Business legal insurance

Join over 113,000 businesses with legal cover from £3.49 per month*

- UK-based expert support, online and on the phone

- Get covered and all your documents the same day

- Compare tailored quotes to find the best business legal cover for you

Business legal expenses insurance – why is it important?

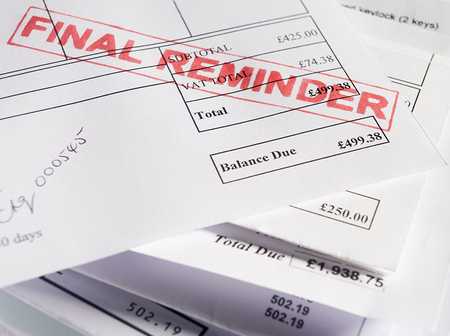

From employment tribunals to tax investigations, legal issues typically cost thousands. On top of the money, they’re a drain on your time and attention, and can take over a year to resolve. Business legal expenses insurance is designed to help cover the costs, and provide expert support on areas like employment and contract disputes, debt recovery, data protection, tax, and more.

- commercial legal expenses insurance for sole traders, limited companies, and more

- covering contract and employment disputes, plus debt, tax, and data claims

- rated 4.7/5 based on 39K+ public liability customer reviews

What does legal insurance cover?

Legal insurance is designed to help cover your legal representation costs and expenses, if a claim is made against you. Expertise is power, so we’ll always provide access to a 24/7 legal advice helpline, plus crisis PR support, giving you a solid first point of contact. Contract and employment disputes, debt recovery, data protection, tax protection, and corporate identity theft are all areas typically covered by legal protection insurance.

Contract disputes and debt recovery

You might claim for this if a contract disagreement prevents you being paid.

Employment disputes and compensation

You might claim for this if an employee (including a volunteer) raises a claim against you.

Data protection

You might claim for this if you’re handling personal data, in any form.

Tax protection

You might claim for this if a tax enquiry is made against you.

Corporate identity theft protection

You might claim for this if someone uses your company’s identity illegally.

Contract disputes and debt recovery

You might claim for this if a contract disagreement prevents you being paid.

What's covered?

- costs and expenses for contractual disputes arising from an agreement

- contracts for the purchase, hire, sale, or provision of goods or services provided by you

- costs and expenses for disputes relating to debt recovery, including judgement enforcements

- unpaid invoices

Debts owed must exceed £200, and you’ll need to make your legal business insurance claim within 90 days of the debt being due or payable.

For example:

- one of your clients has informed you that, after checking over your works, they’re not happy with the result and believe you haven’t met the contractual requirements. As a result, they’re refusing to pay their outstanding invoice

What isn’t covered?

- contractual disputes arising from supply, hire, sale, or provision of any software, computer systems, or hardware

- debts arising from an agreement you entered into before your legal expenses insurance policy start date

- disputes arising from any debts you have purchased from a third party

Employment disputes and compensation

You might claim for this if an employee (including a volunteer) raises a claim against you.

What's covered?

- costs and expenses to defend your legal rights as a business owner, before legal proceedings in a court or tribunal

- employee dismissals

- employment contract disputes

- alleged breach of statutory rights

For example:

- an employee feels you haven’t fulfilled your contractual obligations, regarding their statutory rights

- you need to dismiss an employee following client complaints, and they threaten to file an unfair dismissal lawsuit

Data protection

You might claim for this if you’re handling personal data, in any form.

What's covered?

- cases relating to civil action taken against you for compensation under data protection legislation

For example:

- your employee leaves their laptop unattended in a coffee shop, and a third party is able to lift a customer’s data

What isn’t covered?

- the cost of fines issued

- loss, alteration, corruption, distortion of, or damage to stored personal data, or reduction of functionality, resulting from hacking or a virus

Tax protection

You might claim for this if a tax enquiry is made against you.

What's covered?

- costs and expenses relating to tax enquiries made against you or your business

- general enquiries against your business

- employer compliance disputes

- VAT disputes

- personal tax enquiries

For example:

- HMRC begin an investigation into your recent tax return, triggered by a fluctuation in your business income

Corporate identity theft protection

You might claim for this if someone uses your company’s identity illegally.

What's covered and included?

- costs and expenses following identity theft

- a personal caseworker, who’ll build an action plan to help regain your stolen identity

- disputes with debt collectors, or any part who takes legal action against you, as a result of identity theft

- costs incurred for phone calls, faxes, or postage to communicate with the police, credit agencies, and financial service providers

- costs and expenses to reinstate your stolen identity, including signing statutory declarations or similar documents

For example:

- someone gets hold of your company bank details and uses them to buy goods and services

- your CEO’s contact details are used by a fraudster to set up a new line of credit with a business bank

What isn’t covered?

- fraud committed by anyone entitled to make a claim under this legal expenses insurance policy

- cover for anyone other than you, other directors of the business, spouses, or civil partners

This content has been created for general information purposes. Make sure you have the right level of business insurance by checking your policy documentation for details. Read our full Terms and Conditions

How much does legal protection insurance cost?

Find out how much you’ll pay by comparing prices from a range of trusted insurers. You choose what goes into your policy, so you only pay for what you need.

Prices start from £3.49 per month

Get your quotes in 7 minutes – prices are guaranteed for 30 days.

Get your tailored quotes in 7 minutes

How we work out example prices: Prices are based on payment over 12 months as of 17/11/2022 and are inclusive of Insurance Premium Tax (IPT). If you pay in a lump sum or by Direct Debit, extra fees may apply.

