What is a cash flow forecast? A guide for small businesses

5-minute read

Businesses with healthy cash flow can plan for future growth, while ones that have cash flow problems may struggle to stay afloat.

The cash flow forecast, then, is designed to help you assess how much money you’ve got coming in and going out of your business over a certain time period.

As well as helping you make decisions about what you can afford, you’ll be able to address any cash flow problems ahead of time.

What is cash flow?

A cash flow definition is simply the money that you have coming into (and leaving) your business.

Otherwise successful businesses can quickly start to struggle without easy access to cash, so understanding cash flow is one of the best ways to plan – both for when business is booming and when it might not be so great.

For example, businesses with staff still have wages to pay, even if they go through quieter periods when cash isn’t coming into the business.

A cash flow forecast helps that business understand when it might suffer those quieter periods, so it can be prudent with its money at other times of the year.

Get your free cash flow forecast template

Download your free cash flow forecast template that you can edit yourself. Get instant access and start managing your cash flow today.

DownloadExamples of cash outflows and inflow

Cash inflow examples

Money that comes into your business is considered cash inflow. The largest portion of inflow is usually through product sales.

It could also be money that enters your business through a return on an investment, or the sale of assets.

Cash outflow examples

Cash outflow is the money that leaves your business. Examples of cash outflow include:

- employee wages

- rent

- payment to suppliers

Other types of outflow are costs like loan repayments or buying business insurance.

Cash flow forecast – essential for planning

A cash flow forecast shows your best estimate for the amount of cash coming in – and leaving – your business over a specific period (usually a year). You’ll need to plot timings too, so you can plan for both busier and quieter months.

A cash flow forecast is an important part of the business plan – it helps prove viability, especially if you’re looking for investment.

A year is a good time period to forecast, because your figures beyond that might not be realistic. While your cash flow forecast should be your best estimate, it doesn’t need to be accurate to the penny, so use round numbers.

You should also update your cash flow forecast if you perform differently than expected – both positively and negatively. If your plan is out of date, it won’t be of any use to you.

How to write a cash flow forecast

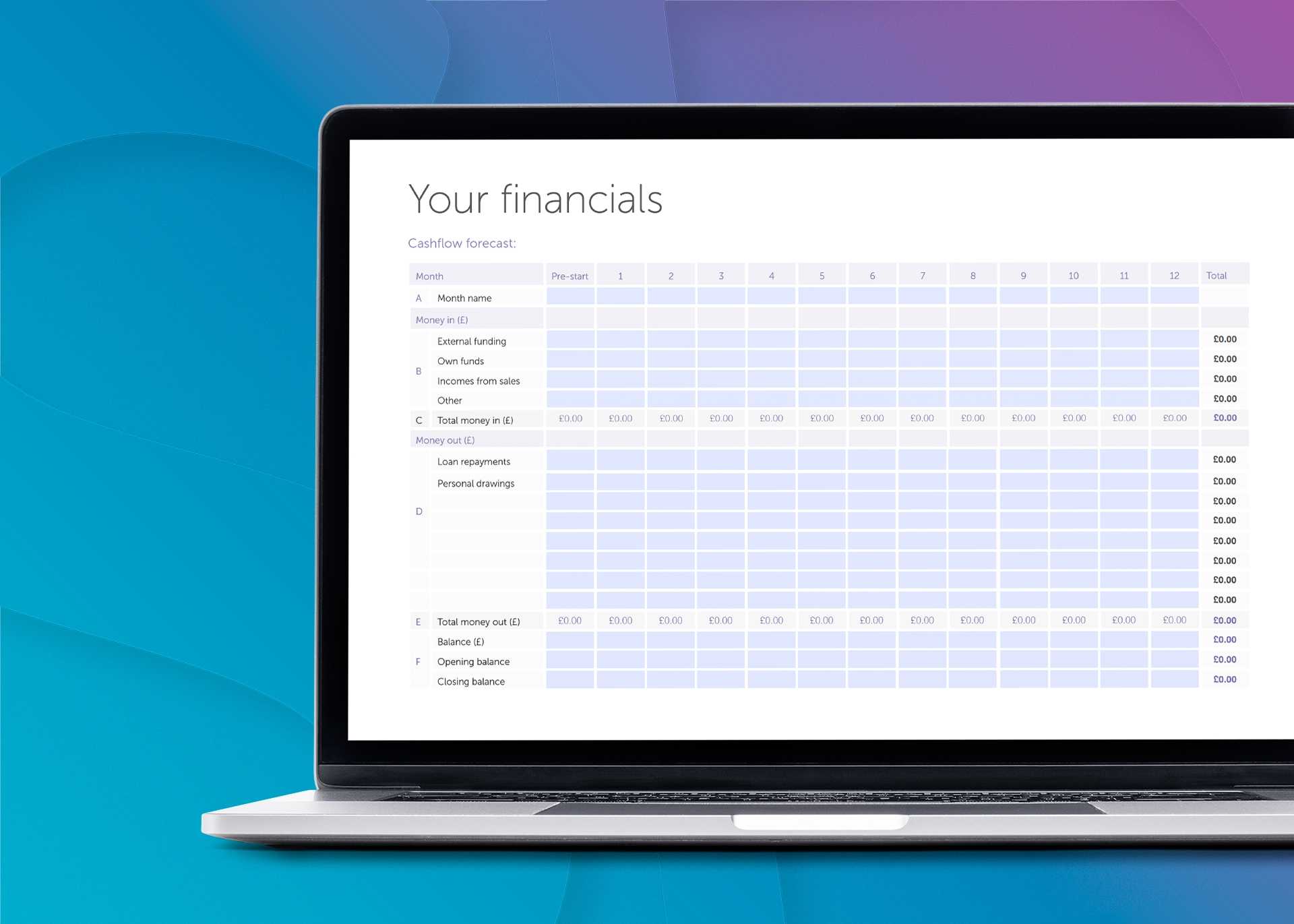

Your cash flow forecast doesn’t have to be too complicated – essentially, you need 12 columns (one for each month), with space to add both the money coming in and going out during that month (you can split this out in the rows underneath).

