How to buy a van for your small business – plus tips for owners

11-minute read

A business van is an important investment, so here we look at which option might best suit you. Whether you’re a fitness trainer or a gas engineer, here’s how to buy a van and maintain it – and how to use it to market your trade to new customers while on the road.

Read on to find out more about the differences between buying and leasing a van, including the best way to buy or lease, the costs involved, and the tax advantages of each. We’ll also cover tips for van owners, from keeping your vehicle serviced and insured to the latest on driving regulations and clean air zones.

Business van guide – buying, maintaining, selling

This ultimate guide will help you figure out the best way to buy a van if you’re self-employed or running your own business. Jump to the section you need or keep reading to learn all there is to know about van ownership.

Contents

And once you’ve bought your van, think about:

Can I drive a van with a car licence?

First off you might be wondering if you can legally drive a van with your car licence. And the answer? It depends on the size of the van you’re looking at.

Drivers with a standard car licence are allowed to drive a van weighing up to 3,500kg – including any passengers and cargo (that’s 3.5 tonnes). Anything larger, you’ll need a specific licence.

If you passed your test before 1 January 1997, you might be able to drive a heavier van (up to 7,500kg) and tow a trailer.

Check your driving licence record to see what vehicles you’re allowed to drive.

How to buy a van for your business

There’s a few ways to buy a business van (or lease one) and the option that’s right for you will depend on your circumstances. We explain a bit more about each here:

Buying a van for business use

Buying a van means it’s yours, which brings a range of benefits. If you decide to buy instead of lease, you’ll either need to buy the business van outright or fund it through a loan, which is often known as ‘finance’.

Buying a van for your business gives you more freedom. You won’t be tied into a strict lease contract and you can make changes to its appearance.

For example, you’ll be able to put your business name and contact details on the van, or make changes to the inside to suit your needs.

You might also want to consider if you need to buy a fleet of vans, if you have a team of plumbers working for you for example.

Leasing a business van

Leasing a van through a limited company is different to buying, as you won’t own it outright. You’ll just be renting it – typically for a monthly fee.

If you lease a business van, you won’t need a big chunk of cash as the cost is spread out over the fixed term of a contract. You’ll just need to pay for a deposit and monthly repayments.

Maintenance costs tend to be covered by the leasing company so you won’t have to worry about that either. If you grow attached to the van there might be an option to buy it, as explained above. You’ll just need to commit to a ‘lease purchase’ style agreement.

If you're looking for information on business car leasing then we have a separate guide for that.

Second-hand vans

Second-hand vans are often a good choice for new businesses because they’re cheaper. As long as you put in the research, you should be able to find a reliable used van.

You’ll have a choice of a range of models and can save a lot of money by not buying a new van. You can still be picky about buying a van with low mileage and have the benefit of being able to ask the previous owner about its reliability.

Searching for a second-hand van on eBay, Facebook Marketplace, Auto Trader, and even LinkedIn can be a good way to go. Always make sure you ask to see and test drive a van before you part with your cash though.

Hire purchase

Another way to get hold of a business van is through hire purchase. This involves an initial deposit and you’ll hire the van for a set period of time. You then have the option to buy the van at the end of your contract.

Using a personal van for business

Is it cheaper to use a personal van or buy through your business? Depending on what you do for work, you may decide to use a van you already own for business purposes.

But it’s important to know that this can affect how you pay tax to HMRC:

- if you’re a sole trader – you’ll need to work out business-related costs on your tax return or you can use simplified vehicle expenses using HMRC flat rates rather than exact costs of buying and running your van

- if you’re a limited company – personal journeys will be subject to benefit in kind tax (this means completing a P11D form for directors and any employees using a company van for personal use)

