How to do a self-employed tax return

7-minute read

The self-employed usually need to do a Self Assessment tax return and pay their tax bill each year. Limited company directors and business partners also need to file a tax return too.

It’s easy to file your tax return online but there are other options available (until Making Tax Digital is fully rolled out). This is a step-by-step guide on how to do a self-employed tax return, who needs to file one, and important deadlines you need to remember.

Register to keep reading and download your own tax return guide for free.

Here’s what we’ll cover:

Our tax hub has even more resources and guides to help you during HMRC Self Assessment tax return season. You can call the HMRC Self Assessment payment helpline on 0300 200 3822 if you think you’ll struggle to pay your tax bill on time.

Deadline for Self Assessment tax return

You have to submit your tax return by 31 January whether you’re a sole trader, in a business partnership, or run a limited company.

The Self Assessment deadline is earlier if you’re filing a paper return, on 31 October.

You file a return for the previous tax year. So for tax year 2022-2023 the deadline for filing your return online and paying your bill is 31 January 2024.

The Self Assessment process can seem complicated at first, so here we break down the tax return step-by-step, including how to:

- register for Self Assessment

- file a tax return

- pay your bill

Get your free guide on completing your tax return

Download your free in-depth guide to completing your self-employed tax return. Why not save it and refer back to the guide when filling in your Self Assessment?

DownloadWhat is Self Assessment?

Self Assessment is the tax return process for self-employed people.

Whereas HMRC collects income tax from employees directly through the PAYE system, the self-employed need to work out their income and expenses and then pay their bill each January.

You might even need to complete a Self Assessment return if you’re not self-employed. For example, if you earn money from renting out a property, read our guide to Self Assessment for landlords.

You’ll also need to complete a tax return if you have significant income from savings, investments and dividends – read about paying tax on dividends.

Sole trader Self Assessment

If you're a sole trader, you’ll declare your business earnings and allowable expenses on your Self Assessment, as your business isn’t a separate legal entity.

Read more about how to register and file your sole trader tax return below.

How to file a partnership tax return

For those in a general business partnership, you'll need to fill in a SA800 Parntership Tax Return form. This is so you can declare:

- trading and professional income

- taxed interest and finance receipts from banks and building societies

You can find the SA800 form on the government website (along with supplementary forms) if you're completing a paper return, otherwise you can submit your tax return online following the steps below.

Paying tax as a limited company

When becoming a freelancer for example, you might choose to set up a limited company instead of being a sole trader.

Limited companies and limited liability partnerships are separate to you personally, and taxed through a company tax return. But you’ll still usually have to send a personal tax return, including your salary and dividends received through the company.

Do I need to fill in a Self Assessment tax return?

HMRC says that you need to send a tax return and pay your bill through Self Assessment if in the last tax year you were:

- a self-employed sole trader earning more than £1,000

- a partner in a business partnership

You’re classed as self-employed if you run your business yourself and are responsible for its success or failure.

HMRC also says you might need to send a return if you have untaxed income from:

- renting out a property (read more about Self Assessment for landlords)

- tips and commission (for example, if you've started a window cleaning business and a customer tips you for a job well done)

- savings, investments and dividends

- foreign income

HMRC has a tool you can use to check whether you need to file a Self Assessment tax return.

How to do a tax return: step-by-step

Thought about the criteria above and know that you need to file a tax return? Follow these steps below.

Register for Self Assessment

You have to register with HMRC for Self Assessment by 5 October in your business’s second tax year. HMRC might fine you if you don’t register by this deadline.

Registering for Self Assessment should also give you a Government Gateway user ID, which you can then use to set up your personal tax account. When you log in you can manage different elements of your taxes online.

Once you’re registered for Self Assessment you’re then able to file your tax return online or on paper – but HMRC will eventually phase out paper tax returns under Making Tax Digital.

Gather your tax return information

For self-employed Self Assessment, the key information is likely to be your income and expenditure details, so you should have all your invoices and receipts to hand.

There are costs you can deduct from your turnover to work out your total taxable profit. You can claim for things like office, travel, marketing and business insurance costs, as long as they’re used solely for your business.

It’s important to keep good records throughout the year. Not only does this make filling in your return easier, HMRC may check your return after you’ve filed and ask to see your records. You’re required to keep your records for five years after the 31 January deadline.

You're likely to need details of:

- employment income (if you’re also employed)

- dividends

- partnership income

- interest

- rental income

- foreign income

- pension contributions

- Gift Aid

- payment on account

- redundancy lump payment or unemployment benefit

- P11D

- capital gains

- reliefs

- allowances

- benefits

If you need to ask third parties (like banks and building societies) for information, make sure you leave enough time for them to give it to you.

