Small business funding and investment: how to grow your business

12-minute read

Getting funding for your business is a huge opportunity but sometimes it can be hard to know where to start and what type of funding you need.

Making the right call could have a positive impact on your business for years to come, so it’s important to know what funding options are available to you and how they work.

Grow your business with funding, investments, or grants

Whether you run a new or established business, growth is always likely to be front of mind.

Growth could be hiring more employees, launching a new product, or creating a new marketing campaign. To get to where you want to be, you’ll probably need some extra cash to invest.

This guide on raising money to grow your business has been created to help you work out which type of funding is suitable for you and the steps you can take to secure it.

Contents:

What are the main types of business funding?

If you’re looking for money to start or grow your business, there are several different options to consider. Some types of funding you’ll need to pay back, others are given to you for free, some require you to give away a share in your business, and you can also use your own money.

Type of funding | Suitable for | Benefits | Considerations |

Business loan | All types of businesses | Access to short-term finance | Interest costs and time taken to pay back the loan |

Angel investment | Startups | Significant investment and business connections | Giving away a stake in your business |

Venture capital | Established businesses | Significant investment and business connections | Giving away a stake in your business |

Crowdfunding | All types of businesses | Diversity of investors and exposure for your business | High effort compared to other types of investment |

Business grants | All types of businesses | Money that you don’t have to pay back | Grants are limited and competitive |

Government schemes | All types of businesses | Investors can benefit from tax relief | There are limits on how much you can raise |

Reinvestment | Businesses making a healthy profit | No debt, retaining full ownership of the business | Making sure you don't overspend |

Debt funding – taking out a business loan

In the same way that you can take out a loan to support your personal finances, you can get a loan to help your business.

