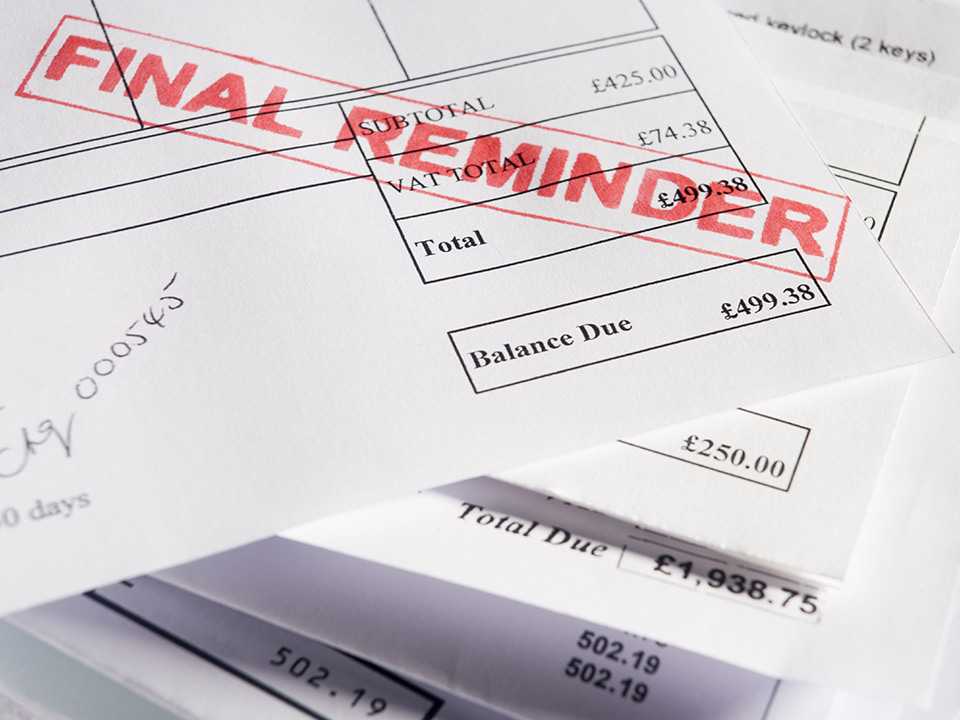

Late payment letter: how to chase late payment, plus download your template

4-minute read

Also known as an ‘outstanding payment letter’, ‘debt recovery letter’ or ‘overdue invoice letter’, a late payment letter is a handy tool to have on file.

Here’s how to write a letter for unpaid invoices – whether it’s a polite nudge, clear reminder, or a final strong letter for outstanding payment.

To make the process even easier, you can also download our late payment letter template to help recover an overdue invoice.

Late payment has sadly been an ongoing problem. The government estimates that more than £23.4 billion is owed to UK businesses, with small businesses waiting for around nine overdue invoices at any one time.

A review into late payments was announced towards the end of 2022, which could also see a crack down on bigger businesses not paying suppliers on time.

When should I send an outstanding payment letter?

You've received a purchase order from a customer, sent the items, and issued an invoice – yet you haven't received payment. What do you do now?

Most of the time, late payment can be easily settled with a quick overdue invoice email to your customer, gently reminding them that they haven’t paid.

When that doesn’t work, however, or you get no response, a letter in the post can help to formalise the situation. Make sure you’ve got an up-to-date address for correspondence, and keep a copy (and record) of everything you send and receive.

To get you started, here’s what an initial outstanding payment letter should include, when to send a ‘nudge’ – and if that fails, what to write in a strong letter for outstanding payment.

How to work out late payments

Did you know you can charge interest on overdue invoices?

The Small Business Commissioner has a late payment calculator you can use to work out how much interest you can charge on top of the outstanding balance.

To use the late payment calculator to work out interest, you'll just need to input the following information:

- payment terms (usually 30 days)

- invoice date

- date invoice was paid (if it has been paid)

- total amount on the invoice

What should a late payment letter include?

Hopefully you’ll only ever need to send one polite nudge for late payment. But if not, you may need a couple of other templates to get the message across, including a firm reminder and a final notice letter.

