Investing in property can be rewarding, allowing you to earn monthly income through rent and benefit from long-term property price rises.

However, depending on your circumstances, you may also need to sell a property in the future. It’s important to sell at the right time to get the best return on your investment.

Buy-to-let property investment strategies

Whether you’re new to property investment or a seasoned landlord, research is paramount when choosing a property. You also need to make sure you’re comfortable with the property buying process and what you need to do after you’ve bought one.

On the other hand, if you’re considering selling a property, it’s a decision that shouldn’t be taken lightly. That’s why you need to be fully prepared when it comes to your tax obligations and whether you want to sell with tenants in-situ.

This ultimate investment guide has been created to help you identify opportunities when it comes to buying and selling property.

Contents

- What is buy-to-let property investment?

- How does buy-to-let work?

- How to get into property investment

- Where are the best areas to buy a rental property?

- Tax and financial considerations for buy-to-let investors

- Choosing your target market: from students to families

- What happens after you buy an investment property?

- How to sell a house – six steps for buy-to-let investors

- Is now a good time to sell a buy-to-let property?

- Tax and financial considerations when selling a buy-to-let

What is buy-to-let property investment?

Buy-to-let property investment is when you buy a property with the aim of getting a financial return. Buying a property to live in doesn’t count as an investment, although you may benefit from rising property prices over time.

In the UK, most investors rent their properties out to tenants to earn monthly rental income. This is known as buy-to-let. However, some investors buy cheap properties, renovate them, and sell them on for a profit. This is known as property flipping.

Property investment – how long does it take to buy a house?

From initial research and viewings to making offers and reaching completion, here’s an overview of the key steps to buying an investment property:

- Set budget and do initial research

- Organise finances, including buy-to-let mortgage

- View properties and make offers

- Get an offer accepted

- Instruct solicitors

- Complete searches and surveys

- Exchange and completion

- Prepare property for rental

How does buy-to-let work?

Investing in property is generally seen as a reliable way of earning passive income compared to other investment asset classes such as stocks and shares.

This is because there’s always likely to be demand for rental property. Plus average property prices generally increase over time, but this isn’t guaranteed.

Is property a good investment?