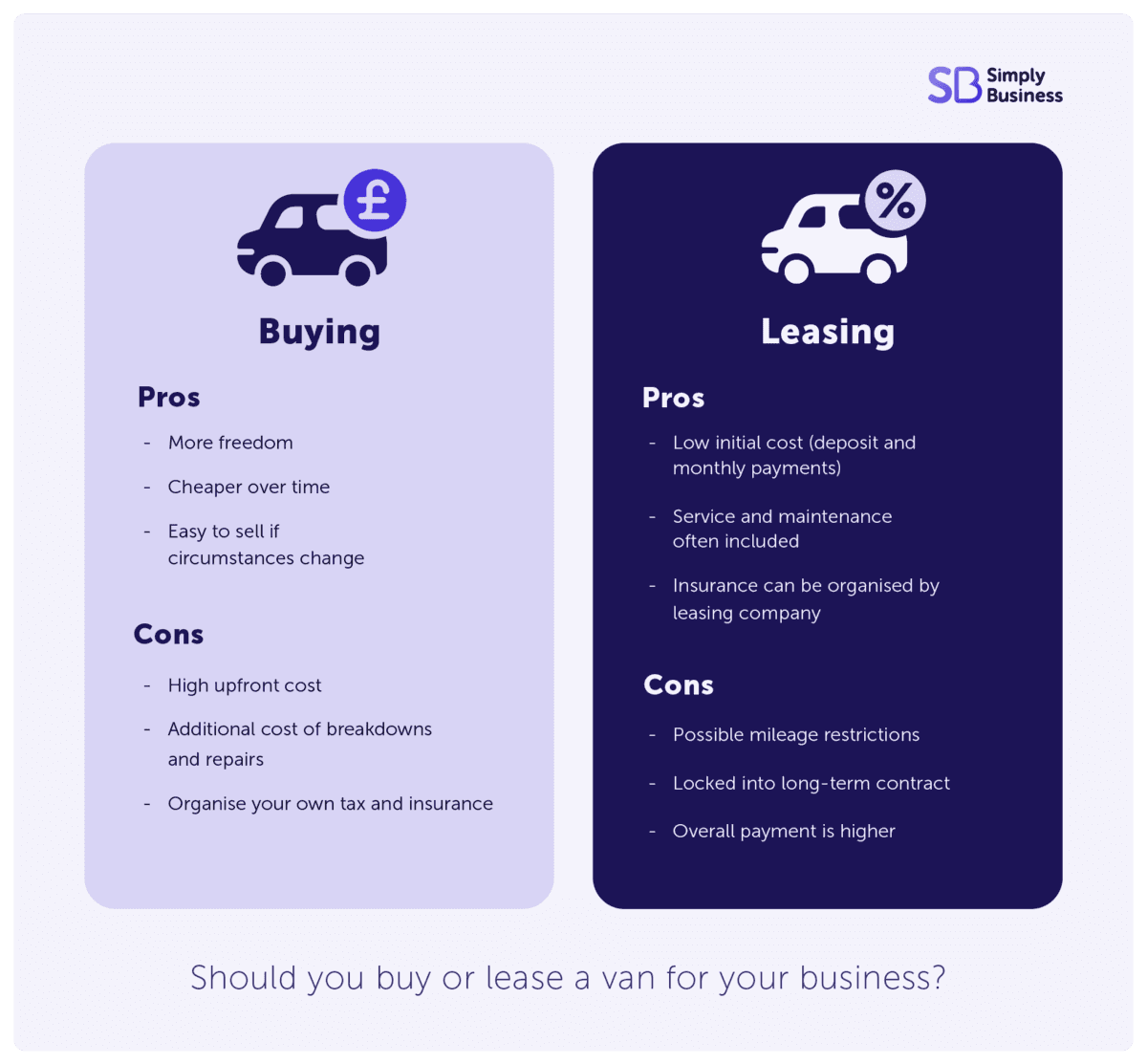

Buy or lease a van – pros and cons

Before committing to buying or leasing, it’s important to bear in mind the drawbacks. By buying you’ll be left solely responsible for:

- the van’s upkeep – including breakdowns, repairs, and general wear and tear

- the legal logistics – your road tax and insurance responsibilities

The costs of breakdowns and repairs can be high (particularly if you're a startup), but if you can cope with this outlay then buying could make more sense. Van leasing certainly isn’t perfect for all, as you might face things like:

- mileage restrictions and hefty penalties if you go over them

- long-term contracts that may not fit with your changing circumstances

- an overall payment that ultimately outweighs the cost of buying outright

So, buying tends to bring a bit more freedom while a van lease could give you a little more security. Neither option is necessarily better than the other and you get tax relief with both.

What fits best will depend on your business. Take a look at your balance sheet, weigh up the pros and cons, and pick your option carefully.

How to pay for your business van

There are a few things to think about when buying a van if you're self-employed or running a business. You could choose to:

- buy outright

- finance (bank loan)

- buy through your limited company

- access government grants

- buy after leasing

One option is to buy a van outright. If you have the capital to do so, this is a good option as you'll have no outgoing payments after you’ve bought it. With no extra payments needed, you may find it easier to budget over a longer period of time.

Alternatively, you could use a bank loan (finance) to buy a van. While this will accumulate interest over time, those interest charges can be reclaimed against tax.