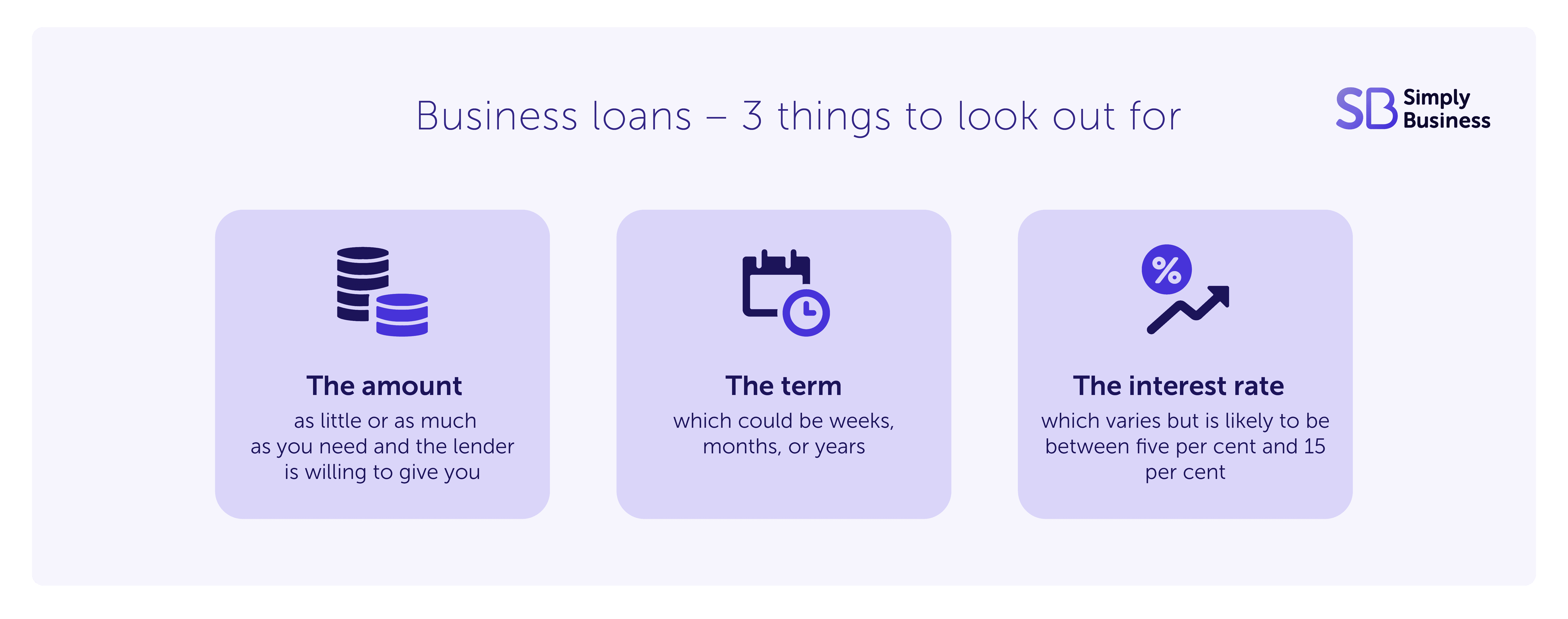

When you apply for a business loan, the provider will offer you:

- an amount (as little or as much as you need and the lender is willing to give you)

- a term (which could be weeks, months, or years)

- an interest rate (which varies but is likely to be between five per cent and 15 per cent)

You may also need to pay a fee and most lenders will have set criteria for their products, such as how old the business is and whether it’s registered in the UK.

To get this type of funding, you’ll need to be able to make a clear case for how it’s going to be used and how you plan to pay it back.

The flexibility and cash injection offered by bank loans means they’re popular with small businesses – almost a quarter (23 per cent) were seeking finance through a bank loan in 2023, according to Simply Business research.

However, there are different types of loan available so it’s important to consider:

- whether you want the interest rate to be fixed or variable

- if you’re looking for short or long-term finance

- whether you want a secured (backed by an asset) or unsecured loan

Three steps to getting a business loan

- Preparation – check your credit score, make sure your finances are in good order, and consider how much you’re willing to pay back over how long.

- Application – most lenders allow you to do this online. You’ll need to fill out a detailed form and provide some documents. Some lenders may also want to see a business plan.

- Decision and payment – you’ll then need to wait and see if you’ve been accepted for funding. If you have, in most cases you’ll get the money in a matter of days. Make sure you read through the terms of the loan agreement thoroughly before confirming.

What is invoice finance?

If you’re having problems with cash flow and need money quickly, invoice financing is a short term option that allows you to sell unpaid invoices to a third party. They’ll lend you up to 95 per cent of the value of the invoices and chase payment themselves.

It’s a very quick way to access cash if you need it. However, it’s important to consider that the costs can add up over time and outsourcing chasing payments could damage relationships with your customers.

Related guides

Private equity – getting investors for your business

Private equity is when an investor or groups of investors give you a cash injection for a stake in your business.

For example, a group of investors could give you £100,000 to help you buy new equipment in exchange for 20 per cent of your business. Private equity investors are also often able to help with business consultancy and connections.

When it comes to private equity investment, there are several options. Which one is suitable for you will depend on what stage your business is in and how much you’re looking to raise.

Angel investment

An angel investor, also known as a business angel, is an individual (or group of investors) looking to identify and invest in businesses with high growth potential.

Angel investors will usually be looking to invest up to £500,000 in startups in exchange for a stake in the business.

Venture capital

Venture capital (VC) funds are made up of investors and business experts. Venture capital firms raise money from private and institutional investors to invest in select companies.

VC funds are more likely to target established businesses and can offer larger sums of money.

Crowdfunding

Crowdfunding is a type of investment where a large number of people contribute smaller sums of money towards your business through an online platform.

Anyone can invest through crowdfunding sites and businesses can use different methods to raise money, such as giving away a stake in the business, loaning money at a set interest rate, or giving away rewards in exchange for cash.

Related guides

Business grants – money you don’t have to pay back

Whether you’re a startup or an established business, a grant could help take your business to the next level.

Grants are popular with business owners because they don’t have to give away a stake in their business or pay back the money they’ve been given.

However, due to these benefits, the awarding of grants is very competitive. Some grants are awarded to one business from thousands of applications, while others are only awarded after a long and detailed application process.

Business grants come in different sizes and can be given to businesses based on things like:

- location or region

- industry or trade

- turnover or revenue

- age of the business owner

- how long the business has been operating

- energy efficiency or sustainability commitments

For example, Simply Business’s annual Business Boost grant awards £25,000 to one entrepreneur to start or grow their business. The winner is chosen by a panel of judges based on criteria such as whether the business has a positive social impact and a thought-out plan to use the money.