Example business legal insurance quotes, real prices

£50.64 /month

£450.09 /year

A self-employed plumber working mainly in local residential properties

- 2-3 years' experience

- Sole trader

- No employees

- Based in Oxford

Public liability

£1,000,000

Employers’ liability

Not included

Legal expenses

£100,000

£142.58 /month

£1267.40 /year

A freelance architect that specialises in residential property conversions

- 5+ years' experience

- Limited company

- 3 employees

- Based in Sunderland

Public liability

£1,000,000

Employers’ liability

£10,000,000

Legal expenses

£100,000

How we work out example quotes These examples are real quotes from our online system (created 14/09/2021). They’re based on a range of factors, like employees and location. Your own quote will be based on what you tell us about your business. Prices may go up or down from day to day, so the prices you’re quoted may differ to the ones you see here.

Looking for something else?

Depending on your set-up, clients and business type, these expert covers might be helpful too:

Is your profession not listed? When you run a quote you can select your trade from over 1,000 options.

How it works

Pick what goes into your policy

Only pay for what you need

Get prices from a range of insurers

Choose the best fit for you

Buy online in minutes

Get your documents the same day

Simply Business

Direct to

insurer

Highstreet

broker

Compare policies from a range of trusted insurers

Buy online or over the phone in minutes

Talk to an expert

Our team of UK-based insurance experts are here to help, Mon 09.00am - 05.30pm, Tues 09.00am - 05.30pm, Weds 09.00am - 05.30pm, Thurs 09.30am - 05.30pm, Fri 09.00am - 05.30pm, Sat 09.00am - 02.00pm

Call our team

How do claims work?

Unlike price comparison websites, we take the hassle out of claims for you. We know how important it is to get your business back on track quickly – and with a minimum of fuss. That’s why you get access to your dedicated claims any time, day or night. Call them on 0333 207 0560 or claim online. They’ll do their best to be fair and supportive.

£28 million in claims paid out in 2021

Paying 80% of settled claims within 24 hours in 2021

The figure above is rounded across our range of products. "Settled" covers paid, declined or withdrawn. Our claims process may vary for different products and operates on a ‘claim by claim’ basis. Our specialist partner Sedgwick will pay the claims on behalf of the insurer. Reviewed on 24/04/2024.

Example claim

Having business legal insurance through Simply Business has saved small business owners thousands of pounds when the unexpected happened.

Steph saved more than £3,100

Steph (not her real name) called our team to make a claim for legal fees she needed to pay, in connection with a client contract dispute. The optional commercial legal expenses insurance added to Steph’s architecture business policy helped cover her legal costs.

Insurance payout

£3,150.00

Covering the cost of contract dispute

Steph’s costs

£100

The excess amount stated in Steph’s policy terms

Chosen by 900,000 small businesses and landlords

We started out as a team of five back in 2005. We’ve grown since then with 900,000 customers across 1,500 trades now trusting us to provide their business insurance.

Compare and buy in minutes

Documents arrive today

Rated 4.7/5

Based on 39,771 reviews

Here to help

Help from UK-based experts

24/7 claims

Make a claim any time

Business legal protection insurance FAQ

Whether you’re new to buying insurance or you’ve been operating your business for a while, here are the answers to some commonly asked questions about legal expenses insurance for business.

You can also check out our business insurance FAQs.

It’s unlikely a standard business insurance policy would cover you for legal costs in the event of a contract dispute or identity theft. That’s why it’s important to add business legal cover to your policy to make sure you have the right level of protection.

Commercial legal cover is another way of saying ‘business legal insurance’. It’s typically built to help provide cover for legal costs and expenses, often when you need legal representation in connection with your business. Our cover also supports you with a 24/7 expert legal advice helpline, plus crisis PR support.

If you change your business legal structure from sole trader to limited company mid-way through your policy, give us a call straight away on 0333 0146 683. It’ll only take us a few minutes to cancel your existing policy and replace it with one that correctly covers your new legal structure. It’s worth bearing in mind that your insurer and premium amount may need to change.

Each insurer looks at CCJs and IVAs differently – some apply stricter rules than others, but having a CCJ or IVA doesn’t necessarily mean you won’t be able to buy insurance.

You can choose the payment type that suits your business and cash flow best. Some customers prefer to pay in one go, while others prefer to pay a regular monthly amount, like you do with lots of other bills. Simply Business offer three ways to pay for your policy:

- one-off credit or debit card payment

- BACS payment

- Direct Debit

If you choose to pay by Direct Debit, our credit provider, Premium Credit, pays Simply Business the full amount for your policy up front. You then repay Premium Credit in 10 monthly instalments.

We create this content for general information purposes and it should not be taken as advice. Always check policy documentation for details and seek professional advice. Read our full Terms and Conditions

Helpful articles for small businesses

Keep up to date with Simply Business. Subscribe to our monthly newsletter and follow us on social media.

Subscribe to our newsletterInsurance

Public liability insuranceBusiness insuranceProfessional indemnity insuranceEmployers’ liability insuranceLandlord insuranceTradesman insuranceSelf-employed insuranceRestaurant insuranceVan insuranceInsurersAbout

About usOur teamAwardsPress releasesPartners & affiliatesOur charitable workModern Slavery ActSection 172 statementSocial mediaSite mapAddress

6th Floor99 Gresham StreetLondonEC2V 7NG

Northampton 900900 Pavilion DriveNorthamptonNN4 7RG

© Copyright 2024 Simply Business. All Rights Reserved. Simply Business is a trading name of Xbridge Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Registration No: 313348). Xbridge Limited (No: 3967717) has its registered office at 6th Floor, 99 Gresham Street, London, EC2V 7NG.