How to buy a van through a limited company

You may find some tax benefits through buying a van through your company.

- Check your van is eligible for you to reclaim VAT

- Buy the van in your company’s name and bank account

You can claim back VAT on the price you bought the van to reduce your corporation tax. You do this by making a capital allowance claim. This just means you need to charge VAT when it comes to selling your vehicle.

Tax is a complex subject so it’s always best to get advice from a professional advisor or accountant to help you make your decision.

Grants – government electric car grants

If you’re thinking of buying an electric van then you may be able to access a government grant. These are included by the seller when you buy your van, so you don’t need to apply for anything.

Certain types of small and large vans are eligible for plug-in vehicle grants – this can be at a 35 per cent discount so it’s worth looking to see what you can get.

Owning a van after a lease

There are some leasing options that give you the opportunity to own the van at the end of your leasing period. One option is hire purchase, where you pay an initial deposit followed by monthly instalments. At the end of the agreement, you own the van.

Another option is balloon hire purchase, which may suit new businesses. Here, you pay smaller monthly payments and then a larger ‘balloon’ payment at the end of the agreement, after which you own the vehicle.

Tax benefits and reliefs

Here we explain a bit more about different tax reliefs you could get when buying a business van.

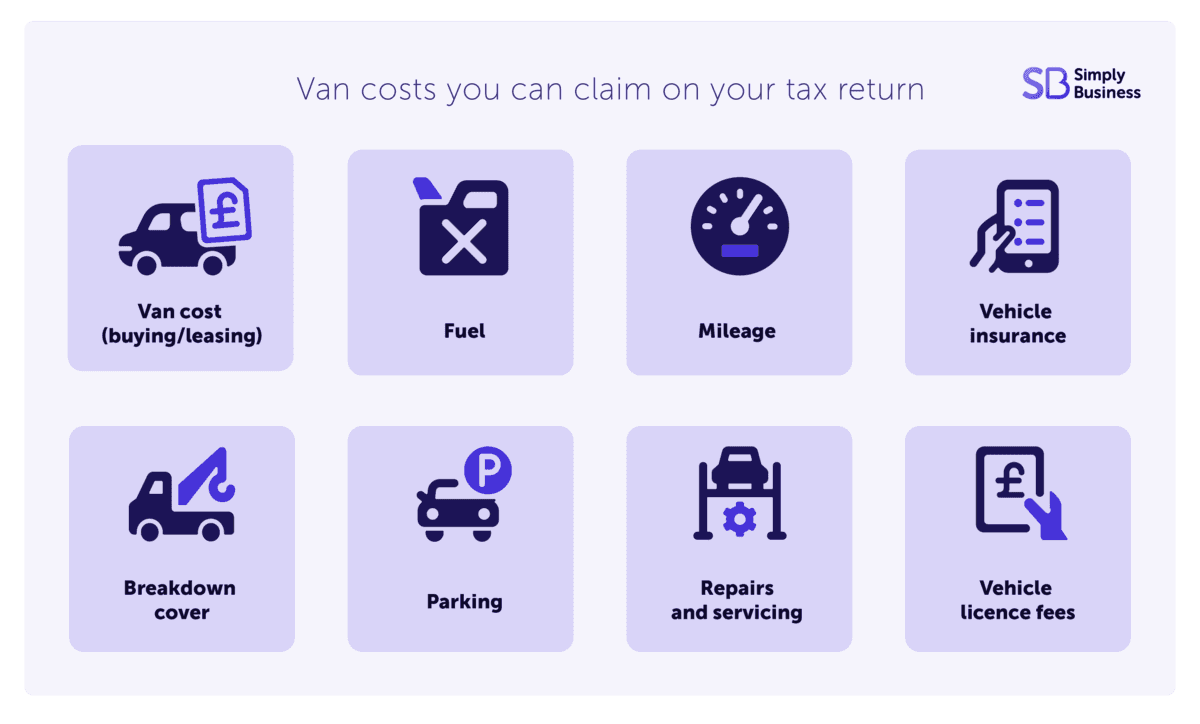

Can I claim for a van on my tax return?

You can claim the cost of buying a van as expenses against your income tax bill, but how you do so depends on how you pay tax.

If you use traditional accounting you can claim the van as a capital allowance. Generally, the same applies if you use cash basis accounting, unless you're using simplified expenses.

How much tax can I claim back on a new van?

There are several tax advantages of leasing a van for business. The main one is being able to claim up to 100 per cent VAT back on the monthly payments, if your business is VAT registered. This is provided that the van is only for business use.