You’ll also need your unique taxpayer reference number (UTR). You get this when you register for Self Assessment – find out more about your UTR number.

If you need help with your records and filing, you might want to consider hiring an accountant – also keep in mind that you can use accounting software to help you keep records and check out our bookkeeping tips.

Fill in your self-employed tax return

Watch the three-minute video below for an overview, or keep reading for our step-by-step guide.

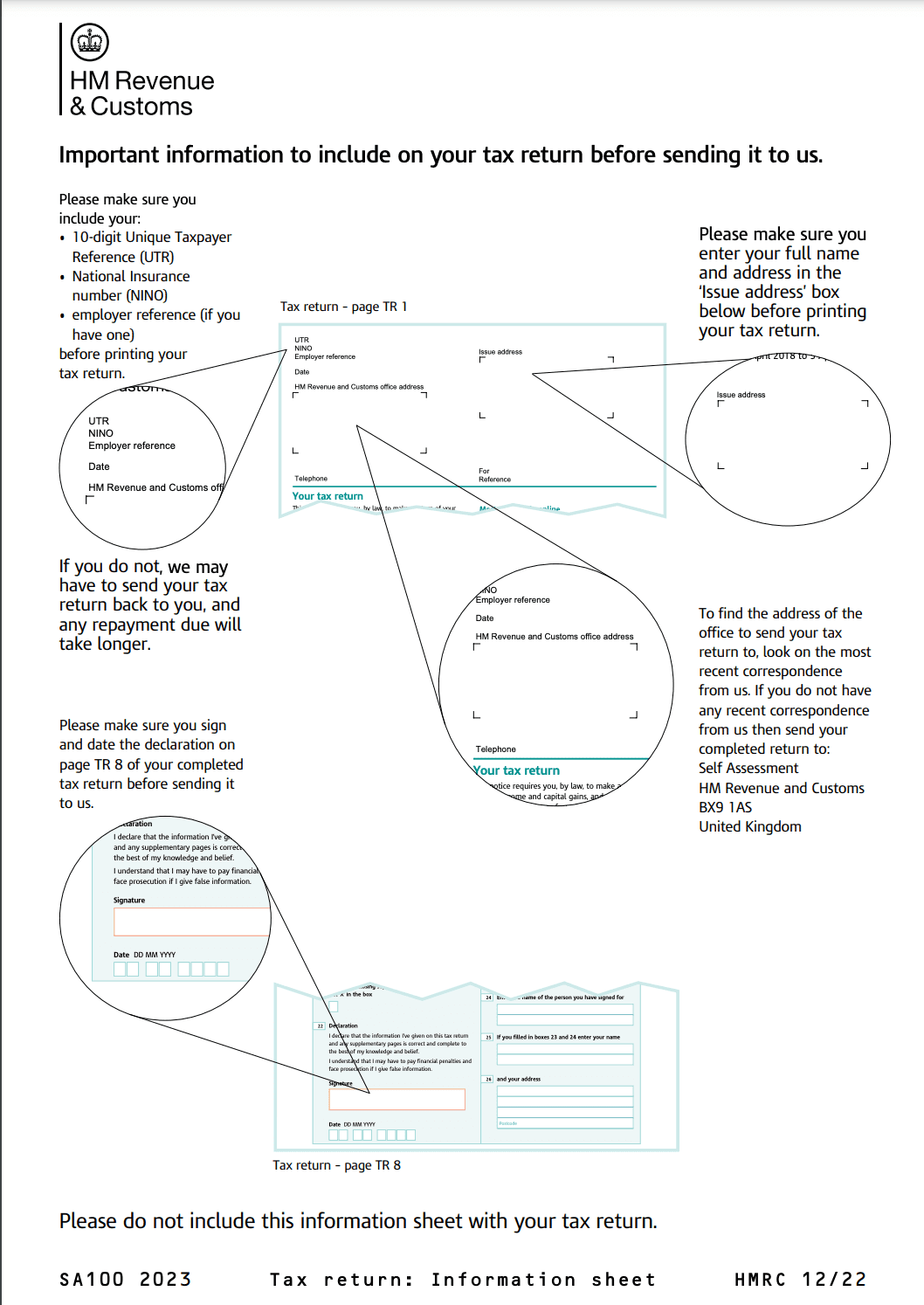

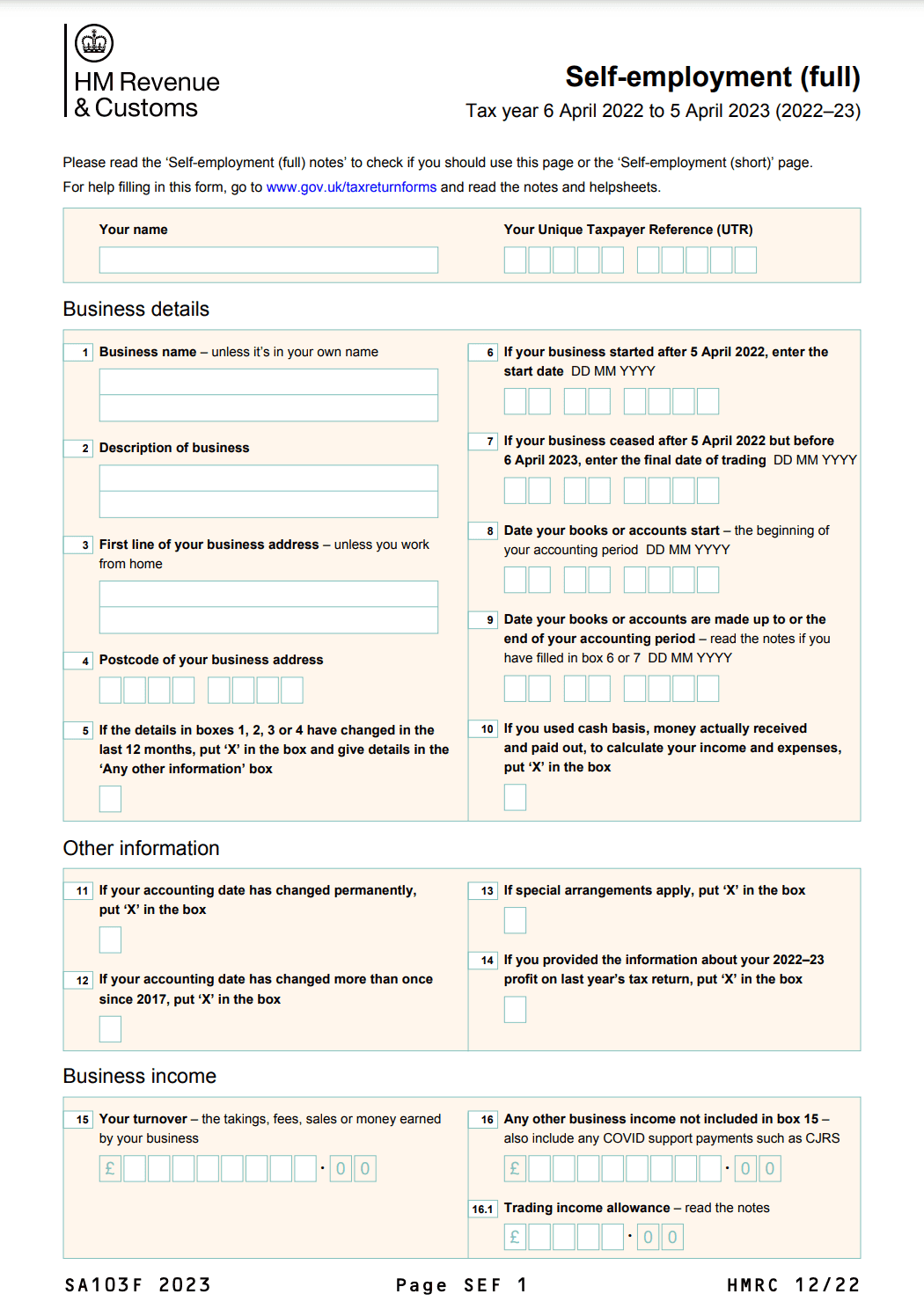

If you’re filing a paper return, you’ll need to complete form SA100 and the self-employed supplement form SA103.

But filing online gives you three more months to submit. HMRC says it’s “quick, easy and secure” – its system reacts to your details as you enter them and gives you reminders on where to find information if you get stuck.

If you’re filing online (or using the app) and you’ve gathered all the information you need, here’s what to do when you’ve logged in:

1. Check your personal details

HMRC should be kept up to date with any changes to your address or your name, for example. You can check and update them during the Self Assessment process.

2. Fill in the sections that apply to you

HMRC’s system reacts to your details as you enter them. This means that as you fill in the form, it may remove sections that aren’t relevant to you.

3. Report on what you’ve earned

This is where you enter your turnover before expenses, so have your sales invoices to hand. Remember that you might also need to enter other income elsewhere, like property income or gains on investments.

4. Add your tax-deductible expenses

Use your expense receipts when filling in this section. Our guide to what you can claim as self-employed tax deductible expenses has more details.