Read our comprehensive guide to small business grants for everything you need to know.

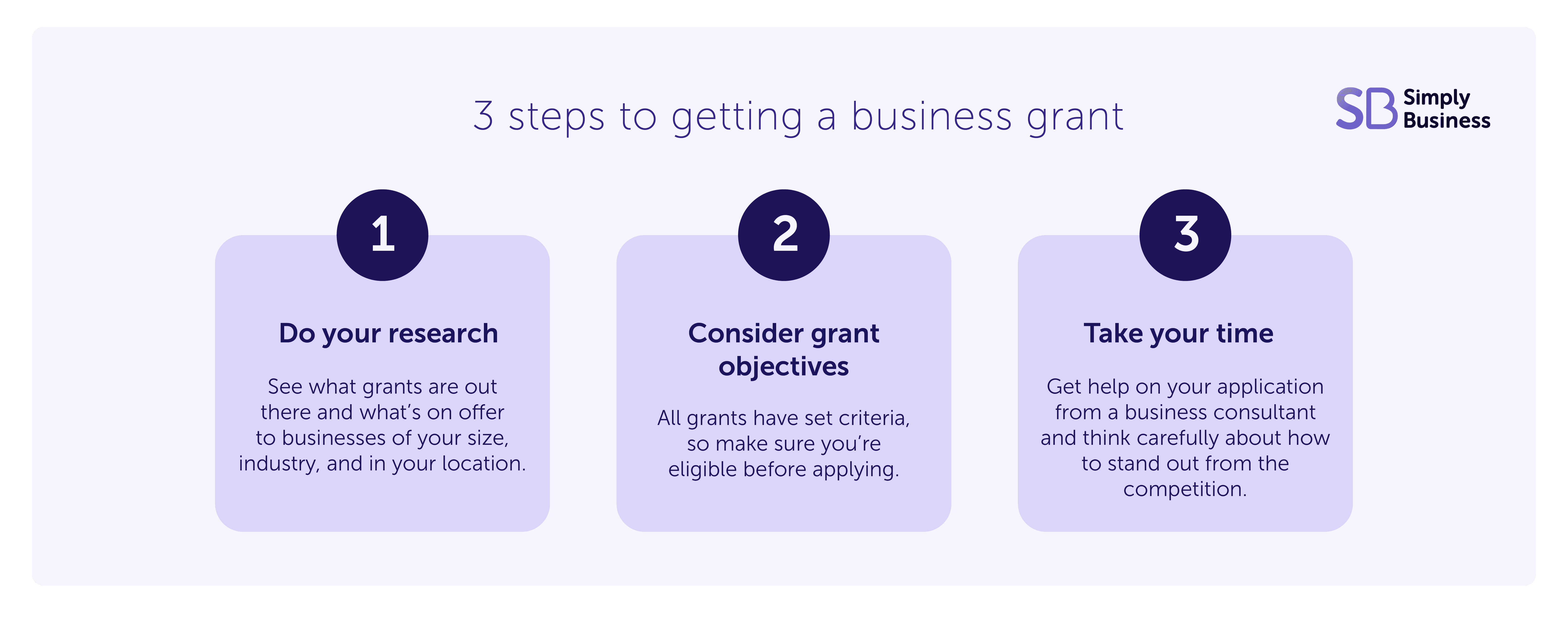

Three steps to getting a business grant

- Do your research – see what grants are out there and what’s on offer to businesses of your size, industry, and in your location.

- Consider the grant objectives – all grants have set criteria, so make sure you’re eligible before applying.

- Take time on your application – get help from a business consultant or mentor if you need and think carefully about how you can stand out from the competition.

Government funding for small businesses

The government runs a range of schemes that can help you to raise money for your business.