And like buying a van for a small business, you can claim the cost of van rental as an expense when it comes to filing your tax return. Your rental payments can be a tax-deductible expense.

If you want to know more about allowable van, car, and travel expenses, check out the UK government’s guide to travel expenses for the self employed.

If you have employees or directors who drive your company van

The way company cars are taxed as a benefit in kind changed in April 2023.

If you have employees or directors who use a company van for personal use then the amount of tax increased by 10 per cent a year for basic rate taxpayers.

There’s no benefit in kind charge for zero-emission vans though.

Van benefit charge

The table below shows the standard value you'll need to report to HMRC if employees use a van for private journeys.

Charge | 2024-25 |

|---|---|

Van benefit | £3,960 |

Van fuel benefit | £757 |

Note though, ‘personal use’ doesn’t extend to infrequent journeys like driving to a doctor’s appointment on the way home.

As an employer, it’s your responsibility to report benefits in kind at the end of the tax year – this is filed using your P11D form or through PAYE.

Meanwhile, the benefit in kind rate for electric vehicles was zero in 2020, but this is now two per cent from 2022 to 2025 (and up to 14 per cent for hybrids).

The government website has more information on how to report company car benefits if using payroll software.

Types of business van – and how to choose one

There’s many considerations when buying a business van, from size, emissions, and running costs to clean air/ULEZ compliance and security features. We have detailed guides to help you choose:

Insure your business van

Business van insurance is a legal requirement and being uninsured can lead to fines and other more serious consequences.

Simply Business offers commercial van insurance to make sure your business is protected. It includes a 24-hour claims helpline and optional breakdown cover from The RAC.

Related reading:

Van security

Van security and keeping your business stock and tools safe from thieves is another important consideration for van drivers.

Unfortunately, tool theft is a common issue in the UK – but there are things you can do to keep your tools safe in your van. Having the right locks and choosing parking spaces carefully can all help reduce the chances of your van being targeted.

Learn more about how Simply Business is working to Stamp Out Tool Theft.

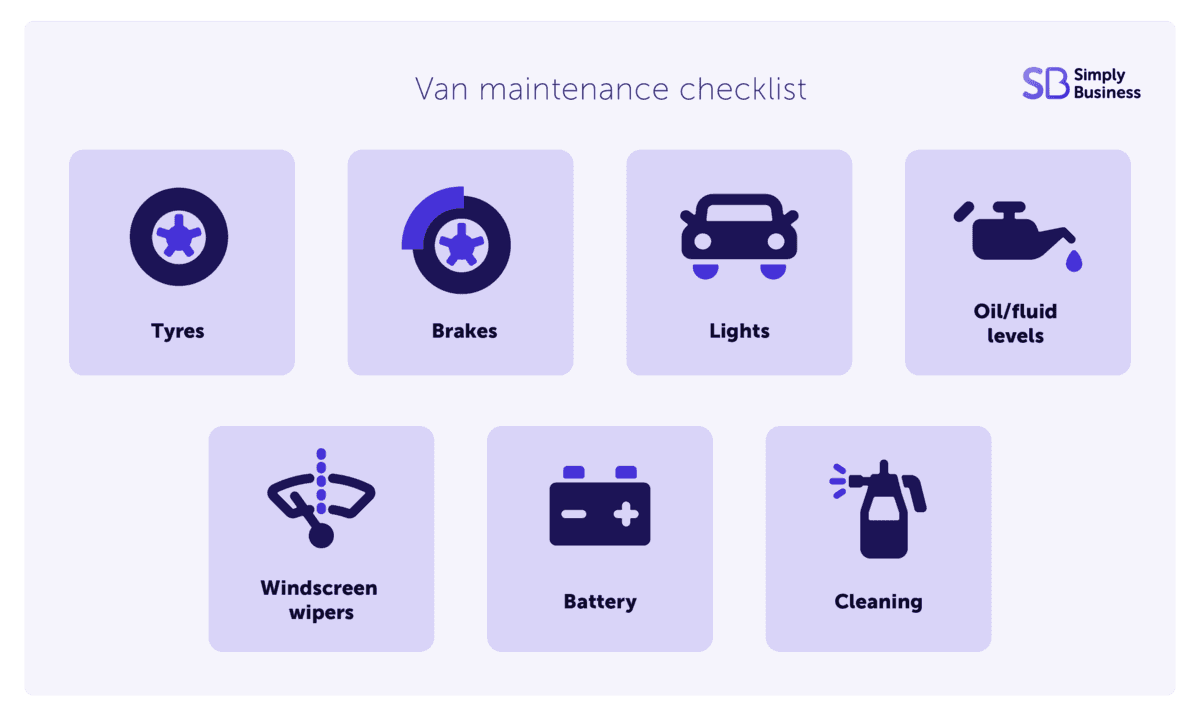

How to maintain your van – van maintenance checklist

Keeping your van in good working order can help save on bigger costs down the road – or minimise the chance of breaking down while on the job.

