If you’re a freelancer with a job inside IR35, it means you’re treated as an employee when it comes to tax. On the other hand, being outside IR35 means you’re treated as a legitimate contractor and may be able to pay tax more efficiently.

Here’s what you need to know about understanding the outside and inside IR35 meaning – and how to check if your contracts are inside or outside IR35.

What does inside IR35 mean?

Being inside IR35 is when a contractor has to pay income tax and National Insurance Contributions, just like employees do.

HMRC introduced the off-payroll working rules (IR35) in 2000 to make sure that contractors who would be employees if there was no intermediary pay broadly the same tax as employees.

What does outside IR35 mean?

If a contract is outside IR35 it means HMRC sees you as ‘genuinely’ self-employed and you’re able to pay yourself in a tax-efficient way.

This could involve working on defined projects (rather than rolling contracts), actively marketing your business’s services, and working for more than one client.

To be outside IR35, your contract must reflect you and your client’s actual working practices, so you aren’t caught out by HMRC.

Your contract is likely to include details of the services you’ll be providing, and when and where you’ll be working. But it won’t include demands from the client’s point of view, such as performance monitoring and appraisals.

If you offer services, rather than a contract for a service, then you’re likely to fall outside of IR35 as you could send someone to do the work in your place, for example.

Inside vs outside IR35: who works it out?

The rules are different depending on whether your client is in the public or private sector.

Public sector contractors – your end client is responsible for determining your IR35 status. That means they’ll use HMRC’s Check Employment Status for Tax tool (CEST), or an independent service, to work it out

Private sector contractors – medium-sized and larger clients are responsible for determining your IR35 status (it’s no longer your responsibility as the contractor). Since April 2021, the end-client, or the agency or third party who pays you, has been responsible for deducting your tax and National Insurance contributions (smaller clients are exempt from the change)

A small end-client (who won’t work out your IR35 status on your behalf) will fall under two or more of these requirements:

- turnover of no more than £10.2 million

- balance sheet total of no more than £5.1 million

- no more than 50 employees

If your end-client is working out your status from April 2021, it needs to give you and the relevant parties (like recruiters) a Status Determination Statement (SDS), which explains whether IR35 applies to the contract.

End-clients need to show they’ve taken ‘reasonable care’ when working out your employment status – otherwise they could be responsible for getting things wrong.

It also needs to have a disagreement process you can use, to object to the decision. Your client needs to respond to your objection within 45 days, saying why it came to the decision, or updating its reasoning based on your objections. If it’s updating its decision, the client will need to change the SDS and give it to the relevant parties.

Read more: HMRC updates CEST tool to help self-employed check tax status

IR35 assessment: how do I know whether I’m inside IR35?

If you’re looking for an inside IR35 calculator, HMRC’s CEST tool is one way to work out whether a contract falls inside IR35 or outside IR35.

To use the tool, HMRC says you need:

- details of the contract

- the worker’s responsibilities

- who decides what work needs doing

- who decides when, where and how the work is done

- how the worker will be paid

- if the engagement includes any corporate benefits or reimbursement for expenses

HMRC’s tool assumes there’s a contract in place, but it doesn’t take mutuality of obligation (MOO) into account.

MOO has been the deciding factor in a number of IR35 tribunals, which is just one reason it’s important to get independent advice too. There are lots of accountants who offer independent IR35 contract review services.

Does CEST give accurate results?

For its part, HMRC says CEST is accurate and it “will stand by the results, provided the information input is accurate and it is used in accordance with our guidance.”

HMRC can open an investigation into your IR35 status if it thinks an outside IR35 determination is wrong, so it’s important to keep accurate financial records and tax return information.

Make sure you have IR35 compliance in mind and actively discuss your status with your clients, who should also be preparing for the April 2021 changes if the status decision will now fall on them.

Our IR35 guide has more information on some of the tests HMRC might carry out to determine whether your contract is inside IR35 or outside IR35.

The off-payroll working rules are complex. Please only use this article as a guide on inside IR35 and its meaning, and if you’re unsure about whether a contract falls inside IR35 or outside IR35, get professional advice.