These are the basic details each letter needs to include:

Late payment letter 1: polite nudge for an overdue invoice

- your company name and address

- recipient’s name and address

- today’s date

- a clear reference and/or any account reference numbers

- the amount outstanding

- original payment due date

- a brief explanation that no payment has been received

- next steps (you could give the recipient the opportunity to contact you and/or pay within a specific number of days)

- payment options

- reference to your payment terms

Late payment letter 2: firm reminder/late payment charges letter

- your company name and address

- recipient’s name and address

- today’s date

- a clear reference and/or any account reference numbers

- the amount outstanding

- a reference to your polite nudge or last communication

- a brief explanation that payment is still outstanding, and any charges that may be added in line with your payment terms (and current government legislation)

- next steps, including a cut-off payment date

- payment options

- reference to your payment terms

Late payment letter 3: final demand letter/letter before action

- your company name and address

- recipient’s name and address

- today’s date

- a clear reference and/or any account reference numbers

- the breakdown of the total amount outstanding, including any additional charges/interest

- a reference to your reminder letters or last communication

- a brief explanation that payment is still outstanding and now in breach of your payment terms

- explanation of any further costs added

- next steps, including a final cut-off date and consequences for failure to pay (this will depend on your debt recovery arrangements)

At this stage, it’s important to think about whether you’re making a formal statutory demand. This gives someone 21 days to pay the debt or reach an agreement with you to pay. If they don’t, you can apply to the courts to bankrupt your debtor or wind up their company, but this can be a costly process – so consider whether you’ve exhausted all of your options.

Read more about making a statutory demand at gov.uk, as there are specific forms that you need to use.

If you’re not making a statutory demand, then this letter can simply be a strong letter for outstanding payment. Still, if you don't receive a response, then a statutory demand may be necessary.

Outstanding payment letter template

Here’s a late payment letter template, giving a reminder of the amount outstanding and due date, plus next steps.

You’ll need to edit this according to your business and circumstances. For example, it might be more appropriate to mention a specific overdue invoice (including the invoice number and any other relevant details), rather than an overdue account balance.

You can also amend this template to turn it into a firm reminder or a strong letter for outstanding payment, according to the steps above. It depends on which stage of the process you’re at.

DownloadLate payment letter online tips and resources

At Simply Business, we often check the most recent legislation and guidance for small businesses, especially when it comes to finance and legal issues. Get hints and tips sent straight to your inbox and check our legal and finance hub for regular updates.

You can also get a lot of insight from gov.uk, especially when it comes to late payments, debt recovery and due compensation. Take a look at their late commercial payments hub for more on charging interest and debt recovery, for quick reassurance of your rights and the proper procedures.

For more guides on managing your business finances, visit our cost of living hub.

Tips for preventing late payment

There are some things you could try to minimise the chance of late payment.

Make your payment terms clear – your invoice should include details of how to pay, your bank details, and clearly state the date they have to pay by.

Invest in accounting software – this can automate reminders to prompt payment, saving you time on chasing up unpaid invoices.

Consider credit checks – you could look into your customer's credit rating before working with them to help give you peace of mind.

Try using 'proforma' invoices – for new customers you could ask them to arrange payment before you supply the products or services to build trust that they'll pay on time.

How legal expenses insurance can help

If you have legal expenses insurance as part of your Simply Business policy, you have access to a number of useful services through DAS Businesslaw (you’ll just need your voucher code found in your policy documents to register).

DAS has a legal advice helpline, available whether you’re facing a serious legal issue or just want to check something with an adviser. They also offer a range of legal templates and guides to help you with managing tenancies.

More useful articles for small business owners

Remember, this article is just a guide, and it's always worth seeking professional legal advice.

Click here to download an overdue payment reminder letter PDF

Looking for self-employed insurance?

With Simply Business you can build a single self employed insurance policy combining the covers that are relevant to you. Whether it's public liability insurance, professional indemnity or whatever else you need, we'll run you a quick quote online, and let you decide if we're a good fit.

Start your quote

Written by

Simply Business Editorial Team

We create this content for general information purposes and it should not be taken as advice. Always take professional advice. Read our full disclaimer

Keep up to date with Simply Business. Subscribe to our monthly newsletter and follow us on social media.

Subscribe to our newsletterInsurance

Public liability insuranceBusiness insuranceProfessional indemnity insuranceEmployers’ liability insuranceLandlord insuranceTradesman insuranceSelf-employed insuranceRestaurant insuranceVan insuranceInsurersAbout

About usOur teamAwardsPress releasesPartners & affiliatesOur charitable workModern Slavery ActSection 172 statementSocial mediaSite mapAddress

6th Floor99 Gresham StreetLondonEC2V 7NG

Northampton 900900 Pavilion DriveNorthamptonNN4 7RG

© Copyright 2024 Simply Business. All Rights Reserved. Simply Business is a trading name of Xbridge Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Registration No: 313348). Xbridge Limited (No: 3967717) has its registered office at 6th Floor, 99 Gresham Street, London, EC2V 7NG.