It’s particularly important to do extra checks on your vehicle in the autumn and winter.

Maintenance checklist:

- tyre pressures and tread depth (minimum depth 1.6mm)

- foot or service brake working correctly, with no excessive travel

- hand or parking brake working

- horn and steering functioning correctly

- lights (main, indicators, brake) all working

- mirrors in place and fully attached

- windscreen washers and wipers free from damage

- fluids, fuel, and oil at the correct levels (coolant, power steering fluid, brake fluid, windscreen washer fluid)

- battery securely in place and no leakages

- seatbelts secure and intact

- dashboard warning lights working (check airbag and automatic braking system)

Read more on daily maintenance checks for van owners.

Rules and regulations for drivers

Understanding the law when it comes to driving is essential, so make sure you read up on what you need to do:

- Register owner as soon as you buy a new or second hand vehicle

- Pay vehicle excise duty – road tax is a legal requirement and is based on your van’s CO2 emissions (and will include electric vehicles for the first time from April 2025)

- Get an MOT every year for vehicles over three years old – our MOT checklist can help you prepare

We have a guide we keep up to date with the latest driving laws, as well as clean air zones across the UK.

Related articles:

Van wrapping and marketing your business

Putting your logo and other business information on your van is a great way to get your business noticed while out on the road. You’ll want to include things like your business website and contact details and maybe a slogan or similar.

Using a van wrapping service can help you get your branding on your van. Just make sure you proofread everything for accuracy and don’t include information that will quickly be out of date.

We have a whole guide to help you with advertising, from getting the branding right to choosing colours and images.

Selling your business van

You might decide you don’t need your van any more or the running costs have become too expensive – or that it’s time for an upgrade.

Selling privately is usually the best way to get a good deal on selling your van, but you can also trade in with a dealership if you’re buying another van at the same time.

You’ll need to provide buyers with:

- MOT and service certificates

- manuals

If you claimed back VAT when you bought your van then you’ll need to charge VAT when you sell it – and the profits will be liable to corporation tax. If that’s the case then you’ll also need your VAT registration certificate and the invoice and bank statements from when you bought the van.

Summary – take the time to look at your finances

A van can help you run your business more efficiently – and even promote your business name – but it’s an important financial decision.

Be sure to take the time to research all your options before jumping into an expensive leasing deal. Check your budget and cash flow forecast so you’re sure you can cover the monthly running costs of a business van.

Overall, it’s a business decision that you might want to discuss with an accountant to understand any tax benefits and implications if you have employees.

Looking for van insurance?

As well as tailored business insurance, Simply Business can now insure your business van – buy comprehensive or third party fire and theft insurance.

Get a quote

Written by

Catriona Smith

Catriona Smith is a content and marketing professional with 12 years’ experience across the financial services, higher education, and insurance sectors. She’s also a trained NCTJ Gold Standard journalist. As a Senior Copywriter at Simply Business, Catriona has in-depth knowledge of small business concerns and specialises in tax, marketing, and business operations. Catriona lives in the seaside city of Brighton where she’s also a freelance yoga teacher.

We create this content for general information purposes and it should not be taken as advice. Always take professional advice. Read our full disclaimer

Keep up to date with Simply Business. Subscribe to our monthly newsletter and follow us on social media.

Subscribe to our newsletterInsurance

Public liability insuranceBusiness insuranceProfessional indemnity insuranceEmployers’ liability insuranceLandlord insuranceTradesman insuranceSelf-employed insuranceRestaurant insuranceVan insuranceInsurersAbout

About usOur teamAwardsPress releasesPartners & affiliatesOur charitable workModern Slavery ActSection 172 statementSocial mediaSite mapAddress

6th Floor99 Gresham StreetLondonEC2V 7NG

Northampton 900900 Pavilion DriveNorthamptonNN4 7RG

© Copyright 2024 Simply Business. All Rights Reserved. Simply Business is a trading name of Xbridge Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Registration No: 313348). Xbridge Limited (No: 3967717) has its registered office at 6th Floor, 99 Gresham Street, London, EC2V 7NG.