Feel simply the best about your business insurance.

Get a policy in minutes and join nearly one million business and landlord customers.

Compare quotes from leading brands

Chosen by nearly one million small business and landlord customers

We started out as a team of five back in 2005. We’ve grown since then, with nearly a million customers across 1,500 trades now trusting us to provide their business insurance.

Small businesses deserve our best

From freelancers to shop owners and tradespeople to landlords, it’s our mission to make small business owners feel simply the best about their insurance.

Whether you’re looking to compare quotes from leading insurers, or get an online quote in minutes, we’ve got you covered when it comes to landlord and business insurance.

Landlord insurance for over 300,000 customers

Thousands of landlords trust us with their insurance, giving them the peace of mind that their investment is protected.

Choose from a range of key covers and build a landlord insurance policy to suit your needs. Whether you’re looking for buildings or contents insurance, or cover for legal expenses or loss of rent, you can compare quotes from leading insurers all in one place.

Get your tailored landlord insurance quote in minutes and only pay for the cover you need.

Get support from UK-based insurance experts

Excellent customer service is at the heart of everything we do at Simply Business.

Whether you want to make a change to your policy or discuss a claim, we have a team of UK-based experts who can help you feel the best about your insurance.

They’re on hand to answer your questions and help make protecting your business as simple as possible.

Our expert team is just one part of our 24/7 service, which allows you to manage your insurance in whatever way works for you.

Don’t take our word for it, here’s what our customers say about us…

Exceptional 4.6/5

39.9K reviews

What we do

As one of the UK’s biggest business insurance providers, we specialise in covers like professional indemnity insurance and employers’ liability insurance. We cover landlords too, offering insurance like tenant default insurance and rent guarantee insurance.

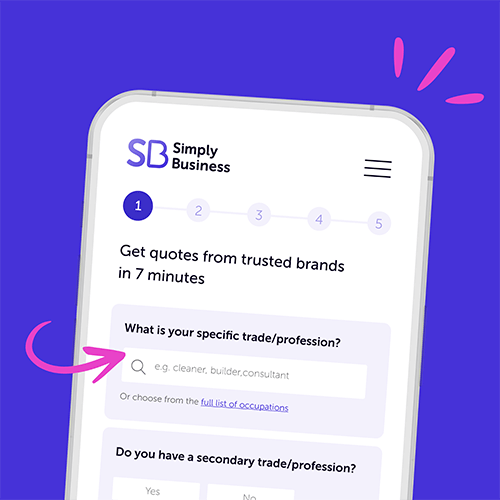

How it works

Whether you’re a cleaner or tradesperson, it’s quick to buy insurance. Answer a few questions and we’ll show you quotes from leading insurers in minutes. It’s easy to buy a range of covers, from public liability insurance to business equipment protection.

Why we do it

We know that every small business or rental property is unique, which means your insurance should be too. We aim to take the hassle out of buying a policy, helping you focus on your big dreams. And as a B Corp, giving back to the communities we serve is a priority.