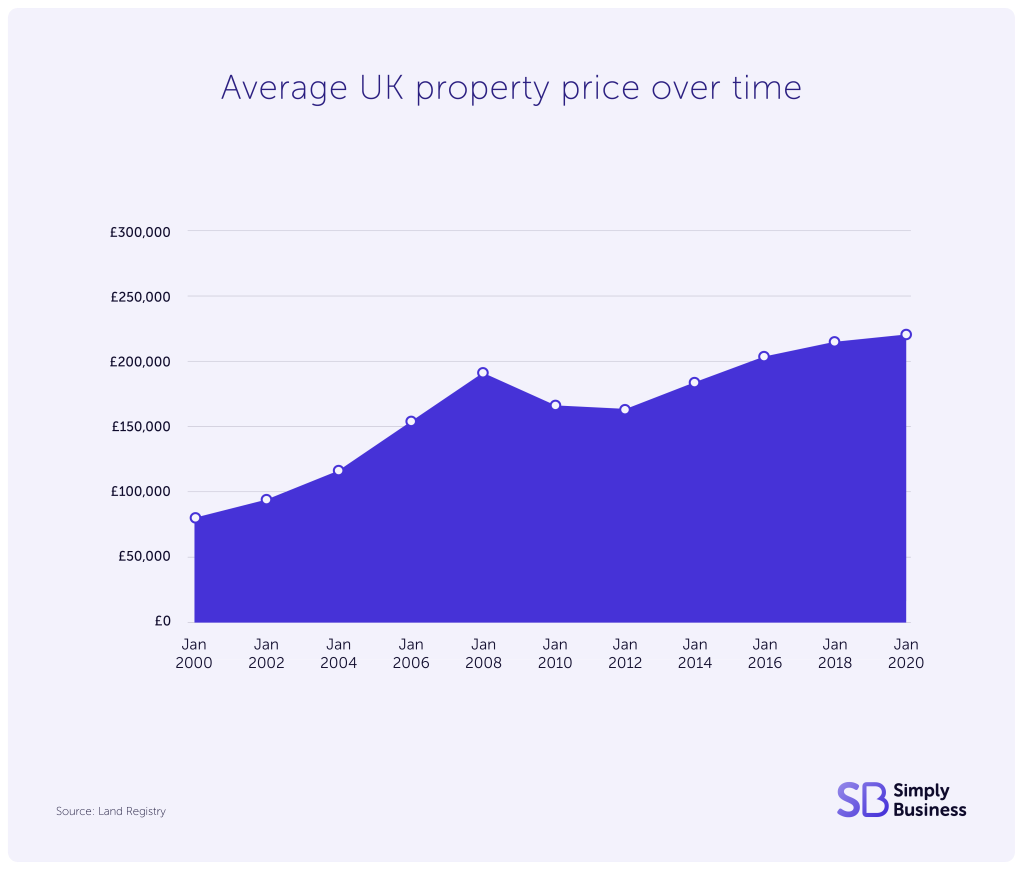

According to Land Registry data, in the 20 years from January 2000 to January 2020, the average property price in the UK increased by £147,320 (174 per cent) from £84,620 to £231,940.

Meanwhile, rental growth has also surged in recent years. Research by Savills shows that average rents grew by over a quarter (26 per cent) between March 2020 and November 2023.

Related guides

- UK house price predictions for next 5 years: a landlord’s guide

- Is now a good time to buy a house? A guide for landlords

Although you can earn a good return by investing in property, it does have some potential downsides. These include:

- extra tax and insurance costs

- cost of maintaining a property

- effort and stress of managing a rental property

- cost of running a property when it’s empty (known as a void period)

Investing in property can be complex and isn’t for everyone. This article is just a guide and isn’t advice, so if you have questions, please speak to a professional adviser.

How to get into property investment

First things first, you’ll need to do your research and come up with a strategy. Decisions will need to be made on things like:

- property location, size, and type

- target tenant and number of occupants

- maximum purchase price and projected monthly rental price

As well as researching the buy-to-let market independently, it could be useful to speak to experienced investors and local letting agents.

You could buy an investment property the traditional way through an estate agent, using property websites like Rightmove and Zoopla to look for homes in a specific area.

However, property auctions are popular with investors because they’re quick and there’s a good chance of finding a bargain.

How to buy a house – what you need to know before making an offer

Choosing the right location and type of property is crucial if you want to make a success of your investment.

There are two main ways to make money from buy-to-let property investment:

- rental income from tenants (usually paid monthly)

- rising property prices (known as capital appreciation)

One of the most popular ways of working out whether a property is likely to be a sound investment is by calculating its potential yield. A rental yield shows the return on a property as a percentage.

But what locations and property types are likely to generate the best yield?

When choosing an investment location, here are some key points to consider:

- is the average property price affordable, with prices likely to rise over time?

- is there a strong rental market with price growth and high demand from tenants?

- is the area likely to become more or less appealing to tenants in the future?

- do you live close enough to the area to be able to visit the property regularly?

If you want to benefit from long-term capital gains, a good strategy is to try and identify a future rental property hotspot.

Property prices and rents in these areas are likely to be lower, but could rise rapidly in time if the area becomes more appealing to tenants.

Some of the common signs to look out for include:

- businesses moving to the area

- improvements to transport infrastructure

- regeneration of public areas

- new housing developments

Where are the best areas to buy a rental property?

Some of the best rental property yields in England can be found in northern cities where average property prices are lower but demand for rental homes is high.

Our article on the best buy-to-let areas has more information on the UK’s HMO property hotspots and the most popular areas by property type.

If you’re thinking about investing in London the upfront cost is likely to be higher, although it’s likely you’ll earn more in monthly rental income. Our article on London rent prices has an overview of the cheapest and most expensive boroughs in the capital.

Research from buy-to-let lender Aldermore ranks investment locations based on average yields, lowest number of vacancies, and percentage of the population in the rental market.

