If your business is registered for VAT, you’ll need to add a tax to your sale prices. But how much is VAT in the UK and how does it affect your prices?

Read our comprehensive guide to find out how VAT works, the latest VAT rates, and use our VAT calculator to work out VAT.

VAT calculator

This VAT calculator lets you work out how much VAT to charge based on the basic 20 per cent rate.

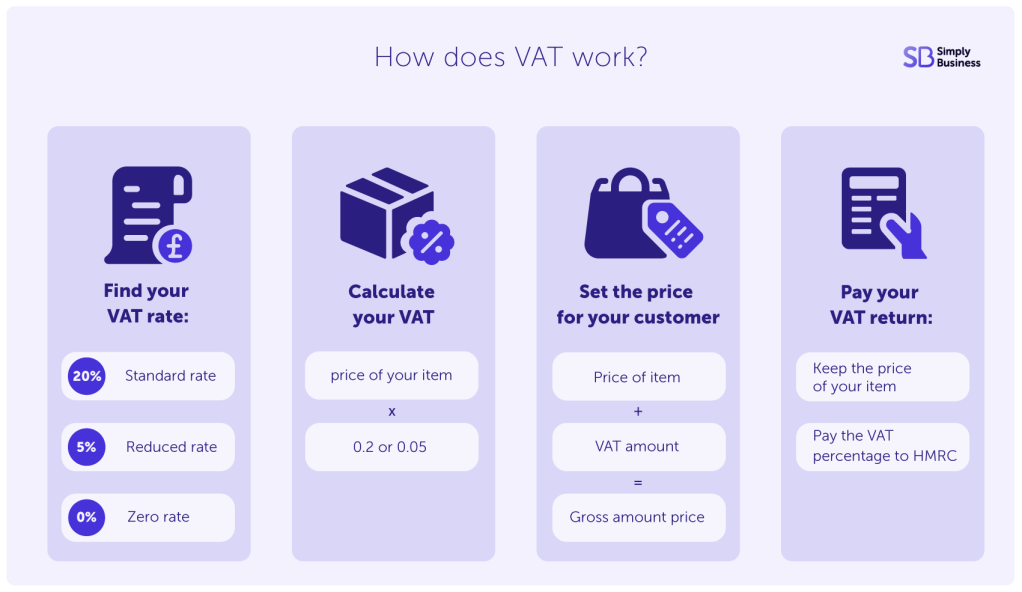

How to work out VAT

The first thing you need to do is work out what VAT rate applies to your product or service. Then it’s just a case of adding a percentage to the sale price. In most cases this will be 20 per cent but, depending on what you’re selling, it could be five per cent or zero per cent.

A simple way to calculate VAT is multiplying your prices by 1.20 for standard rate VAT or multiplying your prices by 1.05 for reduced rate VAT.

For example, you’re selling a vase that’s priced at £275. The £275 sale price multiplied by 1.20 equals £330, which is the VAT-inclusive price you should charge your customers.

On the other hand, you’re selling a children’s car seat for £65. As this product falls under the reduced rate of VAT, you multiply the sale price by 1.05 to reach a VAT-inclusive final price of £68.25.

Everything you need to know about VAT

How does VAT work?

Value added tax (VAT) is known as an indirect tax because it’s added at every step of the supply chain and passed on to the final consumer.

When a VAT-registered business buys materials from a VAT-registered supplier, they’ll have to pay VAT (known as input VAT) which they can claim back from HMRC.

If that business then uses those materials to create a product, they’ll add VAT to the price of the product when they make a sale (known as output VAT).

Businesses must pass the output VAT they receive from customers on to HMRC as part of their VAT return.

Read our in-depth guides on how to register for VAT and how to complete a VAT return for more information.

How much is VAT in the UK in 2025?

The rate of VAT depends on the product you’re selling or service you’re providing (see more below).

VAT-registered businesses must include VAT in their prices set at the correct rate.