Here’s an overview of the main options:

- Seed Enterprise Investment Scheme (SEIS) – a type of venture capital funding that allows investors to buy shares in your company and benefit from tax relief. You’ll need to be a limited company to qualify for an SEIS scheme and can raise a maximum of £150,000

- Enterprise Investment Scheme (EIS) – similar to the SEIS, the EIS focuses on growth and development with the opportunity to raise up to £12 million. To be accepted, you’ll need to do one of the qualifying trades and be a limited company

- Venture Capital Trust (VCT) – another scheme that offers tax reliefs to investors, the VCT allows them to invest indirectly in small, high risk companies (usually startups) through trusts

- Enterprise Finance Guarantee – this loan scheme is run by The British Business Bank on behalf of the government. It’s for businesses that have been turned down for a loan due to not having a proven track record or lack of security. Borrowers can get up to £1 million, with repayment terms of up to 10 years

Reinvestment – using profit to grow your business

Reinvestment is putting the profits you make back into your business. The benefit of taking this approach is that you won’t have to give away any stake in the business, nor will you have any debt or interest to pay back.

Taking the reinvestment route gives you more control over your finances and your business. However, this approach could increase the time it takes to grow and to do it safely, you’ll need to keep a close eye on your profit margin.

What do businesses need funding for?

Investing in your business can be key to future success in the long term. In many cases you’ll need some extra cash to help you grow.

Here are some of the most common things small businesses use funding and investment for:

- marketing – promoting your brand through advertising and on social media can expand your audience

- product development – improving existing products or launching new ones can increase profits and create new revenue streams

- new premises – as you grow, you might need a bigger premises or somewhere with better facilities

- hiring employees – the bigger your team, the more work they can get through

- buying stock – more stock means you can fulfil orders quickly and upsell other products

Funding for small business – what do you need?

If you need money quickly, it may be best to look into getting some debt funding, whether that’s a traditional business loan, invoice financing, peer to peer lending, or a bridging loan.

If you’re looking for a big sum of money, it could be better to seek investment. Going down this route is also useful if you’re looking for extra business support and contacts.

However, it’s important to remember that in most cases investors will want a stake in your business.

Merlie Calvert, CEO and Founder of Farillio, an award-winning tech startup in the business and legal services sector, explained: “Every time someone gives you money, you’re giving away a slice of the pie.

“And that’s OK in the beginning as you have a lot of pie to share, and you need the money. But as that pie gets eked away, so does your control and your ability to determine the future of your business.”

With this in mind, if you’re not keen on paying back an investment over time and don’t want to give up a stake of your business, your best option would be to look for a business grant or reinvesting your own profits.

How to get investment in a business

You’ve reached the point where you think your business could benefit from some investment, but how do you get your brand and ideas in front of the right people?

First off, you can speak to other business owners in a similar position – they may have had investment or know some angel investors or venture capitalists.

Where to go for small business funding

The people or organisation you approach for money to grow your business will depend on the type of funding you’re looking for.

Here’s an overview of the main options:

- your own finances – whether it’s savings or profits, starting with your own money could prove beneficial in the long term

- family and friends – more informal and potentially more flexible, but the risk is that personal relationships could be damaged if things don’t work out

- banks – a reliable and safe source of funding, but the cost of paying it back can be high

- the government – another reliable source for investment. Expect lots of competition from other businesses

- alternative lenders – an option if you’re looking for short-term finance. Beware of high interest rates

- investors – whether it’s crowdfunding or angel investment, be prepared to give up a stake in your business

- incubators and accelerators – although you can’t usually get funding directly from an incubator or accelerator, these schemes can put you in touch with investors

The importance of networking

When it comes to securing funding to grow your business, It’s also important to be an active networker. Attending in-person and online events can help you get in touch with the right people. As well as attending events specifically themed around investment, it could be worth going to general business events as you never know who you might meet.

Another thing to consider is your personal brand. Posting thought leadership content regularly on platforms like LinkedIn can help to make you more appealing to investors. On top of this, speaking and presenting at events can help to increase your profile and the chances of getting noticed by investors.

Why you need a solid business plan

When you start speaking to the right people, you’ll need to make sure you have a solid vision of where your business is going and exactly what you’d do with any investment.

It’s likely you‘ll need to create a specific business plan for investors or lenders – download our free business plan template to get started.

Investors and banks will look at your business plan to make sure the funding they provide will help you – and offer a return on their investment.

Here are some things to consider when writing your business plan:

- be realistic about the limitations of your business, but remain optimistic

- show you’re prepared for any potential obstacles that may come your way

- if you need funding for a particular problem, demonstrate how you’ll overcome this with funding

If you’re successful in getting investment, it could mean that you have new stakeholders in your business. Keeping stakeholders up to date with how the business is performing will be crucial.