Here are the top five for 2024:

| Ranking | City | +/- change |

| 1. | Bristol | +2 |

| 2. | Manchester | -1 |

| 3. | Coventry | +7 |

| 4. | Brighton | +10 |

| 5. | London | -3 |

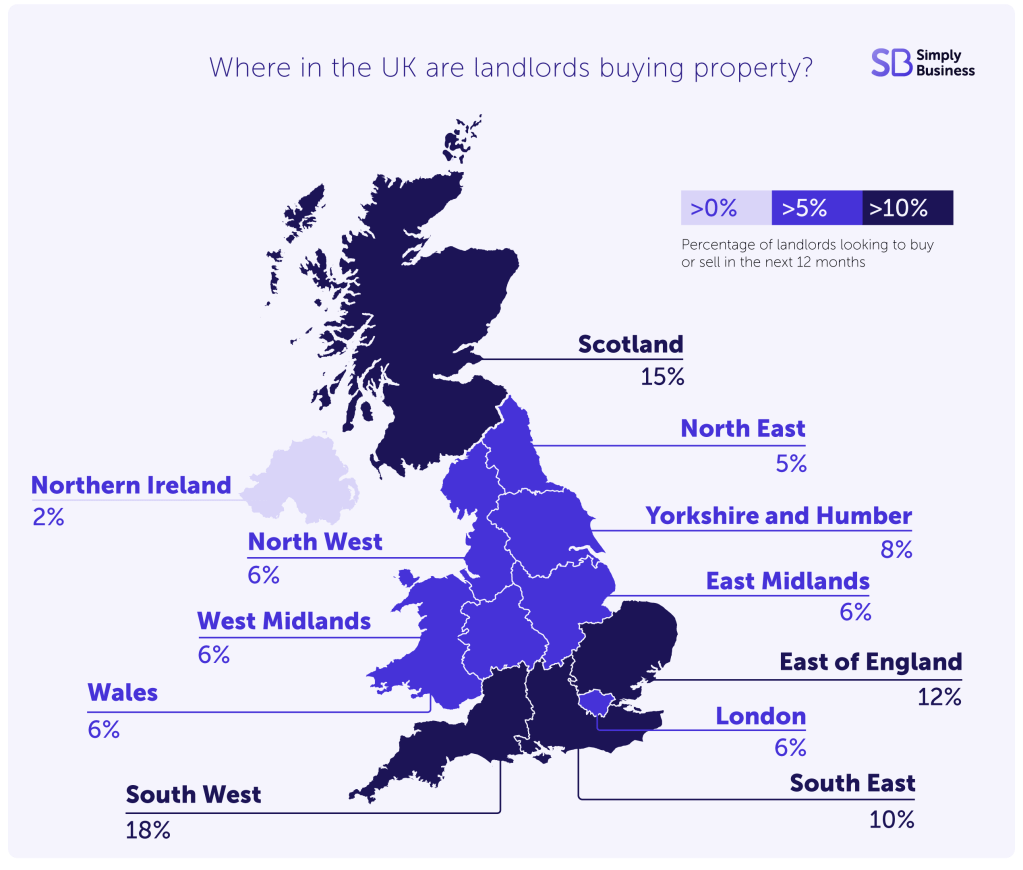

In 2023, We asked landlords whether they were planning to buy a property in the next 12 months. Of those who said they were planning to expand their portfolio, the most popular UK regions were the North West, Scotland, and the East of England.

The graphic below shows a regional breakdown of the most popular buying locations among existing landlords:

Tax and financial considerations for buy-to-let investors

If you already own a property and buy another one as an investment, you’ll need to pay a three per cent stamp duty surcharge.

For example, if the investment property costs £350,000, your stamp duty bill would be £18,000 (instead of £7,500 if you were buying the property to live in yourself).

Read our comprehensive guide to buy-to-let stamp duty for everything you need to know.

Other financial considerations you’ll need to make include whether you’ll need a buy-to-let mortgage and setting a budget of how much you want to spend on a new property.

Choosing your target market: from students to families

The type of property you buy will depend on the type of tenant you’re looking to target or vice versa.

For example, older properties are likely to have more bedrooms so could be suitable for families. New builds are likely to be more energy efficient, which could be appealing to young professionals looking to save money on bills.

If you want to rent your property to three or more tenants from separate households, this is known as a House in Multiple Occupation (HMO). Most HMOs require a licence and there are rules on things like minimum bedroom sizes that you’ll need to follow.

If you want to rent to students, you’ll need to take a slightly different approach. It’s likely you’ll encounter longer void periods when tenants are at home during the university holidays. As a result, it could be a good idea to visit the property more regularly to make sure there are no maintenance issues.

