HMRC self-employed simplified expenses – a guide

5-minute read

Simplified expenses use flat rates to save the self-employed calculating actual business expenses when reporting tax to HMRC.

There’s no doubt that bookkeeping and accounting can be complicated when you work for yourself. HMRC’s simplified expenses set a flat rate to make the claiming process easier and quicker for small businesses to manage.

You can use simplified expenses for certain business costs to help ease the pain of filing your tax return. But what are simplified expenses, and who can use them?

HMRC simplified expenses – when and how to use flat rates

Simplified expenses let the self-employed calculate some of their allowable business expenses based on flat rates set by HMRC. This is instead of working out your exact expenditure, which can be a complicated process.

The self-employed allowable expenses list using flat rates includes:

- business-related vehicle costs

- working from home

- costs if you live in your business premises

Simplified expenses may be suitable for those who have straightforward tax affairs and relatively few business expenses. It can also be useful if you drive a lot for your business.

However, it’s not the right option for everyone as calculating and reporting your actual outgoings may save you more money – check which expenses method is best for you on the government website.

For all other costs, other than those listed above, you’ll need to work out exactly how much you’ve spent.

Simplified expenses can only be used by:

- business partnerships in which none of the partners is a company

If you’re set up as a limited company, or a partnership involving a limited company, you can’t use simplified expenses.

Simplified expenses and working from home

Running a business from home or freelancing from home can make calculating exact business expenses a challenge. This is because you’ll need to work out the proportion you use for business purposes, for example the hours you work and rooms you use.

With the simplified expenses scheme you can claim a flat rate allowance if you use your home as an office or workshop.

Using your home as an office

If you’ve made use of your home as an office for at least 25 hours a month, you can use this allowance for the following expenses:

- rent/mortgage

- utilities

- other similar costs

You can’t use it for internet or telephone expenses as you’ll need to work out the proportion used for business purposes.

