London ULEZ expansion – ultimate guide for small businesses

8-minute read

Clean air zones and emissions charges are gradually being introduced to improve air quality and reduce emissions. This includes London’s Ultra Low Emission Zone and congestion charge, but also other cities across the UK.

Make sure you don’t get caught out with extra charges if you drive for your small business. From key dates for your diary to which vehicles the charges apply to, read up on the rules so you aren’t hit with unexpected penalties.

Get your small business guide to driving in clean air zones (including maps):

DownloadThis article covers everything you need to know, including:

What is ULEZ?

The ULEZ clean air charges were introduced in London in 2019 to manage air pollution that causes environmental and health risks. It applies all year round, 24 hours a day, seven days a week (apart from Christmas day).

ULEZ expansion – what’s changing?

From 29 August 2023, a further ULEZ expansion means the London ULEZ will include everything within the Greater London Authority boundary.

Initially the zone just covered central London, but it expanded in October 2021 up to (but not including) the North Circular Road (A406) and South Circular Road (A205).

The August 2023 expansion means all London boroughs will be covered by ULEZ, making it 18 times larger than when it was first introduced in 2019.

The planned expansion has been under the spotlight, with some of London's councils voicing concerns about the scheme. Many are worried the added costs of driving and owning a vehicle in London will be challenging for small businesses owners already grappling with the cost of doing business crisis.

The levels of polution have reduced since the scheme was introduced, according to a study from the Greater London Authority and TFL. It found that emissions of toxic nitrogen oxides are 23 per cent lower across London, compared with the estimated level if the scheme didn't exist.