As most students don’t have a regular income, it’s common for landlords to ask for a guarantor. This means the rent will still be paid even if the student doesn’t have the money.

What happens after you buy an investment property?

Once you’ve bought your buy-to-let property, you’ll need to get it ready for tenants. Some of the things you’ll need to do include:

- advertising the property

- making sure it complies with government regulations

- tenant referencing and organising a tenancy agreement

During the tenancy, it’s important to do regular inspections. This can help you to spot any maintenance issues before they become serious and make sure tenants are looking after the property.

And when tenancies end, you’ll need to take the necessary steps to prepare your property for the next set of renters. To make managing a property easier, many landlords choose to work with a letting agent. Read more about how much letting agents cost and the different services you can use them for.

Three checklists to help you manage your property

- Pre-tenancy checklist – what to do before renting out a property

- Property inspection checklist – how can you prepare?

- End of tenancy checklist – here’s what you need to do

How to sell a house – six steps for buy-to-let investors

There might come a time when you choose to sell a buy-to-let property. This could be for several reasons, including needing to free up cash or pursuing other investments.

In 2023, our survey of almost 1,500 landlords found that almost one in ten (nine per cent) had sold a property in the previous 12 months while a quarter (25 per cent) were planning to sell a property in 2024.

Popular reasons for wanting to sell included new legislation such as the Renters’ Reform Bill, plus rising interest rates and mortgage costs.

If you’re considering selling a rental property, here are six steps to follow:

1. Get a property valuation

Before you sell, it’s important to get an idea of how much your property is worth. You can get an instant online valuation, but it’s also worth getting a market appraisal from several local agents.

2. Instruct an estate agent

There’s no legal requirement to sell your property through an estate agent, but most sellers choose to do so for ease and security. Make sure you choose a firm that knows the local market and has sold similar properties in the past.

3. Hire a solicitor

You’ll need a solicitor or conveyancer to help you with the legal side of the sale, and to transfer the ownership. Remember that there will be a charge for this, so make sure that you get a range of quotes.

4. Prepare for property viewings

Whether your property is occupied or not, it will need to be in a suitable condition for viewings. As you would when selling your own home, make sure it’s clean and tidy, plus consider fixing minor issues and some light redecoration.

5. Negotiate offers and contracts

Once you have an offer, you’ll need to decide whether to accept, reject, or negotiate. As well as the price being offered, it’s important to consider whether the buyer is part of a chain and the timeframe in which they’re looking to move.

6. Exchange and complete

Once you’re committed to a sale, you’ll exchange contracts. This is the point at which the sale becomes legally binding. After this comes completion, when payment is accepted, keys change hands, and the ownership is legally transferred.

What about selling with sitting tenants?

It may be more complicated to sell your buy-to-let property if it currently has tenants in it. However, it’s still possible, and is preferred by many sellers as you can continue to receive rental income while the property is on the market.

If you’re selling an occupied property, you’ll need to explain this to your tenants as soon as possible. Tell them why you’re selling and reassure them that their tenancy agreement still stands.

When selling a tenanted property, there’s a chance you’ll be selling to another landlord.

In this instance, be prepared for the buyer to carefully examine the terms of the existing tenancy, and the sitting tenants themselves – they may, for example, want to carry out their own referencing.

If you want to sell a tenanted property unoccupied, you’ll need to make sure you give tenants a legally compliant Section 21 eviction notice.

Buy-to-let: is now a good time to sell a house?

Whether it’s the right time to sell your rental property will depend on your personal circumstances. For example, you may need to raise money for another business interest or maybe you no longer want to be a landlord.

When it comes to selling a property, external factors you’ll need to consider include:

- average property prices in your area

- supply and demand of rental homes in your area

If average property prices in your area are healthy, it’s likely the value of your rental property has increased. And if there’s high tenant demand for rentals and a lack of supply, it’s likely other investors could be looking to buy property in your area.

If, based on the above, it doesn’t feel like a good time to sell, it could be worth holding on to your property for a bit longer to make sure you maximise your return on investment.

Where are landlords looking to sell?