Each income or expenditure type should also have its own row. For example:

- utilities, wages and rent in your money out rows

- income from sales, investment, or other funding in your money in rows

- total rows that add up the total money out and money in for each month

If you set up a cash flow forecast using spreadsheet software (like Google Sheets or Excel), you can use the SUM function to add up the values in each column for the total at the bottom.

The useful information is your monthly closing cash balance. If it’s negative or close to zero for one month, this might be a problem. If it’s like this for a number of months, it’s likely that you’ll have to rethink your business model. It can be hard to track these trends over time, but using a balance sheet template can make things easier.

You’ll need information from other forecasts, such as your pricing strategy, sales and costs forecast, and your profit and loss forecast, to help inform your cash flow forecast.

Many accounting software packages also include cash flow forecast functionality, which should automate much of the process for you.

Here's a cash flow example for you to get an idea of the layout.

Benefits of a cash flow forecast

We’ve already hinted at many of the benefits of a cash flow forecast, but to summarise:

- you can make decisions about the future of your business based on the cash you’ll have available at certain points in time – for example, hiring staff if you have lots of cash, or making your business more efficient during cash shortages

- you can identify when you might be strapped for cash and try to solve it – for example, if payment is the problem, you can change your invoice policies by introducing stricter (and shorter) payment terms

- it can help you gain funding and investment – people will ask to see your cash flow forecast to check whether your business is viable (they may also ask to see your balance statement and other forecasts)

- it’s a fluid document, meaning you can update your cash flow forecast if you perform differently than expected – so your future plan always reflects where you are in the present

- as it’s a forecast, you can adapt it to suit different conditions that are out of your control – for example, economic booms or downturns

While planning and forecasting mostly puts your business at an advantage, there are a couple of drawbacks to using a cash flow forecast. The first is that if you use unrealistic numbers, it won’t give you an accurate forecast. Be honest and use your best estimates.

The second is true for all forecasts, including a break even analysis – it’s only your best estimate. Running a small business can be unpredictable, so you’ll need to adjust your plan accordingly. That being said, your cash flow forecast should help you remain resilient during the tougher times.

Cash flow statement – is it different to a cash flow forecast?

Yes, a cash flow statement is different – although the fundamentals are the same.

The cash flow statement shows a business’s cash inflows and outflows over a particular period of time, but it’s primarily a statement used for financial accounting and reporting rather than business planning.

This means it reports on what’s actually happened, instead of trying to forecast the future.

In financial accounting, businesses produce statements for public use, which customers, suppliers, and investors can use to assess how well a business is doing.

Limited companies have to produce a cash flow statement as part of their statutory accounts (although smaller businesses are exempt – check with an accountant if you’re not sure).

How to improve cash flow

Cash flow analysis can help you make changes to improve cash flow. If you’ve identified a potential problem, these tips can help you solve it:

- use the latest data available – using real-time data can help you update your forecast as you go and identify problems quickly. Make sure you’re amending your forecast against actual numbers – accounting software can automate much of this for you

- change your payment terms – your payment terms could be slowing your cash flow – and worse, you might be struggling with perennial late payers. Consider switching from 30 days to seven days, for example (but be sure to have a conversation with existing customers first). You could also set up a proper debt collection process for cash you’re owed

- examine your costs – look for any inefficiencies in the amount you’re spending to keep your business running. Is there a way to boost employee productivity? Do you keep stocking a product line that doesn’t sell? Looking at your cash flow alongside other reports should help you come up with a solution

- use discounts and other incentives – in the example above, if you have goods that aren’t selling, cutting prices could boost your cash flow in the short-term. After you’ve shifted them, you can focus on better marketing for the items that already do well for you

Useful guides for small businesses

Do you have any tips for creating a cash flow forecast or improving cash flow? Let us know in the comments below.

Is your business insured?

We have over 800,000 UK customers plus a 9/10 satisfaction score. Why not take a look at our expert business insurance options – including public liability insurance and professional indemnity – and run a quick quote to get started?

Start your quote

Written by

Sam Bromley

Sam has more than 10 years of experience in writing for financial services. He specialises in illuminating complicated topics, from IR35 to ISAs, and identifying emerging trends that audiences want to know about. Sam spent five years at Simply Business, where he was Senior Copywriter.

We create this content for general information purposes and it should not be taken as advice. Always take professional advice. Read our full disclaimer

Keep up to date with Simply Business. Subscribe to our monthly newsletter and follow us on social media.

Subscribe to our newsletterInsurance

Public liability insuranceBusiness insuranceProfessional indemnity insuranceEmployers’ liability insuranceLandlord insuranceTradesman insuranceSelf-employed insuranceRestaurant insuranceVan insuranceInsurersAbout

About usOur teamAwardsPress releasesPartners & affiliatesOur charitable workModern Slavery ActSection 172 statementSocial mediaSite mapAddress

6th Floor99 Gresham StreetLondonEC2V 7NG

Northampton 900900 Pavilion DriveNorthamptonNN4 7RG

© Copyright 2024 Simply Business. All Rights Reserved. Simply Business is a trading name of Xbridge Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Registration No: 313348). Xbridge Limited (No: 3967717) has its registered office at 6th Floor, 99 Gresham Street, London, EC2V 7NG.