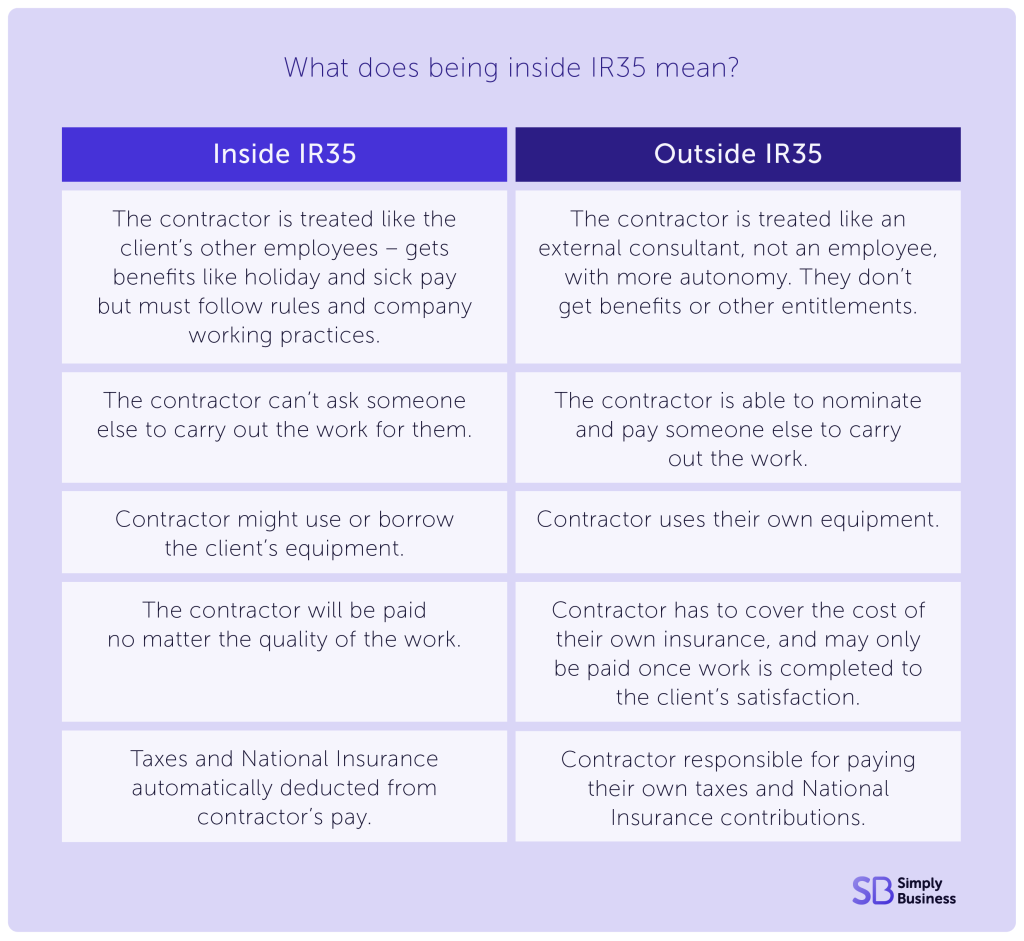

Inside IR35 vs outside IR35 comparison

Your IR35 status has different implications for the tax you pay.

When you’re inside IR35 you:

- are classed as an employee for tax purposes

- need to pay income tax and National Insurance Contributions

- pay this tax by making a ‘deemed payment’ at the end of the tax year

Working out your deemed payment can be complex, so it’s best to speak to your accountant to make sure you get it right.

Your fee payer will work out and pay your tax and NICs on your behalf. This applies to public sector contractors and, since April 2021, private sector contractors (unless the small company exemption applies to you).

Even though HMRC sees you as an employee for tax purposes when you’re inside IR35, you might not be entitled to employee benefits like holiday pay and sick pay.

When you’re outside IR35 you:

- are self-employed and operate as a proper business

- are responsible for your business’s taxes

- can pay yourself in a tax-efficient way

If you’re outside IR35 you’ll be paid your fee and will be responsible for managing your business’s taxes as normal.

Should I avoid inside IR35 contracts?

You can continue to run your limited company even when a contract is inside IR35. As mentioned, it means you need to make a ‘deemed payment’ to HMRC for the contracts caught inside the rules.

So it’s perfectly possible for professional contractors to have a mix of contracts both inside and outside of IR35 – but it means you’ll need to be organised and ask for professional advice, if you need it.

Negotiating outside IR35 contracts

It’s important to negotiate carefully and make sure you’re clear from the beginning if you’re contracting outside IR35. You should:

- align your working practices with your contract

- ask an expert to review your contract

- keep a compliance file

IR35 check: using IR35 contract review services

An IR35 contract review service can be useful for checking that your contract accurately reflects your working practices. They’ll help make sure you’re compliant with the changes and determine if you fall inside IR35 or outside IR35.

Expert review services can also provide a pass/fail test result as well as a detailed report on how to be outside IR35, depending on how much you want to spend.

What about existing contracts?

If you’re making changes to an existing agreement you should keep a record of decisions made for compliance. It’s a good idea to have your client sign a document – or a new contract – confirming these changes in case HMRC decide to investigate.

Does being outside IR35 mean paying less tax?