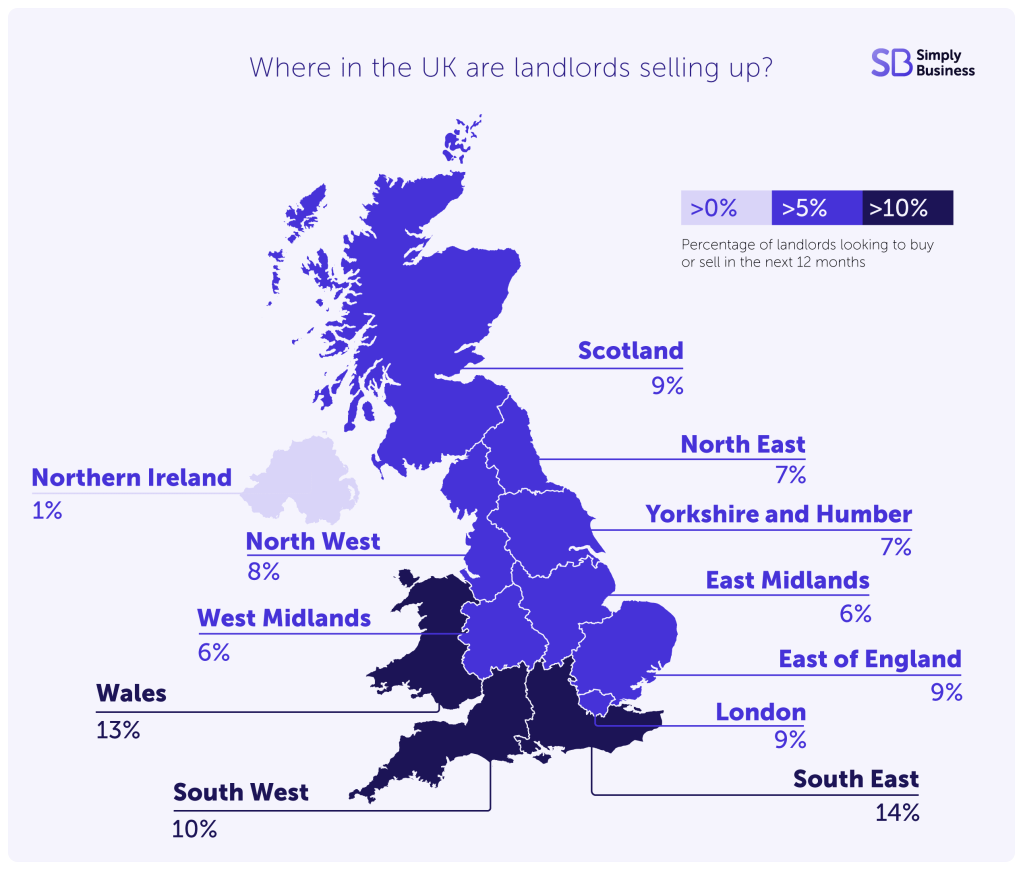

Of those who said they were planning to sell a property in 2024, the most popular UK regions were the South East, Wales, and the South West.

The graphic below shows a regional breakdown of the most popular selling locations among buy-to-let investors:

Tax and financial considerations when selling a buy-to-let

When you come to sell a buy-to-let property, the main financial consideration is likely to be capital gains tax (CGT). You’ll be liable to pay CGT if you sell your property for more than you originally bought it for.

The CGT allowance for the 2024-25 tax year is £3,000 – this means you’ll pay tax on any gain over £3,000 you make when selling a buy-to-let property.

Meanwhile, the rate of CGT for selling a buy-to-let property for the 2024-25 tax year is 18 per cent for basic rate taxpayers and 24 per cent for additional and higher rate taxpayers.

Read our guide to capital gains tax for more information and use the government’s CGT calculator to get an idea of how much you might need to pay.

Buying or selling? Do your research

Whatever stage of the buy-to-let journey you’re at, doing your research before making any big decisions can set you up for a bright future.

As well as taking your time and assessing the property market, it can be beneficial to speak to other landlords and rental market experts before buying or selling a property.

Done properly, buy-to-let investment can provide you with a healthy passive income stream while owning a valuable asset for the long-term. And when you do decide to sell, you could be in line to receive a solid return on your investment if your property has increased in value over time.

Get set with tailored landlord cover

Over 200,000 UK landlord policies, a 9/10 customer rating, and claims handled by an award-winning team. Looking to switch or start a new policy? Run a quick landlord insurance quote today for covers such as accidental damage and tenant default.