A deep dive into the UK’s small business landscape in 2023

The Simply Business SME Insights Report is an annual study of challenges and trends in the small business sector.

Our in-depth survey of small business owners gives us unique insight into their needs and concerns, from funding to regulation.

The data also highlights macroeconomic trends to help us understand the overall state of the SME market in the UK.

What’s it like for small business owners in 2023?

Optimism, concerns, challenges – our SME insights report is a detailed temperature check on UK small businesses. Watch the video below to see the key findings from our report.

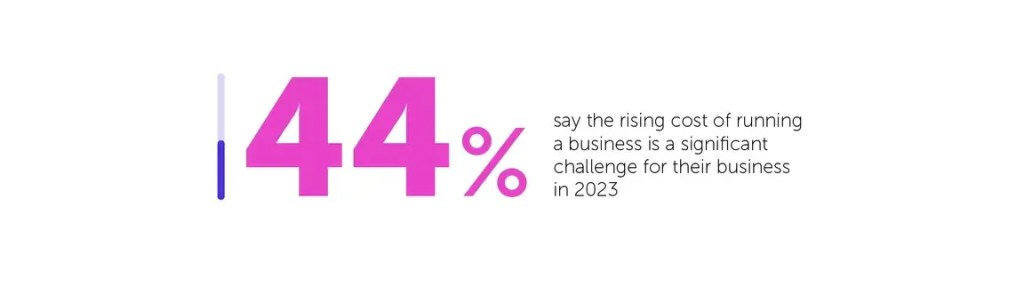

Mounting pressure from rising costs

Living costs and energy prices have risen, inflation is high, and consumer spending is declining – this has created the perfect storm for SMEs.

Our findings show the impact of the mounting financial pressure on small businesses.

Confidence remains high

To be a small business owner in the last few years you’ve needed to be resilient. SMEs have always found a way to overcome the challenges they face, so it’s no surprise they’re optimistic for the future.

Over 1,000+ businesses surveyed

To create our annual report, we spoke to over 1,000 small business owners all at phases of their growth, from start-up sole traders to mature businesses with 10+ employees.

The importance of small businesses can’t be underestimated – they account for 99 per cent of all British businesses and contribute a combined £2 trillion in annual turnover to the UK economy.

We want to understand what it’s like to be a small business owner in 2023, from the unique challenges they face to their confidence levels and economic outlook.

An economist’s view

Our data has been analysed by Professor Jonathan Portes of King’s College London, who is an expert on economics and public policy. He offered his perspective on what the report could mean for the UK economy:

“Given the importance of SMEs to the overall economy, this should give some cause for – very cautious – relative optimism about the UK’s economic prospects over the next year.”

Empowering Women in Business

Four in five women business owners have experienced sexism, gender inequality, and unequal access to opportunities whilst running their business, according to new research from Simply Business.

Following a survey of more than 900 women business owners, we’re shining a light on key challenges, barriers to growth, as well as opportunities to drive change.

Find out more about the key challenges facing women in business.

Mind Your Business campaign

Simply Business has partnered with Mental Health at Work, a programme curated by Mind, to support the UK’s self-employed with their mental health and wellbeing.

Take a look at the report to learn more about the responses and what we’re doing to change things.

About Simply Business

Simply Business is one of the UK’s biggest business insurance providers. More than nearly a million customers customers across 1,000 different trades trust us to support them with their insurance.

You can build a policy tailored to your business, choosing the covers that you need to help protect your business.