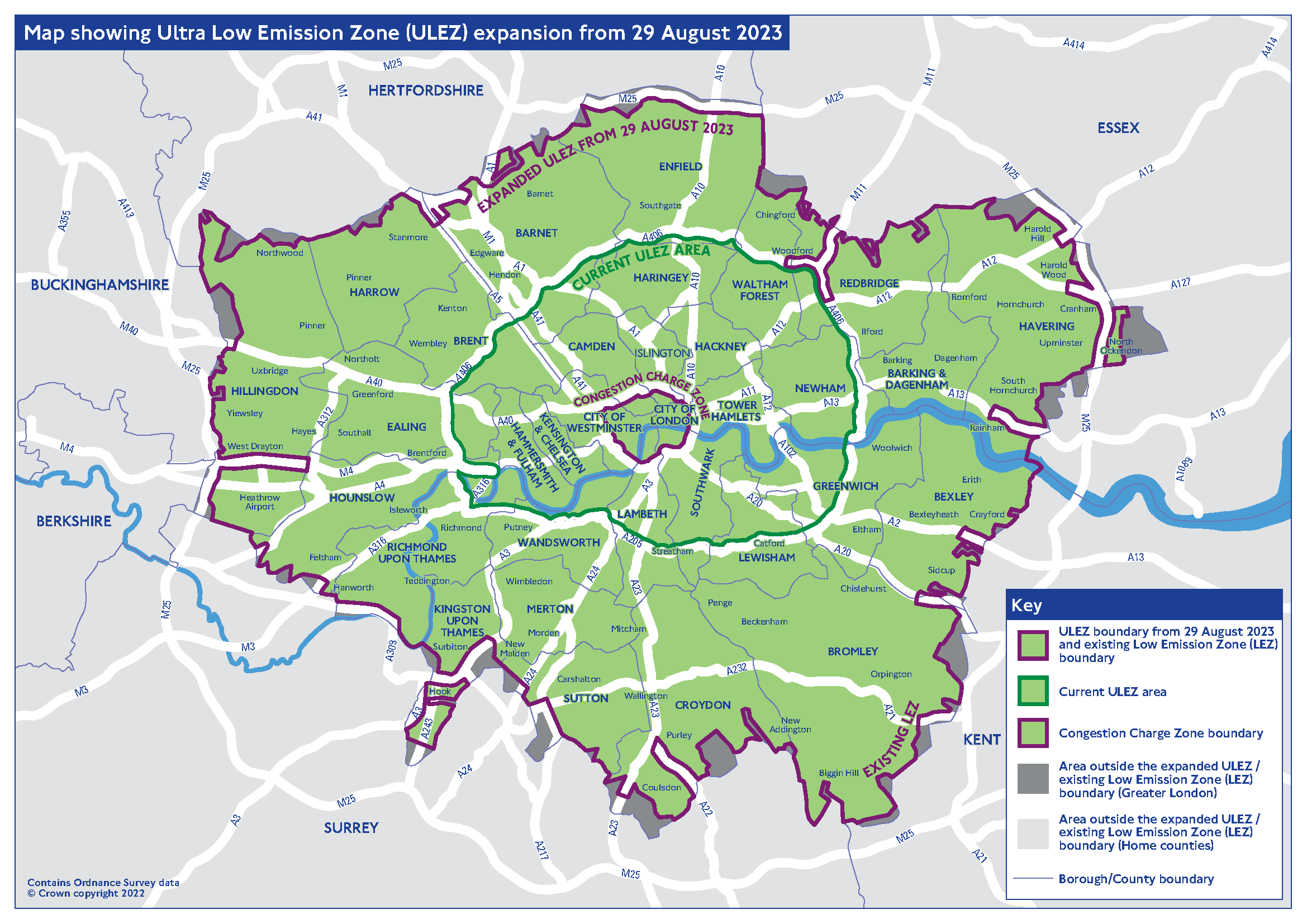

ULEZ map – see where the rules apply

This map shows where the ULEZ rules apply now, and the expanded zone.

ULEZ check – do you need to pay the charge for your business vehicle?

You can use TFL’s vehicle check tool to see if your vehicle is exempt from the charge. You just need your car registration number to find out.

Typically, vehicles that don’t meet the emissions standards and have to pay the ULEZ charge are:

- petrol cars and vans that don’t meet Euro 4 standards (typically vehicles registered before 2006)

- diesel cars and vans that don’t meet Euro 6 standards (typically vehicles registered before 2015)

- motorbikes that don’t meet Euro 3 standards (sold before July 2007)

Electric vehicles are exempt from the charge. Check other exemptions and grace periods with TFL.

How much is the ULEZ charge?

If you’re driving in the area and your vehicle doesn’t meet specific emissions and safety standards (typically older vehicles) then you have to pay £12.50 a day. You don't have to pay if your car is parked in the zone on days you're not driving.

There’s a penalty charge of £180 if you fail to pay by midnight on the third day following the journey, although this is reduced to £90 if you pay within 14 days.

You can use TFL’s congestion charge tool to check if the charges apply to your business vehicle.

How to pay

You can pay the charge in a number of ways:

- set up Auto Pay – this gives you the option to register up to five vehicles if your business regularly uses multiple vehicles, and you’ll be charged automatically so you won't have to worry about forgetting to pay the charges

- TFL app – using the app you can set up to auto-pay, make payments, and view your balance

- by phone – call 0343 222 2222 to pay the charge over the phone

Claim tax relief on ULEZ charges

Small businesses driving in the UK capital will be able to claim tax relief on the daily ULEZ charge.

HMRC confirmed on 29 August 2023 that the charge will be classed as an allowable business expense. This means the self-employed can deduct the amount from their taxable profits and reduce the amount of tax they need to pay.

The relief only applies to journeys made for business purposes – and doesn't include commuting.

What is London's scrappage scheme?

Londoners with high-polluting vehicles will be able to access money to replace them through the ULEZ scrappage scheme.

There are grants of up to £11,500 available for businesses, depending on the type of vehicle they drive.

Read our guide to the scrappage scheme for more information on how it works and how to apply for a grant.

Don’t forget about the London congestion charge

You’ll need to pay a congestion charge if you drive at certain times in central London.