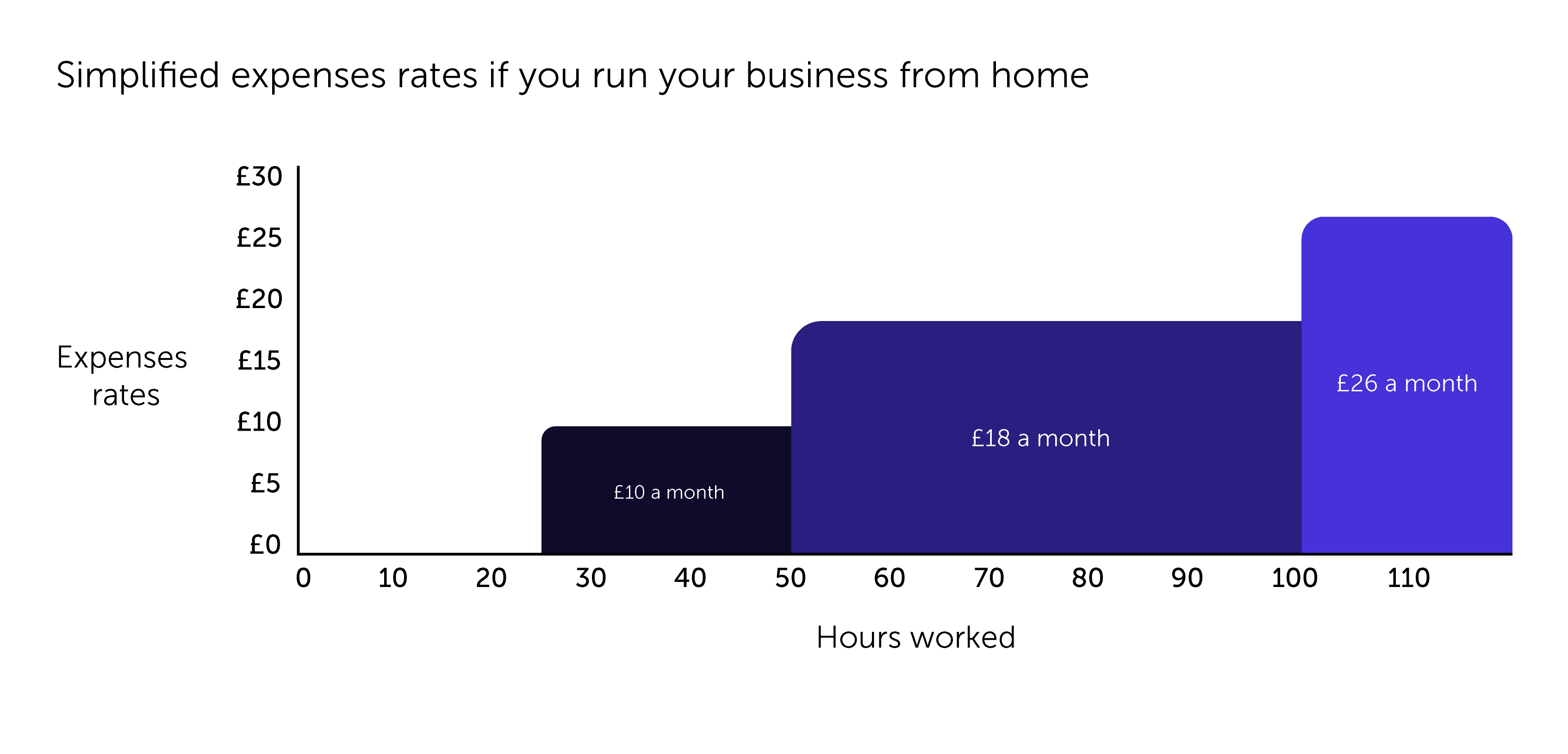

The simplified expenses flat rate for business owners working from home is:

- £10 a month if you work between 25 and 50 hours a month

- £18 a month if you work between 51 and 100 hours a month

- £26 a month if you work 101 or more hours a month

For example, you run a candle making business from your home and worked 30 hours each month for 10 months but you had a busier period in winter where you worked 55 hours for two months. Here’s how you’d work out your simplified expenses for your rent/mortgage and utilities costs while you run your business from home:

10 months x £10 = £100

2 months x £18 = £36

Total you can claim = £136

Simplified expenses mileage rates

If you use a vehicle for your business, you could claim simplified expenses rather than working out the exact cost of buying and running your vehicle. This also applies if you lease a company car.

HMRC mileage rates can be used for:

- cars (except for those specifically designed for commercial use, such as a black cab or a driving instructors' dual control car)

- goods vehicles (such as vans)

- motorcycles

The simplified expenses scheme can’t be used for vehicle expenses if you’ve already claimed capital allowances, or if you’ve already included them as part of your business profits.

The simplified expenses mileage rates are:

- 45p a mile for cars and goods vehicles on the first 10,000 miles

- 25p a mile for cars and goods vehicles over 10,000 miles

- 24p a mile for motorcycles

This rate only applies to the use of these vehicles.

It’s important to note that once you start claiming simplified expenses for your vehicle, you must continue to do so for as long as it’s being used for business purposes.

You don’t have to use flat rates for all of your vehicles. If you have multiple vehicles used for work, you might choose to use flat rates for some, and work out exact costs for others.

Simplified expenses and living at your business premises

Some self-employed people live in their business premises – for example those running a bed and breakfast, or using a spare room as a working salon. In this case the process for calculating simplified expenses works slightly differently.

If you’re living in your business premises, you can use the HMRC flat rates to calculate a deduction from your total expenses related to the premises. This means you’ll still need to work out your exact costs, but you don’t have to work out the balance between personal and business use.

The simplified expenses flat rates for living in a business premises for the 2022-23 tax year are:

- £350 a month if one person is living in the premises

- £500 a month if two people are living in the premises

- £650 a month if three or more people are living in the premises

For example, two people living full time in a bed and breakfast can claim £500 multiplied by 12 months (£6,000) for the year. As their overall business premises costs are £20,000 a year, they can deduct the flat rate and claim the remaining £14,000 as a business expense.

