Taking care of your finances is an essential part of running a business, from understanding how business banking works to choosing the best account for your needs.

Read on to find out more about opening a bank account for your business, from legal and tax considerations to key features from high street and challenger banks.

Plus compare 16 of the best business bank accounts on criteria such as overall service quality, online banking services, and account management.

Your guide to business bank accounts

Which is the best business bank account?

If you’re thinking of opening a business bank account, you’ll want to research which bank offers the best account for the needs of your business.

Consumer insight consultancy BVA BDRC conducts a regular independent survey for the Competition and Markets Authority (CMA). In this survey, people with a business bank account are asked how likely they are to recommend their provider.

The survey of 19,200 small business banking customers ranks 16 banks, and was carried out between July 2023 and June 2024.

We’ve used the latest data to list the best business banks, allowing you to compare the business accounts offered by the top providers.

16 business banks – compared and ranked

Small businesses voted across five categories in the CMA survey:

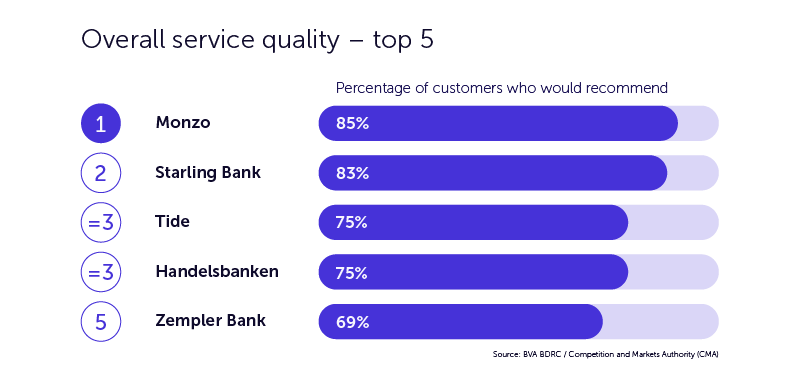

Overall service quality

The best business banks based on overall service quality are:

Monzo, Starling Bank, Tide, Handelsbanken, and Zempler Bank make up the top five banks.

Eleven other banks round out the rest of the ranking:

- Metro Bank (65 per cent)

- Lloyds Bank (61 per cent)

- Santander (61 per cent)

- NatWest (57 per cent)

- Virgin Money (56 per cent)

- Bank of Scotland (55 per cent)

- TSB (55 per cent)

- Royal Bank of Scotland (53 per cent)

- Barclays (50 per cent)

- The Co-operative Bank (50 per cent)

- HSBC UK (48 per cent)

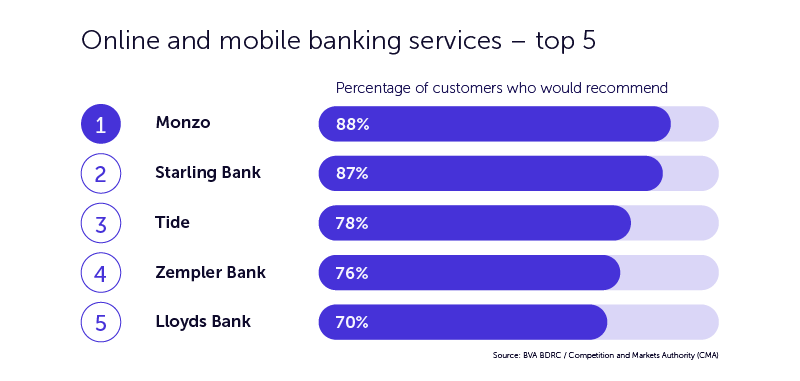

Online and mobile banking services

The best business banks based on online and mobile banking services:

The top five banks for this category are Monzo, Starling Bank, Tide, Zempler Bank, and Lloyds Bank.

