes just around the corner, over two thirds (68 per cent) of landlords said they’re not prepared for Making Tax Digital, according to Simply Business research.

So, how does Making Tax Digital for landlords work, when it could apply to you, and how you can prepare?

- Making Tax Digital for income tax and Self Assessment

- MTD for landlords – key dates and criteria

- Making Tax Digital – what landlords need to do

- How to register for Making Tax Digital

- How to prepare for Making Tax Digital

- Landlords reveal expected impact of MTD

- Penalties for non-compliance with MTD

- Making Tax Digital for landlords FAQs

What is Making Tax Digital?

Making Tax Digital is the government’s plan to create “a modern, digital tax service fit for the 21st century”.

MTD for VAT-registered businesses was rolled out for those with turnover above the VAT threshold in 2019 and extended to all VAT-registered businesses in 2022.

What is MTD for income tax?

The next stage of the initiative is Making Tax Digital for income tax and Self Assessment (MTD ITSA). This will require Self Assessment taxpayers to use government-approved software to file their tax returns digitally. They’ll also move from an annual return to quarterly updates (with one final declaration at the end of each tax year).

The government says that these changes will make the tax system “more resilient and effective, boost business productivity, and better support taxpayers”.

Making Tax Digital for income tax has been delayed several times but is currently due to come into force from 6 April 2026.

MTD for landlords – key dates and criteria

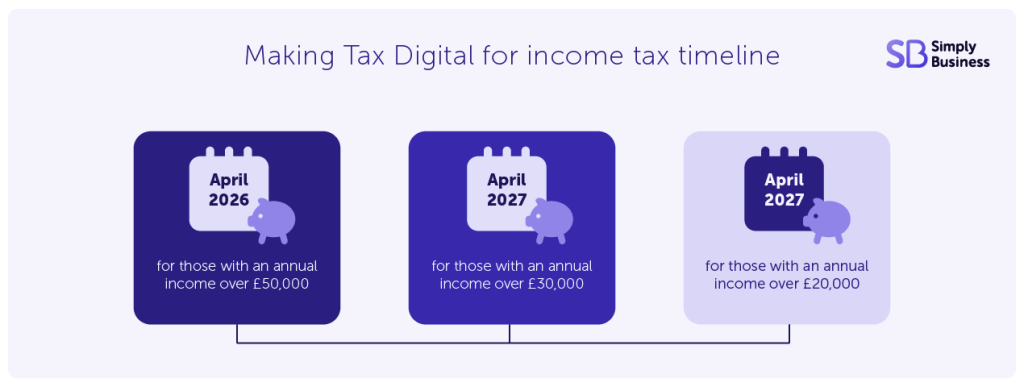

Making Tax Digital is being rolled out for Self Assessment taxpayers in stages. These are the key dates and criteria landlords need to be aware of:

- 6 April 2026 – MTD for income tax rules will apply to landlords with an annual income of £50,000 or more. This includes combined income from property and other business interests or employment

- 6 April 2027 – Making Tax Digital will be extended to landlords with property and business income of £30,000 or more a year

- 6 April 2028 – landlords with annual property and business income of £20,000 or more will need to comply with MTD for income tax

Making Tax Digital for income tax – what landlords need to do

Making Tax Digital will require landlords to keep digital records of their property income and allowable expenses for tax purposes.

To do this, they’ll need to use government-approved software that’s compatible with MTD.

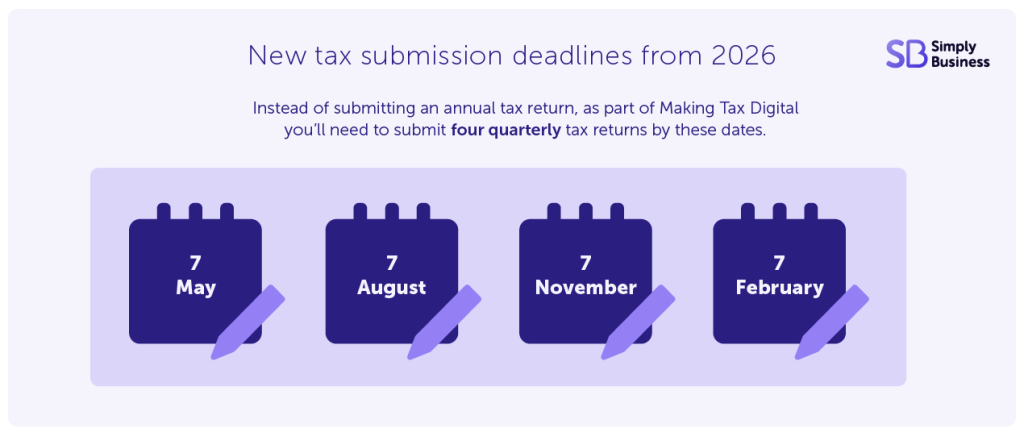

Instead of an annual tax return, landlords will need to provide HMRC with quarterly tax updates by the following dates:

- 7 May

- 7 August

- 7 November

- 7 February

They’ll then need to submit a ‘final declaration’ by 31 January each year. The final declaration will confirm that the quarterly updates were accurate. This is also when landlords can apply for any allowances or tax reliefs and provide extra relevant tax information.