Related guides

Have you done your research?

You might be an expert in your industry or trade, but to impress potential investors or to be awarded a grant, you may need to show a strong understanding of the business world.

This could include demonstrating you’ve done sufficient market research into your industry – such as predicting upcoming trends or gaps in the market.

It’s also important to know what your competitors are doing. You can impress investors or lenders with competitor research when you're applying for different funding opportunities.

Make sure you nail the pitch

Whether you’re meeting with potential investors, entering a competition, or applying for a loan, a strong pitch is essential for your success.

We have a whole guide on how to write an elevator pitch – but it all comes down to being prepared, confident, and understanding your audience (not your customers, but the specific people you’re pitching to).

To help simplify your messaging and make the most of your time, we recommend preparing a strong mission statement and vision statement – this will show why you do what you do and the goals you want to achieve with your funding.

Why is small business funding and investment important?

For many businesses, raising money is their biggest obstacle to growth. A quarter of businesses (25 per cent) said a lack of funding or access to credit was a major concern, according to our 2023 SME Insights Report.

The same study found that over half (56 per cent) of businesses were seeking a bank loan or government grant.

More than a third (36 per cent) said they were seeking over £50,000, while 45 per cent said they’d need between £50,000 and £100,000 to take their business to the next level.

As well as the financial boost, getting a loan, investment, or grant could provide you with extra support when it comes to running your business.

Expert advice and useful contacts could help you to achieve your goals quicker.

Risks of business funding to be aware of

Due to the risks that come with all types of small business funding, it’s important that you fully understand all the options and what you really need.

For example, business loans can come with high interest rates and long repayment terms. And if you get an unsecured loan, your personal assets (such as your home or car) could be seized if you get into financial difficulty.

Taking on a business loan that you’re struggling to pay back could also have a negative impact on your business credit score.

As for any type of investment in a business, the main risk is giving away ownership and control over how you operate. Investors could have demands that you don’t agree with and you could be pressured into making decisions.

And if your business is underperforming, it could be a stressful time. As well as being accountable to investors, you could be at risk of financial difficulty if they decide to cash out early.

This article is intended as a guide. Business finance can be complex so it’s important to speak to a professional if you’re not sure of anything before making any decisions.

Final thoughts – patience is key

Choosing the right type of funding for your small business will take time and it’s important not to make any rash decisions.

The type of funding you choose – whether it’s a loan, grant, or investment – is likely to have a big impact on the future of your business.

Although getting access to a large sum of money quickly could seem appealing, having to pay it back over a long period of time or giving up a portion of your business could be challenging.

Make sure you speak to other business owners before making a decision and get help from a business finance expert if you’re not sure of anything.

Looking for self-employed insurance?

With Simply Business you can build a single self employed insurance policy combining the covers that are relevant to you. Whether it's public liability insurance, professional indemnity or whatever else you need, we'll run you a quick quote online, and let you decide if we're a good fit.

Start your quote

Written by

Conor Shilling

Conor Shilling is a Copywriter at Simply Business with over two years’ experience in the insurance industry. A trained journalist, Conor has worked as a professional writer for 10 years. His previous experience includes writing for several leading online property trade publications. Conor specialises in the buy-to-let market, landlords, and small business finance.

We create this content for general information purposes and it should not be taken as advice. Always take professional advice. Read our full disclaimer

Keep up to date with Simply Business. Subscribe to our monthly newsletter and follow us on social media.

Subscribe to our newsletterInsurance

Public liability insuranceBusiness insuranceProfessional indemnity insuranceEmployers’ liability insuranceLandlord insuranceTradesman insuranceSelf-employed insuranceRestaurant insuranceVan insuranceInsurersAbout

About usOur teamAwardsPress releasesPartners & affiliatesOur charitable workModern Slavery ActSection 172 statementSocial mediaSite mapAddress

6th Floor99 Gresham StreetLondonEC2V 7NG

Northampton 900900 Pavilion DriveNorthamptonNN4 7RG

© Copyright 2024 Simply Business. All Rights Reserved. Simply Business is a trading name of Xbridge Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Registration No: 313348). Xbridge Limited (No: 3967717) has its registered office at 6th Floor, 99 Gresham Street, London, EC2V 7NG.