Here’s where the other banks placed:

- NatWest (68 per cent)

- Metro Bank (68 per cent)

- Royal Bank of Scotland (67 per cent)

- Bank of Scotland (67 per cent)

- Santander (64 per cent)

- Barclays (63 per cent)

- TSB (61 per cent)

- Virgin Money (61 per cent)

- HSBC UK (59 per cent)

- Handelsbanken (56 per cent)

- The Co-operative Bank (39 per cent)

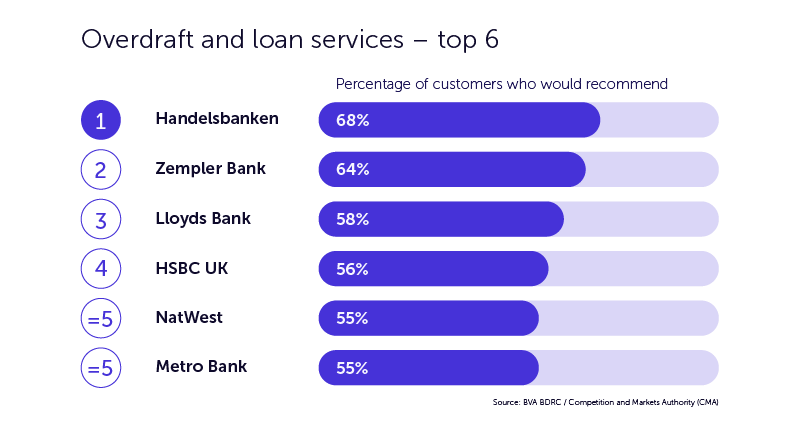

Overdraft and loan services

The best business banks based on overdraft and loan services:

Top of the ranking in this category is Handelsbanken, followed by Zempler Bank, Lloyds Bank, HSBC UK, Natwest, and Metro Bank.

Here are the results for the remaining six banks:

- Virgin Money (54 per cent)

- Santander (54 per cent)

- Royal Bank of Scotland (52 per cent)

- Bank of Scotland (48 per cent)

- Barclays (46 per cent)

- TSB (45 per cent)

*Starling Bank, Tide, Monzo, and The Co-operative Bank weren’t included in this category due to small sample sizes

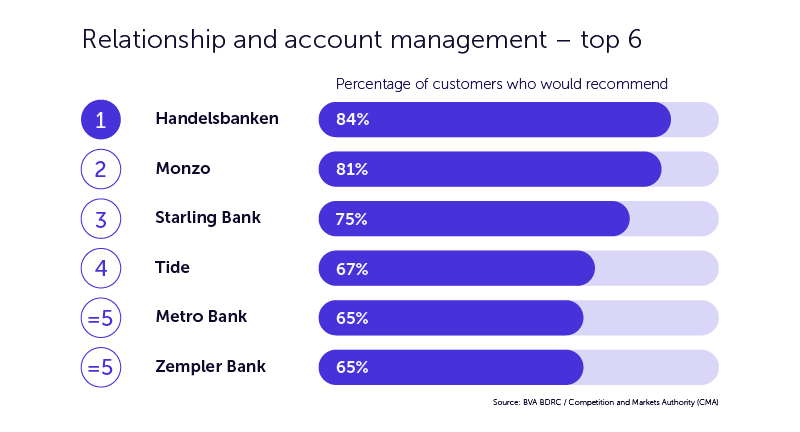

Relationship and account management

The best business banks based on relationship and account management:

For the relationship and account management category, the top six comprises Handelsbanken, Monzo, Starling Bank, Tide, Metro Bank, and Zempler Bank.

This is how the rest of the banks fared:

- Lloyds Bank (60 per cent)

- NatWest (56 per cent)

- Bank of Scotland (55 per cent)

- Virgin Money (54 per cent)

- Royal Bank of Scotland (52 per cent)

- Santander (52 per cent)

- TSB (51 per cent)

- The Co-operative Bank (49 per cent)

- HSBC UK (49 per cent)

- Barclays (47 per cent)

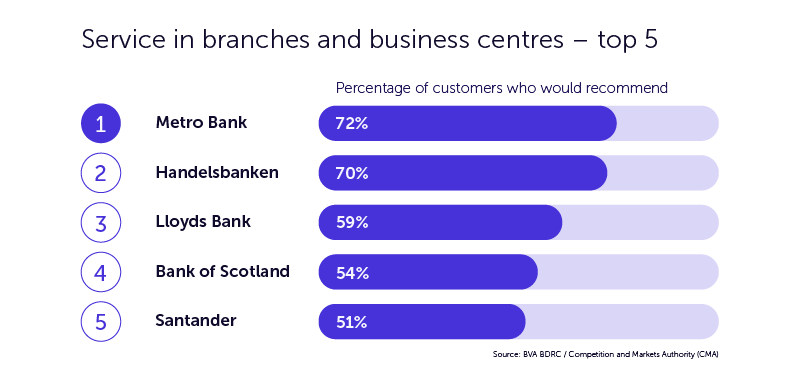

Service in branches and business centres

The best business banks based on service in branches and business centres:

Leading in this category is Metro Bank, followed by Handelsbanken, Lloyds Bank, Bank of Scotland, and Santander.