Congestion charge times apply between 7am and 6pm during the week (Monday to Friday) and between 12pm and 6pm on weekends and bank holidays. Charges don’t apply between Christmas Day and the New Year’s Day bank holiday.

Check the congestion charge map on TFL’s website to see if charges apply. You’ll know if you’re in a congestion charge zone as there are signs showing a white ‘C’ in a red circle.

It costs £15 a day and can be paid for the same way as the ULEZ charge. TFL has more information on paying to drive in London.

Electric vehicles are exempt

If you drive an electric car or van, then you’ll be exempt from both the Ultra Low Emission Zone charge and the congestion charge – this could save you £27.50 every day.

Read our guide to choosing an electric vehicle and how to decide if you need one for your business.

Clean air zone cities across the UK

There aren’t any other ULEZ cities beyond London, but there are other cities with low emission zones in the UK.

Below is an overview of which cities have a clean air zone and when the charges apply:

National exemptions apply if you have a eco-friendly vehicle that meets the low emissions standards. However, many of these cities also offer discounts or grants for small businesses located within the clean air zones.

It's also worth noting that you can claim these charges as a tax-deductible expense, provided the journey you made was solely for business purposes.

Sign up to our newsletter to get the latest guides for small businesses and the self-employed

Your email address will be used by Simply Business so that we can send you the latest guides, offers and tips. You can unsubscribe from these emails at any time. For more information, check out the Simply Business privacy policy.

Bath

While this doesn’t apply to cars and motorbikes, Bath has been running a clean air zone since 21 March 2021.

Vehicles it applies to: Buses, coaches, taxis, private hire vehicles, heavy goods vehicles (HGVs), and large goods vehicles (LGVs).

Cost: £9 to £100 a day, depending on your vehicle.

Find out more about the Bath clean air zone, including how to pay and details about exemptions.

Birmingham

Birmingham’s clean air zone was introduced on 1 June 2021 and operates 24 hours a day, seven days a week.

Vehicles it applies to: Buses, coaches, taxis, private hire vehicles, HGVs, LGVs, and car drivers.

Cost: £8 a day for cars that don’t comply with the emissions standards.

If you work in the clean air zone, you may be eligible for a financial incentive to scrap your non-compliant vehicle.

Bradford

Bradford’s clean air zone is in force, but it doesn’t apply to car drivers and motorcyclists.

Vehicles it applies to: HGVs, LGVs, buses, coaches, and private hire vehicles.

Cost: £7 to £50 a day (depending on your vehicle).

Find out more on Bradford Council’s website, including a map of the zones, grants for local businesses, and exemptions.

Bristol

A daily charge was introduced in Bristol in Summer 2022.

Cost: £9 a day for cars, taxis, and light goods vehicles (under 3.5t).

Find out more about Bristol’s clean air zone and check if it'll affect you. There’s also financial support available to help people with the cost of paying the charge or upgrading their vehicle – this includes grants for small businesses and the self-employed based in the zone.

Newcastle and Gateshead

A clean air zone launched in Newcastle and Gateshead on 30 January 2023, although it doesn’t affect car drivers.

Vehicles it applies to: private hire vehicles, buses, coaches, taxis, PHVs, HGVs, and LGVs.

This is set to be expanded to polluting light goods vehicles and vans from July 2023.

Cost: £12.50 a day for vans and taxis and £50 a day for buses, coaches, and HGVs.

There will be no charge for vehicles that meet emissions standards and it won’t apply to car drivers.

Find out more about the clean air scheme, including exemptions and how to pay.

For example, there are some instances when you can apply for an exemption, including if your business is located within the clean air zone.

Oxford

Following a pilot scheme, Oxford introduced Britain’s first zero emission zone in February 2022.

It’s enforced in the city centre from 7am to 7pm, seven days a week.

Cost: Ranging from £0 for zero-emission vehicles to £10 a day for vehicles not meeting the emissions standards.

Check Oxford City Council’s website for information on streets affected by the zone, as well as for exemptions and discounts for small businesses.