If your contracts are outside IR35, you could be more tax efficient and as a result, pay less tax.

This is because, as a genuinely self-employed contractor, you could pay yourself a small salary and take the remaining profits from your company as dividends. Dividends are usually taxed at a lower rate than income.

When you’re self-employed you can also reduce your tax burden using allowable expenses.

Who benefits from outside IR35 status?

As a freelancer, you could benefit from outside IR35 status if it lowers the amount of tax you have to pay. You may also benefit from greater freedom and control over your work.

Your clients could also benefit by getting access to your specialised skills in a flexible way.

Although working outside IR35 has benefits, it can involve more administration. It’s also important for both you and your clients to make sure you’re compliant with the law.

IR35 insurance: cover for legal investigations

As a contractor you might consider legal expenses insurance to protect you in case you face a tax investigation, including anything related to IR35.

For example, DAS Businesslaw has a legal advice helpline, available whether you’re facing a serious legal issue or just want to check something with an adviser. They also offer a range of legal templates and guides to help you with tax and contracts.

What is mutuality of obligation?

Mutuality of obligation (MOO) refers to the obligation to give work (and pay for it) and the subsequent obligation to do the work (and get paid for it).

It’s one of the key tests that tax investigations and employment tribunals can use to determine a contractor’s employment status (and whether they owe any tax).

If an element of mutuality of obligation exists then the relationship between contractor and client may resemble employment, placing the contractor inside IR35.

Mutuality of obligation test

Mutuality of obligation sits alongside supervision, direction and control and substitution as a key employment status test.

This means that IR35 investigations will try to establish that the client was obliged to offer the contractor work and the contractor was required to accept (and complete) the work.

Mutuality of obligation and employment law

Consider the traditional relationship between employee and employer. The employer is obliged to pay the employee and give them work. The employee is obliged to complete the work. The employer might also give the employee work that goes beyond their job role, depending on the contract. The employee wouldn’t usually be able to turn these tasks down.

But if you’re self-employed and contracting with a client, you shouldn’t necessarily expect such mutuality of obligation to exist. This means that your client should engage your personal service company to perform a particular task for a specific project.

You’re free to move on once your contracted task is completed. Your client isn’t required to offer any future work and you don’t have to perform any more work for your client (unless they contract your company to work on a new project).

Importantly, your contract should reflect this arrangement, as a contract for services rather than a contract of service.

Mutuality of obligation IR35 controversy

Mutuality of obligation is ambiguous. For example, HMRC maintains that for any contract to exist, some kind of mutuality of obligation must already be present.

HMRC’s Employment Status Manual states that without mutuality of obligation “there can be no contract of any kind”. It also says that the basic requirements of mutuality of obligation could be “present in either a contract of service or a contract for services and, on their own, will not determine the nature of a contract.”

According to HMRC, this means that mutuality of obligation exists in some form even if someone is contracting outside IR35, on a proper contract for services.

This might be why HMRC’s CEST tool doesn’t explicitly take mutuality of obligation into account. HMRC says this is because it assumes mutuality of obligation already exists if a contract is in place.

But the Freelancer and Contractor Services Association’s chief executive, Julia Kermode, says HMRC’s view is ‘over-simplistic’: “In broad terms, MOO should be thought of whether there is an ongoing indefinite obligation for the client to offer work and whether there is an ongoing obligation to execute that work.”

HMRC’s views on mutuality of obligation (and the fact it’s a complex topic) mean it’s important to get independent advice on your contracts, rather than rely on the CEST tool. Many accountants offer professional review services – please use this article as a guide only and speak to a professional if you’re not sure about anything.

Inside vs outside IR35 FAQs

What does outside IR35 mean if you’re self-employed?

If you’re self-employed, outside IR35 means you’re considered to be working independently of the business you’re working for by HMRC.

As a result, you pay your own taxes and claim your own business expenses.

What does it mean to fall outside of IR35?

If a contract you’re working on falls outside of IR35, it means that HMRC doesn’t deem you to be a ‘disguised employee’ of the company.

This means you’re considered to be a genuine self-employed freelancer and so you pay tax accordingly.

Is it better to be inside or outside IR35?

Whether it’s better to be inside or outside IR35 depends on your circumstances and what you’re looking for as a freelancer.

Being inside IR35 means you could pay more tax, but managing your role as a contractor could be simpler.

Being outside IR35 means you could have more control over your work and be more tax efficient. However, there’s more administration involved and there’s a higher chance you’ll be investigated by HMRC.

Guides for small businesses and the self-employed

Do you need IT contractor insurance?

As one of the UK’s biggest business insurance providers, we specialise in public liability insurance and professional indemnity insurance. Why not take a look now and build a quick, tailored contractors insurance policy?