Here’s how the other seven banks ranked:

- The Co-operative Bank (50 per cent)

- Virgin Money (49 per cent)

- TSB (49 per cent)

- Royal Bank of Scotland (49 per cent)

- NatWest (48 per cent)

- Barclays (41 per cent)

- HSBC UK (38 per cent)

*Starling Bank, Monzo, Zempler Bank, and Tide weren’t included in this category because they don’t offer in-branch services

Compare business bank accounts from the top providers

Here are more details on the products themselves, letting you compare business bank accounts from the top providers.

Monzo: best business account for online and overall service

Challenger bank Monzo topped the rankings for overall service quality and online banking.

Monzo Business Banking starts with no monthly fees or UK transfer charges and account holders get access to free 24/7 UK support. A paid-for account is £5 a month and includes extra benefits, including invoicing, tax pots, and integrated accounting.

There are two business account options to choose from: “Pro” and “Lite”.

Accounts are available to sole traders or directors of a registered limited company by shares based in the UK. Certain business types aren’t supported at the moment, including partnerships, charities, and community interest companies.

Other features include FSCS protection, instant notifications when you pay or get paid, and savings pots that earn you interest.

Handelsbanken: best business account for relationship management and overdraft services

Handelsbanken came top in the survey for relationship management and overdraft services. It also came second for in-branch services and joint third for overall service quality.

It calls itself a relationship bank, where each branch works as a local business. Handelsbanken say this helps them better understand their customers and the community.

The bank offers a direct line to an account manager and team at your local branch, as well as current accounts in a range of currencies, and overdrafts (subject to status).

There aren’t any details about fees on their website, so you’ll need to get in touch with your local branch to find out what they might charge your business.

Starling Bank: a popular bank for online banking, and overall service

Challenger bank Starling came second in the rankings for overall service quality and online banking, as well as third for relationship management.

Starling Bank business account holders pay no monthly fees or UK payment charges and get access to free 24/7 UK support.

The account is available to all business types and sizes, offering benefits including integration with a range of software solutions, FSCS protection, and free withdrawals in the UK and abroad.

Starling’s business customers can also pay for extra services, such as:

- The Business Toolkit – for help with bookkeeping and tax returns

- Euro business account – allowing you to exchange and hold euros

- US dollar business account – allowing you to use dollars without needing an extra card

Metro Bank: best business account for branch and business centre service

Metro Bank came top for service in branches and business centres. It also made the top five for overdraft and loan services and relationship management.

Its USP is that its branches are open outside of usual working hours, seven days a week.

To open a business bank account with Metro Bank, you need to have an annual turnover of less than £2 million.

When it comes to fees, there’s no monthly charge for daily balances above £6,000. If your daily balance ends at below £6,000 in the month, you’ll pay the monthly fee of £8.

You’ll also get 30 free UK transactions each month, but if you exceed this limit, a fee kicks in at 30p for each transaction (balances below £6,000 don’t get the free transactions).

Barclays: accounts for different-sized businesses

Barclays, which came 14th in the overall rankings and eighth for mobile banking services, has specialised products for businesses of different sizes.

- the start-up business account is free for the first 12 months and you get access to free invoicing and account software from FreshBooks

- the business account is for established businesses with turnover up to £400,000 – account holders pay no fees for the first 12 months, then £8.50 a month after that

- the business account for £400,000-£6.5 million turnover is for larger businesses, with access to a team of local relationship managers

Business account vs personal account

Whether you’re legally obliged to have a business bank account depends on your business structure. Having a business bank account can be a good idea for most businesses – even freelancers and sole traders.

The main difference between personal and business bank accounts is that business accounts usually charge monthly fees, plus a range of fees for certain transactions. Lots of banks usually offer an initial fee-free period before charging, so be sure to shop around before choosing one.

