For many years, small business owners and the self-employed have used the annual Self Assessment to report their income and tax. In fact, as of October 2025, 3.5 million people had already completed the process for the 2024-25 tax year – with 97 per cent choosing to do it online the previous year.

But big changes are coming, as HMRC’s Making Tax Digital (MTD) initiative will roll out in 2026. In short, it’s reshaping how businesses handle their tax in a bid to make record-keeping easier, more accurate, and more efficient.

If you’re self-employed or run a small business, the shift from one annual tax return to quarterly digital updates might sound daunting. But with the right preparation, your finances could actually be clearer.

In this guide from GoSimpleTax, see what’s changing and what you need to do now – especially as the next Self Assessment deadline approaches.

The current Self Assessment process

Under the current Self Assessment system, you’re required to record your income and expenses and then submit your Self Assessment by 31 January each year. For the 2024-25 tax year (due by 31 January 2026), you’ll still do this in the usual way.

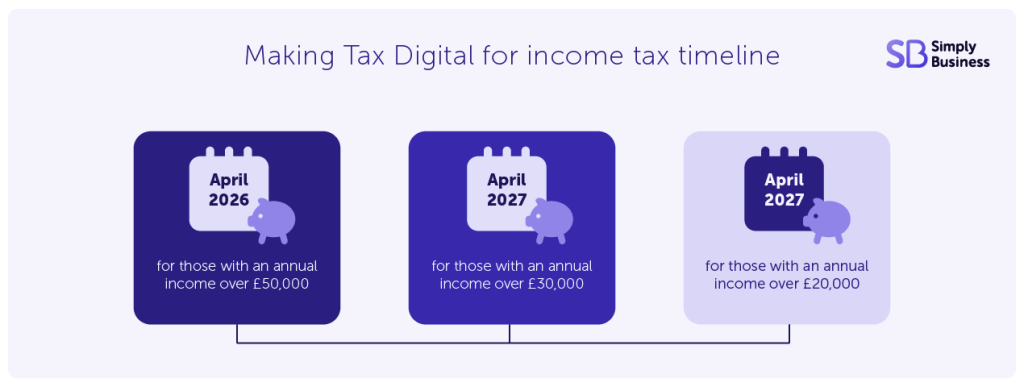

But from April 2026, MTD for Income Tax Self Assessment (MTD ITSA) will begin rolling out, initially for self-employed individuals and landlords earning over £50,000 a year. Currently, that’s thought to be around 864,000 people.

Those earning above £30,000 will follow in 2027 – and by 2028, it’s believed that anyone earning over £20,000 from self-employed and property income will be included. This could be up to 2.9 million people in the UK.

Read more: Applications open for Making Tax Digital exemptions

What MTD could mean for you

Under MTD, you’ll no longer submit one big annual return. Instead, HMRC requires you to send quarterly updates using MTD-compliant software.

Each update will include your business income and expenses for that period, so that HMRC (and you) has a real-time view of your tax position.

At the end of the year, you’ll still need to make a final declaration similar to the current Self Assessment. This will confirm your total income and allow you to make any adjustments.

Read more: 72% of businesses expect MTD to increase their costs

Why this change is happening

MTD is designed to:

- reduce errors caused by paper records and manual entry

- help taxpayers understand their liabilities throughout the year

- streamline tax reporting for businesses and HMRC

In short, it’s about moving towards a tax system that’s modern and digital and (hopefully) less stressful.

How to prepare for MTD in 5 steps

Step 1: go digital now

Start using accounting software that’s already MTD-ready. Cloud-based tools make it easy to track income and expenses, and they provide tax estimates in real time – so you’ll be ready when quarterly submissions become mandatory.

Step 2: keep digital records

You’ll need to maintain your business records online. This includes invoices, receipts, and expense reports. Start now by scanning or photographing receipts to get into the habit.

Step 3: review your bookkeeping

If you currently update your books once a year, it’s time to get into the habit of doing it either monthly or quarterly. This will make MTD much easier and help you keep a clearer picture of your finances.

Step 4: talk to your accountant (or find one)

Industry professionals are also preparing for MTD so they can advise on software, help set up digital records, and explain what your new responsibilities will look like.

Step 5: don’t forget your 2025-26 Self Assessment

Even though MTD changes are on the horizon, you’ll still need to submit your 2025-26 Self Assessment by 31 January 2027.

5 mistakes to avoid when preparing for MTD

1. Delaying digital adoption

Waiting until the last minute to start using compatible software can be risky. Instead, early adoption means you can familiarise yourself with the tools and get into a routine before you are required to provide quarterly updates.

2. Inconsistent record-keeping

MTD requires up-to-date and accurate records. Leaving invoices and expenses unrecorded can lead to errors and make your quarterly submissions stressful. It’s best to get into the process of recording transactions either weekly or monthly.

3. Neglecting software training

Using new software without fully understanding its features can slow you down. Spend this time before things become mandatory by accessing tutorials and webinars. Your accountant could also be able to give you advice on your chosen system.

4. Mixing personal and business finances

Combining personal and business accounts will only complicate reporting and can increase the risk of mistakes. Keeping separate bank accounts and clearly categorising each transaction can help to make complying easier.

5. Ignoring your accountant

Trying to navigate MTD alone can be daunting – and costly. This is why it can be best to get your accountant involved early. They can review your records and make sure you meet the new HMRC requirements without stress.

Read more: The 9 best self-employed accounting software for 2025

The benefits of getting ahead

By preparing early, you can:

- avoid the last-minute rush when MTD becomes mandatory

- have better visibility of your income and expenses

- make smarter business decisions based on accurate and up-to-date figures

- reduce the risk of errors and HMRC penalties

MTD can give you more control and less stress – plus a smoother transition to a digital era of tax.

Preparing for MTD – a recap

MTD might feel like a big change but in reality, it’s an opportunity to modernise how you manage your business finances and avoid that last-minute scramble.

As we approach the next tax deadline, why not use this time to get comfortable with digital tools? Try downloading a compatible MTD software today, check your record-keeping habits, and take the first step towards MTD readiness.

About GoSimpleTax

GoSimpleTax is a solution for landlords, the self-employed, sole traders, freelancers, and anyone with income outside of PAYE.

You can use the software to record income, expenses, and tax submissions all in one. It will also provide you with hints and tips that could save you money on allowances and expenses you may have missed.

Coconut is your Making Tax Digital for Income Tax solution brought to you by the team at GoSimpleTax.

Whether you’re on site or on the move, Coconut makes it simple to know what you’re earning, what you’re owed, and how much tax you need to set aside. They have you covered for MTD.

More tax guides for small businesses

- Small business tax changes: new thresholds, rates, and allowances

- What is a business tax account? HMRC’s BTA explained for small businesses

- Tax-free allowance 2025-26: what it means for your business

- Reduce your tax bill by claiming these self-employed expenses

Ready to set up your cover?

As one of the UK’s biggest business insurance providers, we specialise in public liability insurance and protect more trades than anybody else. Why not take a look now and build a quick, tailored quote?