Self Assessment allowable expenses

Simplified expenses are a way of working out some of your business expenses for Self Assessment using flat rates. For other tax-deductible expenses, you need to work out the actual costs.

Self Assessment – what can I claim?

Other allowable expenses mean you may be able to claim back certain expenses such as office supplies, travel, insurance, and financial costs.

For example, if you’re making train journeys or using other transport solely for business purposes, you can claim these costs as allowable expenses. This differs from the flat rate for vehicles mentioned above as you’ll need to work out the exact cost.

Read our guide on allowable business expenses to find out more.

Simplified expenses and living at your business premises

Some self-employed people live in their business premises – for example those running a bed and breakfast, or using a spare room as a working salon. In this case the process for calculating simplified expenses works slightly differently.

If you’re living in your business premises, you can use the HMRC flat rates to calculate a deduction from your total expenses related to the premises. This means you’ll still need to work out your exact costs, but you don’t have to work out the balance between personal and business use.

The simplified expenses flat rates for living in a business premises are:

- £350 a month if one person is living in the premises

- £500 a month if two people are living in the premises

- £650 a month if three or more people are living in the premises

For example, two people living full time in a bed and breakfast can claim £500 multiplied by 12 months (£6,000) for the year. As their overall business premises costs are £20,000 a year, they can deduct the flat rate and claim the remaining £14,000 as a business expense.

Self Assessment allowable expenses

Simplified expenses are a way of working out some of your business expenses for Self Assessment using flat rates. For other tax-deductible expenses, you need to work out the actual costs.

Self Assessment – what can I claim?

Other allowable expenses mean you may be able to claim back certain expenses such as office supplies, travel, business insurance, and financial costs.

For example, if you’re making train journeys or using other transport solely for business purposes, you can claim these costs as allowable expenses. This differs from the flat rate for vehicles mentioned above as you’ll need to work out the exact cost.

Read our guide on allowable business expenses to find out more.

Need some help with small business accounting?

As we mentioned above, the simplified expenses scheme isn’t right for everyone as you may save money by recording and reporting your exact costs.

As with everything related to your business taxes, it’s important that you seek advice from a qualified accountant before making a decision.

Is there anything else you need to know about self-employed simplified expenses? Let us know in the comments.

Is your business insured?

We have 800,000 UK policies plus a 9/10 satisfaction score. Why not take a look at our expert business insurance options - including public liability insurance and professional indemnity - and run a quick quote to get started?

Start your quote

Written by

Catriona Smith

Catriona Smith is a content and marketing professional with 12 years’ experience across the financial services, higher education, and insurance sectors. She’s also a trained NCTJ Gold Standard journalist. As a Senior Copywriter at Simply Business, Catriona has in-depth knowledge of small business concerns and specialises in tax, marketing, and business operations. Catriona lives in the seaside city of Brighton where she’s also a freelance yoga teacher.

We create this content for general information purposes and it should not be taken as advice. Always take professional advice. Read our full disclaimer

Keep up to date with Simply Business. Subscribe to our monthly newsletter and follow us on social media.

Subscribe to our newsletterInsurance

Public liability insuranceBusiness insuranceProfessional indemnity insuranceEmployers’ liability insuranceLandlord insuranceTradesman insuranceSelf-employed insuranceRestaurant insuranceVan insuranceInsurersAbout

About usOur teamAwardsPress releasesPartners & affiliatesOur charitable workModern Slavery ActSection 172 statementSocial mediaSite mapAddress

6th Floor99 Gresham StreetLondonEC2V 7NG

Northampton 900900 Pavilion DriveNorthamptonNN4 7RG

© Copyright 2024 Simply Business. All Rights Reserved. Simply Business is a trading name of Xbridge Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Registration No: 313348). Xbridge Limited (No: 3967717) has its registered office at 6th Floor, 99 Gresham Street, London, EC2V 7NG.