Ultimately, a business account will usually be the best option for your business as it lets you keep your finances separate.

Many banks offer features that personal accounts don’t have access to, including:

- business finance

- specialist business banking managers

- the ability to take payments from customers

- online tools and software to help you run your business

Read more: The best business savings accounts revealed

Can I use a personal account for business?

It depends on whether you’re operating as a sole trader or setting up a limited company.

As a sole trader, you’re not required by law to have a business bank account. Legally, you can use your personal bank account for both business and non-business transactions, or you can set up a second personal bank account to use for your business.

As a limited company is a separate legal entity, it needs to have its own business bank account.

If you’re not sure which business structure to pick, check out the difference between a sole trader and a limited company.

Do I need a business account as a sole trader?

Even if you’re not legally required to have a business bank account, there are a number of reasons why setting one up is a good idea.

Some banks offer a specific business sole trader account. This gives you the benefit of separating your finances, but often with a lower monthly fee that’s tailored to the services you need.

5 benefits of opening a business bank account

Here are five reasons why you might consider opening one as a sole trader.

1. Your personal bank’s terms and conditions

It’s likely that somewhere in the small print of your personal bank account documents it says that your account should be for personal use only.

If your bank realises that you’re using the account for your business (particularly if there’s a lot of money passing through), they may force you to close your account and open a business account.

2. To keep things clear for HMRC

When you complete your tax return, you need to tell HMRC how much money your business has made. You can subtract certain allowable expenses (travel costs and office costs, for example) to calculate your taxable profit.

If your personal costs are mixed up with your business costs, it can be difficult to make these calculations accurately.

3. Simplify your admin

Not only does having a business bank account help with reporting to HMRC, it also makes it much simpler for you to manage your business budget and forecasts.

Sorting out which expenses are personal and which are for your business takes time, so having separate bank accounts helps you manage your finances more efficiently.

It also makes keeping accurate business records easier in general and will save you time when bookkeeping.

4. Build your credit rating

Having an account in your business name can help you if you need to apply for a business loan in the future.

It helps to build up a credit history for your business, which many banks will look for when considering if you’re eligible for business finance.

5. Look professional

Having a dedicated bank account can make your business appear more professional, as clients can make payments to an account held in your business name rather than your own name.

It’s important to bear in mind that some clients don’t like making payments into personal accounts.

Read more: How to open a business bank account

Do I need a business bank account for a limited company?

If you’ve set up a limited company you’re required by law to have a business bank account, as your business is legally a separate entity.

You shouldn’t be using a personal account for business.

Do I need a business bank account if I’m self-employed?

Beyond the legalities and your bank’s terms and conditions, think about these questions:

Do you have employees, or plan to in the near future? If you’re a sole trader managing your own payroll accounting, this can become very complicated without a separate account.

Do you need to apply for a loan? While not essential, having a business account might help if you want to apply for business loans and other forms of finance.

Do you want expert business support? Many banks have separate departments that manage services for businesses. By using a personal account, you’ll be missing out.

You might need a business account that accommodates your growth plans. For example if:

- you’re planning to incorporate your business as a limited company

- your business is processing a lot of transactions

- your business income and expenses are getting complicated

- you want to take card payments from your customers

The rise of challenger and sustainable banks

A challenger bank is usually a smaller retail bank, set up with the aim of competing with large, long-established national banks.

It’s clear from the CMA data that challenger, digital banks, and multi-currency accounts are becoming increasingly popular with businesses.

Monzo topped the overall rankings, while Starling Bank, Tide, and Zempler Bank also ranked highly.

There’s also been a rise in the number of sustainable banks, such as Triodos, which only finances projects and organisations that have a positive impact on society, culture, and the environment.

Whichever bank you choose, it’s important to research all of your options carefully and decide what’s best for you. Please only use this article as a guide, as part of your research.

Do you have any unanswered questions about business bank accounts? Let us know in the comments below.

Useful guides for small businesses

- What can I claim on tax? A guide to self-employed expenses

- What is a balance sheet?

- What is zero-based budgeting?

- Do I need public liability insurance?

Ready to set up your cover?

As one of the UK’s biggest business insurance providers, we specialise in public liability insurance and protect more trades than anybody else. Why not take a look now and build a quick, tailored quote?

kucherav/stock.adobe.com