Portsmouth

Portsmouth’s clean air zone came in on 29 November 2021.

Vehicles it applies to: Buses, coaches, taxis, PHVs, and HGVs.

Cost:

- £10 a day for polluting taxis and private hire vehicles

- £50 a day for HGVs, buses, and coaches

If you drive a car, motorcycle, or van then you won’t have to pay the charge.

There was a Clean Air Fund from Portsmouth City Council, but this has now closed for new applications.

Sheffield

Sheffield is bringing in a clean air zone from 27 February 2023. This won’t apply to private cars and motorbikes though.

Vehicles it applies to: Taxis, LGVs, HGVs, buses, and coaches.

Cost:

- £10 a day for taxis and vans/LGVs that don’t meet the emissions standards

- £50 a day for coaches, buses, and HGVs

Find out more about Sheffield’s clean air zone.

To check if you need to pay for your vehicle or to pay the daily charge for cities outside London, visit the government’s clean air zone page.

Other cities to be aware of:

- Greater Manchester – a scheme for this area was planned for May 2022 but plans were withdrawn

- Liverpool – the Liverpool low emission zone is no longer going ahead

Low emission zones in Scotland – Aberdeen, Dundee, Edinburgh, and Glasgow

Four Scottish cities introduced low emissions zones in spring 2022, although enforcement of these is coming in stages.

- Glasgow – the charges applied to buses initially but since 1 June 2023 it applies to all vehicles (although residents will get another year before having to pay)

- Dundee – this will be enforced from 30 May 2024

- Aberdeen – enforcement will start from 1 June 2024

- Edinburgh – enforcement will begin on 1 June 2024

Vehicles that don’t meet the emissions standards won’t be allowed to drive in the zone. These zones will apply 24 hours a day, seven days a week.

Vehicles it applies to: Buses, coaches, taxis, PHVs, HGVs, and car drivers.

Penalty charge: £60 (reduced by 50 per cent if paid within two weeks) if driving a non-compliant vehicle in a low emission zone.

Find out more about Scotland’s low emission zones. Funding is also available to support eligible people prepare for the new zones, including retrofit grants and disposal grants.

Keep an eye on updates from your local authority about low emissions zones so you don’t get caught out.

How do you feel about the ULEZ expansion and other clean air zones? Let us know in the comments.

Guides for small business owners and drivers

Ready to set up your cover?

As one of the UK's biggest business insurance providers, we specialise in public liability insurance and protect more trades than anybody else. Why not take a look now and build a quick, tailored quote?

Start your quote

Written by

Catriona Smith

Catriona Smith is a content and marketing professional with 12 years’ experience across the financial services, higher education, and insurance sectors. She’s also a trained NCTJ Gold Standard journalist. As a Senior Copywriter at Simply Business, Catriona has in-depth knowledge of small business concerns and specialises in tax, marketing, and business operations. Catriona lives in the seaside city of Brighton where she’s also a freelance yoga teacher.

We create this content for general information purposes and it should not be taken as advice. Always take professional advice. Read our full disclaimer

Keep up to date with Simply Business. Subscribe to our monthly newsletter and follow us on social media.

Subscribe to our newsletterInsurance

Public liability insuranceBusiness insuranceProfessional indemnity insuranceEmployers’ liability insuranceLandlord insuranceTradesman insuranceSelf-employed insuranceRestaurant insuranceVan insuranceInsurersAbout

About usOur teamAwardsPress releasesPartners & affiliatesOur charitable workModern Slavery ActSection 172 statementSocial mediaSite mapAddress

6th Floor99 Gresham StreetLondonEC2V 7NG

Northampton 900900 Pavilion DriveNorthamptonNN4 7RG

© Copyright 2024 Simply Business. All Rights Reserved. Simply Business is a trading name of Xbridge Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Registration No: 313348). Xbridge Limited (No: 3967717) has its registered office at 6th Floor, 99 Gresham Street, London, EC2V 7NG.