For example if your business has a television to sell for £900, the VAT-inclusive price that you’d advertise to customers would be £1,080. This includes the £900 sales prices plus £180 VAT at 20 per cent.

Your business will keep the £900 and forward the £180 on to HMRC as part of its next VAT return.

It’s rare that a business would show prices excluding VAT and if you do, you could be breaking advertising rules.

2025 VAT rates

There are three rates of VAT that are charged on products and services by VAT-registered businesses:

- standard rate – 20 per cent

- reduced rate – five per cent

- zero rate – zero per cent

The majority of goods and services fall under the standard rate of VAT (20 per cent).

This has been the same since 2011, when it was increased from 17.5 per cent, excluding some reductions that were put in place as a result of the Covid-19 pandemic.

At the moment, there are no plans to increase the standard rate of VAT.

“If the chancellor wants to help small businesses, they need to reduce VAT on sales or give some free allowance up to a certain amount of takings. That would undoubtedly give businesses immediate financial relief and stimulate growth.”

Daniele Paduano

Owner of Kotch! Pizza

The reduced rate of VAT (five per cent) covers goods and services, such as:

- car seats for children

- fuel and heating products

- some health products

- some contraceptive products

- mobility aids for the elderly

- smoking cessation products

The zero rate of VAT applies to goods and services, such as:

- most food items

- children’s clothes

- books, newspapers, and magazines

- prescription medicines

There are also some products that are exempt from VAT, these include things like postage stamps, lottery tickets, and insurance. Products and services that are exempt from or out of scope of VAT are different to those that fall under the zero rate.

Read HMRC’s guide to VAT rates on different goods and services for the full list.

There’s often debate around which products should fall into which VAT rate category. For example, some retailers, charities, and MPs urged the government to remove period pants from the standard rate of VAT (20 per cent) and to reclass the garments as period products.

And as of 1 January 2024, VAT was removed on period pants – so it’s always worth keeping up to date with the latest VAT news.

Is VAT due on imports and exports?

If you import products into the UK from abroad, you’ll need to pay VAT when you pay customs. This tax can be claimed back as part of your VAT return. The government website has more information on import VAT.

If you export goods to EU countries, you’ll need to add export VAT (the rate of which varies). Read more about export VAT on the government website.

VAT on digital services in the EU

If your business supplies digital services to customers based in an EU country, then it’s important to note the latest VAT rules.

Digital services include:

- broadcasting

- ebooks

- telecomms

- video

- music downloads

- games

- apps

- software

As of 1 January 2021, UK businesses must charge VAT at the rate set by the EU country your customer is based. You must also declare those sales to the appropriate country.

You can no longer use the UK’s VAT MOSS scheme. You can only use VAT MOSS to make corrections to registration information until 31 December 2024.

You’ll need to register for the EU VAT MOSS non-union scheme in a member state, or register in each EU state you make sales.

Read more about supplying digital services to customers.

Online VAT calculator

There are online VAT calculators which can help you to work out how much tax you need to add to your prices.

Just enter the cost of the item and choose the rate of VAT that the product or service falls under.

The calculator will then show you:

- the net amount (the cost of your item)

- the gross amount (the cost of your item plus VAT, which should be advertised to customers)

- the total VAT amount (how much of the total sale price is owed to HMRC in tax)

Do you have any unanswered questions about VAT rates? Let us know in the comments below.

More tax guides for small businesses

- How to pay National Insurance when self-employed or running a business

- When is corporation tax due? A guide to UK corporation tax

- Self-employed tax brackets 2024/25: new thresholds, rates and allowances

- What is Making Tax Digital – is your business ready?

- How much business insurance do I need?

Get personalised insurance for your business

Whether your company needs business interruption insurance, public liability insurance or something else entirely, our award-winning team of insurance experts will work with you to provide the cover you need. Get a quote online, or talk to our expert team on 0330 165 4988 who can walk you through the process.

Malambo C/peopleimages.com/stock.adobe.com