5. Double check your return

If you need to, you can save everything you’ve entered and come back to your tax return, which is useful if you want to check your numbers. But if you notice a mistake, it’s possible to change your tax return after filing.

6. Pay your tax bill

When you submit your tax return, you should get a confirmation message and a reference number. HMRC will calculate the tax you owe, as well as the National Insurance contributions you need to pay.

How to pay self-employed tax

The quickest way to pay your tax bill is using the HMRC app. And it's fast-becoming one of the main ways of paying.

HMRC figures show that between April and September 2023, 97,365 customers used the app to pay their tax bill for the 2022-23 tax year – that's three times the number of people who used it in the same period last year.

You can download the app on iOS and Android – you’ll need your Government Gateway user ID and password to sign in for the first time.

HMRC created this video with step-by-step instructions for paying your self-employed tax using the app:

You can also use the app to check your tax details, National Insurance, tax credits, and benefits.

The deadline for paying your tax return is the same day as the deadline for filing – 31 January.

If you file your tax return late, you’ll get a £100 penalty (if it’s up to three months late – it’s more if it’s later). After that, HMRC uses a points-based system to apply penalties.

Other ways to pay your tax bill:

- online or telephone banking

- CHAPS

- debit or corporate credit card online

- at your bank or building society

You can also pay by Bacs, cheque or Direct Debit, but these take longer.

Remember that most self-employed people usually need to make a payment on account too, which can catch newly self-employed people out – make sure you have enough set aside.

Payment on account is when you make two payments towards your next tax bill (one in January and one in July).

Once you've filed your first tax return, you can set up a budget payment plan to pay your tax bill in weekly or monthly instalments. But you must be up to date with your Self Assessment payments.

Find out which payment plan is right for you.

Help if you’re struggling to pay Self Assessment tax

HMRC’s Time to Pay service is available if you can’t pay your tax bill by the 31 January deadline.

This is for those struggling financially – so if you can pay your tax bill, you should, not least because through Time to Pay you’ll pay interest on what you owe. This makes your bill more expensive.

You’ll need to complete your tax return first, so don’t leave it until the last minute. If you miss the deadline for either filing your return or paying your bill, HMRC may give you a fine.

You can call the HMRC Self Assessment payment helpline on 0300 200 3820 to discuss a Time to Pay plan. We also have a guide to HMRC’s Time to Pay service.

What is a tax return – and what does it look like?

A tax return is a document that tells HMRC how much income you’ve received during the tax year. This is then used to work out how much tax you need to pay.

HMRC has plenty of guidance on what you need to include on your tax return. The easiest thing to do is to get the HMRC app, but the pictures below give you an idea of what a paper tax return looks like.

The main SA100 tax return form shows the information you’ll need to include.

Page one of the self-employed supplement form SA103 looks like this:

HMRC tax return guidance

There’s lots of Self Assessment guidance on the government website and you can also call the Self Assessment helpline on 0300 200 3310.

But in previous years HMRC’s phone lines have crashed so make sure you leave enough time to get in touch with them if you need to.

HMRC also warns the self-employed to watch out for tax scams during Self Assessment.

How are you getting on with filling in your tax return? Let us know in the comments below.

Ready to set up your cover?

As one of the UK's biggest business insurance providers, we specialise in public liability insurance and protect more trades than anybody else. Why not take a look now and build a quick, tailored quote?

Start your quote

Written by

Sam Bromley

Sam has more than 10 years of experience in writing for financial services. He specialises in illuminating complicated topics, from IR35 to ISAs, and identifying emerging trends that audiences want to know about. Sam spent five years at Simply Business, where he was Senior Copywriter.

We create this content for general information purposes and it should not be taken as advice. Always take professional advice. Read our full disclaimer

Keep up to date with Simply Business. Subscribe to our monthly newsletter and follow us on social media.

Subscribe to our newsletterInsurance

Public liability insuranceBusiness insuranceProfessional indemnity insuranceEmployers’ liability insuranceLandlord insuranceTradesman insuranceSelf-employed insuranceRestaurant insuranceVan insuranceInsurersAbout

About usOur teamAwardsPress releasesPartners & affiliatesOur charitable workModern Slavery ActSection 172 statementSocial mediaSite mapAddress

6th Floor99 Gresham StreetLondonEC2V 7NG

Northampton 900900 Pavilion DriveNorthamptonNN4 7RG

© Copyright 2024 Simply Business. All Rights Reserved. Simply Business is a trading name of Xbridge Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Registration No: 313348). Xbridge Limited (No: 3967717) has its registered office at 6th Floor, 99 Gresham Street, London, EC2V 7NG.