Similar to the current Self Assessment system, the tax owed for the previous tax year will need to be paid by a 31 January deadline.

Most limited company landlords won’t be affected as they’ll continue to pay corporation tax instead of income tax. However, limited company directors who are also registered for Self Assessment to pay tax on dividends and other income not collected through PAYE will be required to sign up for Making Tax Digital.

What information do you need to provide?

In your quarterly updates, you’ll need to provide:

- income records – for example the rent you receive from tenants. You’ll need to record the date it was received, the amount, and who it was paid by

- expenses records – for example any repairs or maintenance you complete. You’ll need to report the amount, date, and category of the expense

You’ll need to provide digital copies of receipts and invoices to support your expenses records, as well as bank statements to support your income records.

You can use the final declaration to:

- make adjustments to individual transactions

- claim reliefs or allowances

- choose the trading allowance instead of deducting expenses

You’ll be asked to confirm that the information you’ve provided is correct and that you’ve finalised your income tax position.

The information you provide will be used to create your final Self Assessment tax bill.

For more information, you can read the government manual for using Making Tax Digital for income tax.

What happens if landlords have multiple income streams?

If you have multiple income sources, such as other self-employment income, you’ll need to record them as part of Making Tax Digital for income tax.

Digital records for other income sources must be kept separately.

How to register for Making Tax Digital

You can sign up for Making Tax Digital on the government website.

To sign up you’ll need to be registered for Self Assessment and have your Government Gateway credentials to hand. You’ll also need to have identified which MTD-compatible software you’re going to use.

Even if you’re not due to comply for a while, you can sign up voluntarily and get to grips with the new system.

How can landlords prepare for Making Tax Digital?

For many landlords, the change to MTD will require significant changes to their accounting process. And although your deadline to comply with Making Tax Digital may still be months or years away, there are things you can do now to make the transition as smooth as possible.

- register now – you can already sign up to MTD voluntarily, which will give you time to get to grips with the new system

- research software – take a look at the available options, most will be MTD-compatible and many of them are free

- go digital – if you haven’t already, start recording your transactions and expenses digitally

- think quarterly – consider what you’ll need to change when you’ll need to report your income four times a year instead of once

- speak to an accountant – a professional will be able to give you guidance on how MTD works or even manage the tax return on your behalf

- check exemptions list – you can apply for an exemption from HMRC, for example if you don’t use computers for religious reasons or don’t have access to the internet

Landlords reveal expected impact of Making Tax Digital

A Simply Business survey of over 1,000 landlords in August 2025 found that fewer than one in three feel prepared for Making Tax Digital.

Landlords also revealed how they anticipate the new system could impact their rental business.

Almost half (41 per cent) think it will make tax returns more expensive, with 45 per cent expecting the process to be more time consuming due to quarterly submissions.

And over a third (35 per cent) think it will make filing taxes more complicated.

Just five per cent said they think Making Tax Digital will make the process more efficient and over a fifth (22 per cent) don’t expect it to have a significant impact on their tax returns.

What are the penalties for non-compliance with MTD?

As with Self Assessment, there are penalties for failing to comply with Making Tax Digital for income tax.

You could receive a penalty fine for:

- missing a quarterly update or final declaration deadline

- missing a tax payment deadline

- persistently missing reporting or payment deadlines

Making Tax Digital – key takeaways for landlords

- landlords who earn more than £50,000 a year (from all income sources) will need to register for Making Tax Digital by 6 April 2026

- to comply with Making Tax Digital, landlords will need to keep digital records of their property income and allowable expenses

- instead of an annual tax return, landlords will need to provide HMRC with quarterly tax updates, with a ‘final declaration’ required by 31 January each year

- similar to the current Self Assessment system, tax owed for the previous tax year will need to be paid by a 31 January deadline, along with a payment on account towards the next year’s tax bill

Making Tax Digital for landlords FAQs

When does Making Tax Digital start for landlords?

Making Tax Digital starts from 6 April 2026 for landlords with a total annual income of £50,000 or more.

It starts on 6 April 2027 for landlords with a total annual income of £30,000 or more, and 6 April 2028 for landlords with a total annual income of £20,000 or more.

What do landlords need to do for Making Tax Digital?

Landlords will need to keep digital records of their property income and allowable expenses. They’ll also need to use HMRC-approved software and submit quarterly returns.

Does Making Tax Digital apply if you own multiple properties?

Yes, landlords with multiple properties are required to apply for Making Tax Digital. This is because the threshold for Making Tax Digital is based on total annual income.

Can you be exempt from Making Tax Digital?

Yes, there are exemptions for Making Tax Digital. There are exemptions you can apply for, such as not having access to the internet. And there are automatic exemptions, such as tax returns being completed on behalf of someone who’s died.

More landlord tax guides

- 5 buy-to-let tax changes landlords need to know about

- Taxable income sources for landlords

- What is Section 24? A guide for landlords

- Stamp duty on second homes: the complete guide

Get set with tailored landlord cover

Over 200,000 UK landlord policies, a 9/10 customer rating and claims handled by an award-winning team. Looking to switch or start a new policy? Run a quick landlord insurance quote today.